Navigating the path to get approved for a home equity loan with bad credit can be challenging. Most smart homeowners consider a HELOC or low credit home equity loan if they already have a low interest rate on their first mortgage.

Can You Get a Home Equity Loan with Bad Credit?

Yes. The RefiGuide has a network of home equity lenders that offer bad credit HELOCs and equity loans for people with poor credit scores. Qualifying for a poor credit home equity loan requires the applicant to get organized and stick to a solid plan that includes income documentation, letters of explanation for derogatory credit and an alliance with a home equity loan company that is willing to take risks while approving equity loans for people with a bad credit history. Learn how to get approved for a HELOC or home equity loan with bad credit in today’s market.

- Home Equity Loan Credit Score 580 OK

- Fixed Rate Home Equity Loan for Bad Credit

- Guaranteed Home Equity Loan with Bad Credit

- Hard Money Home Equity Loans

- Competitive HELOC with Bad Credit

- Cash Out HELOCs for Low Credit Scores

- No Pre-Payment Penalty Equity Loan Programs

These home equity loan alternatives may be more accessible than traditional cash out refinance programs in today’s market with rising interest rates.

Many people believe that bad credit home equity loans are not possible in today’s lending environment. It is not surprising that the people who often need loans the most are the ones who do not qualify because they have credit problems in their past. If you have a low credit score, it is likely you have been turned down for personal loans or lines of credit before.

Shop Top Lenders Offering Low Rate Home Equity Loans and HELOCs with Bad Credit Scores.

Whether you need funds for education, a health emergency, a car repair or fixing a leaking roof, you may be wondering how you can tap the equity in your home to get the money you need. People ask us all the time, “Can I get a home equity loan with bad credit?” The RefiGuide has built a stellar reputation connecting homeowners with top home equity lenders in the country who offer 2nd mortgages and HELOCs to people with all ranges of credit.

Whether you have had late payments, increased credit card debt or past credit problems, such a bankruptcy or foreclosure, our team will connect you with top-rated mortgage companies that provide fixed rate home equity loan credit lines and low intro-rate HELOCs with interest only payment options. Can you get a home equity loan after a bankruptcy?

Compare Home Equity Loans and Credit Lines with Good, Fair and Bad Credit Scores

There are more borrowing options for home equity loans with fair credit than you might think.

Even if you were turned down for a cash our refinance, you may qualify for an equity loan with a bad credit score if you have compensating factors.

Are you a homeowner looking for a home equity loan with no credit check?

Talk to multiple lenders before letting them pull your credit. For no cost to you, we will help you find brokers and banks that give home equity loans with bad credit.

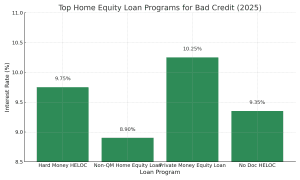

Here are some good options to consider if you have struggled to get a line of credit with a low credit score;

Do Lenders Still Offer Home Equity Loans with Bad Credit?

A home equity loan is similar to a HELOC but you get your home’s equity up to a certain amount in a single lump payment. If you have a single, large expense you need to pay now, you might consider a home equity loan, such as a big medical bill or the down-payment of a home.

A home equity loan has a fixed interest rate and fixed monthly payment. Loans with bad credit may have a higher rate than prime credit equity loans, and even higher still if you have a low credit score, but it still is a good option for people who have bad credit but access to home equity. This is not a guaranteed home equity loan option but worthy of consideration nonetheless.

The RefiGuide will teach you how to get a home equity loan with bad credit by connecting you with lenders and banks that give a low-credit home equity loans to borrowers that have compensating factors. This is not guaranteed home equity loan with bad credit, but there is an opportunity worth exploring.

An equity loan with bad credit offer numerous benefits when it comes to debt consolidation. First and foremost, these equity loans enable homeowners to leverage the equity they’ve built up in their property to secure funds at typically reduced interest rates compared to other forms of debt, such as credit cards or personal loans. Refinancing high interest debt and unsecured personal loan agreements makes sense when you use a fixed rate home equity loan that provides lower monthly payments.

By consolidating high-interest debts into one, more affordable home equity loan, borrowers can significantly improve their financial status by reducing their monthly burdens of high interest credit card and high rate personal loans.

Additionally, home equity loans typically off fixed simple interest amortization that provide more predictability in repayments and simplifies the budgeting process.

Moreover, the benefits of using a home equity loan for debt consolidation include reduced interest rates, predictability in monthly payments, and potential tax advantages. It’s a wise financial move that can help homeowners regain control of their finances, reduce the overall cost of debt, and work towards a debt-free future.

Tips to Get a Home Equity Loan with Bad Credit Scores

- Get a copy of your current credit report. Examine your credit history. You may find inaccuracies that are hurting your credit report. If there is anything that is wrong that is hurting your score, you can contact each credit bureau and contest each negative, incorrect item. Before applying for a home equity loan or HELOC, make sure that all your loans are being reported with the correct monthly payment.

- Collect all of your financial data so you can give your lenders proof of good income and employment. It will help if you have a decent savings account and investments that are producing returns. When discussing a potential home equity loan, it is very important to show with damaged credit that you are financially stable and have been for at least the last 12 months. Unless you are self-employed, the underwriter will be considering your gross monthly income.

- Apply for home equity loans with at least three lenders. You will need to give them copies of your credit report, mortgage information and proof of income. You also may need to show bank statements to show that you have cash in the bank. People with poor credit who own a home with equity can get approved, but the more financial documents you have, the better chance you will have to qualify for a low credit home equity loan.

- If you have a foreclosure or short sale on your record, you may need to provide letters of explanation to lenders. There are some homeowners who may have been invested in real estate for income purposes during the recession but lost those properties to foreclosure. If you still are current on your home and have equity, you may be able to convince some home equity lenders through manual underwriting to approve you. But you will need to show once again that you have a high level of current financial stability.

- Carefully consider the terms and rates you are offered from each lender. If you are getting a HELOC, you should look at whether it is fixed or adjustable and for how long, what the rate is, any fees, payment schedule, and when rate can change. Most home equity loans with bad credit have a fixed interest rate with simple interest that guarantees a set monthly payment for the life of the loan, but verify the details with the loan officers you are working with.

Maximizing Home Equity Regardless of Credit

If you have below-average credit but have equity in your home, you probably can get approved for a low credit home equity loan or HELOC. You will just need to show ample proof that you have steady income and are financially stable.

This means showing them plenty of documents that prove you are a worthy borrower that can afford to make the monthly payments on time, every month. It is imperative to prove you have the ability to pay your monthly payments to be approved for a home equity loan with bad credit.

If you are able to produce W-2s, tax returns, bank statements and pay stubs that indicate good, steady employment, it is likely that you can get a home equity loan. Just be ready to shop around. If one lender says no, another may say yes. We have discussed the fixed home equity loan in depth, so let’s expand into the details of another option, the HELOC.

Finding Home Equity Lenders Specializing in Bad Credit

Not all lenders offer home equity loans for people with bad credit. In fact most mortgage lenders do not offer home equity loans and and even the one’s that do, its rare to find a home equity lender offering programs for people with a low credit score. Consumers want to know where they can get a $50,000 equity loan with bad credit? The RefiGuide can help you shop lenders and banks that offer $50,000 loans with low credit scores.

Some brokers specialize in working with individuals with less-than-perfect credit histories. Researching and locating non-prime home equity lenders can be a wise move that increases your chances to get approved.

In most cases the minimum credit score for bad credit equity loan is 580 if the borrowers is below 80% LTV. If the borrower is at 90% LTV, the minimum credit score is likely 620 for most bad credit equity loan programs. Most lenders consider the debt consolidation is a valuable loan purpose for these poor credit equity loans as the reduced high interest debt also reduces the perspective borrower’s risk factor.

Compare and Review Quotes from Banks that Offer Home Equity Loans with Bad Credit

It’s advisable to seek guidance from financial professionals to navigate the complexities of guaranteed home equity loans with bad credit successfully. If you do not meet the home equity loan requirements because of minimum credit scores or income documentation, consider hard money loans for low credit scores.

The HELOC is a home equity line of credit that is considered a 2nd mortgage enabling you to tap some of your home equity while keeping your first mortgage in place. Most banks and credit unions are offering home equity lines of credit to borrowers with pretty good credit, but there are a few lenders that specialize in high risk borrowers.

What Is a Bad Credit HELOC?

A HELOC with bad credit is a secured line of credit that works somewhat like a credit card, but offers you a revolving line of credit even though you have below-average credit scores. People ask us all the time, “Can I get a HELOC with bad credit?” The answer is Yes, if you compelling compensating factors.

The HELOC credit line is simply maximizing the equity in your home. It lets you take out a certain amount of money up to a certain limit. When the HELOC is paid off, you can use it again if you like.

Are you looking for a line of credit but have been turned down by banks due to low credit scores? The credit score for a HELOC will vary depending on the LTV. So, the more equity you have, the better chance you have to be approved for a HELOC with bad credit.

Let’s say you want to do a home renovation for $100,000, such as add a family room extension and redo the kitchen. This is a major project that may take several months. When you work with a contractor, it’s typical to pay about half of the cost up front and ½ on completion. Or you may need to make another payment in the middle of the project.

With a bad credit HELOC loan, you only need to pay interest on the money you have taken out. You can save hundreds or even thousands in interest because you don’t need to take out the entire $100,000 at the start of the project.

A home equity line of credit has a draw period and a repayment period. The draw period usually lasts about 10 years. During the draw period, you only pay the interest on the loan. The interest rate is usually variable so it can go up and down after the initial fixed interest period of six months or a year.

Then the repayment period begins, which is where you pay interest and principal back. This is when the payment on the guaranteed HELOC with no credit check will be considerably higher. It’s important to be sure that you can handle the higher payment because you risk losing your home.

Many people are looking for a line of credit with no credit check and we will connect you with lenders you can talk to prior to them running your credit with the three credit bureaus.

FAQ for Bad Credit HELOCs and Home Equity Loans

The RefiGuide gets a lot of questions about requirements and home equity loan credit guidelines so we listed a few of the frequently asked questions below:

What Credit Score Do You Need for a Home Equity Loan?

Most banks and lenders require a minimum credit score of 620 for a home equity loan. Higher scores, typically 700 or above, may qualify you for lower interest rates and better terms. Lenders also consider factors like income, debt-to-income ratio, and home equity during the approval process. The RefiGuide can help you find companies that specialize in home equity loans for low credit scores.

Can I get a HELOC with low credit scores?

Although lenders usually prefer higher a credit-score when offering a HELOC, a lower score doesn’t necessarily disqualify you. There are home equity lenders that approve a HELOC with bad credit. These lenders consider other factors, such as a low debt-to-income ratio and most important a low loan-to-value ratio. If you are looking for a bad credit HELOC you should have at least 25% equity in your home.(below 75% CLTV)

What is the minimum credit score for HELOC loan?

Most of the time, the HELOC credit score requirements are the same as they are fixed home equity loan products. Of course the minimum credit score for a HELOC approval ranges dramatically depending upon which bank or mortgage lender you are speaking with. As we mentioned earlier, the banks and credit unions want a 660 -700 score with 20% equity. Most traditional lenders are looking for a 620 credit score on fair credit HELOCs. whereas Non QM lenders will allow a 580 to 600 credit score on low credit HELOC loans. There are hard-money and private lenders that will offer a HELOC with 500 credit score if you have a significant amount of equity. The RefiGuide will match you with aggressive home equity lenders if you need a low credit HELOC loan and you have the right credentials.

Can I get an FHA home equity loan with bad credit?

FHA does not insure FHA home equity loans like they do purchase or refinance mortgages. They allow equity home loans or HELOCs behind an FHA insured mortgage, but they do not offer them through the Federal Housing Administration. They do offer the FHA 203K for home renovations, but the rules are stricter than traditional home equity loan products.

What can prevent you from qualifying for a home equity loan?

Besides credit, the combined loan to value is the most important factor to qualify for a home equity loan or HELOC in 2025. Most lenders require that you retain at least 15% to 20% 80 to 85% LTV) equity in your home after accounting for the new home equity loan amount and that is if you have good credit reports. If you have poor credit-scores, then you could need 20 to 35% equity in your home or (65 to 80% LTV) If your home’s value hasn’t increased sufficiently or you haven’t paid down enough of your mortgage, you may be ineligible for a 2nd mortgage or line of credit due to insufficient equity.

Can I use a home equity loan for debt consolidation?

Yes. Many borrowers take out a home equity loan to pay off high interest debt, credit cards, and adjustable rate home equity lines of credit. Consolidating debt with a fixed rate home equity loan can reduce your monthly debt payments and provide increased savings that improve your financial situation.

Does a HELOC Affect Your Credit Utilization?

A HELOC can impact your credit utilization, but its effect varies depending on the credit scoring model used. FICO® Scores typically exclude HELOCs from the credit utilization calculation, as they are secured by your home. However, some credit bureaus include HELOC balances in its utilization metrics. Regardless of the model, responsibly managing your HELOC credit line—such as making timely payments and keeping balances low—can positively influence your credit profile over time

Can I use a HELOC to pay off credit cards?

Yes, you can use a HELOC to pay off credit cards, often at a lower interest rate. Since HELOC rates are typically lower than credit card rates, consolidating high-interest debt can save money and reduce monthly payments. However, transferring unsecured credit card debt to a HELOC, which is secured by your home, carries risks—missed payments could lead to foreclosure. Be sure to manage your HELOC responsibly.

Can I get a HELOC with late mortgage payments?

It can be challenging to get a HELOC if you have late mortgage payments. Lenders typically require a strong payment history, and recent late payments may lower your chances of approval. Some lenders may still approve a home equity line of credit if you have significant home equity and a strong credit profile, but expect higher interest rates or stricter terms. Improving your payment history before applying can increase your chances.

If the late payments are isolated incidents and your overall credit profile is strong, some lenders might still consider your approving a bad credit HELOC. It’s essential to communicate with potential lenders about your specific circumstances.

Do mortgage lenders offer guaranteed home equity loan with bad credit no credit check?

No. Lenders do not guarantee home equity loans without credit check of evaluating a property’s value. Since this is a second lien on the home, the risk factor increases significantly. The home equity loan cannot be guaranteed with no credit check like a small payday loan or personal loan that is unsecured.

Do You Need Good Credit for a Home Equity Loan?

While good credit improves the likelihood of getting the best interest rate and favorable terms, however it’s not always required. There are a handful of bad credit home equity lenders that accept low credit scores though higher scores may qualify for better rates and lower closing costs. Low loan to value ratios and stable income can sometimes offset lower credit scores in the approval process.

Do Home Equity Loans Affect Your Credit?

Yes, home equity loans can impact your credit. Applying for one triggers a hard inquiry, which may slightly lower your score. Successfully managing the loan by making on-time payments can improve your credit over time, while missed payments or defaults can negatively affect it.

Does Using a Home Equity Line of Credit Help Rebuild Your Credit History?

Can I get a HELOC with bad credit? Yes, in many instances when a borrower pulls out funds from their HELOC account and then repays the debt, the borrowers credit will benefit. The more the times you use the credit line and make the payment on time, the better it is for reestablishing your credit profile.

For people with a low credit score who already own a home and have equity, you still may be able to get a home equity line of credit or HELOC. Many applicants are requesting a HELOC for bad credit. A word of warning: You are putting your home up as collateral for the loan. So if you do not pay, you lose your home. Make certain that you can afford the bad credit HELOC payments!

Even if you have less than perfect credit, if you are still paying your mortgage on time, some home equity lenders may consider extending you a line of credit in the form of a HELOC even with a poor credit score.

In most cases, to get approved, expect to need a combined loan to value ratio of 80%. That means you should have at least 20% equity in the property. If you think you do not have that much equity, don’t be too sure: Home prices have been rising steadily since the Great Recession.

You could have more equity than you think. If you apply for a HELOC with bad credit, the lender will probably order a residential appraisal to get the current value so that they can determine the combined loan to value (CLTV).

For borrowers with bad credit, it will help if you can show good, steady income and employment and a reasonable debt to income ratio.

If you are approved for a bad credit equity line or cash out refinance, you will likely need to pay a higher interest rate. The good news here is that you can probably deduct that interest off of your yearly taxes.

The home equity interest rate you pay will be interest only for a five or 10 year period, and then it will go up to include interest and principal. You should plan to pay that loan back before principal payments are due. Yes the interest rate on a poor credit HELOC with no credit check can go up or down with the market, whereas the rate on a bad credit equity loan always remains the same, because it is fixed.

A HELOC is essentially a line of credit up to a certain amount, but is backed by your home. You can take out the money as you need it, just like a credit card. A poor credit HELOC loan is often a smart choice for a person who needs a steady source of money for expenses that are drawn out, such as a college education or a long term rehabilitation project.

If you need a lump sum of money at once, you should consider the guaranteed home equity loan with bad credit. However, if you have a credit-score above 700, check out the latest home equity loan credit guidelines.

Updated Home Equity Programs for People with Damaged Credit

Key Requirements for a Home Equity Loan and Bad Credit: In the realm of real estate financing, bad credit often presents a challenge, but it doesn’t always shut the door to accessing the equity in your home through a home equity loan.

While traditional lenders may be more cautious when extending low credit home equity loans to individuals with a lower credit-score, there are still avenues for securing home equity loans with no credit check. Understanding the home equity loan requirements is crucial for those looking to tap into their home’s equity despite a less-than-ideal credit history.

Credit Score Parameters: The primary factor influencing approval for a home equity loan is your credit score. While traditional lenders typically prefer a score above 700, there are lenders willing to consider applicants with a lower credit score.

When applying for a home equity loan with bad credit, underwriters will examine your credit history, with particular attention to any recent delinquent payments, bankruptcies, or foreclosures.

The credit score criteria ranges from 580 to 640 for most subprime home equity loan programs. Of course, the minimum credit score requirements may vary between lenders, so do you research before committing to a bad credit equity loan online.

Loan-to-Value (LTV) Requirements: Lenders often evaluate the Loan-to-Value ratio, which is the percentage of your home’s appraised value that you can borrow against. While a higher LTV may be acceptable with good credit, lenders may be more strict with bad credit. Prepare yourself for loan amount limitations relative to your house’s value.

The whole premise of a home equity loan is based on the equity you’ve built in your home. Lenders will consider the difference between your home’s current market value and the outstanding balance on your mortgage. The more equity you have, the better your chances of qualifying for a home equity loan with less than perfect credit.

Income and Employment History: It’s no secret that demonstrating a stable income and employment history can increase the likelihood for getting approved for home equity loan with poor credit. Lenders want assurance that you have the financial capacity to repay the loan, even with a less-than-perfect credit history. Consistent employment and a steady income can instill confidence in lenders.

Debt-to-Income Ratio (DTI): Your Debt-to-Income ratio is another crucial factor. Lenders assess your ability to manage additional debt by comparing your monthly income to your existing debts. While home equity loan guidelines may vary, a lower debt to income ratio is generally favorable for equity loan approval. Typically if a borrower consolidate credit card debt in their home equity loan, their debt to income ratio will decline significantly.

Loan Purpose: Clearly outlining the purpose of the home equity loan can impact the lender’s decision. Financing home repairs or consolidating debt may be viewed more favorably than riskier endeavors. A well-defined plan for utilizing the funds can enhance your home equity loan application.

Assets and Collateral: In addition to your home being used as collateral, home equity lenders may consider other assets you own. Providing proof of tangible assets can contribute positively to your bad credit home equity loan application, offering additional security for the bank or lender.

Should You Get a HELOC or Fixed Home Equity Loan?

Whether taking out a HELOC is a smart idea depends on your finances, goals, and financial discipline. Many people use their 2nd mortgage to renovate the home, which can increase its value before you sell.

Also, the interest on your bad credit HELOC used to be tax deductible if you’re using the money for home renovations.

Other borrowers use their equity to cover education costs, but some borrowers get better interest rates with student loans.

Most financial professionals tell people to avoid using equity to pay for cars because you aren’t building wealth with depreciating assets and lower interest rates.

Personal loans are popular as well, but its hard to beat the benefits of a fixed interest rate home equity loan. Finding a lower interest home equity loan should be the primary goal.

How to Get the Best HELOC Interest Rate

Getting the best rate for your loan comes down to your credit reports, financial profile, and research. The more you look around for an interest rate the better you often can find. Again the rate on a bad credit HELOC will be higher than a home equity line for a person with a good credit history.

The first place to check is your bank or credit union because they may offer a discount if you give them your business. You also should check an online mortgage broker and at least one or two other home equity loan lenders.

Shop for the best HELOC lenders today that specialize in working with people that have credit problems in the past.

Should I Get Cash Out with a Equity Loan or Refinance Mortgage?

Their are pros and cons to both cash out refinancing and taking out an equity loan. Typically if a borrower already has a low, fixed interest rate secured to their first mortgage, the more appealing a second mortgage or home equity loan would be. Of course it largely depends on how much you cash you need and how much lower your initial home loan interest rate is compared to the present market. The RefiGuide can help you meet lenders that offer money with both cash out refinance and home equity programs regardless of your credit report. We will help you compare loans that meet your credit and goals. The question you should ask yourself is, Which loan offers the lowest monthly payments?

How to Increase Your Ability to Get Approved for a Home Equity Loan

1. Work on improving your credit score

While a few home equity loan lenders will approve you for a home equity loan with a credit score as low as 600, typically lenders and credit unions are looking for higher credit-scores ranging from 640- 700.

The other concern is that if you are approved with for an equity loan with poor credit, you will be charged higher interest rates and that will increase your monthly payment.

If your score is below 640, it makes sense to work on raising your three credit scores from Experian, Trans Union and Equifax. There are a few things you can do to raise your credit score, so you qualify for a home equity loan with the lower possible rate.

2. Review credit card balances and revolving debt

Examine all three credit reports and find the credit card balances and other revolving debt, The quicker you can get get these credit card balances paid as quickly as possible. Reducing your debt on revolving credit lines down to 30% of the credit available to you will increase your credit utilization ratio, which typically increases your credit-scores.

3. Reduce your Debt-to-Income Ratio

Your debt-to-income ratio is the sum of all your monthly obligations divided by your gross monthly income. If it’s higher than 35% to 40%, it can be a sign you’re living above your means and may be at risk of defaulting on your loans.

To lower your DTI ratio, you’ll need to increase your income or reduce your debt. You can take on side gigs to make extra money, cut back on dining out or media streaming services, or even sell things you no longer use.

How Much Equity Can I Borrow from My Home?

So, how much money can you get with a bad credit HELOC? It depends on the value of the home and how much the lender will let you borrow. The higher your credit score you have, typically the less equity will be required. Likewise, the lower your credit score, the more equity will be required for a bad credit HELOC.

First, multiply your home’s value by the percentage the lender lets you borrow. That number is the maximum equity you can borrow.

Take the maximum amount of equity you can borrow and subtract it from how much is left on your mortgage. That’s the total cash equity you can borrow.

Let’s say your property is worth $300,000 and you have a mortgage balance of $200,000. The lender lets you borrow 80% of the home’s value. So, the lender says you can borrow $240,000 and you owe $200,000. Thus, you can receive $40,000 equity in cash, if you qualify.

How Does a Home Equity Line of Credit Work?

According to the FTC, home equity lines of credit function similarly to a credit card in that it lets you borrow up to your credit line as often as you like. This provides you with the flexibility to borrow some of your home equity, repay it, and borrow again.

Most bad credit lines have an adjustable interest rate with a short fixed-rate period at the beginning. After the draw period of five or 10 years ends, the interest rate can go up or down.

To set the interest rate, the HELOC lender uses an index such as LIBOR then adds a markup for their profit. The higher your FICO credit score, the lower the lender markup. During the draw period, the HELOC may offer low monthly payments because the minimum payments are interest only.

Remember to check the loan paperwork before you sign to find out what the markup is. Remember the closing costs and interest rates are sometimes negotiable.

Paying Back Your Home Equity Line of Credit

Every HELOC has two parts: the draw period and repayment period.

The draw period allows you to borrow from your maximum credit line. The minimum monthly payments are usually interest only for the draw period of five or 10 years.

The repayment period starts after the draw period is over. You cannot borrow from the credit line again. Now, you need to pay back the HELOC every month, which includes principal and interest. Note that the payment each month will be significantly higher than before.

The repayment period for most home equity lines is 20 years. If you still owe money at the end of the repayment period, you may need to refinance that amount.

Many people overlook the benefits of repaying their bad credit HELOC as they don’ realize the positive impact it can have on your credit reports. By paying the HELOC each month in a timely manner is rewarded by Experian, EquiFax and Trans Union. These credit repositories clearly appreciate borrowers paying the HELOC payments when they are due.

Considerations with Home Equity Credit

There are a few downsides of HELOCs to consider so you have all the information to make the best decision.

First, a HELOC is revocable. This means if your credit situation changes, the lender may close the HELOC loan without warning once you pay it off. So, remember to keep your credit rating in good shape so the home equity line of credit is available when you need it.

You likely already know that the interest rate on a bad credit HELOC is typically higher than for borrowers that have high credit-scores.

Second, the interest rate on this equity loan can vary dramatically depending on the market. The interest rate is usually tied to the Prime Rate or LIBOR index. After the initial fixed period, your interest rate can go up quite a bit.

It’s important to be ready for higher monthly payments so you don’t put your home at risk.

Also, there are not as many tax benefits to HELOCs anymore. Tax law changes a few years ago mean that you only can deduct mortgage interest on your taxes if the money is used to renovate your home or build a home.

A home equity line of credit is a fantastic choice for tapping home equity when you already have a low rate on your first mortgage. There are many excellent HELOC products available, so make sure you check several banks offering home equity credit lines for the best rates.

Timing with Home Equity Loans and Poor Credit

Like so many things in life, timing is everything with interest rates and the real estate market. A home equity loan with no credit check can be a perfect way to get the cash you need for home renovations at a low interest rate. Also consider a poor credit home equity loan if you have low credit scores and need a lot of cash at one time.

The RefiGuide can help you connect with lenders that offer 2nd mortgages and home equity loans for all types of credit. We strongly recommend that you speak to an experienced home equity lender today about loan options and current credit score rules and you may be on your way to getting approved for a guaranteed home equity loan that gets you the cash you need!

Related RefiGuide Articles to Read:

- Can I get a HELOC with No Appraisal?

- What are the Closing Costs on Home Equity Loans?

- Is a HELOC a Second Mortgage?

- Can You Refinance a Home Equity Loan?