For several decades the FHA cash-out refinance plan has helped millions of Americans with affordable refinancing with cash out opportunities that do not require as much equity as most conventional mortgages. Do you want to refinance your FHA loan into a lower rate and get cash out? The RefiGuide will help learn everything you need t know about FHA cash out plans and refinancing opportunities in 2025.

FHA Cash Out Refinance Loan Guidelines Expanded and Refi Rates Remain Competitive!

How about pulling out some money to finance those long-awaited home improvements? You can possibly do both with FHA cash out refinancing. Homeowners have the unique opportunity of gaining access to quick money with competitive interest rates guaranteed by the Federal Housing Administration if they meet the cash-out refinance requirements.

- Learn about Credit Standards & FHA Guidelines for Cash Back

- Talk to Lenders with Strong Reputations for Cash Out Refinance with FHA

- Check Today’s FHA Refinance Rates with No Application Fees

- Review Offers and Compare Cash Out Loan Programs

- Check Eligibility for FHA Cash Out Plan

- FHA Cash Out Refinance Rates Remain Competitive

This year home prices remained steady even though mortgage rates rose. FHA cash out refinance rates are still competitive in 2025. This year could be a great time for you to refinance your FHA mortgage and get money back. The cash out refinance requirements continue to be eased for qualified borrowers. Keep reading for more information and current FHA refinance guidelines for cash out transactions. Check todays FHA refi rates and get a no obligation quote from FHA approved lenders.

The Federal Housing Administration offers a range of mortgage refinance options, including cash out refinance loans, designed to help homeowners access their home equity for various financial needs. However, like most finance programs, FHA cash-out plans are subject to specific rules, limitations and regulations. Let’s explore the cash-out rules for FHA refinance loans for 2025.

Understanding FHA Cash-Out Refinance Program

A cash-out refinance allows homeowners to refinance their existing mortgage and receive cash back from their home’s equity. With FHA cash-out refinance loans, borrowers can access up to 85% of the home’s appraised value minus the remaining balance on the original FHA loan.

The cash obtained can be used for various purposes, such as debt consolidation, home improvements, or other financial needs. If you already have a low interest rate on your current mortgage, consider a home equity loan for cash back.

Maximum Loan-to-Value (LTV) Ratio on Cash Out Refinancing with FHA

In 2025, FHA cash-out refinance loans are subject to specific LTV ratio limits:

- Up to 85% LTV: Homeowners can borrow a maximum of 85% of their home’s appraised value through a cash-out FHA refinance transaction. This means that if your home is appraised at $400,000 and your current FHA loan balance is $240,000, you could potentially access up to $100,000 in cash ($400,000 x 85% – $340,000).

- **Previous LTV Limit: It’s crucial to understand that these Cash-out FHA LTV limits have changed over the years. Prior to 2021, the maximum LTV ratio for FHA cash-out refinance loans was 85%, but it was reduced to 80% due to concerns about the housing market’s stability. In 2021, it was raised back to 85% LTV.

What is the FHA Cash Out Plan?

The Federal Housing Administration released the FHA cash out plan that allows borrowers to refinance more than your current mortgage balance, giving you the difference in cash proceeds that comes back to them when the loan closes escrow. The FHA cash out program provides money that can be used for nearly any purposes, such as financing home renovations, starting a new business, consolidating high-rate personal loans, or covering the down payment for an investment property. The RefiGuide will help you shop lenders that specialize in the FHA cash out plan.

FHA Cash Out Plan Eligibility Requirements

To qualify for an FHA cash-out refinance loan in 2025, borrowers must meet certain eligibility requirements:

- Existing FHA Loan: You must have an existing FHA lien to be eligible for the FHA cash-out plan.

- Occupancy: The house being refinanced must be your primary residence.

- Credit Score: FHA cash-out refinance loans typically require a minimum credit score of 580. However, some approved FHA lenders may have their own credit score requirements with loan options for borrowers with credit scores as low as 500.

- Debt-to-Income Ratio: Borrowers should have a reasonable debt-to-income (DTI) ratio, typically below 43%, although some FHA companies may accept higher DTI ratios under certain circumstances.

- Sufficient Equity: You must have enough equity in your home to meet the LTV ratio requirements to qualify for the FHA cash out program .

Use of Funds

The cash obtained from the FHA cash out program can be used for various purposes, such as:

- Debt Consolidation: Paying off high-interest debts, such as credit card balances or personal loans.

- Home Improvements: Financing renovations or repairs to enhance the home’s value.

- Education Expenses: Covering educational costs for yourself as well as your family.

- Emergency Expenses: Paying medical bills or other financial emergencies.

- Investments: Investing in other real estate properties or financial opportunities.

Documentation and Closing Costs on Cash-Out FHA Refinancing

When applying for an FHA cash-out refinance loan, borrowers should be prepared to provide necessary documentation, including proof of income, credit reports, and information about the intended use of funds. Additionally, borrowers should be aware of closing costs in conjunction with refinancing, which may include appraisal fees, origination fees, escrow and title insurance.

In 2025, FHA cash-out refinance loans offer an LTV ratio of up to 80%, provided borrowers meet the necessary criteria. These cash out loans can be a practical financial tool for homeowners looking to consolidate debt, fund home improvements, or meet other financial needs.

Before pursuing an FHA cash-out refinance, it’s advisable to consult with an approved FHA lending specialist and financial advisor to ensure that you meet the eligibility requirements and fully understand the implications of this type of home refinancing on your financial situation. This FHA cash-out plan will ensure that you can make an informed decision that conforms with your financial goals and needs.

The FHA cash out refinance program has been a popular way for FHA borrowers to access additional funds, it’s important to be aware of the financial obligations involved. You will need to come up with closing costs, which can range from 1.5% to 5% of the FHA cash out refi loan amount, and borrowers are also be responsible for the upfront FHA mortgage insurance premium of 1.75%.

More People Are Turning to the FHA Refinance Loan to Access Cheap Money

It’s pretty amazing that interest rates have stayed this low for so long. Now banks, brokers and lending companies are announcing new cash-out programs that are much more aggressive than at any time in the last decade. Today, FHA continues to insure loans with pretty easy cash out refinance rules.

Overview of the FHA Cash Out Refinance Program

An FHA cash out refinance allows you to replace your current mortgage with another mortgage, as well as get cash, if you have sufficient equity in your property. See cash out refinancing rules & examples. You will be opening a new loan with a larger balance than you have today, with the excess cash going to you. Borrowers appreciate the flexible cash out refinance guidelines with respect to credit and Loan to Value requirements with FHA. This is a unique FHA cash out plan, as most programs do not allow the borrow to receive money back in the loan.

What Are the Benefits of a FHA Cash Out Refinance Mortgage?

There are two benefits for the most part: You usually get a lower interest rate, and you also get cash that you need for a variety of major purchases or whatever you want to use it for.

Getting approved for cash out refinancing with a competitive pricing and cash in your hand is a unique opportunity that is only available to homeowners.

If you don not want to refinance your FHA mortgage but need more money, consider a home equity loan or line of credit.

The money you receive from the cash-out transaction can be used for anything, but these are the most common uses:

- Improving your home – this can be a very good idea if done right. You may be able to add value to your home and get more when you sell.

- College education costs – depending upon interest rates, you may be able to borrow money less out of your home than you would pay on a college education loan.

- Investing in real estate – if you can find good, cash flowing real estate that earns a good rate of return, this can be a really good way to add monthly income.

- Paying off debt – if you have credit card or other high interest debt, you can pay it off with home equity and usually pay a much lower interest rate.

Let’s look at a quick example. If you owe 100,000 on your house, you could establish an FHA cashout loan for 150,000, if you have enough equity and you can qualify. If you had to pay $5000 in closing costs, you could theoretically get $45,000 in your pocket for whatever you want.

The FHA refinance cash out loans also can be taken out for other purposes. You also can take the opportunity to get a lower rate or move into a 15-year fixed loan. Or you might move from a fixed rate into a lower adjustable rate.

Cash out FHA refinance loans usually have more flexible qualification guidelines. If you have a lower credit score, you will not necessarily be barred from refinancing. You also can have a higher debt to income ratio than a conventional loan and still qualify. Ask a HUD approved lender about the cash-out requirements for FHA refinancing.

FHA cash-out refinances let you open a new loan with as much as 85% of the current value of the home. Many people have trouble qualifying for that high of an LTV with a conventional refinance loan.

Updated Guidelines for an FHA Refinance with Cash Out

If you think you want to do cash back mortgage, here are the current FHA refinance guidelines for 2025:

- Income: You need to show on paper that you have enough income to be able to pay the new loan each month. You need to have your income verified with two recent paycheck stubs that show your current and YTD earnings. You also will need to produce your W2 forms from the last two years and may need to show your last two tax returns. This latter point is important if you are self-employed.

- Assets: You do not usually need to show reserve funds to quality and apply for an FHA loan online. But the loan officer still may request bank statements or investment account statements.

- Appraisal: To determine the FHA cash out refinance LTV, you will need to have a new appraisal done. The value of the appraisal will tell you how much money you will be able to get on the new loan. As of 2025, the maximum loan for an FHA cash out refi is 85% of the home’s value. The home needs to have been bought a year or more ago, and it cannot go over the loan limits established by FHA for your county. With a FHA refinance cash out LTV at 80% that means that underwriters will verify that there is at least 20% equity left in your house after the cash out amount is calculated.

- Credit: There is no minimum FICO score needed to get a cash out refi loan. But most lenders will have their own internal requirements for your FICO score. Generally, you will need to have a score of 640 to 680 to qualify. See low credit score mortgage options.

More Qualifications for an FHA Cash Out Program are as follows:

- FHA refinance loans for cash out can only be for owner occupied properties, not rental properties.

- Mortgage payment history: You need to have not had any late payments in the last 12 months that were more than 30 days late.

- If you have been in the home under a year, the lender will use the lower of the appraised value or the original purchase price of the property to figure what the maximum loan amount.

- The maximum FHA debt ratios are currently 29% and 41%, but you may be able to qualify for higher ratios. The first ratio is for just hour total housing payment and your gross monthly income. The second ratio includes your housing payment plus all other debt payments each month.

Considerations for FHA Refinancing with Money Coming Back to You in the Loan

Cash out FHA refinance loans have some down sides. Every FHA lien has an upfront mortgage insurance cost, as well as a monthly insurance cost. You will need to pay an upfront premium of 1.75%, and you also have to pay a variable monthly fee for mortgage insurance that often can be approximately $45 for every $100,000 borrowed.

Check with an approved FHA company for current cash out refinance rues. Because of these costs, you may want to consider a conventional cash out refinance if you have a lot of equity in your home, or if you have very high credit scores.

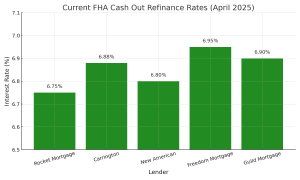

What Are Today’s FHA Cash-Out Refinance Rates?

- Key Points:

- FHA cash-out refinance rates average 6.45–6.87% in July 2025, with APRs around 6.88.02–7.07%.

- Rates are slightly higher than standard FHA refinances due to increased loan amounts.

- Borrowers can access up to 80% of home equity, requiring a 580+ credit score.

FHA cash-out refinance loans allow homeowners to tap up to 80% of their home’s equity, replacing their mortgage with a larger FHA-backed loan and receiving the difference in cash. As of July 2025, 30-year fixed FHA cash-out refinance rates range from 6.65% to 7.07%, with APRs between 7.02% and 7.07%, per Bankrate. These rates are 0.25–0.5% higher than standard FHA refinances due to riskier loan profiles. Rates vary by credit score (580 minimum, 600+ preferred), debt-to-income ratio (43% or less), and lender. Mortgage insurance premiums (1.75% upfront, 0.15–0.75% annually) apply, increasing costs. Shop multiple lenders for the best FHA cash out refi-rates.

Useful Tips for a FHA Cash Out Refinance with Low Credit Scores

An FHA cash out refinance loan is a great product for people with more average credit scores, and those who may have a foreclosure or a few late payments on their record. You should check out the FHA cash out refinance for bad credit today.

An FHA cash out refinance loan is a great product for people with more average credit scores, and those who may have a foreclosure or a few late payments on their record. You should check out the FHA cash out refinance for bad credit today.

Cash out FHA refinance rates in 2025 should maintain an affordable theme. We anticipate rates to fall this year with several rate cuts from the Federal Reserve. Historically speaking, the FHA cash out refinance rates are still low, so it is still a good time to consider a cash out refinance.

A cash out refinance allows a homeowner to kill two birds with one stone:

- Get a lower interest rate than you have now. This can help you to save hundreds of dollars per month in interest charges, and tens of thousands in interest over the life of the loan.

- Pull cash out of your home. Use your built-in equity to pay for things that you need, such as a new business, college education, home repairs and more.

But what if you have a low credit score? How can you do your cash out refinance with bad credit? Well, refinancing with a low credit score is not the ideal situation, but there are still ways that it can be done. You will pay a higher interest rate, but it still might be worth pulling the trigger if the loan is at least one point lower than your current interest rate. See FHA credit score requirements.

If you have low credit and still want to refinance, below are some good tips to make your cash out refinance easier:

#1 Find a Cosigner

If you have a family member with good credit who you trust (and who trusts you), that person can cosign on the mortgage. You are using his or her credit to help you to qualify for the cash out loan. The cosigner will be responsible for paying off the loan along with you and must sign all documents to get the loan.

Getting a relative with a FICO score of over 700 and good income can make it easier to get approval for your cash out refinance. But remember – that person is on the hook for the loan. If you don’t pay, he or she has to or their credit will take a big hit. Talk to a cash out refinance lender about whether or not a cosigner is needed in your situation.

#2 Check with a Lot of Cash Out Lenders

One of the common mistakes that people will low credit scores make is to assume that because they have a 600 credit score that they cannot refinance. This is not always the case.

There are thousands of lenders in America today offering premium cash out refinancing programs. Credit requirements are looser than they were last year. Thus you may be in a better position to refinance than you think.

For example, there are many FHA-approved lenders that have varying requirement for new home loans and refinances. FHA sets up minimum credit score requirements, but lenders may have varying requirements in terms of credit scores and incomes. It is important for you as the home owner to shop around to see if there is a lender who can help you.

#3 Consider an FHA Cash Out Refinance

The FHA loan is one of the best things that has happened to American homeowners ever. Cash out refinance loans with FHA are guaranteed by the US government, so the lender is more likely to lend to people with low credit scores.

Lenders want to have a larger pool of possible homeowners to work with, but they must be careful to not take too much risk for their investors. The FHA guarantee allows them to offer many more home loans each year, including those who want to FHA cash out refinance with bad credit.

FHA underwriting guidelines are more flexible than conventional mortgages, and it is easier for you to qualify with lower income and credit. If you are over 62 years old, ask about reverse mortgages, as FHA insures home equity conversion mortgages.

#4 Increase Credit Score

There are things that you can do to improve your credit score in only a few months. First, pay every bill on time. Make sure no credit cards or other loans are 30 days late. Ideally, pay every bill by its due date, but usually if you are a few days late, you will have to pay a late fee, but it does not get reported to the credit bureaus. But never be 30 days late! This will put a big black mark on your credit.

If you have negative marks on your credit report, do your best to have everything on time for a year. This will increase your score.

Another way to boost credit fast is to pay off your credit cards. If you get rid of $5,000 in credit card debt, your score can go up at least 40 points in many cases.

Also consider becoming an authorized user on a credit card that someone you know has who has good credit. Some credit cards, such as Discover, will report on time credit card payments on your credit report if you are an authorized user on someone’s account. Be sure that person has good credit and is reliable!

There are more options today than five years ago to do a cash out refinance with a low credit score. We recommend that you consider the cash out rules discussed and try the tips outlined above to get a refinance today for the money you need.

What is a FACOP refinance?

FACOP stands for Federal Assistance Cash-Out Program. Some mortgage companies use the term FACOP refi interchangeably with FHA cash-out loans.

Only FHA cash-out refinances backed and insured by the Federal Housing Administration are considered legitimate.

It is very important to speak with approved FHA lenders that have experience with cash out refinancing.

Pros and Cons of the FHA Cash Out Program

Homeowners with an FHA lien have two major loan refinance options.

The streamline refinance with the FHA loan is a good move for the borrower who has a higher rate mortgage and the current interest rates are more than .5% or so below your rate. A streamline refinance can be done with minimal paperwork and can be completed in a few weeks. The streamline program is strictly a rate and term refinance option and does not allow borrowers to receive cash back.

The other option is the FHA cash out refi loan. This loan gives you cash in your hand when you refinance to a lower interest rate. You will open a new loan with a larger balance than what you owe now. The excess money is your equity, and it goes to you.

However, like any cash our refinance loan, the risk is higher for the lender. So, the FHA refinance for cash out does require full documentation. If you are considering FHA cash out refinancing with FHA, keep reading to learn the pros and cons.

Pros of a Cash Out Refinance with FHA

The biggest benefit of a cash out refinance with FHA is that you will get the cash that you need for various expenses. The cash out refinancing funds can be used for many things that people need a large amount of money for. The most popular uses are:

- Improving the home – this can add value to the property if it is done right.

- College costs – the interest rate on a home loan is often much less than a college loan.

- Consolidate your credit card debt – most credit cards have a rate of 18% or higher. You can save thousands in interest in some cases by using your FHA cash out refinance proceeds. This only makes sense however if you have the financial discipline to not run up the cards again!

- Invest – if you can find real estate or another investment that you are confident will pay you an interest rate above what you pay on the loan, this can be a good financial move.

- Paying for medical costs – health care in the US is very expensive, and you may want to pay for a major medical expense with a low interest home loan.

Here is a simple example of how a cash out FHA refinance loan works. You might owe $100,000 on your house, and you open an FHA cash out refinance loan for $150,000. If your home has enough equity and you can qualify, you may be able to get $45,000 in your pocket after closing costs.

One thing borrowers love is that the FHA cash out refinance LTV is 85%. So, that means an applicant only needs 15% home equity after the cash-back is factored in.

Another possible benefit of the refinance loan is that you can potentially move from a 30-year to 15-year loan, or from a fixed to an adjustable loan, or vice versa.

Cons of an FHA Refinance for Cash Out

Every financial move usually has downsides, and the FHA cash out refinance is no exception:

- All new loans have closing costs. Your new loan will have several thousand dollars in closing costs. It is up to you whether you want to pay those out of pocket or with a slightly higher interest rate over time.

- All FHA financing has a requirement for upfront mortgage insurance and a monthly insurance premium. The upfront cost is 1.75% of the loan amount. The monthly amount is .80% of the amount of the loan per year. So, this could be $67 for every $100,000 you borrow. Also, monthly mortgage insurance on FHA loans today must be paid for at least 11 years, not just five as in previous years.

- If you have more than 20% equity, you may want to consider refinancing into a conventional loan, as there is no PMI requirement.

Breaking Down the FHA Cash Out Refinance Guidelines, Rules and Standards

Because you are pulling out cash, you are required to show that you have sufficient income to pay the new loan amount. According to the FHA cash out refinance rules, the borrower must have their income verified. This will require recent pay stubs, W-2s for two years, and sometimes tax returns for the last two years. Also, you must typically have your assets verified in the form of investment and bank statements.

Next, the home has to be appraised to see if the home has sufficient current equity to serve as collateral for the loan. The current maximum loan amount for this type of loan is 85% of the value of the home. Some states may limit your loan to 80% LTV.

Regarding credit, you need to have a bare minimum 500 credit score. But you will usually need to meet higher credit standards of the individual lender. Expect to need a credit score of 620 to 680 and the higher the better.

To qualify for cash back refinance with FHA, you cannot have been late over 30 days on more than one payment in the last 12 months. The current mortgage has to be at least 180 days old.

Getting cash out with a FHA refinance loan often makes a great deal of sense. If you have a good reason to get the money, this is one of the best, low interest loans that you will ever be able to get. Check out the most updated cash out refinance rules for tax deductions.

FHA Offers Unique Opportunities to Homeowners Seeking a Cash Out Refinance Mortgage

This year, homeowner’s have more equity in their home than any time in history.

The Federal Reserve states that homeowners are sitting on more than $15 trillion of equity in their homes. This is an all-time high.

Many homeowners are thinking about how to tap that equity for things they need, such as home improvements, paying off debts or other financial needs.

The good news is if you have an FHA loan, you can do a cash out refinance that allows you a loan up to 85% of the home’s current market value.

You just take the difference between the current amount of your loan and the new loan amount in cash.

Even a borrower with a lower credit profile can qualify, even if they were unable to get a poor credit home equity loan or a cash out refinance conventional loan.

Conventional Loan vs. FHA Cash Out Refinances

The FHA cash out loan is a good product, but one thing you have to remember is the mortgage insurance with the FHA loan. FHA loans require both upfront and monthly mortgage insurance premiums. These are as follows:

- 75% of the new amount of the loan upfront, which is wrapped into the new loan.

- .80% of the amount of the loan each year, paid in 12 installments with your monthly mortgage payment.

This is $1,750 up front and $67 per month for each $100,000 you borrow. In return for this mortgage insurance cost, you have more credit score flexibility and a higher LTV than a conventional loan. Note that conventional cash out refinances do not have an upfront or monthly mortgage insurance requirement.

To qualify for an FHA cash out refinance loan, you need to have made your last 12 months of payments on time. If you have been in the home less than a year, you must have made a minimum of six payments on your current loan.

Another good aspect of cash out refinance loans insured by FHA are the rates. Because of the strong government backing of these loans, lenders can issue these loans with less risk. So, you often find the rate for FHA mortgages could be at least .5% less than for a conventional loan.

In general, the FHA cash out refinance loan is a good option for people who want access to their cash but have a lower credit score.

Cash Out Refinances Versus Home Equity Loans

When homeowners are looking to leverage their home equity for financial needs, they often consider two popular options: cash-out refinancing and home equity loans.

Cash Out Refinances: This option involves replacing your existing mortgage with a new one for a higher amount than what you currently owe. The difference between the old and new loan amount is given to you in cash, which you can use for various purposes.

Cash-out refinances generally offer lower interest rates than personal loans or credit cards, making them an attractive choice for substantial financial needs. However, they often entail higher closing costs, a longer application process, and the risk of a higher mortgage balance. The interest rate on a rate and term refinance are typically a quart point lower than cash out refinance rates.

Home Equity Loans: An equity loan or equity line of credit is a separate loan against your home’s equity, leaving your existing first mortgage untouched. This 2nd mortgage option offers a lump sum of money with a fixed rate, enabling you to budget your repayments precisely. Check the current 2nd mortgage loan rates online.

Home equity loans have reduced closing costs and the HELOC process is quicker compared to cash out refinances. Nevertheless, cash-out refinance rates are typically lower interest rates.

The choice between cash-out refinancing and equity loans depends on your specific financial goals, the terms that best suit your situation, and your willingness to redo your existing mortgage. Both lending options can be valuable for accessing your home equity, but it’s essential to weigh their respective advantages and drawbacks before making a decision.

Homeowners with below-average credit and want to tap their home equity are ideal candidates for a FHA cash-out refi. With many easing credit rules, 2025, may be a great time to qualify for FHA and get some much needed cash in your hands. If you’re considering an FHA cash-out refinance, it’s prudent to compare offers from trusted lenders and bank to find the best rate on your FHA loan refinance.

Frequently Asked Questions for FHA Cash Out Refinances

Can You Refinance a FHA Loan?

Yes, you can refinance an FHA loan, and we can connect you with Approved FHA lenders that want to earn your business. The two popular FHA refinance programs are the FHA Streamline Refinance and the FHA Cash-Out Refinance. The FHA Streamline Refinance is a straightforward process that doesn’t typically require a credit check or appraisal. It’s designed to lower your interest rate, reduce your monthly payments, and save you money over time. However, the streamline program does not allow you to receive cash back.

Borrowers frequently ask if its hard to refinance an FHA loan. The FHA Simple Refinance presents a feasible choice for homeowners who initially bought their homes using an FHA loan. The RefiGuide will help you learn how a cash out refinance works.

What is an FHA Cash-Out Refinance?

An FHA cash-out refinance allows homeowners to replace their current mortgage with a new, larger loan and withdraw the difference in cash using their home’s equity. This type of refinance is often used to fund home renovations, debt consolidation, or to cover other major financial needs.

What Credit Score Do You Need for an FHA Cash-Out Refinance?

Most lenders require a minimum credit score of 580 to qualify for an FHA cash-out refinance with full loan-to-value financing. However, some lenders impose stricter credit criteria, with requirements ranging from 580 to 620, depending on their individual underwriting policies. These higher standards reflect the lender’s risk tolerance and are meant to ensure borrowers can manage the new loan responsibly.

How Long Does It Take to Close an FHA Cash-Out Refinance?

The completion time for an FHA cash-out refinance typically ranges between 30 and 60 days, but the exact timeline can vary based on factors such as the lender’s processing speed, the borrower’s financial profile, and the complexity of the loan application. Delays may also arise from appraisal scheduling, document submission, or the lender’s internal underwriting procedures.

What is the FHA Cash Out Plan FACOP?

FACOP is an acronym for the FHA Cash Out Plan. which allows homeowners with FHA-insured loans to refinance their existing mortgage and access the equity in their home as cash. To qualify, borrowers must meet FHA cash out refi requirements, including a minimum credit score, sufficient home equity (typically up to 80% loan-to-value), and verifiable income.

What is the maximum LTV for FHA cash out refinance?

The maximum loan-to-value (LTV) ratio for an FHA cash-out refinance is 80%. This means homeowners can refinance their mortgage and borrow up to 80% of the property’s current appraised value. For example, if your home is worth $300,000, you could access up to $240,000 through the refinance, minus any existing mortgage balance. Meeting the FHA cash out refinance max LTV requirement ensures that borrowers maintain some equity in their property, reducing lender risk. The FHA rate and term refinance max LTV is 97.5% for borrowers that mee the DTI and and credit score requirements.

How to Apply for FHA Refinance No Cash-Out?

To apply for an FHA no cash-out refinance, start by contacting an FHA-approved lender. Provide financial documents such as income verification, credit history, and proof of homeownership. The lender will assess eligibility based on FHA guidelines and your current mortgage terms. This option helps lower your interest rate or change your loan terms without accessing your equity as cash.

How Much Equity Can You Access with an FHA Cash-Out Refinance?

Borrowers can tap into up to 80% of their home’s current market value through an FHA cash-out refinance. This means at least 20% of the home’s equity must remain untouched after refinancing.

What are the seasoning requirements for FHA cash out refinance?

The seasoning requirements for an FHA cash-out refinance include that the homeowner must have owned the property for at least 12 months before applying for the refinance. Additionally, the borrower must have made on-time mortgage payments for the past 12 months to qualify. If the current mortgage was an FHA loan, the seasoning requirement ensures that sufficient equity has built up in the property and that the borrower has demonstrated responsible financial behavior, improving the chances of approval.

Does an FHA Cash-Out Refinance Require Mortgage Insurance?

Yes, FHA loans mandate both upfront and annual mortgage insurance premiums (MIP). These premiums add to the overall cost of the loan, with an upfront premium of 1.75% of the loan amount and a smaller annual fee rolled into monthly payments.

Can You Use an FHA Cash-Out Refinance for a Rental or Second Home?

No, FHA cash-out refinancing is only available for primary residences. The property must be owner-occupied for at least 12 months before applying for this type of refinance.

How Long Do You Need to Own Your Home to Qualify?

To be eligible for an FHA cash-out refinance, homeowners must have lived in the home for at least 12 months and made on-time mortgage payments throughout that period.

Is an Appraisal Required for an FHA Cash-Out Refinance?

Yes, an appraisal is required to determine the current market value of the property, which directly impacts how much equity can be accessed.

Can You Do an FHA Cash-Out Loan in Texas?

Yes, FHA cash-out refinance loans are available in Texas, but they must comply with the state’s Texas Equity Laws, which limit cash-out loans to 80% of the home’s appraised value. This program allows homeowners to refinance their mortgage and access their home equity as cash. Ensure you meet FHA requirements, including sufficient credit, income, and property eligibility.

How Many Lates Can I Have for FHA Cash-Out?

To qualify for an FHA cash-out refinance, you must have no more than one late mortgage payment in the past 12 months and none within the last three months. Consistent, on-time payments improve your chances of approval and demonstrate financial reliability to mortgage lenders.