Cash-out refinancing remains a popular strategy for homeowners looking to leverage their home’s equity in 2025. This process involves replacing your existing mortgage with a larger one, pocketing the difference in cash for purposes like consolidating debt, financing home improvements, or business investments. The RefiGuide published this article to educate homeowners on how long the cash out refinance programs are taking to fund whether its, Fannie Mae, FHA, VA, USDA, DSCR, hard money and non QM loans.

How to Streamline Cash Out Refinancing for Faster Fundings

Homeowners love to leverage their real estate with a cash out refinance, but to may borrowers it seems like they can never receive the cash from the loan quick enough.

The timeline from application to funding a cash out refinance can vary significantly based on loan type, lender efficiency, market conditions, and individual circumstances.

On average, conventional cash-out refinances take 30-45 days, but specialized programs like government-backed or alternative loans have their own paces.

Factors influencing speed include appraisal turnaround (7-14 days), underwriting (1-3 weeks), documentation verification, and closing coordination.

In a stable 2025 market with interest rates hovering around 6-7%, delays might stem from high application volumes or economic uncertainties. The RefiGuide posts surveys and reports to break down average closing times for specific cash-out refinance types—FHA, VA, USDA, Non-QM, DSCR, and hard money—while highlighting why variances occur.

What is the Average Cash-Out Refinance Process and Timeline?

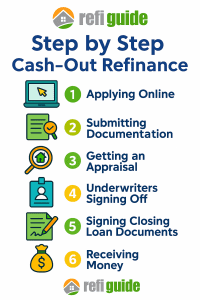

Understanding the standard steps provides context for type-specific variations. The journey begins with pre-approval, where you submit financial docs like pay stubs, tax returns, and credit reports. Lenders then order an appraisal to confirm your home’s value, crucial for determining equity and loan-to-value (LTV) ratios—typically capped at 80% for cash-outs.

Underwriting follows, scrutinizing your debt-to-income (DTI) ratio (ideally under 43%), credit score (620+ minimum), and employment stability.

Once approved, you receive a Closing Disclosure, triggering a mandatory three-day waiting period before signing. Funding occurs 1-3 days post-closing, with cash disbursed via wire or check.

Delays can arise from incomplete paperwork, appraisal revisions, or title issues. In 2025, digital tools like e-signatures and automated underwriting have shaved days off, but government loans often involve extra oversight, extending times. Conversely, private or alternative lenders prioritize speed for competitive edge. Now, let’s dive into averages for each queried type, based on current industry data.

Conventional Cash-Out Refinance: Average Timeline

Conventional cash-out refinances, backed by Fannie Mae or Freddie Mac, are the most common type for borrowers with strong credit (typically 620+) and stable finances. They allow up to 80% LTV and don’t require mortgage insurance if equity exceeds 20%. From application to funding, conventional cash-outs average 30-45 days. This timeline benefits from standardized guidelines and efficient processes at major banks and online lenders. Appraisals usually take 7-10 days, with underwriting wrapping in 1-2 weeks for clean files. In 2025, some digital platforms close in 20-30 days using automated valuation models (AVMs) instead of full appraisals, but expect extensions to 50 days during busy periods or if manual reviews are needed for complex income sources.

FHA Cash-Out Refinance: Average Timeline

The Federal Housing Administration (FHA) cash-out refinance is ideal for borrowers with lower credit scores (down to 580) or limited equity, allowing up to 80% LTV. It requires mortgage insurance premiums (MIP) but offers flexible guidelines. From application to funding, FHA cash-outs typically close in 30-45 days. This aligns with general refinance averages but can stretch to 50 days if appraisals lag—FHA mandates detailed inspections, and appraisers must adhere to strict HUD standards. Borrowers need at least six months of on-time payments on their current mortgage, adding a built-in wait for recent homeowners. In 2025, with streamlined FHA processes, some lenders close in under 30 days for straightforward cases, but expect extras like home inspections to add time.

VA Cash-Out Refinance: Average Timeline

Veterans Affairs (VA) cash-out refinances cater to military members, offering up to 100% LTV in some cases—no private mortgage insurance required. However, they involve a 210-day seasoning period or six on-time payments post-original closing. Average closing time is 40-50 days from application to funding, slightly longer than FHA due to VA-specific appraisals (often 10-14 days) and funding fee processing. In 2025, VA refinances can hit 60 days during peak seasons, as regional loan centers review files for compliance. Speed-ups occur with lenders using automated systems, potentially closing in 30 days for IRRRL (streamline) variants, but full cash-outs demand more scrutiny.

USDA Cash-Out Refinance: Average Timeline

The U.S. Department of Agriculture (USDA) program focuses on rural properties but does not offer true cash-out refinances. Instead, it provides rate-and-term or streamlined refinances, where borrowers can’t extract equity beyond reimbursing closing costs. If cash-out is needed, homeowners must refinance into a conventional or other loan type. For USDA refinances, timelines average 30-45 days, similar to purchases, with underwriting involving income verification for low-to-moderate earners. Appraisals in rural areas can delay by 7-10 days due to fewer comparables. In 2025, streamlined assists close faster (25-40 days), but full refinances require 180-day seasoning. Borrowers seeking cash should explore alternatives to avoid USDA restrictions.

Non-QM Cash-Out Refinance: Average Timeline

Non-Qualified Mortgage (Non-QM) cash-outs suit self-employed or non-traditional borrowers, bypassing Fannie Mae/Freddie Mac rules with flexible underwriting like bank statement income verification. They allow higher DTIs (up to 50%) and credit down to 500. Closing averages 30-45 days, akin to conventional, but can be quicker (20-30 days) with specialized lenders. No strict seasoning (as little as one day post-event like bankruptcy), but custom docs extend review. In 2025, Non-QM’s rise in popularity means busier pipelines, potentially adding weeks if asset depletion or foreign income is involved.

DSCR Cash-Out Refinance: Average Timeline

Debt Service Coverage Ratio (DSCR) loans, often under Non-QM, target investors using rental income to qualify—no personal DTI needed if DSCR ≥1.0. Cash-outs up to 75% LTV for investment properties close in 15-30 days on average, faster than traditional due to asset-based focus. Appraisals emphasize income potential, speeding things up, but lease reviews can delay. In 2025, fintech lenders close in 10-21 days, appealing to real estate investors needing quick equity access.

Hard Money Cash-Out Refinance: Average Timeline

Hard money loans from private investors emphasize property value over borrower credit, with rates 8-15% and short terms (6-24 months). Cash-outs fund quickly—7-15 days average—due to minimal paperwork and in-house underwriting. No seasoning required; some close in 24-72 hours for urgent needs. However, high fees (2-5 points) and appraisals (3-5 days) apply. In 2025, they’re ideal for flips or bridges, but expect 2-3 weeks if title issues arise.

Case Study 1: FHA Cash-Out for Debt Consolidation

Lisa, a 38-year-old nurse in Ohio with a 650 credit score, owned a $300,000 home with $150,000 equity. Seeking $50,000 to pay off credit cards, she applied for an FHA cash-out in March 2025. Appraisal took 10 days, underwriting 2 weeks amid MIP calculations. Delays from tax doc revisions added 5 days, but she closed in 42 days total—funding wired 2 days later. This average pace suited her, saving on interest despite the wait.

Case Study 2: VA Cash-Out for Home Improvements

Mike, a 45-year-old veteran in Texas, had a $400,000 home with $200,000 equity and 720 credit. In June 2025, he pursued a VA cash-out for $80,000 renovations. The 210-day seasoning was met, but VA appraisal delayed 12 days due to regional backlog. Underwriting cleared in 18 days, closing at 48 days—funding immediate. Mike appreciated no MIP but noted extra VA steps extended beyond 40 days.

Case Study 3: Hard Money Cash-Out for Investment Flip

Sarah, a 50-year-old investor in California, needed $100,000 from her $500,000 rental’s equity for a quick flip. With spotty credit, she chose hard money in August 2025. Minimal docs and in-house appraisal wrapped in 5 days; no seasoning needed. She closed in 10 days, funding same-day. High rates were a trade-off, but speed enabled her deal.

How to Speed Up the Cash-Out Refinance Process in 2026

In December 2025, home equity reached a record $32 trillion and cash out refinance rates remain at 6.75% for 30-year fixed loans. The cash-back refinance process, averaging 30-45 days, can drag due to appraisals, underwriting, and documentation. Streamlining it saves time and money.

Here are seven proven strategies to accelerate your cash-out refinance, backed by insights from Bankrate, ensuring you access funds swiftly in a competitive market.

1. Apply Online for Cash Out Refinance:

Take advantage of advanced technology and choose a cash-out lender from a free platform like the RefiGuide. Choosing the right bank or mortgage lender can reduce the time it takes to close on the refinance transaction.

2. Gather Documentation Early

Lenders require two years of tax returns, W-2s, pay stubs, bank statements, and proof of homeowner’s insurance. For self-employed borrowers, profit/loss statements are key. Pre-collecting these, as advised by LendingTree, cuts verification time by up to 10 days. In 2025, digital uploads via platforms like LoanDepot’s streamline loan submissions, with 80% of delays tied to missing docs.

3. Schedule the Appraisal Promptly

Appraisals, costing $400-$600 and taking 7-14 days, are a common bottleneck. Book early with lender-approved appraisers, and ensure your home is accessible and well-maintained to avoid follow-ups. In high-demand markets like Florida, where appraisal backlogs hit 20 days (per Forbes), pre-scheduling via services like ClearCapital can save a week.

4. Choose a Lender with Digital Underwriting

In 2025, lenders using AI-driven underwriting, like LoanDepot or CrossCountry Mortgage, process applications 20% faster than traditional banks. These platforms analyze credit, income, and appraisals in real-time, cutting approval to 15-20 days. Rocket Mortgage’s digital portal, for instance, offers instant pre-qualifications, reducing manual reviews and accelerating closings for cash-out refis up to $500,000.

5. Close the Cash Out Refi Quickly

If you choose the right lender upfront, they will connect you with the best escrow and notary company so you can sign the final loan documents and close as quick as possible.

6. Receive the Money

Homeowners love the part of closing their loan and receiving their cash. You can receive a check or have the funds wired directly to your bank account.

By implementing these steps, you can slash weeks off the cash-out refinance timeline, unlocking equity efficiently in 2025’s dynamic market. Start early, stay organized, and leverage digital tools for a seamless process.

More Cash Out Refinancing Tips:

Boost Your Credit Score Before Applying : A strong credit score (680+ preferred, 620 minimum) secures faster approvals and better rates, reducing lender scrutiny. In 2025, check your score via AnnualCreditReport.com, pay down credit card balances below 30% utilization, and correct errors (15% of reports have them, per FTC). A 720 score can shave 5-7 days off underwriting, as lenders like Better Mortgage prioritize high-FICO applicants for streamlined processing.

Shop Cash Out Refi-Lenders Within a 14-Day Window Multiple lender inquiries within 14-45 days count as one hard pull, minimizing credit score impact (5-10 points). Compare rates from banks, credit unions, and online lenders like Quicken Loans using tools like Bankrate’s rate tables. In 2025, securing pre-approvals from three lenders in two weeks can lock in terms and expedite closing by 7-10 days, per Experian.

LOW DTI: It also helps to maintain a low Debt-to-Income (DTI) Ratio. Having a DTI below 43% (ideally 36%) signals affordability, speeding underwriting. Pay off small debts or avoid new credit before applying—new loans can delay approvals by 10 days, per myFICO. In 2025, a $300,000 cash-out refi adding $50,000 debt requires income of $7,000/month to stay under 43%, ensuring quick lender confidence.

Choose No-Cost or Low-Fee Refinancing: No-cost refinances, absorb fees (2-5% of loan) in exchange for slightly higher rates (0.25-0.5%). This skips fee negotiations, shaving 5-7 days off closing. In 2025, 60% of cash-out borrowers choose these for speed, per Bankrate, accessing funds faster despite long-term cost trade-offs.

Takeaways on How Long Cash Out Refinancing Takes

Cash-out refinance timelines in 2026 range from 7-15 days for hard money to 40-50 days for VA, with FHA and Non-QM at 30-45, DSCR at 15-30, and USDA unavailable for cash-outs (refinances 30-45 days). The RefiGuide can help you shop cash-out refinance lenders, prepare docs early, and consider your needs—speed vs. cost. Consult professionals to navigate options effectively.