Home values continue to rise, while mortgage rates on cash out refinancing, HELOC lines of credit and home equity loans are holding steady or even falling. That is why many homeowners are considering pulling equity out of their homes.

With that money, you can afford to do home renovations, pay for college, start a business and other things that require a lot of capital. Having access to “cheap money”, is one of the most significant financial benefits for homeowners in 2026. The RefiGuide reviews the pros and cons of cash out refinancing vs HELOCs so homeowners can make prudent financial choices.

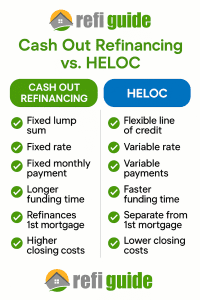

Cash Out Refinance vs HELOC Loan

In some markets cash-out refinances offer distinct advantages over opting for a HELOC credit line. By leveraging the equity you’ve built in your home, you can access a larger sum of money.

Most lenders tend to offer lower interest rates on cash-out refinances compared to equity lines of credit.

Even if you refinance during periods of higher interest rates, they are likely to be lower than those associated with a HELOC credit line.

For homeowners who have fully paid off their mortgage but require funds for significant expenses, debt consolidation, or property renovations, a HELOC could be a viable option.

Additionally, if you currently hold a favorable interest rate on your existing mortgage, a HELOC might present an attractive alternative.

Homeowners have unique opportunities to leverage their property for low-cost borrowing with home equity lines of credit and cash-out refinances.

Don’t overlook cash out opportunities with a mortgage refinance, home equity loan or HELOC.

The RefiGuide will help you compare HELOCs, home equity loans and cash out refinances.

Homeowners have several advantageous financial opportunities depending upon your borrowing credentials.

There are three basic options for pulling equity out of your home that we will discuss in detail below:

#1 Cash Out Refinancing

A mortgage refinance is an entirely new mortgage loan. It pays off the balance on your existing mortgage and replaces it with a new one. This is the most common choice for home owners who have an older mortgage that has a higher than current market rate. Home-owners will often choose to refinance their existing mortgage to drop their interest rate.

At the same time, if you have enough equity, you also may be able to pull cash out of the property. For example, if you have a balance of $100,000 on your mortgage and your property is valued at $150,000, you possess $50,000 in equity. You might decide to get $20,000 in cash back. This would give you a new loan balance of $120,000.

Refinance for cash back can be a good choice if you can get at least .5% lower on your new mortgage rate. If you cannot get a interest rate that is much lower than your current rate, you may want to leave your current mortgage in place. The Federal Housing Administration also offers FHA cash back refinancing options. See cash out refinance rules for FHA.

#2 Interest Only Home Equity Line of Credit (HELOC)

Sometimes you may have a very good interest rate on your first mortgage. If so, it would not make financial sense to replace it with another mortgage. So, you may want to consider getting a second mortgage. Comparing secured credit lines home equity loans is a wise move before you pull the trigger.

A second mortgage option that many people choose is a home equity credit line. This is a line of credit that works very much like your credit cards. Your lender approves you for a certain credit limit, say, $20,000. That dollar amount is based upon the amount of equity in your property.

With that credit line, you may draw out up to $20,000 over a period of up to 10 years, depending upon the lender. During that period, you will probably make interest only payments on the loan. The rate on a HELOC also is variable, so it can go up or down over time based upon current market rates.

Many people choose to get a home equity line of credit because it offers the lowest initial rate. But after the draw period ends, you have to start paying back principal. This will cause the payment to go up. And if rates go up, your interest rate will go up as well.

HELOCs are a great way to tap your equity, but keep in mind that your payment will probably go up eventually. There were many cases during the last mortgage crash when people lost their jobs and could no longer afford to pay for their home equity line. The result was that they lost their homes. In some cases lenders will offer a HELOC without an appraisal required.

If your credit situation changes, your bank also can decide to pull your HELOC line of credit.

One benefit of this type of loan – you only pay interest on the amount of cash that you draw out. Many homeowners seek to refi a HELOC. If you get a home equity line of credit and want to increase the limit, consider a HELOC refinance.

#3 Simple Interest Home Equity Loan

A home equity loan is another type of second mortgage. This is a lump sum loan based upon your equity stake in your property. You receive one lump sum of cash to use however you like.

A home equity loan carries a fixed interest rate that is higher than a HELOC’s rate. The advantage with this type of an equity loan is that you know exactly what your rate and payment schedule will be on the loan. This makes it easier to plan financially over the long term.

The home equity loan is less popular than the HELOC with home owners, but it is more predictable than a HELOC. This is a benefit that more financially conservative home owners definitely value.

Considerations for Cash Out Loans

As you consider whether to do a cash out refinance or get a second-mortgage, you really have to determine if you are going to be able to save on the interest payment on your first mortgage. If you cannot get a lower rate on your first mortgage, you are much better off leaving it in place and getting a second mortgage.

Whichever option you choose, you will be able to usually write off the interest you pay on your taxes. This is one of the most important benefits of having a mortgage, whether it is a first or second.

Don’t Forget the Value of Home Equity

Pulling equity out of your home is one of the biggest advantages of owning a home instead of renting. It is possible to use that equity in a way that benefits you financially. You can use it to improve your home, which will theoretically increase its value. Or, you may invest in a business or real estate, which can bring you additional income.

But think carefully about whether you are going to refinance your first mortgage or get a HELOC or home equity loan. It also is recommended to check with several mortgage lenders. See which lender will offer you the best rates. Do not assume that you will get the lowest rate with your current mortgage lender. The lowest rates tend to be at credit unions, but the more you shop, the better off you will be.

7 Reasons Homeowners Are Choosing a HELOC Over a Cash-Out Refinance in 2026

In 2026, with home equity at a record $32 trillion and HELOC rates averaging 8.1%—versus 7.5% for cash-out refinances—homeowners increasingly favor Home Equity Lines of Credit (HELOCs) for flexible, lower-risk borrowing.

Unlike cash-out refis, which replace your existing mortgage with a larger one and fixed payments, HELOCs offer revolving credit during a 5-10 year draw period, with interest-only options.

Bankrate reports a 22% surge in HELOC applications this year, driven by economic uncertainty and Fed pauses. Here are seven key reasons homeowners are choosing HELOCs over cash-out refis, plus a real-world case study.

1. Flexibility in Borrowing

HELOCs allow draws as needed—$10,000 today, $50,000 next year—without reapplying, unlike cash-out’s lump sum. In 2026’s volatile market, this suits phased projects like renovations, per NerdWallet’s 4.7/5 HELOC guide.

2. Lower Closing Costs

HELOCs average $1,000-$3,000 in fees, versus $5,000-$10,000 for cash-out refis (2-5% of loan). Navy Federal’s no-cost HELOCs save thousands, as 60% of borrowers prioritize cost per Experian.

3. Preserve Low Mortgage Rates

Did you know that 70% of American homeowners have mortgages below 5%? (pre-2023), It’s not smart to choose a cash-out refis at 7.5% that reset rates on the full balance. HELOCs keep primary loans intact, saving $400/month on a $300,000 mortgage.

4. Interest-Only Payments During Draw Period

HELOCs require only interest (e.g., $675/month on $100,000 at 8.1%) for 5-10 years, versus cash-out’s full principal/interest ($1,200+). This eases cash flow, per Bankrate’s calculator.

5. No Rate Risk on Full Balance

HELOCs expose only drawn amounts to variable rates, unlike cash-out’s fixed rate on the entire loan. If rates drop in 2026, undrawn HELOC portions benefit, per Forbes.

6. Easier Qualification for Partial Equity

HELOCs need 15-20% equity for $50,000-$100,000 lines, versus cash-out’s 20-30% for full replacement. This aids moderate-equity owners, per LendingTree.

7. Tax Deductibility on Interest

HELOC interest is deductible if used for home improvements (up to $750,000 debt), matching cash-out’s perks without refinancing the primary loan, per IRS 2026 guidelines.

Case Study: Sarah’s Renovation Strategy (Austin, TX)

Sarah, a 38-year-old teacher with a 4.5% mortgage on her $400,000 home, needed $80,000 for a kitchen remodel in 2026. A cash-out refi at 7.5% would raise her $1,800 payment to $2,600, risking her budget. Instead, she chose Navy Federal’s 8.1% HELOC, drawing $80,000 with $540 interest-only payments. Closing costs: $1,200 vs. $8,000 for refi. By year-end, her score held at 720, and the remodel added $60,000 in value. “HELOC kept my low rate intact—flexible and affordable,” Sarah shared on X, echoing MIDFLORIDA’s HELOC success stories.

In 2026, HELOCs empower strategic equity use—shop via Credible to lock in perks before potential rate shifts.

FAQs on HELOCs and Cash Out Refinances:

Is a HELOC better than a cash-out refinance?

A HELOC can be better than a cash-out refinance if you want flexible access to funds without changing your existing mortgage rate. HELOCs work like revolving credit, allowing you to borrow only what you need and pay interest on the drawn amount. However, a cash-out refinance may be better if you want one fixed-rate loan with predictable payments. The best choice depends on your current mortgage rate, equity, cash-flow needs, and whether you prefer variable or fixed financing.

What is the negative to a cash-out refinance?

The main downside to a cash-out refinance is that you replace your entire mortgage—potentially at a higher interest rate—to access equity. This can increase your monthly payments and total interest paid over time. Cash-out refinances also come with closing costs, stricter guidelines, and longer processing times. If you already have a low-rate mortgage, a refinance may not be cost-effective. Borrowers should calculate break-even points and compare alternatives like HELOCs or home equity loans.

What is the disadvantage of a HELOC?

The biggest disadvantage of a HELOC is its variable interest rate, which can cause payments to increase over time—especially during rising-rate environments. HELOCs also typically require interest-only payments during the draw period, followed by higher amortizing payments later. Borrowers who overuse the line may face payment shock. Some lenders charge annual fees or early termination fees. Because HELOCs are secured by your home, missed payments can lead to foreclosure, making disciplined use essential.

Takeaway on Cash Out Refinancing vs HELOCs

There are pros and cons to leveraging your home as collateral, whether you’re looking to get cash out with a refinance or securing a second mortgage with a HELOC. It’s essential to assess factors like your credit score, repayment rate, and the amount of equity you have in your home.

The primary factor to consider when deciding between a HELOC and a cash-out refinance is the mortgage rate on your existing home loan compared to what you could secure with a refinanced loan. The RefiGuide will help you shop for the best banks and lenders offering both cash out refinances and HELOC loans so you ultimately get the best loan for your needs and credentials.