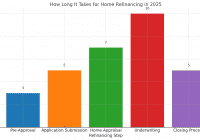

How Long Does It Take to Refinance a House?

Applicants always want to know how long it takes for the home refinance process from the time they complete their residential loan application. Refinancing your house means you are getting a new home loan, so it can take some time. In many situations, the timeline for refinancing a home takes 30 to 45 days on… Read More »