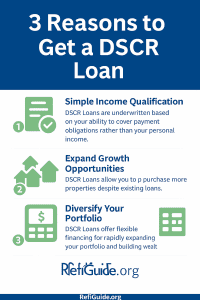

DSCR loans evaluate a property’s ability to generate enough rental income to cover its debt obligations, calculated as Net Operating Income (NOI) divided by annual debt service (principal, interest, taxes, insurance, HOA). Unlike conventional loans, DSCR loans don’t require personal income verification, making them accessible for investors with complex financials. In 2026, with rental demand strong and rates averaging 6.375%–8.000% APR, DSCR loans are popular for scaling real estate portfolios. The RefiGuide published this article to help consumers shop and compare the most trusted DSCR loan lenders online.

How to Find the Best DSCR Lenders

These private money and Non QM lenders offer low DSCR loan rates, high LTVs (up to 80%), minimal DSCR requirements (0.75–1.0), and fast closings (7–14 days).

These DSCR loan companies cater to first-time and seasoned investors, with flexible credit requirements (580–660+) and no personal debt-to-income (DTI) checks.

Banks and mortgage lenders were selected based on DSCR loan rate competitiveness, terms, customer reviews, and availability in 2026.

Key DSCR Loan Highlights

- DSCR Loans Overview: Debt Service Coverage Ratio (DSCR) loans are non-qualified mortgages (non-QM) designed for real estate investors, qualifying based on a property’s rental income rather than personal income, ideal for rental properties.

- Top Lenders: Leading DSCR lenders in 2025 offer competitive DSCR loan rates, flexible terms, and fast closings, catering to investors with diverse credit profiles and property types.

- Rates and Terms: DCR loan Rates range from 6.375%–8.000% APR, with aggressive terms like low or no minimum DSCR, high loan-to-value (LTV) ratios, and interest-only options.

- Considerations: Higher rates than conventional loans and foreclosure risks require careful planning; compare multiple DSCR mortgage lenders for optimal terms.

Top 12 DSCR Lenders in 2026

Below are the top 12 DSCR loan lenders, ranked by rates, terms, and investor suitability, based on 2025 data. DSCR loan rates assume a 30-year fixed or adjustable-rate mortgage (ARM), 700+ credit score, 75–80% LTV, and DSCR ≥1.0.

| Rank | Lender | Rate/APR | Key Terms and Features | |

|---|---|---|---|---|

| 1 | New Silver | 6.375%–7.50% | No minimum DSCR, 80% LTV, $100K–$3M loans, 5-day closings, interest-only options | |

| 2 | Defy Mortgage | 6.50%–7.75% | DSCR ≥0.75, 80% LTV, $75K–$2M, 7-day closings, no state restrictions | |

| 3 | Griffin Funding | 6.50%–7.75% | hard money and DSCR HELOCS | |

| 4 | Kiavi | 7.00%–8.00% | ||

| 5 | Truss Financial Group | 6.75%–8.00% | ||

| 6 | Lima One Capital | 7.00%–8.00% | ||

| 7 | Angel Oak Mortgage | 6.75%–8.00% | hard money, DSCR and non QM loans. | |

| 8 | American Heritage Lending | 6.75%–8.00% | DSCR ≥0.75, 80% LTV, $75K–$2M, condo/multifamily focus, 40 states | |

| 9 | Mortgage Vintage | 7.00%–8.00% | ||

| 10 | Park Place Finance | 7.00%–8.00% | ||

| 11 | Quontic | 7.00%–8.00% | ||

| 12 | North American Savings Bank (NASB) | 7.00%–8.00% | DSCR ≥1.0, $100K–$2M, 30-year terms, high customer ratings |

How to Choose a DSCR Lender

- Compare DSCR Loan Rates and Terms: Look for low APRs (6.375%–8.000%) and high LTVs (up to 80%). New Silver and Defy Mortgage offer aggressive terms with low or no DSCR minimums.

- Check Eligibility: Ensure your property meets DSCR requirements (1.0–1.5) and your credit score aligns (580–700). Griffin Funding accepts 620+ scores.

- Evaluate Speed: Lenders like Kiavi and Truss Financial close in 7 days, ideal for competitive markets.

- Assess Fees: Avoid high origination or prepayment penalties with DSCR cash-out refinance. Park Place Finance eliminates junk fees.

- Verify Property Types: Confirm the lender supports your property (e.g., condos, multifamily, short-term rentals). American Heritage Lending excels for diverse properties.

- Read Reviews: Check online platforms for customer feedback on reliability and service.

DSCR Loan Pros and Cons

Debt Service Coverage Ratio (DSCR) loans, popular among real estate investors in 2025, offer unique advantages and challenges for financing rental properties.

Pros: DSCR loans qualify based on a property’s rental income, not personal income, making them accessible for investors with complex financials or low W-2 income.

There are DSCR lenders like New Silver allow DSCRs as low as 0.75, with high loan-to-value ratios (up to 80%) and loan amounts from $75,000 to $5 million, enabling portfolio expansion.

Check out the Interest-Only options and fast closings (7–14 days) from Kiavi or Griffin Funding suit time-sensitive deals.

DSCR loan rates (6.375%–8.000% APR) are competitive for non-QM loans, and no personal debt-to-income (DTI) verification broadens eligibility (580+ credit).

Cons: Higher rates than conventional loans (6.31% APR) increase borrowing costs, and low DSCRs may require 20–25% down payments or reserves (6–18 months). Tenant vacancies or market downturns can strain cash flow, risking default and foreclosure, as properties are collateral. Limited lender availability—focused in states like California or Texas—can restrict options. Prepayment penalties and origination fees (1–3%) may apply, impacting profitability. For example, a $300,000 property with $24,000 NOI and a $20,000 loan payment (DSCR 1.2) is viable, but a vacancy could drop the DSCR below 1.0, complicating repayment. Investors should compare terms from DSCR loan lenders like Defy Mortgage, ensure strong property cash flow, and consult financial advisors to mitigate risks (OfferMarket).

As mentioned, DSCR loans carry higher rates than conventional mortgages (6.31% APR) due to investment property risks. A DSCR below 1.0 may require larger down payments (20–25%) or reserves (6–18 months). Tenant vacancies or market downturns can impact cash flow, risking default and foreclosure. Ensure your property’s NOI supports a DSCR of 1.25+ for better terms. Consult a financial advisor to align loans with your investment strategy.

20 Things DSCR Lenders Can Help You Accomplish in 2025

In 2025, DSCR (Debt-Service Coverage Ratio) loans continue to be a powerful financing option for real estate investors and property owners.

Unlike traditional loans, DSCR loans are approved based on the income generated by the property rather than the borrower’s personal income.

This unique approach opens a wide array of opportunities. Here are 20 things the best DSCR lenders can help you accomplish in 2025:

- Purchase Investment Properties Without Tax Returns

The best DSCR lenders will evaluate the property’s income rather than your W-2s or tax documentation, making it ideal for self-employed investors or those with complex financial profiles. - Qualify Based on Rental Income

If your rental property generates enough monthly income to cover the new loan payments, you could qualify, even with limited personal income. - Buy Multiple Properties at Once

Unlike conventional loans with strict limits, DSCR loans often allow you to finance multiple properties simultaneously. - Expand Real Estate Portfolios Quickly

By focusing on the income of the property rather than the borrower, DSCR loans make it easier to scale your real estate investments faster. - Cash Out Equity for Reinvestment

DSCR lenders can help you tap into home equity through cash-out refinance options to fund new property purchases. - Renovate and Flip Properties

With sufficient rental income and equity, DSCR HELOCs and loans can be used to renovate properties for resale or increased rental value. - Finance Short-Term Rentals (Airbnb/VRBO)

Many DSCR lenders now recognize short-term rental income, offering funding options for Airbnb and vacation rental investments. - Refinance Existing Investment Mortgages

Investors can restructure debt for better rates or longer terms without the need to qualify using personal financials. - Secure Long-Term Fixed Rates

The best DSCR lenders offer fixed-rate options for purchase, refinance or HELOC that allow investors to lock in consistent payments over 15 to 30 years. - Work Around High Debt-to-Income Ratios

Since DSCR loans don’t rely on personal DTI ratios, they are ideal for borrowers who wouldn’t qualify under traditional standards. - Access Financing with Lower Credit Scores

Some DSCR mortgage lenders work with borrowers with credit scores in the low 600s, provided the property is cash-flowing. - Avoid Employment Verification

Employment status and income aren’t primary qualifiers for DSCR loans, which simplifies and speeds up the application process. - Simplify the Documentation Process

No tax returns, W-2s, or pay stubs are required; only rental income documentation like leases and rent rolls. - Invest in Out-of-State Properties

DSCR lenders often support out-of-state investments, giving you geographic flexibility. - Acquire Mixed-Use Properties

Some lending companies allow funding for properties with both residential and commercial use, expanding investment opportunities. - Improve Property Cash Flow

Strategic DSCR funding enables investors to make improvements that can lead to higher rents and increased property value. - Partner with LLCs or Corporations

Some of the best DSCR lenders allow you to borrow in the name of a business entity, offering liability protection and organizational advantages. - Defer Taxes Through 1031 Exchanges

DSCR loans can be used in conjunction with 1031 exchanges, enabling tax-deferred growth. - Buy Properties with Low Down Payments

Some lenders allow for down payments as low as 15-20%, making property acquisition more accessible. - Build Wealth Without Traditional Barriers

DSCR lending opens the doors for investors who may not fit the mold of traditional financing but want to grow wealth through real estate.

Case Study 1: Homebuyers Using a DSCR Loan

Case Study 2: Homeowner Cashing Out to Buy Another Investment Property

Sandra owned a rental home in Phoenix that had appreciated significantly. She contacted a DSCR lender to do a cash-out refinance based on the property’s strong income history. With $150,000 in equity, she purchased a second rental property in Tucson without touching her savings. Both properties now generate income, and Sandra has increased her net worth by leveraging a strategic DSCR loan.

Case Study 3: Renovating with a DSCR HELOC and Profiting from a Sale

David, an experienced investor, took out a DSCR-based HELOC on a triplex in Miami. He used the line of credit to renovate the units, adding modern kitchens and energy-efficient upgrades. Once renovations were complete, he increased rents by 30%. After 18 months, David sold the property at a $175,000 profit. None of this required personal income verification—just the property’s income metrics.

How to Shop DSCR Loan Interest Rates Today

Let’s consider practical steps to compare DSCR loan rates effectively, ensuring investors secure competitive terms for their rental properties.

- Understand DSCR Loan Basics: DSCR loans qualify based on the property’s cash flow, calculated as Net Operating Income (NOI) divided by annual debt service. A DSCR of 1.0–1.25 is typical, with lower ratios (0.75–1.0) offered by aggressive private and non QM lenders like New Silver. DSCR loan rates (6.375%–8.000% APR) depend on DSCR, credit score (580–700+), loan-to-value (LTV) ratio (75–80%), and property type (e.g., single-family, multifamily).

- Check Your Property’s Debt Service Coverage Ratio: Calculate your property’s DSCR using rental income, expenses, and estimated loan payments. For a $300,000 property with $2,500 monthly rent and $1,500 expenses, NOI is $12,000 annually. A $240,000 loan at 7% APR has $20,000 annual debt service, yielding a 0.6 DSCR, which may require a larger down payment. Use calculators like OfferMarket to assess viability.

- Compare Multiple DSCR Lenders: Request quotes from at least three DSCR lenders, such as Defy Mortgage (6.50%–7.75% APR), Griffin Funding (6.50%–7.75% APR), and Kiavi (7.00%–8.00% APR). Compare APRs, which include fees, and terms like LTV, DSCR minimums, and closing costs (1–3%). Online platforms like PrivateLenderLink connect you with lenders offering competitive DSCR loan rates.

- Evaluate Terms and Fees: Look for low origination fees (0–2%), no prepayment penalties, and interest-only options, as offered by Truss Financial. Check if DSCR loan lenders like Lima One Capital allow short-term rentals or condos, which may affect rates. Ensure fast closings (7–14 days) for competitive markets.

- Leverage Credit and Equity: A 700+ credit score and 20–25% down payment secure lower rates (6.375%–7.00% APR). If credit is lower (580–660), lenders like American Heritage Lending may offer DSCR rates closer to 8%. Increase equity by choosing properties with strong rental potential to improve LTV.

- Consult a DSCR Mortgage Broker: Brokers can access multiple DSCR lenders, negotiating rates and terms tailored to your portfolio. They streamline applications, saving time and potentially securing better deals from lenders like Park Place Finance.

DSCR Loan Requirements

Debt Service Coverage Ratio (DSCR) loans are non-qualified mortgages tailored for real estate investors, prioritizing a property’s rental income over personal income. In 2025, these loans are popular for purchasing or refinancing investment properties, with APRs ranging from 6.375%–8.000%. Understanding DSCR loan requirements is crucial for securing favorable terms. This article outlines the key requirements investors must meet to qualify for DSCR loans, ensuring informed decision-making.

Key Requirements for DSCR Loans

1. Minimum DSCR Ratio

Lenders require a DSCR of 1.0–1.25, meaning the property’s Net Operating Income (NOI) must cover 100–125% of annual debt payments (principal, interest, taxes, insurance, HOA). For example, a $300,000 property with $24,000 NOI and $20,000 debt service has a 1.2 DSCR. Lenders like New Silver accept DSCRs as low as 0.75, but higher ratios secure better rates (6.375%–7.00% APR).

2. Credit Score

A credit score of 580–700+ is typically required, with 660+ preferred for competitive rates. Lenders like Griffin Funding accept scores as low as 620, but lower scores may face higher APRs (7.75%–8.00%) or larger down payments (20–25%). Strong credit enhances loan approval and terms.

3. Loan-to-Value (LTV) Ratio

Most lenders cap LTV at 75–80%, meaning you need 20–25% equity or down payment. For a $400,000 property, a 75% LTV allows a $300,000 loan. Defy Mortgage is a DSCR loan lender that offers up to 80% LTV, increasing borrowing capacity for qualified investors.

4. Property Eligibility

Eligible properties include single-family homes, multifamily units (2–4 units), condos, and short-term rentals. The property must be in a rentable condition and meet appraisal standards. Kiavi supports diverse property types, including non-warrantable condos.

5. Reserves and Experience

DSCR lenders like Lima One Capital require 6–12 months of cash reserves to cover payments during vacancies. Some, like Quontic, prefer experienced investors with a history of managing rentals, though first-time investors may qualify with strong DSCRs.

DSCR loan requirements focus on property cash flow, with a minimum DSCR of 1.0–1.25, 580–700+ credit score, 75–80% LTV, and eligible rental properties. Reserves and experience can enhance your approval odds.