It’s no secret that the housing market is shaky with inflation and soaring energy costs. Even though the house buying process can add a lot of pressure to your life, if you take a pragmatic approach and work with trusted lending professionals home-ownership can be a wise decision. The Federal Housing Administration was created in 1934 in an effort to make the home buying process more affordable and more fair. Today, FHA continues to simplify the home financing process and this make America even more attractive. Let’s examine the benefits of financing a home using FHA mortgages.

Popular Types of FHA Mortgages

The FHA provides a wide variety of loan options, meeting the lending needs of American borrowers. Please see the comprehensive list of all FHA-insured products below:

FHA Home Loan -The Federal Housing Administration refers to this as the “Home Mortgage 203b” and it is considered the standard FHA program designed for financing single-family homes. It’s essential to note that FHA mortgages are exclusively available for primary residences and do not cover vacation homes or secondary residence.

FHA 40-Year Mortgage -This is a new FHA product that was created to off-set inflation and rising interest rates with lower monthly payments. Since the 40-year loan stretch’s the term an extra 10-years it lowers the initial monthly payment.

FHA Streamline Refinance -This is a rate and term refinance option for existing FHA borrowers that enables them to lower your interest rate or shorten the loan term. Streamlining the process, this option eliminates the need for a new appraisal, saving time and reducing paperwork.

FHA 203K Refinance -This option incorporates the expenses for repairs or renovations into your total mortgage amount. However, it’s crucial that these upgrades adhere to FHA eligibility requirements.

FHA Cash-Out Refinance -With this type of refinancing, your current mortgage is replaced by a larger amount with additional cash allocated to be dispersed to the borrower.

Why FHA Is So Trusted

The US housing market is still going strong in 2023, with rising home prices and mortgage rates still below 7%. But for millions of Americans, buying a home can be very stressful because of the difficulty of getting a mortgage. If you have a lower credit score, down payment and income, you might think that home ownership is an impossible dream. But this is not true. Mortgages are backed by the Federal Housing Administration or FHA make it possible for many more Americans to buy a home.

This article describes the FHA program in detail. Remember: For millions of renters, FHA mortgages are the path to home ownership! Keep reading to learn much more.

Overview of the FHA Financing

FHA mortgages are a good choice for possible home buyers who may have past credit problems. These loans also are a good option for first time buyers who do not have a large down payment available. FHA financing is backed by the the Federal Housing Administration. This is a key for the lender and the home buyer. It means that if the buyer does not pay the mortgage, the lender will be repaid by FHA. For the home buyer, this federal guarantee means a lower interest rate. In fact, FHA interest rates can be even lower than market. (Investopedia.com)

Keep in mind that FHA itself does not underwrite the loans. Instead, the agency approves certain lenders to provide FHA mortgages. There are thousands of FHA-approved lenders across the US. There are probably several near you. Even if you do not have an FHA-approved lender in your community, you can nearly always find one online that can offer an FHA loan to you in your state. Compare conventional loans to FHA in a side by side analysis.

Benefits of an FHA Mortgage

FHA loans are often easy to qualify for because a low down payment is required, and you do not need to have a high credit score. The down payment requirements are very reasonable, as are the debt to income requirements. Further, FHA mortgages are assumable. This means when you sell the home, the prospective buyer can assume the loan, if the buyer can qualify. In a rising interest rate market, this can be a major benefit to getting your home sold faster.

FHA loans are available to people who have had foreclosures and bankruptcies. You will probably need to wait at least two or three years to be approved for an FHA loan if you have either of these negative events on your credit report. But you do not need to wait seven or 10 years as many people believe. However, FHA wants to see that you have recovered financially from the negative credit event, so make sure you have been paying your bills on time for at least 12 months before applying for an FHA loan.

How to Qualify for an FHA Loan

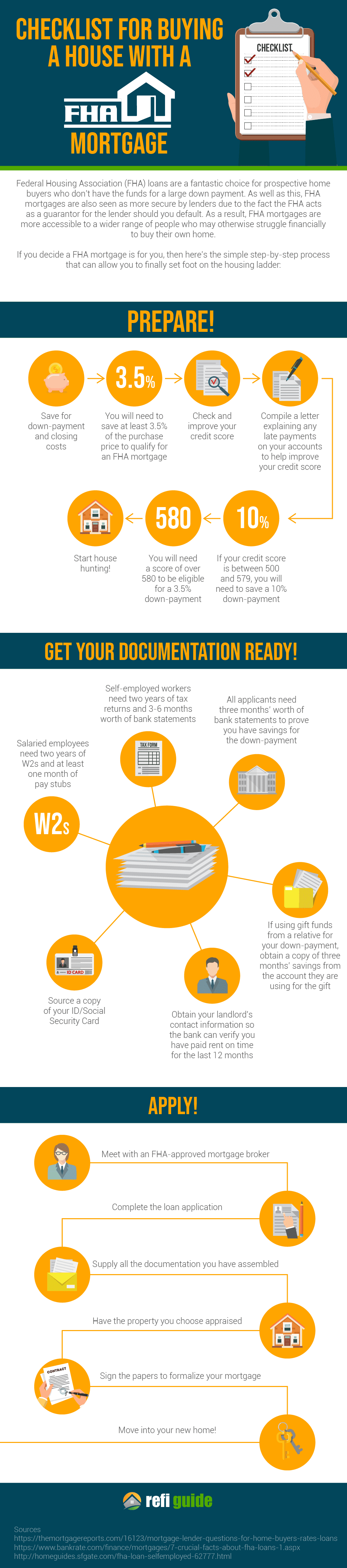

Many people think they should start looking for a house first. Wrong! The best way to start looking to buy a home is to begin with getting your mortgage financing set up with FHA. Below are the basic steps for getting an FHA mortgage.

Save For 3.5% Down Payment

When you are ready to get an FHA mortgage to buy your home, one of the advantages is that you do not need to have a huge down payment. Many Americans are still under the false impression that you need to have at 20% down payment to buy a home. This is not true. Why do so many people believe this?

It could be because most lenders require a 20% down payment for you to not have to pay for private mortgage insurance or PMI. Private mortgage insurance protects the lender from the buyer defaulting on the loan. Statistics show that when a buyer has less than 20% stake in the home, foreclosure is more likely. So, if you have less than 20% down, you will need to have mortgage insurance, whether you get a loan from FHA or another source.

That said, there are many options today for buying a home with a down payment that is much lower than 20%. The FHA mortgage program currently requires a down payment of only 3.5%. If you buy a home for $200,000, you may need to have only $7,000 down. To qualify for a 3.5% down payment through FHA, you do need to have a minimum 580 credit score for FHA loans. FHA-approved lenders have the option of requiring a higher credit score for you to qualify for a 3.5% down payment. But 580 is the bare minimum required by FHA.

It is usually better to have a higher credit score so that you have more FHA-approved lenders competing for your business. People who have at least a 620 credit score will find it is easier to get approved for an FHA home loan with a 3.5% down payment.

Even if your credit score is lower than 580, you still can get approved for a bad credit FHA mortgage. But in this case, you will need to have a 10% down payment.

With FHA mortgages, it is easier to save for a down payment because you do not need to have a 20% down payment. With such a low down payment required, you have a much better chance of getting your piece of the American dream.

Save For Closing Costs on FHA Mortgages

As with any home loan, FHA mortgages have closing costs. Some of the fees are from the mortgage lender itself. Others are from third parties that are involved in the home purchase, such as the home appraiser, title company, and credit reporting agencies.

Before you start looking for a home, note that FHA closing costs usually are approximately 3% of the purchase price, but they can vary from state to state. There are other factors that can affect how much you pay when you close, such as prepaid interest points where you pay to lower the interest rate.

An advantage of FHA mortgages is the US government allows the home seller to pay some of your closing costs, if they agree to do so. They can pay up to 6% of the sales price in most situations. This can be important in a buyer’s market, or where the seller needs to unload the home fast and is willing to pay some of your closing costs to get the deal done. (FHAHandbook.com)

If you buy a home with a purchase price of $200,000, you can expect to pay approximately $6,000 in closing costs. But Bankrate.com reports that you can pay higher than this in many states, including Hawaii, New Jersey, Connecticut, West Virginia, California and Arizona.

As noted above, if you pay discount points to lower your mortgage rate, you will have higher closing costs for your FHA mortgage. But, you will reduce the interest that you pay over the years, so it can work in your favor. One discount point is 1% of the loan amount. So, if you have a purchase price of $200,000, paying 1 point at closing would mean $2,000 more in closing costs. Learn more about the cost of FHA loans.

FHA allows you to get your entire down payment from a friend or family member. It is possible in some cases to effectively have a loan with no down payment with FHA, if you can get the funds through a gift.

Check and Boost Your Credit Score

FHA mortgages are very flexible in terms of the credit score you need to be approved by the underwriter. Still, it will always benefit you to increase your credit score before you apply for FHA financing. The higher your score is, the more lenders will be willing to work with you. This can result in your getting a better rate and terms on your loan.

Before you even begin looking at homes, get a copy of your credit report from the three credit reporting bureaus. You should know your score from all three because the score with each one will differ somewhat. Some of your creditors will send information to every agency, while others send to one or two.

Your credit score can vary widely at each bureau. When the mortgage lender checks your credit, they will use the middle score from the three bureaus to determine if they will lend to you or not. You are entitled to a free copy of your credit report from each bureau every year. You can get yours by going to Annual Credit Report. (FTC.gov)

When you obtain copies of your credit reports, it’s essential to scrutinize them for any inaccuracies that might be negatively affecting your credit score. If you come across any errors, you can initiate a dispute process with each credit bureau through their online platforms. Should they acknowledge the mistake, it can be rectified, subsequently boosting your credit score.

Once you’re aware of your credit score, it’s prudent to take steps to improve it. The most effective methods to enhance your score involve ensuring punctual bill payments and reducing your outstanding debts. If possible, work on paying off credit card balances, as this can swiftly elevate your score by as much as 20 points or more, making the qualification process for an FHA mortgage even smoother.

It’s worth noting that FHA eligibility is relatively forgiving in terms of credit scores. Nevertheless, it’s crucial to demonstrate to the FHA-approved lender that you maintain a stable financial foundation. This entails having a clean record with no late payments on any credit lines for at least the past 12 months, significantly streamlining the approval process.

Check Your Debt to Income Ratios

All mortgage loans come with specific debt-to-income ratio requirements to ensure borrowers aren’t overextended and can manage their loan payments responsibly.

For FHA loans, lenders typically seek a front-end ratio not exceeding 31%. This ratio compares your gross monthly income to your total monthly mortgage payment, encompassing principal, interest, insurance, taxes, and mortgage insurance.

FHA lenders also look for a back-end ratio no higher than 43%. This ratio compares your gross monthly income to your overall monthly debt payments, including your home loan, car payments, credit cards, student loans, and more. It is possible to secure approval with a higher debt-to-income ratio, but in such cases, borrowers may need to demonstrate their creditworthiness further, potentially by having a higher credit score, income, or making a larger down payment.

Organize Your Income Documentation

Every mortgage lender today requires full documentation of your income, debts, assets and general finances to qualify you for a mortgage. To meet eligibility for FHA income requirements, you will generally need the following items:

- Two years of W-2s if you are a full time, salaried employee

- At least one month of pay stubs for full-time employees

- Two years of federal tax returns

- Three months of bank statements

- If you are self-employed, you will need two years of tax returns, three months of bank statements, and possibly a profit and loss statement for the current year to date

- Contact information for your landlord who can verify you have paid rent on time for the past year.

FAQs:

Can I buy a house in another state with an FHA loan?

Yes, you can buy a house in another state with an FHA loan, but it must be your primary residence. FHA loans are designed for owner-occupied properties, meaning you must move into the home within 60 days of closing and live there for at least one year. If you’re relocating for work or other reasons, an FHA loan can be a great option for purchasing a home in another state.

Can I buy a multifamily home with an FHA loan?

Yes, FHA loans allow you to buy a multifamily home with up to four units, as long as you occupy one of the units as your primary residence. This can be a great option for house hacking, where you live in one unit and rent out the others to offset your mortgage costs. The FHA 203(b) loan and FHA 203(k) loan are popular choices for purchasing and renovating multifamily properties. Learn more about financing a multi-family residence.

Can you buy investment property with an FHA mortgage?

No, FHA loans cannot be used to purchase investment properties unless you intend to live in the home. However, you can buy a multifamily home (up to four units) and rent out the additional units while living in one. This allows you to generate rental income while still qualifying for FHA financing. If you’re looking for a loan specifically for investment properties, conventional or DSCR loans may be better options.

Consider FHA Mortgages for Home Buying

Now that you understand everything that you need to apply for an FHA loan, all you need to do is to meet with an FHA-approved lender, complete their loan application, and supply the required financial documentation. If you have done everything right, you should be able to get pre-approved for FHA mortgages up to a certain amount based upon your income and other financial information. You will need this pre-approval to shop for a home so that you can show sellers and real estate agents that you have the funds available to buy.

FHA mortgages are a fantastic option for millions of Americans who might not otherwise be able to enjoy the American Dream. To learn more, talk to an FHA-approved lender in your community today.

References

- HUD vs. FHA Loans – What’s the Difference? (n.d.).

- Free Credit Reports. (n.d.).