Mortgage interest rates have been soaring so more borrowers are choosing a HELOC or home equity loan to pull out cash from the equity in their property. Before taking out a second mortgage against your property, you need to understand the benefits and risks of home equity loans and HELOC lines of credit. It’s important before shopping with banks and lenders that you understand the pros and cons of a HELOC and home equity loan so you can choose the best type of financing that meets your needs and goals.

Why the Home Equity Loan vs HELOC Debate Is Important

You need to learn which home equity program is best to meet your financial needs before making such an important decision. Take a few minutes and compare the HELOC vs home equity loan programs that are available in 2025 from the top second mortgage lenders in the country. If you own a home and need more money, the HELOC and HELOAN may help you accomplish this goals while improving your financial state.

Many homeowners do not know the difference between a home equity loan and HELOC. While both of these types of home equity financing have many similarities and benefits, there are a few major differences.

What is the Difference Between the HELOC vs. Home Equity Loan?

The RefiGuide helps borrowers educate themselves on the pros and cons of both equity loans and home equity credit lines. The interest rate is calculated differently between an equity loan and a HELOC.

The home equity loans is an installment loan that carries a fixed interest rate and the home equity line of credit has a variable interest rate and acts like a revolving line of credit. A home equity installment loan provides borrowers with fixed monthly payments and a fixed rate and a lump sum of money.

A HELOC line of credit and a home equity loan both fall under the category of second mortgages. Unlike a home equity loan, a HELOC doesn’t provide a one-time lump sum. Instead, it functions similarly to a credit card, allowing for repeated use and repayment through monthly installments. This type of secured loan uses the accountholder’s home as collateral.

Conversely, home equity line of credit offers the flexibility of accessing funds as needed, but they often come with an adjustable interest rate. When the home equity rates are trending upward then the home equity line of credit becomes riskier, but it depends on what you are using your home equity for.

We will outline the HELOC vs the home equity loan options so that understand the primary mortgage distinctions and commonalities between the two popular finance products and assist you in determining which one aligns best with your financial objectives.

HELOC and Home Equity Loan Rates:

-

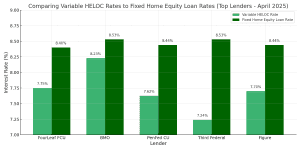

FourLeaf Federal Credit Union: Variable HELOC: 7.75%, Fixed Home Equity Loan: 8.40%

-

BMO: Variable HELOC: 8.23%, Fixed Home Equity Loan: 8.53%

-

PenFed Credit Union: Variable HELOC: 7.625%, Fixed Home Equity Loan: 8.44%

-

Third Federal Savings and Loan: Variable HELOC: 7.24%, Fixed Home Equity Loan: 8.53%

-

LoanDepot : Variable HELOC: 7.70%, Fixed Home Equity Loan: 8.44%

Note: Rates are subject to change and may vary based on creditworthiness and other factors. (Bankrate)

7 Key Differences Between a HELOC and a Home Equity Loan

When homeowners seek ways to leverage the equity they’ve built in their property, two popular options arise: Home Equity Lines of Credit (HELOCs) and Home Equity Loans. Although both involve borrowing against home equity, they function quite differently. Understanding these differences can help borrowers make informed decisions.

1. Structure of the Loan

A home equity loan provides a lump-sum payment upfront, which borrowers repay in fixed installments over time. In contrast, a home equity line of credit functions more like a credit card, allowing borrowers to access funds as needed during a specific draw period, with a credit limit based on the home’s equity.

2. Interest Rates

Home equity loans typically have fixed mortgage rates, meaning the monthly payment stays the same throughout the loan term. HELOCs usually have variable rates, meaning payments can fluctuate depending on market conditions, which introduces a level of unpredictability.

3. Repayment Structure

With a home equity loan, repayment begins immediately in fixed installments. HELOCs, however, have two phases: the draw period (where borrowers can access funds and only pay interest) and the repayment period (when the principal and interest are paid back).

4. Access to Funds

An equity home loan provides one-time access to a set amount of money. HELOCs offer revolving access to funds, meaning borrowers can draw, repay, and borrow again within the draw period, as long as they stay within their limit.

5. Loan Purpose Flexibility

Both loans can be used for various purposes, such as home improvements, education, or debt consolidation. However, HELOCs are better suited for ongoing expenses due to their revolving nature, while home equity loans are ideal for one-time, large expenses.

6. Closing Costs and Fees

Both loans may involve closing costs, but HELOCs often include lower initial fees. However, some lenders may charge annual maintenance fees or inactivity fees for HELOCs. Home equity loans tend to have higher upfront costs, similar to traditional mortgages.

7. Risk and Stability

Since home equity loans come with fixed rates and predictable payments, they offer more stability. HELOCs, with their variable rates, introduce more financial risk as payments can increase with interest rate hikes. Borrowers seeking financial certainty may prefer the former.

While both HELOCs and home equity loans offer ways to leverage home equity, their differences in structure, repayment, and risk should align with the borrower’s needs. Those requiring flexibility might benefit from a HELOC, while borrowers looking for predictability may prefer a home equity loan.

When You Should Get a Home Equity Loan and When You Should Get a HELOC

Your home isn’t just where you live – it’s also a potential source of financial leverage. As you build equity in your home, you may find yourself wondering how best to access it. Two of the most common ways to tap into that value are through a home equity loan or a home equity line of credit. While both options let you borrow against the equity in your home, they serve different purposes and are structured in distinct ways. So, how do you know which option is right for you? Let’s explore when you should choose a home equity loan and when a HELOC is the better choice.

A home equity loan is like planting a tree in your backyard – it’s rooted in stability. You know exactly how much water (payments) it needs, and it will grow steadily over time, with no surprises.

Think of a HELOC as a financial umbrella – you open it when you need protection (cash) and close it when you don’t. It provides flexibility, but its usefulness depends on the weather (market conditions and your financial needs).

When Should You Get a Home Equity Loan Over a HELOC?

A home equity loan is best suited for situations where you need a large sum of money upfront and prefer the predictability of fixed payments. This option is ideal for projects or expenses with a clear cost, such as:

Home Renovations: If you’re planning a significant renovation project, like remodeling your kitchen or building an addition, an equity house loan can provide the funds you need all at once. The fixed payments allow you to budget confidently, knowing exactly what your monthly obligations will be.

Debt Consolidation: A home equity mortgage can be a smart way to consolidate high-interest debt. By paying off credit cards or personal loans with a home equity loan’s lower interest rate, you can reduce your monthly payments and save money over time.

When your debts are piling up, when your interest rates are skyrocketing, when your payments are overwhelming – a home equity loan can be a beacon of stability in a sea of financial uncertainty.

Major Purchases: If you’re planning a wedding, sending a child to college, or facing medical bills, a home equity installment loan offers the stability of a fixed repayment schedule. You know exactly how much you’re borrowing and can plan for the future with confidence.

A home equity loan is like buying a plane ticket – you know your destination, you know the price, and you’ve committed to getting there.

When Should You Get a HELOC Over a Home Equity Loan?

A HELOC is the right choice when you need flexibility and don’t want to borrow a large sum all at once. It’s ideal for situations where costs are uncertain, or you want ongoing access to funds over time. A HELOC works best for:

Ongoing Home Improvements: If you have multiple home projects planned but don’t know the total cost, a HELOC offers flexibility. You can draw from the credit line as needed, which allows you to fund one project at a time without paying interest on unused funds. The HELOC loan is highly recommended for financing home improvements.

Imagine a toolbox that never empties – that’s the power of a HELOC. It’s there whenever you need it, providing a constant stream of resources for your evolving projects.

Emergency Fund : A HELOC can serve as a safety net for unexpected expenses, such as medical bills, car repairs, or job loss. Since you only pay interest on what you borrow, you can keep the line of credit open without incurring costs until you need it.

A HELOC is like a lifeline in a storm – it’s there when life throws you curveballs, offering support when you need it most.

Education Expenses: If you have a child going through college, tuition and other expenses can vary from year to year. A HELOC allows you to draw funds as needed, making it easier to manage unpredictable education costs.

A HELOC works like a reusable gift card – you draw from it whenever you need to, and the balance replenishes over time.

More Tips for Choosing Between a Home Equity Loan and a HELOC

So, how do you decide between a home equity loan and a HELOC? The answer lies in your financial goals and the nature of your expenses.

If you want certainty, if you want fixed payments, if you want to know exactly what you owe, a home equity loan is the answer. If you need flexibility, if you want to borrow as you go, if you want a safety net, a HELOC is the solution.

Consider the following factors:

- Fixed vs. Variable Costs: If your expenses are fixed, like a home renovation with a set budget, a home equity loan is ideal. If costs are variable, such as ongoing education expenses, a HELOC offers more flexibility.

- Payment Structure: If you prefer the security of fixed monthly payments, a home equity mortgage provides consistency. If you’re comfortable with variable payments and HELOC rates, a HELOC might be better suited to your needs.

- Interest Rates: Home equity loans typically have fixed rates, while HELOCs have variable rates. If you expect interest rates to rise, locking in fixed rates with a home equity loan could save you money in the long run.

Shop and Compare HELOCs and Home Equity Loans Online

- Interest Only Payments with HELOCs

- Fixed Monthly Payments with Equity Loans

- Borrow and Reborrow with HELOC Line

- Up-front Money with a Home Equity Loan

- Tax Deductible Home Improvements

Compare Home Equity Loan vs HELOC Line of Credit Terms and Rates

When shopping home equity loan lenders, banks and credit unions it is crucial that you compare the interest rate, APR, closing costs, lending fees, terms and amortization schedules. Please verify that there is no pre-payment penalty for paying off or refinancing home equity loans and HELOCs.

We suggest the HELOC when you are looking to finance home improvement projects, remodeling and repairs. It’s no secret that home renovation projects are difficult to budget for the flexibility of the HELOC makes sense for this purpose. Projects that increase living space, renovate outdated rooms such as kitchens or baths are good financing fits with the an equity line of credit.

Homeowners Value the HELOC for Emergencies

Life has a tendency to get expensive, especially when you least expect it. As a homeowner, it often seems that you fix one problem only to see another pop up in its place. A leaky roof? A busted air conditioner? Plumbing problems?

Whether you have a legitimate fixer-upper on your hands or you’re simply looking to update parts of your property or pay other expenses, money is a significant factor in making these changes. That’s why it’s important for homeowners to understand what are sometimes seen as risky methods to cover such costs — obtaining the best HELOC (Home Equity Line of Credit) or a Home Equity Loan (commonly called a second mortgage).

In most instances we suggest the home equity loan for debt consolidation and refinancing. If you are looking for a responsible way to consolidate revolving debt, high interest credit cards, student loans, and other adjustable rate personal loans, we recommend the home equity loan because it features a fixed interest rate with fixed monthly payments. Eliminating compounding interest may improve your financial situation significantly.

Both home equity loans and HELOCs offer significant opportunities for homeowners to borrow money cost effectively. The RefiGuide will help you calculate home equity and get connected to home equity loan pros that best meet your needs and qualifications.

The Pros and Cons of a HELOC Line of Credit

The terms and conditions of your equity line of credit will vary from a home equity loan, most notably where the interest rate is concerned.

According to NerdWallet, HELOCs often start with a lower interest rate with one big caveat — that rate is adjustable, or variable, which means it can go up and down and affect your monthly payment in kind.

The adjustable-rate HELOC is a unique second mortgage that offers many benefits to homeowners.

First, it provides flexibility in managing finances, as you can choose to pay only the interest during the initial draw period, usually around ten years.

This can result in lower monthly payments and more control over your budget. Additionally, the funds from the HELOC credit line can be used for various purposes, such as house improvements, college, or bill consolidation. The interest paid on the HELOC used to be tax-deductible. However, it’s important to carefully manage your finances and have a solid repayment plan in place to make the most of an Interest-Only HELOC.

Much like a credit card company, some HELOC lenders will take a portion of what you owe and hold it at a fixed (or introductory) rate. But the balance of your home equity line of credit will ultimately be at a variable rate, meaning you might owe more on your monthly payment than you initially thought. Shop for Today’s HELOC Interest Rates.

The minimum credit score for a HELOC loan ranges from 600 to 660 with most traditional lenders in 2024. However there are still a few brokers that approve HELOCs with minimum credit scores between 580 and 600. Don’t forget that you can always refinance a HELOC if the interest rates start rising.

After the HELOC draw period (typically 10 years), borrowers will begin the repayment period that begins to repay remaining mortgage balance with a specific repayment schedule that is usually 10 to 15 years.. During the repayment period the outstanding balance is paid back to the lender. In most cases, the HELOC payment still carries adjustable interest rates, unless the lender offers a fixed rate conversion.

Here are other pros and cons of obtaining a home equity line of credit:

HELOC Pros:

- HELOCs can be used to pay for home repairs, remodeling and construction.

- They often include two main periods of repayment. One, the draw period, means you only pay interest due on the money borrowed. When you enter the repayment period, the loan payments convert to a schedule where both principal and interest are due.

- Home equity lines often have lower interest rates than a personal loan or credit card, which means you could be a lot better off financially while using one.

- You can write a check with a HELOC line.

- HELOCs offer flexible opportunities to pay contractors as needed. (That’s why these are a very popular home improvement loan.)

- The interest on your HELOC might be tax-deductible if the money was used to make home improvements.

- The HELOC offers an interest only payment which can increase your cash flow.

Cons:

- HELOC lines of credit might require a number of upfront costs, such as an application fee, appraisal, title search, and more (almost like closing costs on a home).

- The Variable interest rate could rise and increase your monthly payments.

- When the draw period ends, you can no longer withdraw money and use the line of credit.

- When you only make interest payments your debt may increase.

- There may be annual fees or closeout fees involved.

- When you select the interest only payments, no principal is paid on the credit limit.

The Pros and Cons of a Home Equity Loan

A home equity loan is another way to allow Americans to tap what is perhaps their single biggest asset: their homes. These types of 2nd mortgages are attractive because they deliver money in one lump sum payment once an application is approved.

Here are some other pros and cons of equity home loans:

Home Equity Loan Pros:

- Home equity loans can be used to pay off just about anything, including high-interest credit card debt.

- The interest on an equity loan is simple interest so it amortizing monthly rather than compounding daily like a credit card.

- The best home equity loan rate can be locked in at fixed rates, meaning your payment period and the amount due each month will never change.

- The equity loan typically allows you to borrow around 80% to 90% of your home’s value, so if you need a large sum, it might be a good option. (If you have damaged credit you may only qualify for 70 -80% LTV and may need to apply for a home equity loan with bad credit.)

- Just like a home equity line of credit, home equity interest might be tax-deductible.

- Home equity loan payments provide fixed rates and fixed payments amortized over a set loan term.

Cons:

- You need to be sure you can afford the payment of your equity loan in addition to paying your current mortgage.

- Interest rates are usually higher than a HELOC.

- Closing costs can be substantial.

- If your fair market value or property value decreases you won’t have an equity available in case of an emergency.

- If you sell your home before you’ve paid off the loan, the balance becomes due immediately.

- Home equity loans do not offer interest only payments.

HELOC vs Home Equity Loan Rates

The interest rates for HELOCs and home equity loans are calculated differently with the monthly payments. The home equity lines of credit carry an adjustable interest rate and the borrowers are only required to pay interest monthly on the portion of the HELOC funds that they use. The home equity loan is amortized with a fixed interest rate and the borrower has a fixed monthly payment with a fixed number of years.

About the Variable Interest Rate Home Equity Line of Credit

The home equity line of credit offers greater borrowing flexibility compared to home equity loans. With an extended draw period, you can access the specific amount of money you require precisely when it’s needed, reducing the risk of borrowing excessively.

If you know what your home is currently worth and what you still owe on your mortgage, chances are that your home has equity available to utilize. Many people choose to take advantage of that by applying for and opening a home equity line of credit, or a HELOC. The home equity lines are set up with variable interest rates.

What is a HELOC, exactly? Most experts would describe it as an exclusive or limited line of credit, much like that small piece of plastic that you have in your wallet. But the key difference is the variable interest rates featured with a home equity line of credit and that that your home serves as collateral. That means if you don’t pay the money back, you default on the property. But as long as you need the money it’s there, so you can use it, pay it off, and use it again, just like a credit card. Let’s continue exploring the differences between the HELOC and home equity loan.

With a HELOC you pay interest only on what you access. For example, if you take out a $100,000 home equity line but you only use $20,000, then you are only making a monthly payment on the $20,000 during the initial draw period. Even though this borrower has a $100,000 credit limit, they only are responsible making interest payments on the amount of the revolving line they used. The minimum monthly payments during the draw period are interest only due. When the repayment period kicks in, then the borrower must pay back outstanding mortgage balance as the amortization transitions into fixed payments of principal and interest being paid monthly.

The Case for Fixed Rate Home Equity Loans

While home equity loans sometimes carry higher interest rates than HELOCs, they still tend to be more cost-effective than alternatives like credit cards. If you are having trouble sleeping at night because you are strapped with high-interest credit card debt, a home equity loan could provide the best solution to pay it down.

Moreover, the fixed rate ensures that you won’t be affected by potential increases in home equity rates, and the federal tax deduction for interest paid is applicable to home equity loans when you are financing home improvements. Fixed interest rates ensure that you will have a fixed monthly payment for the life of the mortgage.

Rest assured, a home equity loan and a HELOC are two different things. With an installment loan, you borrow an amount of money (drawn from the equity in your home) just once and then make regular payments on that amount over a fixed amount of time.

Unlike a HELOC, a home equity loan doesn’t free up money to use again as you make payments. But like a HELOC, a home equity loan borrows against your home so you’ll want to stay current on paying it back. According to Lending Tree, most repayment periods vary between 5 and 15 years, but with interest rates slightly higher than a HELOC or your original mortgage.

Simple interest home equity loans offer distinct advantages to homeowners. Unlike a traditional home equity credit line, it charges interest on the outstanding balance daily, which means you can reduce your interest costs by making extra payments or paying off the equity loan early. This flexible structure allows you to save money in the long run.

Moreover, simple interest loans typically have lower upfront closing costs, making them an economical choice for homeowners looking to tap into their home equity. Additionally, the interest paid on these loans may be tax-deductible, offering potential financial benefits.

The fixed interest rate equity loan offers financial flexibility, cost savings, and potential tax advantages for homeowners seeking money for a variety of reasons. Overall, home equity loans are said to be the preferred choice for borrowers who don’t like surprises.

The minimum credit score for fixed home equity loans is 620 with most 2nd mortgage brokers. The RefiGuide can help you connect with lending sources that offer home equity products with a minimum credit score as low as 550 if you have a low enough loan to value ratio. Find the best home equity loan rates online.

Case Study 1: Fixed Rate Simplicity with a Home Equity Loan

Karen, a homeowner in North Carolina, needed $50,000 to consolidate credit card debt and fund her daughter’s college tuition.

She chose a home equity loan because it offered a lump sum, fixed interest rate, and predictable monthly payments.

This helped her lock in a stable 10-year repayment plan and avoid rising variable rates.

The consistency gave her peace of mind and made budgeting easier.

Case Study 2: Flexibility with a HELOC for Home Renovations

James and Lisa in North Carolina wanted to remodel their kitchen and bathroom but preferred to pay in phases.

The home equity line of credit gave them a flexible solution with a 10-year draw period.

They used checks linked to the HELOC to pay contractors only when needed, reducing interest costs and allowing more control over their project spending.

The revolving credit line helped them stay within budget while upgrading their home over time.

Frequently Asked HELOC and Home Equity Loan Questions

Many homeowners wish to compare interest rates on HELOCs and home equity loans. In fact, one of the most commonly asked questions on Google is, “What is the current interest rate on a home equity loan?”

National and regional lenders will offer different rates on each product, with the rate averages for home equity loans offered with a five-year, 10-year, or 15-year term. Generic rates assume the borrower likely has a certain credit score, a standard amount of equity in the home, and may put a cap on how much the homeowner wants to borrow. But remember, Individual lenders will all have their own rates and terms and you shouldn’t be afraid to shop around.

Other commonly asked questions include:

“Will a HELOC hurt my credit?” and “Is a home equity loan a good idea?”

Because a home equity loan HELOC is a type of credit, an application will impact your credit score. But if you open a HELOC and don’t use all of the money available, your score might improve. Can I consolidate debt with a home equity loan or HELOC?

Both Home Equity Loans and HELOCs Can Benefit Homeowners Financially

Because both HELOCs and home equity loans have advantages and disadvantages, you’ll need to decide if opening one is a “good idea” based on your situation.

Can You Convert a HELOC to a Fixed Home Equity Loan?

There are a few home equity loan pros that permit the conversion of your home equity credit line into a fixed-rate equity loan. To qualify for these unique HELOC loans, it’s essential to have sufficient untapped home equity and stay within the lending sources’ specified debt-ratio limit.

Additionally, one should carefully assess the potential closing costs and fees associated with these credit line option in comparison to the advantages of securing a fixed interest equity loan.

What Are the Closing Costs for a HELOC and Home Equity Loan?

In the past, home equity mortgages carried substantial closing costs and additional lending fees, because they are considered a higher risk. You should expect similar closing costs as a home refinance, such as underwriting, processing, escrow and title fees.

These expenses, typically falling within the range of 2% to 4% of the total amount of money borrowed. Some home equity lenders will offer low cost HELOC loans to borrowers with good credit scores, so it is prudent to shop home equity loan and HELOC options before making a commitment.

What Debt to Income Ratio Do You Need to Qualify for a HELOC and Equity Loan?

Most lenders will assess your overall gross monthly income and the extent of your existing debt obligations. Documentation such as proof of employment or other income statements may be requested for thorough evaluation. The maximum debt to income ratio (DTI) ranges from 40-45%. There are still a few HELOC lenders that allow DTI up to 50%, but the home equity rates are higher than traditional interest rates.

Which Is Better a HELOC or Home Equity Loan?

Both home equity loans and HELOCs offer valuable ways to tap into your home’s equity, but the right choice depends on your unique financial situation. A home equity loan is ideal for those seeking stability, with predictable payments and a fixed loan amount. On the other hand, a HELOC provides the flexibility to borrow as needed, making it a perfect fit for uncertain or ongoing expenses.

By understanding the nuances of each option and weighing your specific needs, you can make an informed decision that aligns with your financial goals – whether you’re looking to consolidate debt, fund home improvements, or prepare for life’s unexpected challenges.

Borrowers want to know if they should choose a HELOC or home equity loan. Again, there’s no simple answer to this question and you should have a big picture view of your finances before making a decision on tapping into your home equity.

Keep in mind that both a HELOC and a home equity loan will require you to make a decision upfront about how much money you’ll need and how you’re going to use it. You should factor in all the pros and cons of the lists above as you make your decision.

Do not forget that an equity loan enables you to obtain a fixed lump sum of money based on the equity in your house. In contrast, the HELOC utilizes a home’s equity but provides homeowners with the flexibility to apply for an open line of credit. With a HELOC, you have the option to borrow up to a predetermined amount as needed.

No matter what, using the equity in your home is a gamble because a failure to pay means you could lose your home. If what you need is short-term funding, neither a HELOC nor a home equity loan is likely the best solution.

No matter what, be sure to do your homework, shop around, and compare a home equity loan vs HELOC offered by various lenders. This will help you lock in the best deal to fit your situation and meet your financial needs.

References