Homeowners who have taken out home equity loans often wonder whether they can refinance these loans to secure better terms, lower interest rates, or access additional funds. The short answer is yes—home equity loans can be refinanced, much like primary mortgages. In 2026, with interest rates fluctuating and lending requirements evolving, refinancing a home equity loan has become an increasingly attractive option for many homeowners seeking to optimize their financial position.

This comprehensive guide explores the requirements for refinancing a home equity loan, the benefits and drawbacks of doing so, and provides real-world case studies to illustrate how homeowners have successfully navigated the refinancing process. Whether you’re looking to lower your monthly payments, consolidate debt, or access more of your home’s equity, understanding the home equity refinancing landscape is crucial for making informed financial decisions.

What Is a Home Equity Loan Refinance?

A home equity loan refinance involves replacing your existing home equity loan with a new one, typically with more favorable terms.

This second mortgage allows homeowners to tap into the equity they’ve built in their property without affecting their primary mortgage.

Home equity loans differ from home equity lines of credit (HELOCs) in that they provide a lump sum of money upfront with fixed monthly payments over a predetermined period, usually five to fifteen years.

When you refinance a home equity loan, you’re essentially paying off the original loan and replacing it with a new one.

This can be advantageous if interest rates have dropped since you first obtained your loan, if your credit score has improved significantly, or if you need to adjust your repayment terms to better align with your current financial situation.

According to recent data from major lenders, home equity loan rates in early 2026 average around 7.15% for qualified borrowers, which represents a significant opportunity for those who obtained loans when rates were higher.

The RefiGuide can help you compare top banks and mortgage lenders. In 2026 we are seeing a surge in refinance home equity loan transactions and HELOC conversions as interest rates drop and lending requirements have been eased.

Requirements for Home Equity Loan Refinancing

Refinancing a home equity loan requires meeting specific criteria that lenders use to assess your eligibility and determine your loan terms. These requirements have evolved in 2026 to reflect current market conditions and lending standards. Understanding these criteria before you apply can help you prepare and improve your chances of approval.

Credit Score Requirements

Your credit score remains one of the most critical factors in determining whether you can refinance your home equity loan and what interest rate you’ll receive. Most conventional lenders require a minimum credit score of 620 to qualify for home equity loan refinancing. However, to secure the most competitive rates, lenders typically prefer borrowers with scores of 680 or higher, with the best rates reserved for those with scores above 740.

Recent lending data shows that borrowers with credit scores in the mid-700s can save significantly on interest compared to those with scores near the minimum threshold. For example, a borrower with a 750 credit score might qualify for a rate that’s 0.5% to 1.0% lower than someone with a 620 score, translating to substantial savings over the life of the loan. If your credit score has improved since you first obtained your home equity loan, refinancing could provide an excellent opportunity to capitalize on your improved creditworthiness.

Home Equity Requirements

Lenders typically require homeowners to maintain substantial equity in their property when refinancing. Most lenders require at least 15% to 20% equity remaining after the refinance, though some may allow you to borrow up to 85% or even 90% of your home’s value depending on your credit profile and other factors. This means your combined loan-to-value (CLTV) ratio—which includes both your primary mortgage and your home equity loan—must stay within these limits.

For instance, if your home is valued at $400,000 and you owe $250,000 on your primary mortgage, you would have $150,000 in equity. With an 85% CLTV limit, you could potentially borrow up to $90,000 through a home equity loan refinance ($340,000 total debt divided by $400,000 home value equals 85% CLTV). However, it’s important to note that market fluctuations can affect your home’s value, so obtaining a current appraisal is often a necessary step in the refinancing process.

Debt-to-Income Ratio

Your debt-to-income (DTI) ratio is another crucial factor that lenders evaluate when considering your refinance application. This ratio compares your total monthly debt obligations to your gross monthly income. Most lenders prefer to see a DTI ratio of 43% or lower, though some may accept ratios up to 50% for borrowers with strong compensating factors such as excellent credit scores or substantial cash reserves.

To calculate your DTI ratio, add up all your monthly debt payments—including your mortgage, car loans, student loans, credit card minimum payments, and the proposed home equity loan payment—and divide by your gross monthly income. For example, if your total monthly debts equal $3,000 and your gross monthly income is $7,500, your DTI ratio would be 40%. If refinancing would push your DTI above acceptable limits, you may need to pay down other debts first or consider a smaller loan amount.

Income Verification and Employment History

Lenders require proof of stable income and employment history to ensure you can manage the new loan payments. Typically, you’ll need to provide recent pay stubs, tax returns for the past two years, and W-2 forms or 1099s if you’re self-employed. Some lenders may also request bank statements to verify your income and assess your financial stability. A strong employment history, ideally with the same employer for at least two years, demonstrates consistency and reduces the lender’s risk.

Payment History

Your payment history on existing debts, particularly your current home equity loan and primary mortgage, plays a significant role in the refinancing decision. Lenders typically want to see a clean payment record with no late payments in the past six to twelve months. Multiple late payments or missed payments can disqualify you from refinancing or result in less favorable terms. This requirement underscores the importance of maintaining timely payments on all your obligations, even when considering refinancing options.

Appraisal and Home Condition

Most home equity loan refinances require a current property appraisal to determine your home’s market value. This step is crucial because your home’s value directly affects how much equity you have and, consequently, how much you can borrow. The appraisal typically costs between $300 and $600 and provides lenders with an objective assessment of your property’s worth. Some lenders may offer appraisal waivers for borrowers who meet certain criteria, such as having significant equity or excellent credit, but this is less common for home equity products than for primary mortgage refinances.

How Much Does It Cost to Refinance a Home Equity Loan?

Refinancing a home equity loan involves various costs that can impact the overall financial benefit of the transaction. Understanding these expenses is essential for determining whether refinancing makes sense for your situation. Typical closing costs for home equity loan refinances range from 2% to 5% of the loan amount, though some lenders offer no-closing-cost options where fees are rolled into the interest rate.

Common costs include application fees, origination fees (typically 0.5% to 1% of the loan amount), appraisal fees, title search and insurance fees, recording fees, and potential prepayment penalties on your existing loan. For example, refinancing a $75,000 home equity loan might involve $2,250 to $3,750 in closing costs. However, if refinancing reduces your interest rate by 1.5% or more, the long-term savings could significantly outweigh these upfront expenses.

Benefits and Drawbacks of the Refinance Home Equity Loan Program

Benefits

Refinancing a home equity loan offers several potential advantages:

- Lower interest rates can reduce your monthly payments and total interest paid over the life of the loan, potentially saving thousands of dollars

- Adjusting your loan term allows you to either reduce monthly payments by extending the term or pay off the debt faster by shortening it

- Converting from a variable-rate HELOC to a fixed-rate home equity loan provides payment stability and protection against rising interest rates

- Access to additional cash out from accumulated equity enables funding for home improvements, debt consolidation, or other major expenses

- Improved credit scores since your original loan can unlock better rates and terms, rewarding your financial responsibility

Drawbacks

However, refinancing also comes with potential disadvantages:

- Closing costs can be substantial and may take years to recoup through lower monthly payments

- Extending your loan term reduces monthly payments but increases total interest paid over time

- Prepayment penalties on your existing loan can add unexpected costs to the refinancing process

- Market volatility affecting home values could leave you underwater if property values decline significantly

- Risk of foreclosure increases when you borrow against your home, as your property serves as collateral

Case Study 1: Refinancing for Lower Interest Rates

Background: Michael and Jennifer Thompson, a couple in their early 40s from Austin, Texas, took out a $60,000 home equity loan in 2021 at an interest rate of 8.75% with a 10-year term. Their home, purchased in 2015 for $325,000, had appreciated significantly to an appraised value of $475,000 by late 2025. With their outstanding first mortgage balance at $210,000 and their home equity loan balance at $52,000, they had built substantial equity in their property.

The Thompsons’ credit scores had improved considerably since taking out the original loan—Michael’s score increased from 690 to 760, and Jennifer’s rose from 685 to 755. They were current on all debt payments and had a combined monthly gross income of $11,500. Their original home equity loan payment was $761 per month, and they had already paid approximately $31,000 toward the loan over three and a half years.

The Refinance: In January 2026, the Thompsons decided to refinance their home equity loan to take advantage of lower rates. They shopped among several lenders and received quotes ranging from 6.85% to 7.25%. They ultimately chose a 10-year fixed-rate loan at 7.15% from their local credit union, which offered competitive rates for members with excellent credit. The new loan amount was $52,000—the remaining balance on their original loan.

The refinancing process took approximately 35 days from application to closing. The Thompsons provided two years of tax returns, recent pay stubs, and bank statements. A new appraisal confirmed their home’s value at $475,000, giving them a combined loan-to-value ratio of 55% ($262,000 in total debt divided by $475,000 home value). Their debt-to-income ratio was 38%, well within acceptable limits.

Results: The Thompsons’ new monthly payment decreased to $608, saving them $153 per month. Over the remaining life of the loan, they would save approximately $11,700 in interest payments. Their total closing costs came to $2,100, which they paid out of pocket. Based on their monthly savings, they would break even on the closing costs in less than 14 months. The refinance also simplified their financial planning by resetting the loan to a fresh 10-year term with predictable fixed payments, providing peace of mind during a period of economic uncertainty.

Case Study 2: Converting HELOC to Fixed-Rate Home Equity Loan

Background: Sandra Martinez, a 55-year-old small business owner from Seattle, Washington, opened a $100,000 HELOC in 2019 with a variable interest rate. She used the line of credit strategically over five years to fund her business expansion, complete home renovations, and consolidate some high-interest credit card debt. By late 2025, she had drawn $85,000 from the line and was making interest-only payments of approximately $565 per month at the then-current rate of 7.75%.

As interest rates fluctuated over the years, Sandra grew concerned about the unpredictability of her HELOC payments. Her draw period was scheduled to end in 2026, at which point she would need to begin repaying principal along with interest over a 20-year period. Her home, valued at $625,000, had a first mortgage balance of $340,000. Her credit score was 720, and her business generated stable income of approximately $9,200 per month after expenses.

The Refinance: Sandra decided to refinance the HELOC into a fixed-rate home equity loan to lock in predictable payments before her draw period ended. She researched multiple lenders and found a 15-year fixed-rate home equity loan at 7.35% from a regional bank. The loan amount was $85,000—the current balance on her HELOC.

The refinancing process was more complex than a typical home equity loan refinance because it involved paying off a revolving credit line. Sandra had to provide three years of business tax returns, profit and loss statements, and business bank statements to verify her self-employed income. The lender required a new appraisal, which came in at $630,000, slightly higher than her estimate. Her combined LTV was 67.5% ($425,000 total debt divided by $630,000 home value), and her DTI was calculated at 42% including the new home equity loan payment.

Results: Sandra’s new fixed payment was $785 per month, which included both principal and interest. While this was $220 higher than her previous interest-only payment, she now had the certainty of a fixed rate and a clear payoff date. More importantly, she was building equity by paying down principal with each payment rather than just covering interest. Her closing costs totaled $3,400, which she rolled into the loan amount, bringing her total loan to $88,400. The stability of fixed payments allowed Sandra to better forecast her business and personal cash flow, and she appreciated knowing that her payment wouldn’t increase if interest rates continued to rise.

Case Study 3: Equity Loan Refinancing to Access Additional Equity

Background: Robert and Emily Chen, both in their mid-50s from Denver, Colorado, had taken out a $45,000 home equity loan in 2020 at 7.5% interest to help pay for their daughter’s college education. By 2025, they had paid down the balance to $28,000. Their home, purchased in 2010 for $380,000, had appreciated substantially to $590,000. Their primary mortgage balance stood at $185,000 after years of payments.

The Chens wanted to undertake a major kitchen renovation that contractors estimated would cost $55,000. They also had $12,000 in credit card debt from medical expenses carrying interest rates between 18% and 22%. Rather than taking out additional debt, they decided to explore refinancing their existing home equity loan to access more of their home’s equity while consolidating their high-interest debt. Their credit scores were 740 and 735 respectively, and their combined annual income was $165,000.

The Refinance: The Chens worked with a mortgage broker who helped them find a cash-out refinance option for their home equity loan. They refinanced into a new $95,000 home equity loan at 7.25% with a 15-year term. This provided $67,000 in cash ($95,000 minus the $28,000 payoff of their existing loan), which they used for the kitchen renovation ($55,000) and to pay off their credit card debt ($12,000).

The underwriting process required updated income documentation, including recent pay stubs and tax returns. A new appraisal confirmed their home’s value at $595,000 (slightly higher than their estimate), giving them a CLTV of 47% ($280,000 in total debt divided by $595,000 home value). With the new home equity loan payment and their existing mortgage, their DTI was 36%, well within acceptable limits.

Results: The Chens’ new monthly payment was $869 for the home equity loan, compared to their previous payment of $337. However, this figure didn’t tell the whole story. By paying off their credit card debt, they eliminated $285 in monthly minimum payments. Their net increase in monthly obligations was therefore $547 ($869 new payment minus $337 old payment minus $285 credit card payments). More significantly, they were now paying 7.25% interest on what was previously 18-22% debt, saving substantial interest over time. Learn more about paying off credit card debt with a 2nd mortgage

The refinancing the home equity loan also provided them with a completely renovated kitchen that increased their home’s value by an estimated $40,000 to $45,000, according to their real estate agent. Their closing costs were $3,900, which they paid from savings. The Chens appreciated the ability to accomplish two major financial goals—debt consolidation and home improvement—through a single refinancing transaction at a rate significantly lower than consumer credit would have offered.

When to Consider Refinancing Your Home Equity Loan

Determining the right time to refinance your home equity loan requires careful consideration of multiple factors.

Generally, refinancing makes sense when interest rates have dropped by at least 0.5% to 1% since you obtained your original loan, as this typically provides enough savings to justify the closing costs.

If your credit score has improved by 40 points or more, you may qualify for significantly better terms, making refinancing worthwhile even if market rates haven’t changed dramatically.

- Refinance Home Equity Loan for a Lower Monthly Payment

- Shop & Refinance for a Better Home Equity Rate

- Home Equity Loan Refinancing for More Cash Out

- Refinance Home Equity Line of Credit into a Fixed Rate

Other situations that warrant consideration of refinancing include struggling with current monthly payments (refinancing to a longer term can reduce payment amounts), wanting to convert from a variable-rate HELOC to a fixed-rate loan for payment stability, or needing to access additional equity for home improvements, debt consolidation, or other major expenses. However, it’s crucial to calculate your break-even point—the time it takes for your monthly savings to exceed your closing costs—to ensure refinancing makes financial sense for your specific timeline.

Alternatives to Home Equity Loan Refinancing

While refinancing can be beneficial, it’s not the only option for homeowners seeking to optimize their home equity loans. Some alternatives include loan modification programs, where lenders may adjust your interest rate or payment terms without a full refinance, potentially avoiding closing costs. You might also consider a cash-out refinance of your primary mortgage, which could allow you to pay off both your first mortgage and home equity loan while potentially securing a lower overall interest rate.

HELOCs are recommended if you are not sure how much money you need to borrow. Many homeowners will consider the no closing cost HELOCs for financing home improvements but you will need very high credit scores to find lenders willing to waive the fees and closing costs. Sometime the credit score requirements for HELOCs are different than fixed rate equity loans, so verify with the bank or lender when shopping second mortgage options. Compare a HELOC vs Home Equity Loan.

Personal loans represent another alternative, particularly if you need a relatively small amount and have excellent credit. Though personal loan rates are typically higher than home equity loans, they don’t require using your home as collateral and often have lower closing costs. Balance transfer credit cards might work for smaller debts if you can qualify for a 0% introductory APR period. Each alternative has distinct advantages and disadvantages that should be weighed against your specific financial situation and goals.

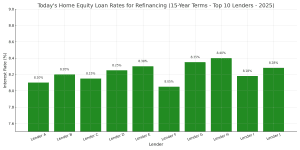

Top 5 Home Equity Lenders for Refinance Offers in 2026

Refinancing a home equity loan can be a strategic move to secure better terms, lower interest rates, or consolidate debt. Here are five top lending sources offering competitive home equity loan refinance options:

-

Navy Federal Credit Union

Ideal for military members and their families, Navy Federal allows borrowing up to 100% of home equity with no closing costs or origination fees. - LoanDepot

Provides premier equity loans with no closing costs, fixed APRs, and loan amounts from $35,000 to $500,000. LoanDepot utilizes a data-based approach for property valuations, eliminating the need for a traditional appraisal -

Rocket Mortgage

Offers a high LTV 2nd mortgage program up to 90% loan-to-value (LTV) with a minimum credit score of 680. Known for a fully online application process and quick funding. -

PNC Bank

Recognized for its comprehensive home equity financing, PNC Bank provides flexible terms and competitive rates, catering to a wide range of borrower needs. -

RefiGuide.org

As a resource platform, RefiGuide assists borrowers in finding the best home equity lenders tailored to their specific needs, connecting users with suitable lenders without any cost or obligation. (not a lender but free service to connect consumers with banks, credit unions and lenders online.)

When considering refinancing your home equity loan, it’s essential to compare offers from multiple lenders to find the best fit for your financial situation. Factors such as home equity interest rates, terms, closing costs, annual fees, and eligibility requirements should be carefully evaluated. Search for the best home equity loan rates online.

Takeaways on the Refinance Home Equity Loan in 2026

Refinancing a home equity loan can be a powerful financial tool for homeowners looking to reduce their interest costs, stabilize their payments, or access additional funds.

The requirements for refinancing—including credit score minimums, equity thresholds, debt-to-income ratios, and payment history—are designed to ensure borrowers can successfully manage the new loan while protecting lenders from excessive risk.

As demonstrated through the case studies presented, successful refinancing requires careful planning, thorough research, and realistic assessment of your financial situation.

Whether you’re seeking lower rates like the Thompsons, payment stability like Sandra Martinez, or access to additional equity like the Chens, refinancing can help you achieve your financial goals.

However, it’s essential to consider the costs involved, calculate your potential savings, and ensure that refinancing aligns with your long-term financial strategy.

Before making a decision, consult with multiple lenders to compare offers, review your current loan documents for prepayment penalties, and consider working with a financial advisor or mortgage professional who can provide personalized guidance based on your unique circumstances. With proper preparation and realistic expectations, refinancing your home equity loan can provide significant financial benefits and greater peace of mind about your homeownership costs.

2nd mortgage interest rates could fall even more in 2026, so can you refinance your home equity loan for a lower rate with a lower monthly payment. If you are ready to apply or have questions, the RefiGuide will help you shop for the best home equity loan refinance options from the most trusted lending professionals in the business.

FAQs on Refinance Home Equity Loans:

How often can you refinance a home equity loan?

There’s no strict limit on how often you can refinance a home equity loan, but lenders require sufficient equity, solid credit, and stable income. Frequent refinancing may not be practical due to closing costs and potential rate changes. Most homeowners refinance when rates drop, when payments become unaffordable, or when they want to restructure debt. Timing your refinance strategically ensures that the long-term savings outweigh transaction expenses and risks.

How long does It take to Refinance a Home Equity Loan or HELOC?

Refinancing your HELOC or home equity loan offers the opportunity to lock a lower interest rate, adjust your term, consolidate debt, or access cash from your equity. The timeframe for how long a it takes to close on an equity loan will vary depending upon what type of appraisal you need, how much income documentation needs to be reviewed and how long the home equity loan lenders may take. Nonetheless, the majority of home equity loans and credit lines typically close within 30 to 45 days from the application. If you the lender or broker waives the appraisal requirement, then it could speed up the process a few weeks.

Can you refinance a home equity loan into a mortgage?

Yes, you can refinance your first mortgage and home equity loan into one new loan, often called a “consolidation refinance.” This approach creates one payment, potentially at a lower interest rate. It’s useful if your HELOC rate is increasing or managing two loans feels overwhelming. However, it resets your mortgage term and may increase total interest paid. Comparing current mortgage rates, fees, and future plans is key before consolidating.

Cash Out Refinance Versus Home Equity Loans

In many ways these types of mortgages accomplish the same thing, Both are secure loans that offer cash back in the loan, but the cash out refinance is a first mortgage and the equity loan is considered a 2nd mortgage. This is important because if you already have a low first mortgage rate and you choose a cash out refinance, then you will have a higher interest rate to receive the cash back.

If you get cash from the home equity loan, you can keep your existing low interest home mortgage. In this kind of market, the home equity loan refinance offers you the best of both worlds. Get cash out from an equity loan and keep the great interest rate that you already have locked, down.

Can You Refinance a HELOC into a Home Equity Loan?

Yes, you can refinance a HELOC into a home equity loan. This can be a good option if you want to switch from a variable interest rate HELOC to a fixed-rate home equity loan with predictable payments. Refinancing may also provide better loan terms, especially if interest rates have dropped. However, eligibility depends on your credit score, home equity, and lender requirements.

Do You Lose Equity When You Refinance?

Refinancing does not directly reduce your home equity, but it can impact it depending on the loan terms. If you take cash out during the refinance, your equity decreases because you’re borrowing against it. However, if you refinance to a lower interest rate without borrowing additional funds, your equity remains the same and could grow faster with lower monthly payments.

Can I Borrow Against My Equity without Refinancing?

Yes, you can borrow against your home equity without refinancing by getting a home equity loan or a home equity line of credit (HELOC). These options allow you to access cash based on your home’s value without changing your existing mortgage. HELOCs provide a revolving credit line, while home equity loans offer a lump sum with fixed payments.

Can I refinance my home equity loan with another lender or bank?

Yes, you can refinance your home equity loan with another lender or bank if better terms are available. Many borrowers switch to lower rates, longer repayment terms, or fixed-rate stability. The process involves a new application, credit review, and possibly an appraisal. Shopping multiple lenders can help you reduce monthly payments or interest costs, but consider closing fees and long-term financial impact before making the change.

References

Bankrate. (2025, July 18). Refinancing a home equity loan: Why and how to do it. https://www.bankrate.com/home-equity/can-you-refinance-home-equity-loans/

reAlpha Mortgage. (2025, July 30). Key mortgage refinance requirements for 2025. https://www.realpha.com/blog/refinance-requirements

Schwab, C. (2025). Home lending: Refinancing, cash-out refi & HELOC. https://www.schwab.com/learn/story/refinancing-cash-out-refi-or-heloc