Applicants always want to know how long it takes for the home refinance process from the time they complete their residential loan application. Refinancing your house means you are getting a new home loan, so it can take some time. In many situations, the timeline for refinancing a home takes 30 to 45 days on average.

Since the mortgage process can be stressful it is very important to most borrowers to close their home refinance loan as quickly as possible. But the exact time to sit down at the closing table depends on many factors, and some of them you do not control. You might be able to close faster, however, if you understand the refinance process. Home refinancing can be a prudent financial move so being pragmatic throughout the mortgage process is critical.

How Quickly Can You Refinance a Mortgage?

The speed of refinancing a mortgage can vary depending on several factors, but most refinance processes take between 30 to 45 days from application to closing.

However, with excellent preparation and favorable circumstances, some lenders can expedite the process, completing it in as few as 15 to 20 days.

Several factors influence the refinancing timeline. First, the complexity of your financial profile plays a significant role; individuals with straightforward financial situations, such as high credit scores, stable employment, and low debt-to-income ratios, often experience quicker processing.

Second, property type and value matter, as lenders may require an appraisal to verify the home’s current market worth, which can add time to the process. Additionally, lender policies and market conditions influence refinancing speed. During periods of high refinancing demand, processing times may be slower, as lenders deal with higher volumes of applications. To expedite the process, borrowers should gather necessary documents in advance, such as tax returns, pay stubs, proof of insurance, and existing mortgage statements, which helps avoid delays due to missing paperwork.

Using a refinance mortgage lender with streamlined digital platforms or automated underwriting systems can also reduce wait times, as technology often speeds up document review and approval. Finally, if your initial mortgage is with the same lender, they may offer faster refinancing options, as they already hold your information. Overall, while mortgage refinancing typically takes about a month, careful preparation, responsiveness to lender requests, and choosing a well-equipped lender can significantly reduce the timeline, allowing you to complete the refinance as quickly as possible.

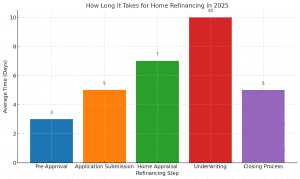

Timeline for a Mortgage Refinance in 2025

As we mentioned above, it takes 30-45 days on average to close a refinance. Ellie Mae reports that it took about 50 days, typically for all loan types to close last year. Of course, FHA and VA loans take a bit longer to close than conventional loans.

We can understand one thing for sure from the Ellie Mae report: Lower interest rates are causing longer close times. The refinance process now takes more than two weeks longer on average than it did in a few months ago. Today’s home mortgage rates are fairly average when considering a historical context. Get more insight from our refinance mortgage guide.

Do You Want to Refinance Your House Faster?

If you want to get your refinance loan closed faster, experts recommend following these steps.

Know the Reason You Want to Refinance

One of the most vital aspects of a home refinance is understanding your financial goals before you start the process. If you backtrack and change your goals during the process, it will slow things down. For instance, you may not need a home appraisal if you only want to lower your payment and rate. Not having an appraisal can save you 1-2 weeks during the refinance process.

But if you decide suddenly you want to pull out equity to remodel your kitchen, it will add time to the mortgage refinance process. The lender will need a new appraisal. The new loan must be approved for the higher loan amount, pushing out the closing date. Also, pulling out cash is deemed a higher risk loan by lenders to extend the underwriting process.

Find Loan Options That Align with Your Financial Goals

If you choose the wrong mortgage program, that could add days or weeks to the refinance process. It can cost you both money and time if your mortgage company must deny your application or find a program that fits better with your financial goals.

Here is a quick rundown of refinance programs to consider based on your financial situation:

- Good credit score and desire a lower interest rate: Conventional loan, rate, and term refinance

- Poor credit and desire a lower rate: FHA rate-and-term refinance

- Military member or veteran and desire a lower rate: VA rate-and-term refinance

- Have an FHA loan and want a lower rate: FHA streamline

- Want equity and have good credit score: Conventional cash-out refi

- Want equity and have bad credit: FHA cash-out refi

- Want equity and are a military member: VA cash-out refinance

Find Out What Your Home Is Worth

Mortgage lenders base the amount for a refinance on your equity. So, watch what the prices are for homes in your area that are similar to yours. Put an address into a home value estimator to get an idea of what your house might be worth. You also can call your real estate agent and get a COA or comparative market analysis for a more exact home value.

Remember to be realistic with your home value estimate. If the appraisal’s value comes in lower, the mortgage lender may adjust the loan’s costs and interest rate. The process might take longer as the underwriter goes over the changes.

Choose a Refinance Product That Doesn’t Need an Appraisal

Having a home appraisal adds at least two weeks to the mortgage application process. If you choose a mortgage refinance program that does not require an appraisal, you can save a lot of time. If you only want to lower your rate or change your loan term, you may be able to get a no-appraisal loan:

- Conventional loan appraisal waiver: Fannie Mae and Freddie Mac back these loans. Fannie Mae sometimes offers appraisal waivers if you have at least 10% equity. Freddie Mac mandates at least 20% equity to be eligible for a waiver. (Consider a fixed rate mortgage refinance with lower competitive pricing. )

- FHA streamline: If you have an FHA loan, you may qualify for a fast, easy refinance with no appraisal. Your lender also might not check your income or credit.

- VA interest rate reduction refinance loan: Military borrowers who are current on their loan can roll their closing costs into the loan. You do not need income documentation or an appraisal.

Inquire About Refinance Timelines

When rates are very low, lenders get a lot of refinancing requests. Be sure to check with three to five lenders about their rates, and you also should:

- Ask how long it takes them to process applications on average. Lenders should be able to tell you if the loans are taking 30 days, 60 days, or more.

- Shop around: Don’t stop with just one or two quotes. Some lenders might raise their rates temporarily, so they do not take on too much business.

Collect Your Financial Documents Ahead of Time

How quickly your application can be mainly processed depends on the quality of your application. If you have missing or incorrect information, there will be delays in the process. Make sure you have all the documentation required and that you fill out the application accurately:

- Pay stubs for the current month

- W-2s for the previous two years

- Contact information for your employers for the last two years

- Two months of bank statements

- This month’s mortgage statement

- Up-to-date homeowner’s policy with full contact information

- Updated property tax statement

Remember, the lender will verify your employment at least twice. If you change jobs, tell your lender right away.

8 Steps to Maximize the Home Refinance Process

It’s no secret that home refinancing can be a strategic move to alleviate financial burdens or capitalize on favorable market conditions.

Whether aiming to reduce monthly payments or shorten the loan term, there are steps to take to ensure you get the best possible home refinance mortgage.

Here are 8 valuable tips to consider when you are navigating through the house refinance process.

1. Know Your Financial Situation:

Before beginning the home refinance process, assess your current financial standing. That means, you must know your current credit scores, determine your debt-to-income ratio. Mortgage lenders evaluate your credit and income situations to determine if you meet their lending requirements and what interest rate you qualify for as well.

2. Set Your Goals:

Make sure you write down your goals of refinancing your house. Whether it’s reducing the monthly payments, lowering the mortgage rate, or reducing the time to pay of your loan, visualizing your goals and benefits are critical.

3. Check Current Mortgage Rates:

Home refinancing offers significant benefits when rates are lower than what you presently have. Before getting too excited, make sure that you have factored in the closing costs, lending fee and the cost of extending the term. You need to look at the whole picture and total savings before committing to a home refinance loan.

4. Understand Types of Refinancing:

There are a wide variety of house refinance programs. For example, the most popular refinance products are cash-out refinancing, streamline refinancing, rate-and-term, and streamline refinancing. When considering various loan options make sure you know what mortgage refinance costs are tax-deductible. Each refi-program offers unique opportunities, and the rate and costs can vary.

5. Shop and Compare Refinance Lenders:

Don’t always commit to the first loan offer. Shop refinance lenders and compare quotes from multiple lenders. Consider the home refinance rates, closing costs, and terms to find the best loan for your situation.

6. Evaluate the Closing Costs:

While aiming for lower interest rates, be mindful of closing costs. These fees can impact the overall savings from refinancing. Calculate the break-even point to determine how long it will take to recoup these costs through reduced monthly payments.

7. Improve Your Credit Score:

Before refinancing your house, you should do everything you can to get your credit score as high as possible. In many cases, higher credit score translates to lower interest rates and better refinance terms. Before refinancing, take steps to improve your credit score by paying off outstanding debts and addressing any inaccuracies on your credit report.

8. Have Documentation Ready:

It’s imperative that you have gathered the required documentation, such as pay-stubs, w2’s, and property information. Having these documents ready to go expedites the refinance process and could result in lower interest rate if the market is experiencing fluctuations.

Home Refinancing Considerations

If you get organized before beginning the house refinance process, you will reduce stress and leverage your opportunity to have the best possible refinancing experience. Before signing any the final loan documents, carefully read and understand the terms and conditions. Look out for prepayment penalties, adjustable-rate provisions, and any clauses that could hinder your ability to refinance your house in the future. Mortgage refinances do not usually take as long as original home loans, with 30 to 45 days being standard timelines. If you follow our tips above, you might be able to shave a few days off those times and get to the closing table faster.

FAQs Home Refinancing:

How long after you buy a home can you refinance?

The waiting period to refinance a home depends on the type of loan. For a conventional loan, you typically need to wait six months after closing. For FHA, VA, or USDA loans, the waiting period may vary, with FHA requiring six months for a rate-and-term refinance and 12 months for cash-out. If refinancing for a better rate, ensure you have enough equity and improved credit to qualify.

What documents do I need to refinance my home?

To refinance your home, you typically need:

- Proof of income (pay stubs, W-2s, tax returns)

- Credit report and score

- Bank statements (to verify assets)

- Mortgage statement (showing loan balance)

- Property appraisal (if required)

- Debt-to-income ratio details (outstanding debts)

Lenders may request additional documentation depending on loan type and financial status.

What does it mean to refinance a house?

Refinancing a house means replacing your existing mortgage with a new one, typically to secure a lower interest rate, reduce monthly payments, or tap into home equity.

How much does it cost to refinance a house?

Refinancing typically costs 2% to 6% of your loan amount. Common expenses include appraisal fees, title insurance, loan origination, and closing costs. Some lenders offer no-closing-cost options with higher interest rates.

How many times can you refinance a house?

There’s no legal limit to how many times you can refinance a house. However, banks and lending companies may have waiting periods, and it must make financial sense based on closing costs and long-term savings.

How long does it take to get a home equity loan?

The process for obtaining a home equity loan typically takes two to six weeks, depending on the lender. This includes application review, credit check, home appraisal (if required), and loan approval. Some lenders offer expedited processing for borrowers with strong credit and sufficient equity. The timeline may also be affected by document verification and closing procedures.

References

- Ellie Mae Insight Origination Report. Accessed at EM_OIR_AUG2020.pdf (elliemae.com)

- Is Refinancing Your Mortgage A Good Idea?