In 2025, homeowners seeking to leverage their property’s equity have a variety of options across the United States. Home equity loans and HELOCs offer avenues to access funds for purposes such as home remodeling, consolidating debt, or educational expenses. It’s not surprising that many of the high cost states like California, Colorado, Florida New Jersey, Virginia and Maryland make the list for best home equity loan and HELOC rates in 2025.

Top 25 States for Best Home Equity Loan Rates, HELOCs and Terms

Home equity interest rates for these financial products can vary significantly based on factors like geographic location, lender policies, and individual borrower profiles.

The RefiGuide published this article ranking the best rates by state offering competitive HELOC and home equity loan rates in 2025.

We broke down the top 25 states for competitive home equity loans and HELOCs if you were curious.

1. Virginia Home Equity Loan Rates

Virginia’s robust economy and competitive banking sector contribute to favorable home equity loan rates. As of March 2025, the average Virginia home equity loan rate was approximately 7.70%, slightly below the national average of 8.40%. Major Virginia home equity lenders in the state offer home equity and HELOC rates ranging from 7.20% to 8.00%, depending on loan terms and borrower qualifications. We suggest comparing the equity loans to the VA HELOC rates as well.

-

Bank of America: Offers competitive home equity lines of credit (HELOCs) with potential rate discounts for existing customers.

-

U.S. Bank: Provides both home equity loans and HELOCs with flexible terms and competitive rates.

-

Langley Federal Credit Union: offers fixed-rate home equity loans with rates starting as low as 5.99% APR for a 7-year term. This option provides the stability of fixed monthly payments over the loan term.

- Virginia Credit Union: provides fixed-rate home equity loans with rates as low as 7.50% APR. This loan features no closing costs and fixed monthly payments, offering predictability for borrowers.

Compare home equity loan interest rates for cities, such as, Virginia Beach, Chesapeake, Arlington, Richmond and Norfolk at no cost.

2. California Home Equity Loan Rates

California’s vast economy and competitive lending environment result in attractive CA home equity loan rates. The average rate is approximately 7.75%, with top lenders offering rates starting at 7.50% for well-qualified borrowers. The state’s diverse financial institutions cater to a wide range of borrower needs. Whether you are looking for a HELOC in San Diego, Los Angeles, Orange County, Riverside, San Jose or San Francisco, we can help you shop for the Best California home equity lenders online at no cost. The RefiGuide will assist you in checking the current HELOC rates in California.

-

Wells Fargo: Offers home equity lines of credit with competitive rates and flexible access to funds.

-

LoanDepot: This top ranked lender provides quick approval HELOCs and fixed rate equity loan, catering to borrowers seeking fast access to funds.

-

Star One Credit Union offers fixed-rate home equity loans with rates as low as 6.625% APR. This option provides the stability of fixed monthly payments over the loan term. They also provide HELOCs with rates starting at 7.500% APR, offering flexibility for borrowers who prefer to access funds as needed.

-

1st United Credit Union United offers CA HELOCs with rates as low as 5.500% APR. This line of credit functions similarly to a credit card, allowing easy access to funds through checks or transfers. Borrowers can utilize up to 80% of their home’s equity

3. Florida Home Equity Loan Rates

The Sunshine states’ dynamic real estate market influences the Florida home equity loan rates. In 2025, the average rate is around 8.10%, aligning closely with the national average. Florida home equity lenders provide rates between 7.77% and 8.30%, contingent on factors such as loan-to-value ratios and credit scores.

-

Regions Bank: Offers home equity loans with competitive rates and flexible terms.

-

Bank of America: Provides HELOCs with potential rate discounts for qualifying customers.

-

Space Coast Credit Union (SCCU) SCCU offers FL HELOCs with no points, no loan origination fees, and no intangible tax. This makes it a cost-effective option for borrowers seeking flexible access to their home’s equity

- Sun Coast Credit Union: Suncoast provides both fixed-rate home equity loans and variable-rate HELOCs with competitive interest rates. They offer up to $1,000 toward closing costs, enhancing affordability for borrowers.

The RefiGuide can help you shop HELOC rates by city. Compare rates for Jacksonville, Miami, Tampa, Orlando and St. Petersburg at no cost.

4. Maryland Home Equity Loan Rates

Maryland’s proximity to major financial hubs ensures access to a variety of lending options. The average Maryland home equity loan rate stands at 7.85%, with competitive offerings from both local and national banks. Borrowers with strong credit profiles can secure rates as low as 7.60%. Consider the Baltimore HELOC rates. Many of the Maryland home equity lenders are offering low introductory MD HELOC rates worth researching. Search home equity rates by city: Also see HELOC rates for Columbia, Germantown, Frederick, Waldorf and Silver Spring.

-

PNC Bank: Offers home equity loans with fixed rates and flexible repayment terms.

-

Truist: Provides HELOCs with potential fixed-rate conversion options.

-

MECU Credit Union: MECU offers fixed-rate home equity loans with terms up to 15 years. For example, a 10-year fixed-rate equity loan is available at an APR as low as 6.49%, with an estimated monthly payment of $11.35 per $1,000 borrowed. MECU provides a low rate HELOCs in Maryland with a 5.99% fixed APR for the first 12 months, transitioning to a variable rate as low as Prime minus 0.25% thereafter. Credit lines are available for up to 15 years, with amounts ranging from $5,000 up to 80% of your home’s equity.

-

APG Federal Credit Union (APGFCU) :APGFCU offers fixed-rate Maryland home equity loans with terms up to 20 years. For instance, a 10-year loan has an APR as low as 5.64%, resulting in a monthly payment of approximately $10.92 per $1,000 borrowed.

5. New Jersey Home Equity Loan Rates

New Jersey’s banking sector offers home equity loan rates averaging 8.00% in 2025. Lenders provide rates ranging from 7.70% to 8.20%, influenced by borrower creditworthiness and equity loan terms. The state’s proximity to major financial centers contributes to a competitive lending landscape. Many banks and lenders are offering low intro NJ HELOC rates. See variable and fixed home equity interest rates for Newark, Jersey City, Paterson, Lakewood and Elizabeth.

- North Jersey Federal Credit Union (NJFCU) offers fixed-rate home equity loans with rates as low as 6.25% APR for a 5-year term. For example, a $10,000 loan at this rate requires 60 monthly payments of $194.47. Rates may vary based on creditworthiness and loan terms.

- First Harvest Credit Union First Harvest provides fixed-rate home equity loans with rates starting at 6.24% APR. Borrowers can finance up to 90% of their home’s equity, with loan amounts up to $200,000 for first-lien positions. The credit union also covers appraisal fees, reducing upfront costs for borrowers.

-

TD Bank: Offers New Jersey home equity loans with fixed rates and no application fees.

-

Third Federal Savings & Loan: Provides competitive NJ HELOC rates with low fees,

6. South Carolina Home Equity Loan Rates

South Carolina’s growing economy and housing market have led to favorable home equity loan rates. The average rate is around 7.90%, with lenders offering rates between 7.60% and 8.10%. Borrowers with excellent credit can access the most competitive rates. Now you can see the current HELOC interest rates for Charleston, Columbia, North Charleston, Mount Pleasant and Rock Hill, SC.

-

South State Bank: Offers home equity loans with competitive rates and flexible terms.

-

Truist: Provides unique SC HELOC programs with potential fixed-rate options and competitive rates.

7. Wisconsin Home Equity Loan Rates

Wisconsin’s stable housing market contributes to home equity loan rates averaging 7.85% in 2025. Local and regional banks offer rates from 7.60% to 8.00%, depending on borrower qualifications and loan specifics. Do not forget to check the Wisconsin HELOC rates as they could be lower than the fixed interest rates.

-

Associated Bank: Offers home equity loans with fixed rates and various term options.

-

U.S. Bank: Provides both home equity loans and HELOC rates in Wisconsin with competitive rates and terms.

Now you can see today’s home equity rates for Milwaukee, Madison, Green Bay, Kenosha and Racine. (Shop top WI HELOC Lenders online.)

8. Georgia Home Equity Loan Rates

Georgia’s diverse economy supports a competitive lending environment. The average Georgia home equity loan rate is approximately 8.05%, with lenders providing rates between 7.80% and 8.20%. Borrowers with strong credit histories can secure more favorable terms. Check variable and fixed home equity loan rates by GA city: Atlanta, Augusta, Columbus and Savannah.

-

SunTrust (now Truist): Offers home equity lines of credit with competitive Georgia HELOC rates and flexible terms.

-

Regions Bank: Provides home equity loans with fixed rates and flexible repayment options.

-

Credit Union of Georgia: Offers fixed-rate home equity loans with rates as low as 6.09% APR for terms up to 15 years. Shorter terms may have Low intro Georgia HELOC rates as low as 5.49% APR. Additionally, there are no closing costs associated with these 2nd mortgages.

9. Michigan Home Equity Loan Rates

Michigan’s recovering housing market has led to home equity loan rates averaging 8.00% in 2025. Lenders in the state offer rates ranging from 7.70% to 8.10%, influenced by factors such as credit scores and loan amounts. The RefiGuide is here to help you find the best HELOC rates in Michigan from banks, credit unions and lenders you can trust.

Lake Michigan Credit Union (LMCU)

-

LMCU offers fixed-rate home equity loans with terms ranging from 5 to 15 years. Lake Michigan home equity rates are competitive, and there are no application fees.

-

For those preferring a variable-rate option, LMCU provides HELOCs with a current rate as low as 7.24% APR. These lines of credit offer flexibility and no annual fees.

Michigan Schools & Government Credit Union (MSGCU)

-

MSGCU offers fixed-rate home equity loans with rates as low as 6.49% APR. These loans are disbursed in a one-time lump sum, making them ideal for specific projects or expenses.

-

For a more flexible borrowing option, MSGCU provides HELOCs with variable rates starting at 7.50% APR. This option allows borrowers to access funds as needed, similar to a credit card.

Check variable and fixed home equity rates by MI city: Detroit, Grand Rapids, Warren, Sterling Heights and Ann Arbor.

10. Texas Home Equity Loan Rates

Texas boasts a robust economy, and its home equity loan rates reflect this strength. The average rate is around 7.95%, with lenders offering rates between 7.70% and 8.15%. State regulations also play a role in shaping loan terms and availability. There are unique state restriction and rules for Texas home equity loans, HELOCs and cash out refinancing, so verify you meet the CLTV restrictions. Check today’s HELOC rates for Houston, San Antonio, Dallas, Fort Worth and Austin, TX.

-

Frost Bank: Offers home equity loans with competitive rates and no closing costs.

-

Bank of America: Lender provides HELOCs with potential rate discounts for existing customers.

11. North Carolina Home Equity Loan Rates

North Carolina’s growing financial sector contributes to competitive NC home equity loan rates, averaging 7.85%. Lenders provide rates from 7.60% to 8.00%, with favorable terms for borrowers with high credit scores.

-

Truist: Provides home equity loans and HELOCs with competitive rates and flexible terms.

-

Bank of America: Offers the best NC HELOCs with potential rate discounts for qualifying customers.

Check the current HELOC interest rates for Charlotte, Raleigh, Greensboro, Durham and Winston‑Salem.

12. Connecticut Home Equity Loan Rates

Connecticut offers home equity loan rates averaging 8.10% in 2025. Lenders in the state provide rates between 7.85% and 8.25%, influenced by borrower profiles and second mortgage characteristics. Learn how to shop and compare CT HELOC rates.

-

Webster Bank: Offers home equity loans with fixed rates and flexible terms.

-

People’s United Bank: Provides HELOCs with competitive CT rates and flexible access to funds.

13. Pennsylvania Home Equity Loan Rates

Pennsylvania’s stable housing market results in home equity loan rates averaging 8.00%. Lenders offer rates ranging from 7.75% to 8.15%, with competitive Pennsylvania HELOC rates and terms available for qualified borrowers.

-

Truist: Offers home equity loans and competitive PA HELOC rates and flexible terms.

-

Bank of America: Provides HELOCs with potential rate discounts for qualifying customers.

Shop and consider fixed equity loan and HELOC rates for PA cities such as, Philadelphia, Pittsburgh, Allentown, Reading and Erie.

14. Ohio Home Equity Loan Rates

Ohio’s home equity loan rates average 7.90% in 2025. Lenders provide rates between 7.65% and 8.05%, with borrower creditworthiness playing a significant role in OH home equity rate determination.

-

Third Federal Savings & Loan: Offers competitive home equity loan rates with low fees.

-

Huntington Bank: Provides home equity lines of credit with competitive rates and terms.

Compare OHIO HELOC lenders for rates for cities such as, Columbus, Cleveland, Cincinnati, Toledo and Akron.

15. Washington Home Equity Loan Rates

Washington’s growing economy and housing market contribute to WA home equity loan rates averaging 8.05%. Lenders offer rates from 7.80% to 8.20%, with favorable terms for borrowers with strong credit profiles. We suggest comparing Washington HELOC rates with fixed home equity loan rates online.

-

U.S. Bank: Offers home equity loans and HELOCs with competitive WA HELOC rates and flexible terms.

-

Wells Fargo: Provides home equity lines of credit with competitive rates and flexible access to funds.

Our team will help you compare fixed and variable HELOC rates for WA cities, such as, Seattle, Spokane, Tacoma, Vancouver and Bellevue.

Accessing your home’s equity through a Home Equity Line of Credit or HELOC or a home equity loan can be a strategic financial move, especially when you secure favorable interest rates.

While home equity rates can vary based on individual credit profiles and lender policies, certain states offer more competitive environments due to factors like lender competition, state regulations, and economic conditions.

Based on recent data, here are ten states that stand out for offering some of the best HELOC and home equity loan rates in 2025:

16. Idaho Home Equity Loan Rates

Idaho’s robust housing market and competitive lending landscape contribute to attractive home equity financing options. Homeowners in the Pacific Northwest can benefit from favorable terms and low Idaho HELOC intro rates.

-

Idaho Central Credit Union (ICCU): ICCU provides home equity lines of credit with low variable rates and easy access to funds via a Visa card. They offer a ten-year line of credit with interest-only payment options. Compare today’s HELOC rates in Idaho.

-

LoanDepot: Specializing in attractive home equity loans in Idaho, LoanDepot offers competitive rates and a streamlined application process, facilitating access to your home’s equity for various financial needs.

17. Colorado Home Equity Loan Rates

With a strong economy and a high rate of home appreciation, Colorado offers homeowners substantial equity to tap into. Lenders in the state provide competitive rates to capitalize on this equity. Compare Colorado HELOC rates with fixed interest rate 2nd mortgages from top CO lenders across this great state.

-

Colorado Credit Union: This institution offers both fixed-rate home equity loans and revolving credit lines with competitive Colorado HELOC interest rates tailored to fit various budgets.

-

Bank of America: Operating nationwide, Bank of America provides HELOCs with flexible terms, allowing borrowers in Colorado to access funds as needed with potentially favorable rates. BofA always competes for the best HELOC rates in Colorado.

Now you can shop and compare home equity rates for CO cities, such as, Denver, Colorado Springs, Aurora, Fort Collins and Lakewood.

18. Illinois Home Equity Loan Rates

Illinois, particularly the Chicago metropolitan area, boasts a diverse and competitive banking sector. This competition among Illinois lenders often results in more favorable HELOC rates for consumers seeking home equity products.

-

Illinois Bank & Trust: They offer home equity lines of credit with competitive introductory rates, providing flexible borrowing options for homeowners.

-

PNC Bank: Recognized as a top mortgage lender, PNC Bank offers HELOCs with features like fixed-rate lock options, catering to borrowers seeking stability in their repayment terms.

Check today’s Illinois HELOC rates by cities such as, Chicago, Aurora, Naperville, Joliet and Rockford.

19. Massachusetts Home Equity Loan Rates

The Bay State’s stable housing market and concentration of financial institutions create an environment where homeowners can access home equity financing at attractive MA home equity loan rates. Let the RefiGuide direct you in shopping online for current HELOC rates in Massachusetts. Shop for Massachusetts equity loan rates by cities such as, Boston, Worcester, Springfield, Cambridge and Lowell.

-

Citizens Bank: Known for its strong customer service, Citizens Bank offers home equity loans with competitive rates and flexible terms, making it a favorable option for Massachusetts residents.

-

Bank of America: With a significant presence in Massachusetts, Bank of America provides HELOCs with various features, including online account management and flexible repayment options.

20. Minnesota Home Equity Loan Rates

Minnesota’s prudent economic policies and strong housing market make it a favorable place for home equity borrowing. MN Lenders in the state offer competitive HELOC rates in Minnesota to qualified borrowers.

-

U.S. Bank: Headquartered in Minnesota, U.S. Bank offers HELOCs with competitive rates and flexible terms, providing local expertise and convenience for residents.

-

Wells Fargo: With numerous branches across the state, Wells Fargo provides home equity loans and lines of credit with various options to suit different borrowing needs.

Compare today’s HELOC interest rates by MN cities such as, Minneapolis, St. Paul, Rochester, Duluth and Bloomington.

21. Missouri Home Equity Loan Rates

Missouri’s cost of living and housing market stability contribute to favorable conditions for home equity financing. Homeowners can find competitive MO home equity rates, especially in urban centers like St. Louis and Kansas City.

-

First Community Credit Union: Based in St. Louis, this credit union offers home equity lines of credit with competitive rates and flexible terms, emphasizing local decision-making and personalized service.

-

Commerce Bank: A regional bank with a strong presence in Missouri, Commerce Bank provides home equity loans and HELOCs with various features tailored to homeowners’ needs.

22. Nevada Home Equity Loan Rates

Nevada’s recovering housing market and no state income tax policy make it an attractive place for homeowners seeking to leverage their home equity. Nevada Lenders offer competitive fixed equity loan rates to encourage borrowing.

-

Nevada State Bank: This bank offers HELOCs with flexible borrowing options and competitive rates, allowing homeowners to access funds as needed.

-

Greater Nevada Mortgage: Providing NV HELOCs with rates as low as 8.50% APR, they offer a limited-time rate discount based on the initial borrowing amount.

Find the today’s Nevada HELOC rates by cities such as, Las Vegas, Henderson, North Las Vegas, Reno and Enterprise.

23. New York Home Equity Loan Rates

Despite its higher cost of living, New York’s vast financial market offers a plethora of lending options. Homeowners, especially those outside the metropolitan areas, can find competitive New York home equity loan rates.

-

Bethpage Federal Credit Union: Recognized for its HELOC offerings, Bethpage provides competitive NY HELOC rates and flexible terms, making it a strong choice for New York residents.

-

Chase Bank: With a significant presence in New York, Chase offers home equity lines of credit with various features, including fixed-rate options and flexible access to funds.

24. Oregon Home Equity Loan Rates

Oregon’s growing economy and housing market appreciation provide homeowners with significant equity. OR Lenders in the state offer attractive Oregon HELOC rates to tap into this market.

-

KeyBank: Operating in numerous states, including Oregon, KeyBank offers HELOCs with interest-only and rate-lock options, providing flexibility for borrowers.

-

Umpqua Bank: A regional bank with branches in Oregon, Umpqua provides home equity loans and lines of credit with competitive rates and personalized service.

Find the current home equity rates by Oregon cities such as, Portland, Eugene, Salem, Gresham and Hillsboro.

25. Tennessee Home Equity Loan Rates

Tennessee’s low tax burden and affordable housing market make it a favorable environment for home equity borrowing. TN Lenders offer competitive rates to attract borrowers in this growing market. Check today’s HELOC rates in TN cities like, Nashville, Memphis, Knoxville, Chattanooga and Clarksville.

-

Regions Bank: Known for its flexible repayment terms, Regions offers HELOCs that cater to various financial needs, making it a strong option for Tennessee homeowners. Check today’s HELOC rates in Memphis and more.

-

First Horizon Bank: With a significant presence in Tennessee, First Horizon provides Tennessee home equity loans and lines of credit with competitive rates and tailored borrowing solutions.

Factors Influencing State Variations in Home Equity Financing Rates

Several factors contribute to the differences in HELOC and home equity loan rates across states:

-

Lender Competition: States with a higher number of financial institutions often experience more competitive rates due to the increased competition among lenders.

-

State Regulations: Local laws and regulations can impact lending practices, influencing the availability and terms of home equity products.

-

Economic Conditions: States with robust economies and strong housing markets typically offer better rates, as lenders view these environments as lower risk.

Lender Tips for Securing the Best Home Equity Rates and Financing Terms

To maximize your chances of obtaining favorable rates, consider the following strategies:

-

Improve Your Credit Score: A higher credit score can significantly impact the interest rates offered to you. Aim to pay bills on time, reduce debt, and avoid opening new credit lines before applying.

-

Shop Around: Compare offers from multiple lenders, including banks, credit unions, and online lenders, to find the best rates and terms.

-

Consider Loan Terms: Evaluate both short-term and long-term loans to determine which aligns best with your financial goals and repayment capacity.

-

Negotiate Fees: Some lenders may be willing to waive or reduce fees associated with the loan. Don’t hesitate to negotiate to lower your overall borrowing costs.

-

Stay Informed: Keep abreast of economic trends and Federal Reserve rate changes, as these can influence interest rates nationwide.

By understanding the landscape of home equity financing and proactively managing your financial profile, you can position yourself to take advantage of the best rates available in your state.

Factors Influencing Low Home Equity Loan Rates

Several factors affect the interest rates on home equity loans:

-

Credit Score: Higher credit scores typically result in lower interest rates.

-

Loan-to-Value (LTV) Ratio: A lower LTV ratio can lead to more favorable rates.Bankrate

-

Loan Amount: Larger loan amounts may qualify for lower rates, depending on the lender.

-

Economic Conditions: Overall economic health and Federal Reserve policies influence interest rates.

In 2025, homeowners across various states have access to competitive home equity loan quotes and find the best HELOC rates today. Factors such as creditworthiness, loan terms, and economic conditions play crucial roles in determining the specific rates available to borrowers.

FAQs for Home Equity Loan and HELOC Rates

How Long to Get a Home Equity Loan?

The time required to get a home equity loan varies by lender but typically takes two to six weeks from application to funding. The process includes applying, credit checks, home appraisal, underwriting, and closing. Some lenders offer expedited approvals, especially for borrowers with strong credit and low loan-to-value (LTV) ratios. If an appraisal is required, it may add extra time to the process. Choosing a lender with streamlined digital applications can help speed up approval.

What Companies Offer the Best Second Mortgage Rates Nationally?

Several national lenders offer competitive second mortgage rates, including Bank of America, Wells Fargo, U.S. Bank, and Rocket Mortgage. Online lenders like Better.com and LoanDepot also provide low-rate options with quick approvals. 2nd mortgage loan rates vary based on credit score, loan amount, and LTV ratio, so it’s best to compare lenders and request quotes. Additionally, credit unions and local banks may offer better deals for qualified borrowers, making it essential to shop around for the best rate.

What Are Equity Loan and HELOC Closing Costs on Average?

Home equity loan and HELOC closing costs typically range from 2% to 5% of the loan amount. These costs may include appraisal fees ($300–$600), origination fees (1%–2% of the loan), title search fees, and government recording charges. Some home equity lenders offer no-closing-cost HELOCs, but they may have higher interest rates. Always review Good Faith Estimates to understand total costs, as some lenders allow borrowers to roll closing fees into the loan balance.

How are home equity loan rates determined?

Home equity loan rates are influenced by the Federal Reserve’s federal funds rate, which affects the prime rate, plus your credit score (higher scores get lower rates), debt-to-income ratio (below 43% preferred), and loan-to-value ratio (80% or less). Market conditions and lender policies also play a role. Compare multiple lenders for the best rate.

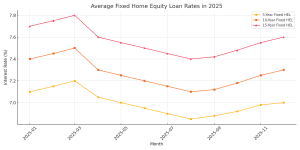

How much are fixed home equity loan interest rates in 2025?

In 2025, fixed home equity loan rates average 8.04%–10.17% APR, depending on loan term, credit score, and lender. Shorter terms (5–10 years) often have lower rates, while longer terms (15–30 years) may be higher. Rates are declining due to Federal Reserve cuts, but vary by borrower. Check with lenders for personalized quotes.

Home equity loan rates vs. refinance rates in 2025?

In 2025, home equity loan rates (8.04%–8.41% APR) are higher than 30-year fixed refinance rates (6.88%–7.26% APR). Home equity loans, as second mortgages, carry more risk for lenders, leading to higher rates. Refinancing may offer lower rates but involves higher closing costs (3–6%). Choose based on loan purpose and cost savings.

What are today’s home equity loan rates for 10 years?

As of June 23, 2025, 10-year fixed home equity loan rates average 8.41% APR for a $30,000 loan, per Bankrate’s survey. Rates vary by credit score (700+ preferred) and lender. Some lenders, like Discover, offer rates as low as 7.96% with no closing costs. Contact lenders for current offers.

What are today’s home equity loan rates for 15-year fixed?

On June 23, 2025, 15-year fixed home equity loan rates average 8.34% APR for a $30,000 loan, according to Bankrate. Borrowers with excellent credit (740+) may secure rates near 7.80% from lenders like PNC Bank. Rates are slightly lower than 10-year terms due to lender pricing. Request quotes for accuracy.

What are the current home equity loan rates for a 20-year term?

As of June 23, 2025, 20-year fixed home equity loan rates average around 8.86% APR for a $60,000 loan, per Discover’s sample rates. Rates may range from 8.06%–9.77%, depending on credit and lender. Navy Federal offers competitive rates (~7.65%) for military members. Verify rates with multiple lenders.

What are today’s home equity loan rates for 30 years?

On June 23, 2025, 30-year fixed home equity loan rates average 8.70%–9.33% APR, with lenders like TD Bank and Discover offering terms up to $500,000. For a $100,000 loan, expect payments around $777 at 8.705% APR. Rates are higher due to longer terms. Compare lender quotes for best deals.