Taking out a second mortgage can be a very useful tool to increase your wealth if it is managed properly and 2nd mortgage interest rates are favorable at this time. In 2025, the second mortgage programs have expanded to offer fixed rate home equity loans and revolving HELOC lines of credit.

Check the Best 2nd Mortgage Loan Rates

In this guide, consumers can compare 2nd mortgage rates online and determine which lender is best choice for their needs. There are many reasons that homeowners take out second mortgage loans and cash out mortgages, and many of them can be good ideas in the right circumstances.

We suggest that you take a few minutes and explore this second mortgage guide to uncover new cash out loan opportunities to save money with today’s 2nd mortgage loan rates for lower payments that improve your financial situation.

You can choose from fixed 2nd mortgage rates and adjustable rate credit lines. Are you looking for an interest rate for second mortgage for quick cash or debt consolidation? The Refi Guide can help you consolidate debt for lower monthly payments with fixed 2nd mortgage rates.

Make sure when you compare home equity loan rates that you consider the annual percentage rate or APR, as this number factors in the cost of the loan.

- Find the Lowest Second Mortgage Interest Rates Today

- Secure the Best 2nd Mortgage Loan Rates Online

- Shop for Competitive Fixed Second Mortgage Rates

The RefiGuide can help you find the best second mortgage lenders with competitive rates and the loan amount you need to accomplish your goals.

What Is a 2nd Mortgage?

A 2nd-mortgage is a lien that homeowners can take out on their house without having to refinance their existing 1st mortgage lien. It’s hardly a secret that 1st and 2nd mortgage interest rates are advertised near record low-levels. Read on an learn how to qualify for the best second mortgages in 2025.

Like any loan that uses your home as collateral, there are risks involved, so it is crucial to weigh the pros and cons of a second mortgage loan before making a big commitment and signing legal documents.

The expression “second mortgage” pertains to the order in which the lending bank receives payment in the event of a foreclosure.

In such a scenario, the home equity loan is compensated only after settling the balance of the first loan. Consequently, if there is insufficient remaining equity, the mortgage company may not fully recover their money. Given the increased risk associated with subordinate mortgages, interest rates for these loans are typically higher compared to rates for primary mortgage liens.

How Does a 2nd Mortgage Work for Homeowners in 2025?

When considering a 2nd mortgage or equity loan, the loan amount hinges on your home equity—essentially, the gap between your property’s value and your current loan balance. The risk is the homeowner default on payments, the 2nd mortgage lender might resort to foreclosure.

Nevertheless, 2nd mortgages typically feature better rates compared to alternatives like revolving credit card accounts or personal loans. Many homeowners explore second mortgages to access their accrued home equity, for consolidating debt, making a big purchase or financing home renovations. Let’s examine the interest rates for 2nd mortgage programs for primary residences and second homes.

How to Get Best 2nd Mortgage Rates Online from Lenders and Bankers You Can Trust

The first step in securing a 2nd-mortgage involves steps complotting the equity loan application and submitting your income documentation, mortgage note and monthly statement for your first mortgage.

Though specifics vary by lending company, you’ll typically need to furnish the documentation that the underwriter requires.

The brokers and lenders will review your credit report and determine your debt to income ratio. an appraisal will be ordered and that will ultimately calculate your loan to value.

Most 2nd mortgage lenders restrict the amount you can borrow, ensuring a portion of your equity remains intact. The Refiguide will help you find the best 2nd-mortgage lenders that offer aggressive home loan programs with less equity required.

We recommend you get your income documentation and mortgage paperwork organized so that the lenders with underwrite your loan quickly with a positive first impression.

The percentage you can borrow varies, with some of the best 2nd mortgage companies allowing up to 85 or 90% of your home’s equity for an equity line of credit or a 2nd mortgage. For instance, if you possess $160,000 in equity, you might be eligible to borrow between $136,000 and $144,000. When lenders calculate loan to value they are adding up the 1st and 2nd loan amounts and then dividing by the appraised value.

Don’t waste your time working with banks and lenders that do not specialize in home equity loans. Shop and compare loans with the best 2nd-mortgage lenders so that you can get the best rates and terms as well.

Case Study: Getting a Second Mortgage for a Lower Interest Rate

Background: John and Lisa, homeowners in Texas, took out a home equity loan five years ago at an 8% interest rate. As their credit scores improved and market rates dropped, they decided to refinance to a lower second mortgage interest rate.

Challenges:

- Their LTV ratio was slightly above 80%, limiting their options.

- Their original 2nd mortgage lender offered only a marginally lower interest rate.

Solution: John and Lisa shopped around and found a lender offering a 5.5% fixed rate. By paying down a small portion of their loan balance, they lowered their LTV to 78%, qualifying them for the best available second mortgage rate.

Outcome: Refinancing saved them $175 per month and over $20,000 in interest over the life of the loan. By timing the market and negotiating terms, they secured a significantly better deal.

How Do 2nd Mortgage Loan Rates Compare to Interest Rates on First Mortgages?

Fixed second mortgage rates are frequently slightly elevated, generally by about 0.5%, 0.75 %, or even up to 1% higher.

This increase serves as a measure to offset the additional risk associated with home equity loans.

Since an equity loan sits on title in second position, that meets that the lender that holds the 1st mortgage note will be paid first in the event of a foreclosure, therefore current 2nd mortgage rates are higher to offset the risk factor.

Since your 2nd-mortgage is backed by collateral, you are more likely to secure a lower interest rate than with unsecured borrowing options like unsecured lines or credit cards.

Lower 2nd mortgage loan rates mean you will pay less interest over the life of the loan, allowing you to save money on substantial expenses.

Keep in mind, your total mortgage payments may be lower if you add up your existing mortgage payment and new equity loan payment because today’s second mortgage loan rates and interest rates from a few years ago would translate to a lower overall monthly payment than if you refinanced your current mortgage to a higher interest rate. In some cases borrowers may get a lower interest rate of.125% for agreeing to automatic payments from your savings account. The RefiGuide can help shop lenders advertising the current second mortgage rates online.

Borrowers have more interest rate options on a primary mortgage. For example, whether someone is buying or refinancing they gave the choice to get a fixed 15 or 30 year mortgage. in addition many borrower consider hybrid ARMs, that offer fixed rates for a specific timelines like 3, 5, 7 or 10 years before they turn into a variable interest rate. (ie. 3/1, 5/1, 7/1, 10/1 ARM)

The fixed 2nd-mortgage rate terms range are for 10, 15, 20, 25 or 30 years. These are fixed rate second mortgage programs that have fixed years and fixed monthly payment. The 2nd mortgage does not have the option for hybrid ARM’s like 1st mortgages.

You can rest assured that Refi Guide will match you brokers and lenders that advertise the best second mortgage loans online.

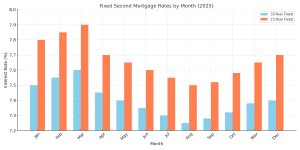

What Are Today’s 10-Year Second Mortgage Rates?

As of January 27, 2025, the 10-year fixed rate 2nd-mortgage with an Annual Percentage Rate (APR) of 6.67% for loan amounts between $50,000 and $99,999, assuming a loan-to-value (LTV) ratio of 70% or less. 2nd mortgage interest rates can vary based on factors such as credit score, loan amount, and LTV. It’s advisable to check with multiple banks and lenders for the most current rates and terms.

What Are the Current 15-year 2nd Mortgage Rates?

Interest rates for 15-year second mortgages vary among lenders and depend on factors like creditworthiness and LTV ratios. For instance, Loa Depot offers 15-year fixed-rate home equity loans with APRs starting at 7.5%, though actual rates depend on individual qualifications. The RefiGuide can assist you in comparing competitive offers from various 2nd-mortgage lenders to find the most favorable terms for your situation. Whether you are in California, Utah, Florida or Massachusetts, we can connect you with banks and lenders that provide competitive second mortgage rates on interest only HELOCs and fixe rate home equity loans.

What Are the 30-Year Second Mortgage Rates?

While 30-year terms are common for primary mortgages, they are less typical for second mortgages. Some lenders may offer 30-year fixed-rate home equity loans; for example, with APRs starting at 7.675%, depending on the borrower’s credit profile and other factors. Since offerings vary, it’s important to consult with multiple lenders to determine available options and current rates.

As of April 2025, average 30-year mortgage rates range between 6.9% and 7.3%, depending on the lender, loan amount, and borrower qualifications. These 2nd loan rates are typically higher than those for primary mortgages due to the increased risk associated with second liens. For instance, in San Diego, California, 30-year fixed mortgage rates are as low as 6.75%. However, 2nd mortgage rates are being reported at 7.75%, so it’s advisable to shop around and compare offers from multiple 2nd mortgage lenders to secure the best terms.

Please note that 2nd loan interest rates are subject to change and can vary based on individual circumstances.

How Do I Apply for a Second Mortgage?

Applying for a second mortgage involves several steps to ensure eligibility and secure the best 2nd mortgage rates and terms. First, check your home equity, as lenders typically require at least 15-20% equity in your property. Next, review your credit score, debt-to-income ratio, and financial stability, as these factors impact approval and interest rates. Research 2nd mortgage lenders offering home equity loans or HELOCs and compare rates, fees, and terms. Gather necessary documents such as proof of income, tax returns, a mortgage statement, and property details. Submit an application to your chosen lender, who may require a home appraisal to confirm your property’s value. If approved, carefully review the loan terms before signing and accessing funds. Consulting with a financial advisor can help you determine the best second mortgage option for your needs.

What Are the Requirements for Getting the Best Second Mortgage Rate?

There is a genuine premium to qualify for a competitive fixed rate second mortgage. These are typical conditions for seeking the lowest rates on the best second mortgages:

- Steady Employment with Sufficient Income

- Equity in your home amounting to a minimum of 10 percent to 20 percent.

- The outstanding mortgage should be under 80 percent of the home’s value.

- A credit score of 700 or above.

The minimum credit score requirement will vary upon bank or mortgage lender. Since 2nd mortgages carry a higher risk than primary mortgages, you will need excellent credentials to get approved for the best 2nd mortgage interest rate.

The RefiGuide can match you with banks and lenders that specialize in home equity loans, HELOCs and cash out 2nd-mortgages. Now you can shop for 2nd mortgage rates today without pressure.

When is the best time for taking out a second mortgage?

The best time to take out a second mortgage is when you have significant equity, a good credit score, and a clear financial purpose—such as consolidating debt or funding renovations. It’s also wise to act when interest rates are favorable and your income is stable enough to handle a second monthly payment.

4 Ways a Second Mortgage Creates Opportunities for Homeowners

A 2nd-mortgage typically involves one of these types of loans:

- A home equity line of credit (HELOC): This is a line of credit that uses the equity in your home. You can borrow up to a certain credit line, just like with a credit card. The advantage of a HELOC is that you need not take out the entire amount at once. You can just use the line of credit as you need it. Most home-equity credit lines allow you to only pay interest on the money you are using.

- A home equity loan: This is a second mortgage that allows you to pull out all of your equity at once in one lump sum. This can be a good idea if you need all of the money at once. Note that you will pay interest on the entire equity amount as soon as you take it out.

Which type of home equity loan you get will depend upon your exact financial needs. If you need all of the money right away, you may want to get a home equity loan, but if you need smaller amounts over time, a HELOC could be best. Below are the most common ways that people use 2nd mortgages to create opportunities for themselves:

#1 Pay for Education with a 2nd Mortgage Loan

If you have children and you do not have enough money saved up to pay for their college education, taking out a home equity loan or equity line of credit can be a good move. If you have good credit, your interest rate on your home equity loan will often beat the rates you can get anywhere else. This is because you are borrowing against your home, and people borrowing against their home are likely to repay the debt.

Another major benefit of paying for a college education with an equity loan is that you can generally write off the mortgage interest you pay on your taxes, if you itemize. You can easily save a few thousand dollars per year on your taxes by doing this. In most cases, the best 2nd mortgage rates are lower than interest rates from credit cards and unsecured loans.

#2 Make Home Renovations with a 2nd Loan or HELOC

Have you been dreaming about remodeling your kitchen and bathroom? A 2nd-mortgage can allow you to do that. You can take part or all of your equity (up to 80-90% usually of your total available equity) and put it into home improvements. If done wisely without overspending, fixing up your home with home equity can be a great move.

You will be able to enjoy your home even more than before, and you also can reap a higher profit when you sell the home. You should focus on repairs to your home that will generate the most return. A kitchen or bathroom renovation often returns a lot when you sell, as does adding square footage with another bedroom or family room extension. Consider a second mortgage to make home improvements in 2024 if interest do not fall dramatically.

Homeowners appreciate the flexibility that comes with HELOCs. Most borrowers finance the home improvements during the draw period and then begin making fixed monthly payments during the repayment period. This is often the time that borrower will refinance a second mortgage if the adjustable rates are higher than the available fixed rates. Find top HELOC lenders now.

#3 Pay Off High Interest Loans and Debt

For decades, the second mortgage for debt consolidation has been considered the driving force for homeowners to consolidate credit cards and high interest loans. For example if you have four credit cards at an average interest of 18% and you qualify for fixed rate second mortgage rates at 9%, then you could potentially lower your monthly payments. Many homeowners have taken out a 2nd-mortgage to achieve debt consolidation. Obviously, you are putting your home at risk by converting unsecured debt into a secured loan, because if you do not make the payments, they could potentially take your home. If you are saving money and can afford the monthly payments then second mortgages can be a wise financial move.

#4 Use the Funds of a 2nd Mortgage to Finance Investments

Another very popular thing to do today with a 2nd-mortgage loan is to pull out some of your equity and to put it into the stock market or possibly into real estate investments. There are particularly many opportunities today to put your equity into cash flowing real estate investments.

If you are able to take out a second mortgage for 5%, and invest in real estate investments that makes 12%, this makes a lot of financial sense. You then can take the money that you are making and use some of it to pay down your second mortgage loan.

Some savvy homeowners are even taking out a second mortgage to buy crypto. We caution you to consider all investment risks when taking out a new 2nd mortgage loan.

Or you can use the profits from the real estate investments to buy more properties. There is no question that done wisely, getting a second mortgage can improve your financial position and create opportunities. However, you should remember the following:

- Borrowing on your home has risk: If you pull out equity and put it into something that does not provide you with a rate of return, such as a new car, you need to remember that you will have to keep paying on that loan for years to come. Can you handle that?

- Some home equity loans lead to foreclosure: There were unfortunately many cases during the last recession where people borrowed money from their homes to buy cars or go on expensive vacations. They expected their property values to continue to increase. When they fell instead, many people couldn’t keep up with the payments and they lost their home.

- Second mortgages have higher mortgage rates: If you were to default, the home equity loan is subordinate to the first, meaning that the first mortgage holder gets paid off first. So, in most instances second mortgage loan rates are offered at higher interest rate than the same borrower would get for a mortgage held in first position on title.

- If you do home improvements, you don’t see the financial benefit until you sell: Improving your home can be a smart move, but you will not realize the profits until you sell your home, which could be years from now.

The Reality of Second Mortgages in Today’s Market

When a 2nd mortgage is used wisely, it creates many exciting financial opportunities for the homeowner. But you need to be disciplined and plan things out so that the use of your equity results in a profit so that your financial situation is improved.

If you do enough planning on how to use your equity wisely, a 2nd mortgage can be used to greatly increase your net worth over time.

How to Make the Most of a 2nd Mortgage Loan Transaction

A second mortgage is either a home equity loan or a home equity line of credit (HELOC) on your home. It is exactly what it sounds like: a 2nd mortgage on your primary residence that you have to pay every month.

As I mentioned earlier, the second mortgage is secured by your home, just like your first mortgage. If you fail to pay it, the bank can take your home, typically after you are 60 or 90 days late on the loan.

Many home owners are attracted to second mortgages again in this year because rates are so low. We may see a surge in 2nd mortgage applications if the Federal Reserve raises key interest rates as anticipated. If you are thinking about getting a second mortgage, we want to tell you some very important information so you can make a good decision.

What Are the Types of Second Mortgages?

You can get either:

- Fixed home equity loan: This is a lump sum of cash that is based upon how much equity you have in your home. With this fixed rate 2nd mortgage, you get the cash in your bank account all at once, which can be appropriate for many large expenses. Note that you will pay interest on the entire sum of money as soon as you receive it. In most cases, the 2nd mortgage interest rates are fixed. If you have low Fico scores, you should ask about home equity loans and bad credit as they are available for borrowers that meet the lender’s criteria. We suggest that you shop and compare offers from second-mortgage lenders and brokers.

- Interest only home equity line of credit: This is a line of credit on your home’s equity that you can write checks against as you need it, within a certain period of time, usually 10 years. It is an interest only payment for the draw period, and then you pay interest and principle once the draw period is over. You only need to pay interest on the amount of money you have taken out. See today’s HELOC rates.

How to Make the Most of Your Second Mortgage Transaction

There are few limits on how you can use your equity that you tap in your home equity loan Many Americans use a 2nd mortgage loan to pay for large expenditures:

- Buy a vacation home

- Pay off credit cards

- Pay for home improvements

- Buy investment properties

- Pay for a college education

As you are thinking about getting a second mortgage, experts advise you to think about the following carefully:

How are you going to use the money? Few financial advisers would recommend that you use the money for anything that does not generate a return on investment. This would eliminate using the money to pay off debt, to buy a car or go on a vacation.

Some homeowners still may go ahead and use their equity to pay off their credit cards. They are being charged a much higher interest rate on the credit cards than they are on the second mortgage.

The problem is if you just use paying of the credit cards as an excuse to pile on more debt again. Now you have the debt in your home, which you will lose if you do not pay. Up until 2018, you can deduct the second mortgage interest you pay if you pay off credit cards, which you cannot do with credit card interest. The recent tax reform bill repealed the deduction of second mortgage interest. This provision does not expire until 2026.

The most common thing that people do with their home equity is to use it for home renovations. If you spend the money wisely on the renovations, this can be an excellent return on investment. Most people like to upgrade the kitchen or bathrooms.

You will not see a return on your money until you sell. But, you will be able to enjoy the benefits of an improved home until you sell, which makes it well worth it for many people.

Another idea is to borrow money out of your home on a 2nd mortgage to purchases investment properties. If you can borrow the funds at 5% and earn 12% or more, this also can be a really good return on investment.

You would be strongly advised to work with a highly experienced realtor or real estate investor. You want to be sure that you are going to be able to get a good return on your money. Remember, if you end up losing money, you still have to pay for that home equity loan!

Some home owners will use their second mortgage to pay for a college education for a child. If the child is going to be earning a good salary in his or her major, this also can be a wise move.

Whether you should take out a second mortgage or not depends upon your financial circumstances. Consider:

- How close are you to retirement? If you are paying on a first and second mortgage well into your retirement years with reduced income, this could be a terrible financial burden.

- How many years do you have left on your first mortgage?

- Are you going to be receiving a higher level of income in the near future?

- Are you really sure that you will be able to make the payments on the home equity loan for years?

- Are you comfortable with the higher risk that you have by having a second mortgage?

Getting a second mortgage is a very popular financial step, and if you make the most of the money, it can secure your financial future. Do all of your financial homework, making sure that the money is going to be put to good use. Borrowing money out of your home IS a risk, and you want to make certain that the risk has a good chance of paying off.

Why a 2nd Mortgage Loan Makes Sense for Cash Out When Interest Rates Rise

Do you own your home and have equity?

You may want to pull out cash to buy a car, pay off credit cards, or pay for college.

But what if interest rates are on the rise?

Refinancing your first mortgage may not be what you want to do.

And if there is not a clear financial reason to do so, such as a lower interest rate, you may not be allowed to refinance it anyway.

What to do?

Many home owners opt for a 2nd-mortgage when rates are rising. What’s a second mortgage all about? Keep reading, please!

Overview of a Second Mortgage Lien

A second mortgage is either a home equity line of credit (HELOC), or a home equity loan. Most home equity loans have a fixed rate for the entire life of the loan. A home equity credit line has a variable interest rate that can change from month to month.

A HELOC-loan will usually start with a lower interest rate, but rise with time, depending upon the markets. If interest rates are rising overall, expect your HELOC interest rate to rise. It can rise substantially as rates go higher. There is a cap above which the rate cannot rise. But if you start with a 5% rate and it goes to 10% in a few years, this is a serious increase in cost that can sink many people.

A home equity line will have a higher rate, but at least it is fixed for the life of the loan. That rate also cannot rise as interest rates continue to rise.

Whether a credit line or home equity loan is best varies based upon your needs and risk tolerance.

If you are more comfortable with fixed payments, strongly consider a home equity loan. If you are fine with payments that may increase (but be lower at first), think about a HELOC.

Qualifying for the Best 2nd Mortgage Loan

To qualify for your second mortgage, you need to meet the lender’s lending criteria, just as with your first mortgage. You do not need to use the same lender for your second mortgage as the first. The RefiGuide can help you find the best second mortgage lenders and bankers offering fixed equity loans and variable rate HELOCs. Remember that if you do not pay on the second mortgage, you can lose your home just as you can if you do not pay the first. Compare a 2nd-Mortgage and Home Equity Loan.

What Are 2nd Mortgage Closing Costs?

There are closing costs to get second mortgages. Most lenders charge lending fees. Many banks charge annual fees on HELOCs as well. In most cases borrowers will roll the HELOC closing costs into the loan which in turn will increase the 2nd-mortgage loan amount. 2nd mortgage closing costs and lending fees typically ranging from 2-5% of the amount borrowed. There are still a few lenders that promote no cost 2nd mortgages, but you will need high credit scores and lot of equity to meet the parameters.

Can I Get a 2nd Mortgage on a Second Home or Investment Property?

Yes, there are home equity programs that allow borrowers to get a second mortgage on an investment property or vacation home. Of course 2nd home mortgage rates are lower if the property is owner-occupied than than a VRBO or Air BnB. Most lenders will only approve a 2nd mortgage on rental properties if you have at least 30% equity available.

Are the second home loans rates competitive?

Banks run a business and set interest rates based on risks. The reality is that the default ratio is higher on second homes and rental properties, that’s why second home loan rates are higher than traditional mortgage rates. If you have good credit and some equity in the second home interest rates are usually only a quarter to a half point higher. If you are looking for a HELOC on a second home than you will need a lot of equity and good credit scores. The RefiGuide will help you shop second home mortgage rates that make sense for your budget and borrowing credentials.

What is the interest rate on a second mortgage?

The interest rate on a second mortgage varies based on credit score, loan amount, loan type (home equity loan or HELOC), and market conditions. Second mortgage rates are generally higher than first mortgage rates because they carry more risk for lenders. Fixed-rate second mortgages typically range from 7% to 12%, while HELOCs may have variable rates tied to the prime rate index.

Are variable second mortgage rate loans a good idea?

A variable-rate second mortgage, such as a HELOC, can be beneficial if interest rates are low and expected to remain stable. However, if rates rise, payments can become unpredictable and more expensive. Borrowers who prefer stability may opt for a fixed-rate home equity loan instead. Evaluating your financial situation and risk tolerance is key when deciding between a variable or fixed-rate loan.

Can I afford a second mortgage?

Affording a second mortgage depends on your income, existing debts, and credit profile. Lenders will evaluate your debt-to-income ratio (DTI) to ensure you can handle the added payment. Use online calculators or speak with a lender to estimate affordability. Make sure you factor in taxes, insurance, and potential rate changes if the loan is not fixed.

What is a Freddie Mac second mortgage?

A Freddie Mac second mortgage refers to a subordinate loan backed by Freddie Mac, typically used in affordable housing programs. It helps qualified borrowers cover down payments or closing costs. These loans often feature deferred payments, low interest, or forgivable terms, depending on the program and borrower eligibility requirements.

What is a closed-end second mortgage?

A closed-end second mortgage is a lump-sum loan with a fixed interest rate and set repayment schedule, typically 5 to 30 years. Unlike a HELOC, it doesn’t allow ongoing withdrawals. It’s ideal for borrowers who need a specific amount of cash upfront—commonly used for home renovations, debt consolidation, or large one-time expenses.

Are the rates high on a second mortgage investment property program?

Yes, second mortgages on investment properties typically have higher interest rates than those on primary residences. This is due to the increased risk for lenders. Rates vary by lender but are often 1–2% higher than standard rates. A strong credit score, low LTV, and solid income can help reduce your rate.

What are 2nd mortgage closing costs?

Second mortgage closing costs typically range from 2% to 5% of the loan amount. These costs may include appraisal fees, origination fees, title insurance, and government recording fees. Some lenders offer lower or no-closing-cost options but may charge higher interest rates. It’s important to compare lenders and understand the full cost before proceeding with a second mortgage.

Can I get a second mortgage to cover the down payment on a home purchase?

Most lenders do not allow a 2nd-mortgage to cover the down payment on a new home purchase. However, some specialized programs, such as piggyback loans, may allow this if you meet specific requirements. Generally, lenders require a personal down payment to reduce risk. Exploring down payment assistance programs or seller concessions may be better alternatives.

This second mortgage down payment strategy helps reduce the primary mortgage amount and may avoid private mortgage insurance (PMI). However, not all lenders allow it, and you’ll need sufficient income and credit to qualify for both mortgages.

Should I get a fixed-rate second mortgage?

A fixed-rate second mortgage offers predictable monthly payments, making it a good choice if you prefer stability. It’s ideal if you need a lump sum for a large expense and want to avoid fluctuating interest rates. However, if you need flexibility and access to revolving credit, a variable-rate HELOC may be a better option. Compare rates and terms to determine the best fit.

Are interest rates lower on a cash-out refinance or second mortgage?

Cash-out refinance rates are typically lower than second mortgage rates because they replace your primary mortgage, which has a lower risk for lenders. Second mortgages, such as home equity loans and HELOCs, generally have higher interest rates since they are subordinate to the first mortgage. Choosing between the two depends on your financial goals, loan terms, and current mortgage rate.

Are second mortgages only for a primary residence?

No, second mortgages can be used on primary residences, second homes, and investment properties. However, eligibility requirements and interest rates may vary depending on the property type. Lenders typically have stricter terms for second homes and investment properties due to higher risk. Checking with lenders about their specific guidelines can help determine loan options.

Does a second mortgage always show up on your credit report?

Yes, in most cases, a second mortgage appears on your credit report and affects your credit score. 2nd mortgage lenders report your loan balance, payment history, and credit utilization. Timely payments can improve your credit, while missed payments can negatively impact it. However, some private money lenders or seller-financed second mortgages may not report to credit bureaus.

Can I do a second mortgage with a VA loan?

Yes, but the VA does not offer second mortgages directly. You can take out a second mortgage from a private lender if you have enough equity in your home. However, lenders may have stricter requirements, and adding a second mortgage could impact future VA loan eligibility.

What is the Florida Assist second mortgage?

The Florida Assist program offers a 0% interest, deferred second mortgage to help eligible homebuyers cover down payment and closing costs. No monthly payments are required, and the loan is repaid only when the home is sold, refinanced, or the primary mortgage is paid off. It’s available through Florida Housing’s first-time homebuyer programs.

What is an interest-only second mortgage?

An interest-only second mortgage allows you to make monthly payments on interest only for a set term, typically 5 to 10 years. After this period, you begin repaying principal plus interest. This structure offers lower initial payments but may result in a balloon payment or higher costs later. It’s best for short-term financing needs.

Why a Second Mortgage Can Make Sense

There are several major advantages that make a second mortgage a logical choice if you are in a rising interest rate environment, and just generally.

First, a second mortgage can be your best option if the rates to refinance are the same or higher than your first mortgage. As noted above, you may not be able to refinance your first mortgage if the interest rate is not substantially lower.

A second mortgage will nearly always carry a lower interest rate than other types of debt, such as variable rate loans and credit cards. You can save yourself thousand in interest if you pay off credit cards with a second mortgage.

Second, a second mortgage usually allows you to borrow a lot more money than a personal loan. The loan is secured by your home so you should be able to borrow quite a bit more than you otherwise would. How much? It will depend upon the lender. Generally, you should be able to borrow 80% of the value of your home, minus what you owe.

Third, second mortgages as with first mortgages usually allow you to tax deduct any interest that you pay. This will save you a lot of money over credit cards and personal loans.

If you use a home equity loan to purchase, construct, or enhance the home your interest payments may be tax-deductible. The IRS stipulates that you can deduct interest on up to $750,000 of qualified mortgage debt.

Getting a second mortgage in a rising interest rate environment also will allow you possibly to do major home improvements. Many people cannot afford to do home improvements with all cash. So, they use a second mortgage to get the home improvements done. Doing so in a rising interest rate market may be a smart move.

Why? Because home prices often are rising in a higher interest rate environment. As you do home improvements, you often will enjoy a good deal of appreciation. This can help your home improvements to largely pay for themselves, at least when you sell.

2nd Mortgage Considerations

As you are thinking about getting a second mortgage, you should keep these things in mind:

- Your chances of foreclosure rise when you take out another mortgage. So, be sure that you can really afford the payments.

- You need to pay for several costs, such as credit checks, appraisals and loan costs. Be sure that you have weighed all of the costs versus what you stand to gain.

- Any time you borrow money, you will have to pay some type of interest. Of course, fixed second mortgage rates usually beat credit cards, but you will pay a higher rate than on your first.

Takeaways for Getting the Best 2nd Mortgage Rates

Getting a second mortgage when rates are rising is often the best bet for home owners who have a first mortgage with a very low interest rate. It is often better to leave that first mortgage in place and borrow the cash you need with a second mortgage. You need to think carefully if a HELOC or home equity loan is best, considering your financial situation and level of risk you prefer.

Typically, the home equity line of credit carries lower rates at first, but in a rising interest rate environment, can go up fast. A home equity loan has a higher rate, but it is fixed.

Its no secret that the cost to borrow money is higher than expected but second mortgage interest rates are still more affordable than credit card and personal loans. The RefiGuide can help shop for the best second mortgage rates today with lenders and brokers you can trust.