Opting for a 40-year mortgage enables you to spread your repayment over four decades to achieve a lower monthly payment. The 40-year loan deviates from the standard 30 or 15-year home loan terms. Whether you want a FHA 40 year mortgage or a 40 year home loan from a private money lender, the RefiGuide connects you with banks and mortgage companies that offer this truly unique forty-year loan.

- Low Monthly Payments with 40 Year Mortgages

- Increased Cash Flow with 40-Year Home Loans

- 40 Year Mortgage Increases Purchase Power

While this extended duration of a FHA 40-year mortgage results in a reduced monthly payment, which helps first time home buyers get approved for a more expensive house that they would not otherwise qualify for.

40-Year Home Loan Provides Lower Mortgage Payments and Increased Purchase Power

Of course, it comes with the trade-off of a slightly higher 40-year mortgage rate and a larger portion of the overall payment allocated to interest throughout the loan’s lifespan. It’s no secret that low mortgage payments are popular and the 40-year mortgage loan is a hot topic with home buyers.

Home buyers and homeowners waited patiently for the FHA 40-year mortgage loan to be introduced to the financing market. During the pandemic, millions of people lost their jobs or had hours cut when the federal government encouraged lockdowns to reduce the spread of the virus.

When that happened, many homeowners fell behind on their mortgage payments, but this problem was temporarily mitigated with Fannie Mae, Freddie Mac, and FHA mortgage forbearance programs.

- The FHA 40-year loan is beloved because it offers borrowers an affordable alternative to the interest only option from other conventional loan programs.

- The 40-year mortgage loan reduces housing expenses for initial your budget.

FHA estimates that more than one million FHA insured mortgages were in forbearance, but most have exited since January 2021. FHA loan providers have finished more than one million loss mitigation home retention plans.

For up to 12-18 months, some homeowners were able to suspend their payments during the pandemic. However, the forbearance programs are coming to an end, and homeowners behind on their payments need to set up a repayment plan to catch up on past-due payments.

A common option is to reduce the principal due on the mortgage, combined with a lower interest rate. However, interest rates are rising in April 2023, with rates for 30-year mortgages near 6%.

Higher rates make it more difficult for a loan modification that are affordable for people behind on their payments. But the Federal Housing Administration is leading the way on a 40 year loan modification with a new FHA program that could promise affordable payments for millions of Americans.

New FHA 40-Year Loan Option Now Available

FHA announced this month that it will offer a 40-year loan modification option to help borrowers who are behind on their mortgages.

This new 40-year FHA mortgage option could be a good fit for homeowners who cannot attain a 25% reduction in the P&I portion of their home loan payment through the current FHA 30-year mortgage modification option.

The proposed rule was released in the Federal Register on April 1. If approved, the program will allow FHA mortgage providers to offer a 40-year FHA loan modification option for people who are struggling to make their mortgage payments after being in Pandemic-related mortgage forbearance.

Mortgage services, however, are allowed to offer the 40-year fixed mortgage option right away and need to offer it as an option to people who are eligible with an FHA-backed Title II forward mortgage.

Options available with the 40-year mortgage program for FHA-backed Title II forward mortgages include:

For FHA borrowers who can make their current payments, the standalone partial claim lets the mortgage arrears be put in a 0% lien against the home. The partial claim money does not need to be paid until one of these happens:

- The FHA mortgage matures

- The home is sold

- The loan is paid off

- FHA insurance is terminated

For FHA borrowers who cannot afford their mortgage payments, this recovery loan modification will resolve the outstanding arrears by adding it to the principle of the first FHA loan. The servicer will extend the term for 30 years at a rate that is no more than the current market rate. Also, the loan can be extended to 40 years at a rate that is no more than 50 basis points more than the current market rates.

40-Year Loan Modification Rules

Conventional Loan: Consider options like Fannie Mae and Freddie Mac’s Flex Modification programs, which are popular choices capable of reducing monthly payments by 20%. To qualify, one must either be at least 60 days behind on payments or demonstrate the likelihood of falling behind within the next 90 days.

FHA Loan with Bad Credit: Homeowners with FHA insured mortgages may qualify for a 40-year loan modification, provided their loan is at least 90 days delinquent.

USDA Loan: If your existing loan is supported by the U.S. Department of Agriculture, a 40-year loan modification may be possible, with the caveat that your lender must explore alternative options before offering this particular modification.

Why a 40-Year Mortgage Loan?

Some people may not understand why the Federal Housing Administration is offering 40-year mortgages. After all, isn’t it a bad idea to have a home loan that goes for that long? That is a valid point, but bear in mind that when the pandemic hit, unemployment soared to almost 15%.

Thousands of businesses shut down temporarily or permanently and more than seven million borrowers went into forbearance programs. That number has dropped a lot, but there are still at least one million people in forbearance with limited options.

- Shop and Compare the Best 40 Year Mortgage Lenders

- Minimize Your Mortgage Payment with Qualified mortgages

- 40-Year Fully Amortized Principal and Interest Payments

- Find Affordable Payments with Interest Only Options

The rule changes allowing 40-year mortgages give mortgage companies more tools to prevent foreclosures that are avoidable. It also gives FHA borrowers time to evaluate what they will do after their forbearance ends.

Some in the industry note that without forbearance and loan modifications, including with 40-year FHA insured mortgages, there could be millions of home foreclosures. This could deliver a devastating blow to the US economy and would take billions of dollars of wealth from vulnerable communities across the nation. The RefiGuide will help you figure out who offers 40 year mortgage loans.

What Are 40-Year Mortgage Rates?

There are three primary categories of these 40-year mortgages: Borrowers can choose from 40 year fixed mortgage rates, an adjustable-rate 40-year mortgage, and an interest-only option where you exclusively pay interest for the initial decade of the 40-year mortgage. The fixed rate 40-year mortgage remains the most popular choice in 2024.

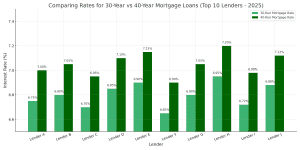

In most cases, the 40-year mortgage rates are slightly higher than the conventional 30-year mortgage rates. You should expect to pay .125 to .50% higher with 40-year mortgage rates with most competitive lenders. Borrowers typically choose the 40 year home mortgage rates because the lower monthly payment increases their purchase power. The 40 year interest rate quotes may range dramatically depending upon your credit score or equity. Take some time and shop mortgage brokers offering the best interest rate on 40 year loans. Compare both variable and fixe rate offers.

What to Know About 40-Year Home Loans

Let’s take a closer look at the 40-year FHA mortgage and how it differs from a 30-year loan:

- The term is 10 years longer. This seems obvious but remember you will pay interest for 10 more years and that is usually tens of thousands of dollars more. Most experts say do the 40-year option if you must for now, but refinance as soon as you can.

- The 40-year payment will be lower. You have 10 more years to pay the loan, so it would take a big spike in the interest rate not to reduce the payment a lot. Enjoy a lower monthly payment with an interest only period.

- You’ll pay a lot more in interest. A 40-year loan will cost you a lot more over the lift of the loan.

- There could be a higher interest rate. Most mortgage investors don’t buy 40-year loans, so you may need to pay a higher rate and more fees.

The 40-year loan is a unique financial tool that can offer some distinct advantages for homebuyers. While not as common as the traditional 30-year or 15-year mortgages, it has its own set of benefits that may make it a suitable choice for certain individuals. Let’s explore the advantages of a 40-year mortgage.

40-Year Loan Offer a Lower Monthly Payment

The most significant benefit of a 40-year mortgage is the lower mortgage payments it provides. By spreading the loan over a more extended period, you can significantly reduce your monthly financial burden. This can be particularly helpful for those who are on a tight budget, as it allows them to afford a larger home or allocate more of their income to other financial goals.

Enjoy Improved Cash Flow with 40-Year Mortgages

With a lower monthly payment, you can free up more cash for immediate needs, such as saving for retirement, investing, or paying off high-interest debt. This extra cash flow can provide financial flexibility and allow you to better manage your overall financial situation. The interest only payments maximize cash flow with the lowest possible monthly payment for the borrower.

40 Year Mortgage Ensure a Easier Path to Qualification

The lower monthly payments of a 40-year mortgage may make it easier for some borrowers to qualify for a home loan. Since lenders typically assess your ability to make monthly payments, the reduced amount can enhance your chances of loan approval, especially if you have a moderate income.

Short-Term Saving Can Be Achieved with 40 Year Loans

While a 40-year mortgage stretches your payments over a more extended period, you can still choose to make additional payments and pay off your loan faster if your financial situation improves. This flexibility allows you to benefit from the lower monthly payments while retaining the option to accelerate your mortgage payoff if desired.

Increased Home Affordability: With lower mortgage payments, you may be able to afford a more expensive home. This can be particularly advantageous if you’re looking to purchase a property in a competitive real estate market or in an area with high housing costs.

Diversified Investment Opportunities: The lower monthly payments on a 40-year mortgage can free up capital to invest in other financial instruments, such as stocks, bonds, or retirement accounts. This diversification can help you grow your wealth over time.

It’s important to note that while the FHA 40-year loan offers various benefits, it also comes with some trade-offs. The longer loan term means you’ll pay more in interest over the life of the loan compared to shorter-term mortgages. Additionally, it may take longer to build equity in your home, as a significant portion of your initial payments goes toward interest rather than principal.

The 40-year mortgage can be a valuable financial tool for those seeking lower mortgage payments, improved cash flow, and easier qualification. It provides financial flexibility while allowing you to invest in other opportunities. However, it’s crucial to carefully consider your long-term financial goals and the total cost of the loan before choosing this mortgage option. Consulting with a financial advisor or lending expert can help you determine if a 40-year mortgage aligns with your unique financial situation and objectives.

FAQ on 40 Year Loans

How to Get a 40-Year Mortgage Loan

Acquiring a 40-year mortgage at the time of purchase, distinct from a 40-year loan modification, closely mirrors the process for obtaining a 30- or 15-year loan. However, there are a few nuances to consider:

Qualification criteria differ: Nonqualified mortgages diverge from traditional loans in their minimum requirements, which can vary among lenders. Non-QM lenders possess significant discretion in determining acceptable minimums for credit scores, loan-to-value (LTV) ratios, and debt-to-income (DTI) ratios.

Limited mortgage lender options: Given the less widespread availability of 40-year home loans, extra research or the assistance of a mortgage broker may be necessary to identify suitable lenders. It’s crucial to ensure the chosen 40-year mortgage lender is reputable, and most legitimate lenders can be found in the NMLS loan originator database.

Who Offers 40 Year Mortgage Loans?

Most banks and credit unions do not offer 40 year home loans. Most banks lenders offer the traditional 30-year mortgages, while 40-year mortgages are generally available only through smaller local banks, independent credit unions, non-traditional mortgage companies and private lenders. Specialized lenders, such as non-QM lenders and some credit unions, offer 40-year mortgage loans. These 40-yr. loans are less common than traditional 30-year options and are typically designed for borrowers seeking lower initial monthly payments. Availability may vary by location, lender, and loan type, so it’s important to shop around and compare terms. The RefiGuide can match you with niche lenders that offer the 40-year home loan program. Take a few minutes and let our team will introduce you with the best 40 year mortgage lenders at no cost with no obligation.

How Does a 40-Year Interest-Only Mortgage Work?

A 40-year interest-only mortgage allows borrowers to pay only the interest for an initial period, typically 10 years. After this phase, payments include both principal and interest for the remaining term. This structure lowers initial payments but results in higher payments later and greater overall interest costs over the life of the loan.

How to Calculate a Payment for a 40-Year Mortgage

To determine the principal and interest payment for a 40-year mortgage, you’ll require the loan amount (the home price minus the down payment), loan duration, and interest rate.

Utilizing a PITI mortgage calculator can assist in calculating the monthly payment and total interest expenses throughout the loan duration. Obtaining information on your taxes and insurance costs will provide a more accurate estimate of your monthly payment on a 40-year home loan.

Can I Refinance to a 40 Year Mortgage?

Most traditional banks and mortgage lenders don’t offer 40-year mortgage refinances. There are a few private money and non QM lenders that offer 40 year refinancing. Keep in mind you will exchanging lower monthly payments for a significantly longer loan term and substantially more interest over time.

Are 40 Year Mortgages Considered Conventional Loans?

A 40-year mortgage is not considered a conventional loan. Conventional loans follow the guidelines set by Fannie Mae and Freddie Mac, which typically limit mortgage terms to a maximum of 30 years. In contrast, 40-year mortgages fall into the category of non-conforming or Non QM loans, meaning they do not adhere to Fannie Mae and Freddie Mac’s standards and are not eligible for their backing. Borrowers need to carefully weigh the long-term impact. Additionally, because 40-year mortgages do not qualify as conventional loans, they are less common and typically offered by household lenders like, Chase, Bank of America or Wells Fargo.

Can You Get a 40 Year Home Loan with Below-Average Credit?

The short answer is Yes. The RefiGuide can match you with mortgage brokers and lenders who offer 40 year home loans to people with all types of credit. Typically, the lower the credit score, the more equity you will need to refinance into a 40-year mortgage or a larger down-payment if you are looking to purchase a home with a 40-year home loan. So remember, you will need to have a lower loan to value (LTV) if you have a bad credit score , if you want to qualify for an affordable monthly payment that is amortized for forty years or 480 months.

Are Banks Offering 40-Year Mortgages?

Yes, some banks and lenders offer 40-year mortgages, but they are less common than thirty-year mortgages. These extended-term loans are often available as non-qualified mortgages and may include adjustable rates. A 40-year term lowers monthly payments but increases overall interest costs. Check with specific banks and credit unions for availability and terms.

Can You Get a 40-Year Fixed Mortgage?

Yes, 40-year fixed-rate mortgages are available from select lenders, though they are less common. These loans provide consistent monthly payments over the loan term, making them appealing for borrowers seeking long-term payment stability. However, they typically come with higher interest rates and longer interest accrual compared to shorter-term loans.

Can You Get a 40-Year Mortgage in California?

Yes, 40-year home loans are available in California through some banks and Non-QM lenders. These unique loans are often used in high-cost areas to make monthly payments more affordable. However, they may include adjustable rates or interest-only options. Check with local lenders for specific terms and 40-year loan requirements.

Can You Get a 40-Year VA Loan?

No, the VA loan program does not currently offer a 40-year loan term. VA loans are typically available in 15-, 20-, 25-, and 30-year terms. However, in some cases, loan modifications through a VA lender may extend repayment up to 40 years to help reduce monthly payments. Check with your lender for available options and eligibility requirements.

Are There 50-Year Mortgages?

Yes, but 50-year mortgages are rare and not widely offered by traditional lenders. They typically appear in specialized loan programs or loan modifications designed to make payments more affordable. While a 50-year term can lower monthly payments, it results in higher interest costs over the life of the 50-year loan. If you need lower payments, consider alternative options like interest-only loans or adjustable-rate mortgages.

7 Reasons Why 40 Year Mortgage Loans Are Looking Good.

When you are thinking about a mortgage and buying a home, it’s smart to review all options.

One of the loan choices that is gaining more attention is the 40-year mortgage.

A 40-year mortgage has lower payments than a 30-year or 15-year mortgage.

This fact can help you afford a home that is more expensive or make the mortgage more affordable. While there are advantages and disadvantages of a 40-year mortgage, there is no question they are becoming more popular as home values rise.

Below are more things to know about these loans and why they could be a good fit for your needs.

Some 40-Year Lenders Offer 10-Year Interest Only

One way some lenders offer 40-year mortgages is like this: You pay 10 years interest only with lower payments, then 30 years paying principal and interest. This is a way you can have lower payments when you are making less money. Then, after you have had raises and promotions, you can move into the interest and principal portion of the mortgage for 30 years.

Some FHA Lenders Offer Variable Rate 40 Year Mortgages

There also are FHA mortgage lenders that offer variable rates on 40-year mortgages. You can get FHA insured mortgages that may be fixed for five years and then reset into a fixed rate for the rest of the loan.

Fixed Rates Available

Interest rates on mortgages are finally falling going into in 2024, but they are likely to rise soon as the Fed is planning to raise rates several times this year. You can get a low, fixed-rate mortgage that lasts for 40 years but you will need to act soon to lock in low rates.

More Lenders Offering 40-Year Mortgages in 2024

It’s more possible today than a few years ago to get a 40-year mortgage. While not every lender offers them yet, they are becoming more known because home values have risen dramatically in the last two years.

Sometimes it is easier to extend a thirty year mortgage to forty years, if you are having difficulty with the payments. It is possible to extend some loans to 40 years that are backed by Freddie Mac, Fannie Mae, FHA and VA.

More Home Purchasing Power with a 40 Year Loan

If you have noticed, home prices have shot up 20% or more in the last year in many cities across America. This fact makes it harder for millions of people to afford a home.

But with a 40-year mortgage, you may be able to have lower monthly payments so you can buy a home.

Can Refinance into A Shorter Mortgage

A new strategy for some borrowers who have a lower income is to get a 40-year mortgage with a lower payment for a few years.

If they expect their income will rise in three or five years, they can refinance their mortgage into a 15 year or 30-year loan. This allows them to take advantage of lower payments for a while but then increase payments when they make more money.

You Can Pay It Off Anytime

Remember that whether you have a 30-year or 40-year mortgage payment, you may be able to pay it off sooner than you think. People’s financial situations change over many years.

Even if you take out a 40-year loan today, you may be able to either refinance it or pay it off after 20 or 25 years.

Good Option for Short-Term Borrower

Let’s say you are sure that you will buy your home, keep it for two or three years, and sell it and move somewhere else. In this situation, it can make sense to have the lowest possible payment.

A common situation is someone in the military who knows they will be in the home for only two years. It may be logical to have a lower monthly payment and put the extra money into something else.

Possible Tax Write Offs for Wealthy Borrower

If you have a high income, it can make sense to pay more interest on the home to write off more on your taxes.

You will pay more interest with a 40-year mortgage, and if you itemize your taxes, you may have a lot more deductions.

Now that you know more about the pluses of 40-year mortgages, you should remember a few things.

First, you will probably pay a slightly higher interest rate. Lenders raise the rate on longer mortgages because of the higher risk.

Second, you will pay more interest with a 40-year loan, so you should crunch the numbers to make sure it makes sense for your financial situation.

Third, a 40-year mortgage builds equity slower because a lot of the payments go towards interest. If you intend to stay in the home for the entire term, then it’s fine. But if you want to sell the home, it may not have as high a price.

There’s little doubt that a 40-year mortgage is more possible today than a decade ago. However, you should review the loan carefully with your mortgage lender.

You will spend more money on your home if you take 40 years to pay the debt. While the monthly payments are lower, the interest payments are higher.

However, a 40-year loan can be a good idea for some borrowers with a lower income and a high credit score. It also can be a good fit for people who want to get into a larger or more expensive home.

So, talk to your lender soon about a 40-year mortgage to find out if you qualify.

Takeaway on 40-Year Mortgage Loans from FHA and Private Lenders

Getting a 40-year FHA mortgage may not be the ideal solution, but if it helps people avoid foreclosure, it could be worth considering. After all, there isn’t anything worse than foreclosure and losing the home. So, while getting a 40-year mortgage can be smart to avoid foreclosure, it’s going to cost you in the long run.

- Lower Monthly Payment – A 40-year mortgage offers a more affordable monthly payment compared to a 30-year mortgage with the same loan amount.

- Increased Buying Power – With the extended payment term and reduced monthly payments, a 40-year mortgage may enable some buyers to afford more expensive homes.

- Increased Flexibility – Getting a low monthly payment with an initial interest-only payment period can provide added flexibility during the early stages of your mortgage. This feature can be helpful when dealing with the initial costs of moving, furnishing, or renovating a new home.

More of your monthly payment will be paying interest. Plus, your equity builds slower. This is the amount of the home that you own outright. The more home you own, the less you are paying interest on. Apply for a FHA loan today.

If you want to refinance, it could be a problem if you only put down 5% or 10% when you bought the house. You need to have about 20% in equity to do most refinances. The FHA 40-year loan has costs, but it can be a great option for people who risk going into foreclosure.

So, if getting a longer mortgage makes payments more affordable and reduces the chances of foreclosure, it may be a good move. Plus, you can always refinance the loan later when your situation improves (if you have enough equity), so talk to your mortgage lender about a 40-year FHA loan today.