VA home loans are attractive and not out of reach if you meet the VA loan requirements and qualifications. Are you active or retired military? You may be able to qualify for a Veteran’s Administration financing, also known as the VA loan. Our team will educate you on the current VA home loan guidelines. These Veteran mortgages are unique and powerful finance options for select American borrowers.

- Easy VA Home Loan Requirements

- Attractive Military Home Loans

- Best VA Home Loan Rates Online

- No Money Down VA Loan Requirement

- Affordable Military VA Loan Programs

- VA Home Buying for All Types of Credit

- 100% VA Mortgage Loans

The VA mortgage loan is highly regarded as the most sought after home financing product in the United States. The VA home loan requirements make buying a house easy if you meet the VA eligibility that we will outline below.

Find Low Credit VA Home Loans, Low Rates with No Down Payment Required

VA loans typically have no down payment requirements and offer lower interest rates to buy a home compared to traditional mortgage products. They are also more flexible, allowing for higher debt-to-income ratios and lower credit scores, and they do not require mortgage insurance or PMI.

For borrowers who are or were in the US military, VA home loans are one of the best options for people serving in the U.S. Armed Forces to buy a house. The U.S. Government Expanded the VA Loan Program to Help More Military Families in the Army, Air Force, Navy, Marines, Coast Guards and Reserves Finance New Homes or Refinance Existing Mortgages. There is no down payment to buy a home required with any VA loans.

If you want to buy a home and are a military veteran or active duty, keep reading to learn more about current VA home loan guidelines for 2025.

VA home financing offers significant benefits to military borrower that served their country. People who qualify for a VA home loan do not have to deal with as much hassle as far as getting approved for a VA loan option, and the veteran home loan rates are usually excellent as well. The RefiGuide can help you get educated on VA loan requirements while getting you a preapproved for a mortgage.

Todays VA Loan Rates

As of May 19, 2025, VA mortgage rates are as follows:

30-Year Fixed VA Loan:

-

Interest Rate: 5.750%

-

APR: 6.223%

-

Points: 1.000

-

Lender: Navy Federal Credit Union

15-Year Fixed VA Loan:

-

Interest Rate: 5.125%

-

APR: 5.773%

-

Points: 0.250

-

Lender: Navy Federal Credit Union

Please note that these rates are subject to change and can vary based on factors such as credit score, loan amount, and specific lender terms. It’s advisable to consult directly with lenders or financial advisors to obtain the most accurate and personalized rate information.

How VA Home Loan Rates Work

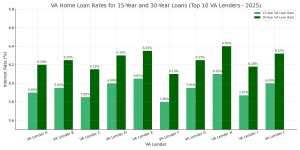

Like conventional mortgage rates, VA mortgage rates fluctuate with the market. They also depend on the repayment term you choose. VA approved lenders typically offer lower interest VA purchase rates for 15-year mortgages than for 30-year loans due to the shorter repayment period and reduced risk.

The VA loan rate you qualify for can be either fixed or adjustable. With a fixed interest rate, you’re guaranteed the same rate for the duration of your VA backed loan. A variable interest rate mortgage will have a fixed rate for an initial period, after which it will adjust periodically based on market conditions.

VA mortgage rates, like all consumer borrowing rates, have risen in recent years following a series of interest rate hikes by the Federal Reserve the last few years. While the Federal Reserve does not directly set mortgage interest rates, its policies significantly influence borrowing costs.

Overview of VA Home Loan Guidelines

Here are some of the key things to know about VA home financing in 2025:

- No down payment needed: For most Americans, no down payment home loans are a thing of the past. The closest most people can get is a 3.5% down-payment issued via FHA loan guidelines. But if you can qualify for a VA loan, it usually can be with no money down. Qualified VA borrowers love the $0 down home loans. All you need to pay is closing costs and the VA funding fee. Borrowers love the no down payment requirement with the VA backed zero down purchase loans.

- No mortgage insurance: If you qualify for the VA loan benefit, you do not have to pay for mortgage insurance or PMI. This is usually required for people who have less than 20% stake in the property. PMI will typically add $100 or more to your monthly payment.

- Flexible lending requirements: Many other lenders have higher credit standards than a decade ago. But the VA mortgage is a military benefit, so the standards are quite flexible. As long as you have a credit score of 620 or higher, you should be able to qualify for the VA home loan benefit.

- Low interest VA loan rates: VA mortgages are usually lower than market rates, so you should be able to have one of the lowest possible monthly payments.

- No pre-payment penalties: If you want to pay off the purchase loans early or refinance, you will not be penalized.

VA Home Loan Requirements

You are eligible for VA loan terms if you meet one of the following criteria:

- Completed at least 90 days of active duty service.

- Served at least six years in the Reserves or National Guard.

- Completed at least 181 days of active duty service during peacetime.

- Accumulated 90 days of cumulative service under Title 10 or Title 32, with at least 30 consecutive days for Title 32 service.

You can initiate a VA loan application through a bank, mortgage company, or credit union that provides such services. The VA home loan application process resembles that of other mortgage types: you provide employment, income, and financial details, and the lender evaluates your eligibility.

How to Get a Pre-Approval for a VA Home Loan

An essential requirement is obtaining a VA certificate of eligibility, a document issued by the Department of Veterans Affairs verifying your fulfillment of the service prerequisites for a VA loan. You can acquire this document directly from the VA or request a VA mortgage lender to obtain it on your behalf.

Once you have shown a lender your income, tax and payroll documentation, he or she can give you a pre-approval letter.

This letter is usually needed when you are going to look at homes and need the lender to state that you are pre-approved for purchase loans that are VA guaranteed. The owner of the property wants to see that you have the ability to get a home loan.

The VA pre-approval letter will usually say that you have been pre-approved for a VA loan up to a certain amount.

You will still need to fully qualify for the VA loan eligibility, but the pre-approval letter is a critical step.

Those are the most important features of buying a home guaranteed by the VA today. The VA loan requirements have not changed much of the last few years. Now let’s examine what you need to qualify.

Top VA Mortgage Lenders in the US in 2025

VA home loans, backed by the Department of Veterans Affairs, offer veterans and active-duty members zero-down-payment mortgages with competitive rates and no private mortgage insurance. Below are the top 11 U.S. lenders offering VA loans in 2025, with estimated rates, APRs, and lending niches. Rates assume a 30-year fixed VA loan, 700+ credit score, and 100% loan-to-value (LTV), but vary by borrower. Closing costs range from 1–3% ($2,000–$6,000 on a $200,000 loan).

-

Veterans United (Columbia, MO): 6.80%–7.40% APR. Largest VA lender, free credit counseling, 14.69% market share.

-

United Wholesale Mortgage (Pontiac, MI): 6.85%–7.45% APR. Broker-only, 8.79% market share, 2% down grant for low-income borrowers.

-

LoanDepot (Lake Forest, CA): 6.90%–7.50% APR. Online process, 22-day closings, NAF Cash for all-cash offers.

-

Freedom Mortgage (Mount Laurel, NJ): 6.85%–7.45% APR. First-time buyer focus, Eagle Eye rate alerts, 4.36% market share.

-

Navy Federal Credit Union (Vienna, VA): 6.75%–7.35% APR. Military-focused, Military Choice loan, below-average rates.

-

DHI Mortgage (Austin, TX): 6.90%–7.50% APR. Homebuilder-affiliated, 2.85% market share, fast closings.

-

Village Capital (San Francisco, CA): 6.85%–7.45% APR. VA/FHA refinancing specialist, 2.62% market share.

-

Guild Mortgage (San Diego, CA): 6.80%–7.40% APR. 540+ credit for VA, non-traditional credit accepted.

-

New American Funding (Tustin, CA): 6.80%–7.40% APR. 500+ credit for VA, underserved borrower focus, 14-day closings.

-

PenFed Credit Union (McLean, VA): 6.75%–7.35% APR. No military affiliation needed, low APRs, $5 membership.

-

Flagstar Bank (Troy, MI): 6.80%–7.40% APR. 580+ credit, Military Choice loan, first-responder discounts.

Key Features for VA Loans

All lenders offer VA purchase and refinance loans, requiring a Certificate of Eligibility and 580–620+ credit. Niches include low-credit options (Guild, New American), military-focused lending (Navy Federal, Veterans United), and fast closings (LoanDepot). APRs range from 6.75%–7.50%, with VA funding fees (1.25–3.3%). Compare VA loan quotes to maximize savings.

Military Service Requirements for VA Loans

You have to be eligible for a VA loan option to get one. Active military and veterans must mean certain qualification standards regarding their service. The current standards to qualify from a service perspective are:

- Serve at least 90 consecutive days active during wartime

- Serve at least 181 consecutive days during peacetime

- Serve at least 6 years for the National Guard or Reserves

- Be the surviving military spouse for those who died in the line of duty or with a service-related, major disability

At least one of the aforementioned service requirements must be satisfied. In the event that they are not met, an alternative avenue to eligibility is to be the spouse of a military member who either lost their life in the line of duty or due to a service-related disability.

Typically, remarriage is not allowed. If you meet some or all of these requirements, you qualify for a VA home loan from a service perspective. You will still need to qualify financially, however.

Note: A co-borrower on the VA loan eligibility must also be a veteran or the spouse of the primary borrower who meets the criteria. Don’t forget that VA loan requirements can change so verify you and your co-borrower still meet the criteria.

Credit for VA Home Loan Qualification

VA loans are very flexible in terms of qualifying, but you will still need to have acceptable credit to get a VA-house loan.

VA loans are very flexible in terms of qualifying, but you will still need to have acceptable credit to get a VA-house loan.

Here are some of the common things you will need to answer with your lender:

- Credit score: As long as it is 620 or higher, you should be able to qualify with most VA mortgage companies.

- If you are lower than that, you may have problems. Ask the lender to check with all three credit bureaus and try to get a score at or above 620. However some VA approved lenders will offer VA loans for bad credit as long as the borrower meets the other VA guidelines.

- Collections or judgments: If you have past due accounts or accounts that have gone into collection, you may have problems getting a VA loan until those are resolved.

- Foreclosures or bankruptcies: If you have a bankruptcy or foreclosure, you will usually need to wait at least a year before being approved for VA loans to buy a home.

- Current income: Is your income stable and can you afford the monthly payment? Even though most veterans can get the VA home loan benefit, the lender must ensure that you have the ability to pay the loan.

What Are VA Home Loan Amounts?

How much home you can buy with a VA loan depends upon your income and debts, but most lenders currently cap VA loans at $417,000. Higher than that and VA will not pay back the lender in case you default. The VA loan limit is higher than FHA and conventional mortgages in most cases.

What Are Closing Costs on VA Loans?

All mortgages have closing costs. VA purchase loans still have lending fees and closing costs. These VA closing costs can range from 1 to 5% of your loan amount. However, the seller is allowed to cover up to 4% of the home’s purchase price in closing costs.

The typical VA loan costs are: appraisal, title charges, VA funding fee, and possibly discount points. Also, you may need to pay a credit report fee.

Shop for the Best VA Mortgage Lenders offering competitive VA House Loans for people in the Air Force, Army, Navy, Marines, Coast Guards, Reserves, etc.

The VA home loan is a great finance vehicle for those who have previous military service.

It is really the premium finance choice if you qualify for the government endorsed program.

The reason is that the VA loan benefits and qualification criteria are so generous.

What Are VA Loan Benefits:

Numerous advantages accompany the VA loan benefit, a program meticulously crafted to recognize and support our nation’s servicemembers. The VA guarantees zero down home loans for first time buyers. Some of these VA loan benefits encompass:

- Reduced VA loan rates

- zero down payment requirement

- No PMI (private mortgage insurance)

- Access to VA cash out refinance program

- Higher debt-to-income ratio allowances

- Assistance with closing costs, with the potential for seller concessions of up to 4% of the purchase price, which your real estate agent can skillfully negotiate

- No early repayment penalty fees

If you have a desire to buy a home using a VA loan benefit, we will help you find an experienced VA lender. We comprehend the distinct needs of servicemembers and their families and can guide you in seizing the VA loan benefits you’ve rightfully earned.

FAQ for VA Home Loans

How Does a VA home loan work?

A VA loan is a government-backed mortgage program designed to assist veterans, active-duty service members, and eligible family members in achieving homeownership. It offers competitive interest rates and requires no down payment, making it easier for qualified borrowers to secure a home. These VA loans also typically have fewer restrictions and no private mortgage insurance (PMI) requirement, further reducing costs and enhancing affordability for military families.

Who qualifies for a VA home loan?

Eligibility for a VA loan option is available to veterans, active-duty service members, reservists, and surviving spouses. To qualify, applicants must meet specific service requirements set by the Department of Veterans Affairs and obtain a Certificate of Eligibility (COE), which verifies their eligibility status. The COE can be acquired through the VA’s eBenefits portal, a lender, or by mail, ensuring applicants meet the necessary conditions to access this home loan benefit.

How do I apply for a VA loan?

You can apply for a VA loan through VA-approved lenders by submitting your Certificate of Eligibility (COE) along with the necessary financial documents, such as income statements and credit information. Many VA lenders use the Web LGY system to streamline the process, allowing them to quickly obtain COEs on behalf of borrowers, reducing delays and simplifying the application process on VA loans. (VA.gov, 2024)

What credit score do I need for a VA loan?

The VA does not set a minimum credit score requirement, but most lenders prefer a score of at least 620. Individual lenders may have stricter requirements depending on loan terms and borrower history. Keep in mind that there is actually no minimum credit score for VA loans, so if you have below average credit and are eligible for a VA loan, you need to find the right lender.

Can I Get a VA Loan with a Manufactured or Mobile Home?

Many military borrowers want to know if they can get a VA home loan for mobile home. Yes and know. If you have a mobile home that was converted to a manufactured house and meets the VA specifications it is possible. Many borrowers have gotten a VA loan manufactured home financing. Make sure when you are shopping VA home lenders that you verify they do VA loans on manufactured or modular homes.

Who qualifies for a VA home loan?

Eligibility for a VA home loan is determined by your length of service, duty status, and character of service. Generally, veterans, active-duty service members, and certain National Guard and Reserve members who meet specific service requirements are eligible. A Certificate of Eligibility (COE) from the VA is required to confirm your qualification.

Do you have to be active duty to get a VA loan?

No, active-duty status is not mandatory to qualify for a VA loan. Veterans, certain National Guard and Reserve members, and some surviving spouses may also be eligible, provided they meet specific service and discharge criteria. Obtaining a Certificate of Eligibility (COE) is essential to confirm qualification.

What are the occupancy requirements for a VA loan?

Borrowers are generally required to occupy the home as their primary residence within 60 days of closing. However, exceptions may be made for service members on active duty, allowing them additional flexibility if deployment or other military obligations prevent immediate occupancy. In such cases, a spouse or dependent may fulfill the occupancy requirement on the borrower’s behalf.

Can I use a VA loan to purchase an investment property?

VA loans are intended for primary residences only. However, buyers can purchase multi-unit properties (up to four units) if they occupy one as their primary home (Military.com, 2025)

What is a VA Streamline Refinance?

Can I get a National Guard VA loan?

Yes, National Guard members may qualify for a VA home loan. Eligibility typically requires at least six years of service in the Guard, or 90 days of cumulative active-duty service under Title 32 orders, with at least 30 consecutive days. A Certificate of Eligibility (COE) is necessary to proceed.

Can a non-veteran assume a VA loan?

Yes, a non-veteran can assume a VA loan if the original loan was closed before March 1, 1988, or if the lender and VA approve the assumption. The new borrower must meet credit and income requirements. However, the veteran’s VA entitlement remains tied to the loan unless the buyer is a qualified veteran who substitutes their entitlement.

What is a 100 percent disabled veteran home loan?

A 100 percent disabled veteran home loan refers to a VA-backed mortgage with enhanced benefits for veterans rated totally disabled. These include exemption from the VA funding fee, eligibility for property tax exemptions in many states, and access to VA zero-down payment financing. It provides more affordable homeownership options for qualifying disabled veterans.

What is the VA funding fee?

The VA funding fee helps sustain the VA loan program and varies based on loan type and borrower status. First-time users pay 2.15% to 3.3%, while subsequent users may pay a higher interest rate.

Can I use a VA loan more than once?

Yes, you can use a VA loan multiple times as long as you meet the eligibility requirements for each new loan. However, only one active VA loan is typically allowed at a time, unless you qualify for a second entitlement. This second entitlement can enable you to take out another VA loan while still holding an existing one, often used when relocating or purchasing a second home due to a change in duty station or family needs. As long as the loan remains within the VA loan guidelines, you can access this benefit repeatedly throughout your lifetime.

Can you have two VA loans at the same time?

Yes, it’s possible to have two VA loans simultaneously under certain conditions. This often occurs when a veteran relocates but wants to keep the first home. The second loan depends on remaining VA entitlement and meeting occupancy and lender guidelines.

How long does it take to assume a VA loan?

Assuming a VA loan typically takes 30 to 60 days, depending on the lender’s processing time and the buyer’s eligibility. The process involves credit approval, VA forms, and legal paperwork. Once approved, the new borrower assumes the loan’s current balance, interest rate, and terms.

Can you use a VA loan to buy land?

VA loans generally do not cover the purchase of raw land alone. However, they can be used to buy land if it’s combined with a construction loan for building a primary residence. The land and home must meet VA property standards and be intended for owner-occupancy.

Do I need PMI with a VA loan?

No, VA loans do not require private mortgage insurance (PMI), regardless of the down payment. Instead, borrowers pay a one-time VA funding fee, which helps support the program. This benefit can significantly lower monthly mortgage payments compared to conventional loans.

How long do you have to serve in the military to get a VA loan?

Service requirements for a VA loan vary:

- Active-duty members: At least 90 continuous days during wartime or 181 days during peacetime.

- National Guard and Reserve members: Six years of service, or 90 days of cumulative active-duty service under Title 32 orders, with at least 30 consecutive days. These requirements may differ based on service dates and discharge status.

11 Useful Tips for Military VA Home Loans

The VA home loan program offers current and retired military members with a great opportunity to get a mortgage. VA military home loans are an excellent deal: If you qualify, you can get a home loan with an VA loan interest rate at least .5% lower than current rates. You also can have a low credit score, no mortgage insurance, and no down payment.

The great benefits of VA loans are why 18 million vets have used the program in the last seven decades. If you are considering applying for a VA loan, here are some useful tips to get you through the approval process faster:

#1 Eligibility for VA Home Loans

To be eligible for a VA loan, you have to meet one of these criteria:

- Be a National Guard or Reserve member with at least six years of service

- Regular active duty military who has been in service at least 181 days or 90 days for the Gulf War

- Retired veterans must have completed at least 181 days of service or 90 days for the Gulf War and gotten an honorable discharge

- Surviving spouses may be eligible if they remarry on or after the age of 57

#2 Credit Score Requirements for VA Loans

You do not have to have an especially high credit score to be approved for a VA loan. But generally the typical VA mortgage company will be looking for you to have a score of at least 620. Higher is better to ensure approval. There are brokers and lenders out there that offer VA home loans for bad credit. These VA lenders are looking for compelling compensating factors, such as high income, low debt to income ratios and be prepared to write a strong letter of explanation to justify the home mortgage with bad credit.

#3 Debt to Income Ratio (DTI) for VA

It is recommended that your total DTI not be above 41%. This means that your total monthly debt payments including housing should not exceed 41% of your gross monthly income.

#4 Other Debts

You need to prove in your financial documents that you can afford your mortgage payment, and also be able to pay all of your existing debt payments and afford a minimum standard of living.

#5 VA Loan Is an Entitlement

This means that while you do have to qualify for the loan, your military service entitles you to the VA loan benefit. So, as long as you meet very flexible standards, most people can be approved for the full VA loan entitlement with enough military service.

This means if you can qualify, you really should only consider a VA loan. You will enjoy a lower down payment, no mortgage insurance and an interest rate that is below market rates.

#6 Know Your Limit on VA Home Loan Amounts

The maximum amount you can be approved for is based upon both your income and where you want to live. VA determines the maximum loan amount it will approve you for based upon the county, city and state you live in. Knowing what the maximum VA loan amount is will help you to focus on what to buy.

#7 Know Your Needs Before Applying for a VA Loan

Before you start to look at homes, you should consider all of the features, location and size you want in your home. This way, you are not spending time looking at homes that do not suit your needs. If you meet the eligibility requirements, we suggest that you take the time to apply for a VA loan.

#8 Decide If a 15-Year or 30 -Year VA Mortgage Is Better

Your monthly payment can vary by several hundred dollars between a 15 year and a 30 year loan. You need to decide if you can afford those higher payments and pay off the loan faster. The VA will also determine for you if your income is high enough to make the higher 15-year loan payment. Check with mortgage companies for the best veteran home loan rates today.

#9 Energy Improvements

You can include as much as $6000 in energy efficiency improvements in the VA loan. This can help you to reduce your energy costs and improve your resale potential.

#10 Organize Your Paperwork

To get approved faster, you should have all of your financial information, bank statements, W-2s, tax returns and pay stubs so that you can get approved fast. Also, you need your social security number and address information for at least the last one or two places you have lived.

#11 Get Pre-Approved for VA Financing

Once you have all of your necessary financial and other information together, you can get pre-approved by your VA approved lender. This lets the potential seller know that you have been approved for financing. It will mean you are a serious potential buyer. If you have not been pre-approved for a VA loan, many sellers will not even want to talk to you. Take a few minutes, apply for a VA home loan and get pre-qualified so the seller takes you seriously.

The Bottom Line on VA Home Loan Financing

A VA home loan is one of the best benefits today of military service once you get home. You can get a loan with no money down, no mortgage insurance and a very low interest rate. It also is easy to qualify for a VA home loan.

If you are a military vet or current military, you should see if you can qualify for a VA loan before you consider any other mortgage product.