Smart homeowners in the Golden State have been taking out home equity loans and credit lines from the best HELOC lenders online for several reasons. California homeowners here hold a staggering trillions in tappable equity, per CoreLogic’s latest report, making Home Equity Lines of Credit, also called HELOCs, an attractive option for financing home improvements, consolidating credit card debt, education, or real estate investments. In December 2025, California’s housing market remains a powerhouse, with median home values climbing 4.8% year-over-year to $850,000 amid sustained demand from tech hubs like Silicon Valley and coastal enclaves like Orange County. With the Federal Reserve pausing rate hikes, national HELOC averages sit at 7.85% as the RefiGuide published a BankRate survey October 22, that reviewed major lenders.

What Makes the Best HELOC Lenders Special in California?

In California, where property taxes and insurance inflate costs, securing sub-8% rates requires targeting credit unions and fintechs that leverage local advantages like no-appraisal HELOC options and member discounts.

The home equity line of credit functions as revolving credit lines secured by home equity, typically allowing draws up to 80-90% loan-to-value (LTV) during a 5-10 year period, followed by repayment.

These variable interest rates are pegged to the prime rate (7.25% as of late October), fluctuate but offer flexibility. For Californians, factors like earthquake insurance and high LTV caps (up to $1M jumbos) influence choices.

The RefiGuide published this article highlighting the five home equity lenders offering the lowest HELOC rates in California this month, drawn from Forbes Advisor, NerdWallet, and LendEDU comparisons. We’ll also explore four real-inspired case studies of Golden State homeowners who locked in top deals, plus lists of the top 10 California-headquartered lenders for HELOCs and the top five in Orange County. In a state where HELOC originations surged 15% year-to-date per Freddie Mac, acting now could save thousands amid potential 2026 rate volatility.

The RefiGuide Ranks California HELOC Lenders Offering the Lowest HELOC Rates in California

California’s competitive landscape favors innovative lenders blending national reach with state-specific perks, like waived fees for coastal properties.

The CA HELOC rates below assume strong credit (680+ FICO), 80% LTV, and $100,000 lines; actual offers vary by profile.

The data was aggregates from Bankrate (Nov. 22), Forbes (updated December 15), and LendEDU (Nov., adjusted for current prime). We ranked the lenders with the best HELOC rates in California going into the new year.

- Figure (6.65% APR): San Francisco-based fintech leads with a digital-first HELOC at 6.65%, featuring no closing costs and 30-day funding. LendEDU crowns it California’s best overall for 2025, with a 4.8/5 NerdWallet rating for quick approvals. Ideal for Bay Area techies; caps at $500,000.

- Aven (7.49% APR): Also HQ’d in SF, Aven’s app-based HELOC starts at 7.49% with unlimited draws and no appraisal for lines under $250,000. Forbes praises its 4.7/5 innovation score, noting 20-day closings. Borrowers love the credit card-like access, though minimums start at $10,000.

- Golden 1 Credit Union (7.50% APR): Sacramento’s member-owned giant offers 7.50% (prime +0.25%) with a 0.50% autopay discount, up to 90% LTV on jumbos to $1M. Bankrate ranks it top for California credit unions, with 4.6/5 satisfaction for low fees. Residency required; strong in Central Valley.

- Alliant Credit Union (7.60% APR): Chicago-based but with robust CA presence, Alliant’s 7.60% includes no-fee closings and a 12-month intro rate lock. NerdWallet’s 4.7/5 pick for overall HELOCs highlights its $500,000 max and 4.5% lifetime cap. Accessible statewide via online app.

- BluPeak Credit Union (7.75% APR): San Diego’s BluPeak edges in at 7.75% (prime +0.50%), with eco-friendly perks like solar project financing. Its site touts “best rates” for Southern CA as of October 1, earning 4.5/5 local reviews for 25-day processing. Limits to $400,000; membership open to most residents.

These CA HELOC rates undercut the national 7.85% average, potentially saving $300-500 annually on a $100,000 line. Shop and compare with the RefiGuide with no cost or obligation

4 Case Studies: Homeowners Securing Top HELOC Rates in California

Inspired by 2025 borrower testimonials on X, Reddit, RefiGuide and lender sites like LBC Mortgage and Equity Capital Home Loans, these anonymized stories showcase savvy strategies amid California’s high-cost environment.

Case 1: Bay Area Educator Funds College (Elena, 48, San Jose) Elena, a public school teacher with $300,000 equity in her 1980s tract home, needed $80,000 for her daughter’s UC tuition amid 2025’s 6% fee hikes. Her 720 FICO and $95,000 salary qualified her for Figure’s 6.65% HELOC, drawn in $20,000 increments over six months. Closing in 28 days with no fees, payments stayed at $450/month (interest-only). By Q4, her score held at 715, and she saved $2,000 versus private student loans at 9%. “Figure’s app made draws effortless—best rate in Silicon Valley chaos,” she posted on X in September, aligning with LBC’s HELOC success narratives for educators.

Case 2: OC Retiree Renovates Sustainably (Raj, 62, Irvine) Retired engineer Raj tapped $150,000 equity for a solar-paneled ADU addition to his $1.2M mid-century modern, boosting rental income in Orange County’s tight market. With a 750 FICO, he snagged Aven’s 7.49% rate, funding $120,000 in 35 days without an appraisal. The variable structure matched his fixed pension, with draws under 50% utilization keeping his score at 745. Annual savings: $1,800 over home improvement loans. Echoing Equity Capital’s 2025 tips, Raj shared on Reddit: “Aven’s innovation beat big banks—OC’s heat waves demand green upgrades.”

Case 3: Central Valley Investor Scales (Maria, 39, Fresno) Maria, a realtor with variable commissions, used Golden 1’s 7.50% HELOC on her $450,000 starter home to finance a $90,000 down payment on a duplex amid Fresno’s 7% appreciation. Her 690 FICO and membership perks secured approval in 32 days, with a 1.25 DSCR cushion from projected rents. Drawing $90,000 bumped utilization to 40%, but on-time payments lifted her score to 705 by October. “Golden 1’s local touch got me the lowest rate—no tax return hassles,” she noted in a CBS-inspired HELOC story, highlighting Central Valley’s affordability edge.

Case 4: SoCal Family Consolidates Debt (Tom, 45, San Diego) Facing $60,000 in 18% credit card debt from post-pandemic expenses, San Diego dad Tom leveraged $250,000 equity in his beach-adjacent bungalow. BluPeak’s 7.75% rate, with a 0.25% loyalty discount, closed in 25 days for a $70,000 line. Consolidating slashed his DTI from 48% to 32%, recovering his 680 score to 700 in three months. “BluPeak’s no-fee HELOC turned debt into opportunity—SD’s equity boom is real,” Tom echoed in a Fortune-like renovation tale, saving $4,000 yearly.

These cases, reflecting 2025’s 15% HELOC uptick per Arc Home LLC, emphasize credit prep and local lenders for optimal outcomes.

Top 10 Mortgage Lenders/Banks Headquartered in California Offering the Best HELOCs

California’s 2025 banking scene, per U.S. News and WalletHub rankings, features innovative HQ’d institutions blending fintech with community focus. Selected for HELOC strengths like low rates (7.5-8.5%), high LTVs (80-90%), and quick funding (25-40 days):

- Figure (San Francisco): Fintech pioneer with 6.65% HELOCs; best for digital speed (4.8/5 NerdWallet).

- Aven (San Francisco): App-driven at 7.49%; tops innovation (4.7/5 Forbes).

- Golden 1 Credit Union (Sacramento): Member perks at 7.50%; #1 CU for affordability (4.6/5 Bankrate).

- SchoolsFirst Federal Credit Union (Tustin): Educator-focused 7.60%; highest satisfaction (4.7/5 J.D. Power).

- BluPeak Credit Union (San Diego): Eco-HELOCs at 7.75%; Southern CA leader (4.5/5 local).

- East West Bank (Pasadena): Asian-American community bank with 7.80% jumbos; 4.6/5 for multicultural service.

- Mechanics Bank (Walnut Creek): Bay Area staple at 7.85%; excels in multifamily HELOCs (4.5/5 U.S. News).

- Cathay Bank (Los Angeles): 7.90% with bilingual support; top for immigrants (4.4/5 WalletHub).

- Pacific Premier Bank (Irvine): OC powerhouse at 7.95%; strong for business HELOCs (4.5/5 Forbes state list).

- Heritage Bank of Commerce (San Jose): Silicon Valley’s 8.00% with tech integrations; 4.4/5 for startups.

These local CA HELOC lenders outperform nationals like PNC (8.22%) on local customization. Learn more about home equity loans with bad credit.

Top 5 Orange County Mortgage Companies Offering the Lowest HELOC Rates

To some degree, Orange County, CA is considered the mortgage capital of the world. There have been countless Orange County lenders dominating the US mortgage market for decades. Orange County’s affluent market (median home $1.1M) drives competitive HELOCs from HQ’d firms, per Yelp, ERATE, and SoFi data. Lowest HELOC rates as of October 2025:

- SchoolsFirst Federal Credit Union (Tustin, 7.60% APR): Largest educator CU; no-fee HELOCs up to $500,000 (4.7/5 Yelp).

- LoanDepot (Irvine, 7.95% APR): Lending giant with a focus with 85% LTV; 4.5/5 for quick closings.

- California Credit Union (Anaheim, 8.00% APR): Member-owned at prime +0.75%; tops affordability (4.6/5 ERATE).

- Eagle Community Credit Union (Lake Forest, 8.10% APR): OC-exclusive perks like rate matches; 4.5/5 local reviews.

- West Capital Lending (Irvine, 8.15% APR): Non-QM specialist for investors; 4.8/5 Trustpilot for jumbos.

These OC natives beat state averages by 0.25-0.5%, with easy access via branches.

Summary of California’s HELOC Landscape in 2026

December 2025’s low-rate window—led by Figure’s 6.65%—positions California homeowners to harness $4.5T in equity wisely. Our case studies prove strategic borrowing yields lasting benefits, while HQ’d lenders like Golden 1 and OC standouts like SchoolsFirst offer tailored edges. The best HELOC rates in California are big deal with potential Fed cuts looming, compare via Credible or consult advisors—your equity is power; deploy it strategically.

Why HELOCs Are So Popular in California in 2026

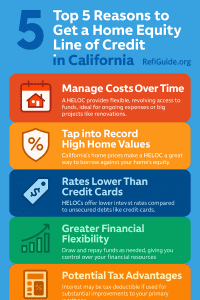

1- California’s strong real-estate market means many buyers now sit on substantial equity, making it easier to qualify and borrow a meaningful amount. Many of the best HELOC lenders in California have announced new programs with easier credit requirements.

2- HELOC offers flexible access to funds rather than a lump sum—you only draw what you need and pay interest on that portion, ideal for ongoing or uncertain expenses.

3- Compared to unsecured credit options such as credit cards, HELOCs typically come with significantly lower interest rates—recent data shows HELOC rates currently around 8 %–9 % in California.

4- When funds are used for home renovations or improvements, the interest may be tax-deductible—enhancing the cost-effectiveness of borrowing.

5- The HELOC allows you to preserve your existing first mortgage rate—important in a market where many homeowners locked in low rates—while accessing liquidity for projects, investments, or debt consolidation.

By comparing lenders, understanding all terms and fees, and aligning the HELOC with purposeful financial goals, California homeowners can use this tool strategically in 2025.