One of the biggest challenges for consumers today is to find a bad credit home loan from a mortgage company you trust. Learn how to get low credit score home loans from lending experts that take risks and offer new opportunities. After the financial crash fifteen years ago, many subprime mortgage programs disappeared, but new opportunities have emerged as new programs designed to help borrowers get home loans with below-average credit, late payments, even bankruptcies.

- Government Home Loans for Bad Credit

- Bad Credit Mortgage Lenders for Home Purchase Loans

- First Time Home Loans with Low Credit Scores

The demand for credit challenged mortgages continues to soar with rising inflation and consumer debt. Our team will help you identify low credit mortgage programs with opportunities for 500 credit score home loans and first time home buyer financing for people with limited credit.

How to Get a Bad Credit Home Loan in 2025

We have been telling people for years, not to get ripped off with high rates and exuberant fees on home loans for people with poor credit. Americans who have poor credit have long felt shut out of the house buying market, but new bad credit home loan programs may offer opportunities that were previously unavailable.

With 2025 here, we can see that housing and financial markets have expanded home loans for people with bad credit, fair credit, even limited credit.

More and more consumers have been asking about the newly added bad-credit home loan products that are available for people with lower fico scores or blemishes displayed on their credit report.

Even if you have past delinquencies and collections showing up on your credit report, the RefiGuide can match you with lenders that specialize in high risk bad credit mortgage programs and home financing for borrowers with credit problems in their past.

Where to Secure Low Credit Home Loans from Bad Credit Lenders

Yes, there are still mortgage lenders in the U.S. that specialize in home buyer loans for people with late payments, collections and lower credit scores.

With millions of Americans hindered by low score, the demand for poor credit home loans has never been greater.

You can turn on the the television or turn up the radio and you’ll likely hear an advertisement offering attractive home loans for people with a bad credit score.

In last 9 months, we have seen a dramatic increase in home financing for borrowers with a below-average credit score. The minimum credit score requirements vary depending on the type of mortgage program and we will delve into that shortly.

Most low-credit home loans have an adjustable rate loan involved, so make sure to revisit refinancing when your credit score improves.

The Refi Guide will help you learn how to get a home loan with bad credit without having to pay too much in closing costs and high monthly payments.

How to Get Approved for Home Loan with a Bad Credit History

If you did not have a credit score in at least the high 600’s, you often were out of luck. Or, if you could get a loan, the interest rate and down payment required were much higher.

Back in 2005, one out of seven subprime-mortgages that were approved had borrowers with credit below 630; this was just one out of 500 borrowers in 2013.

In 2025, we anticipate lending reports revealing that the approval rate on applications for home loans with poor credit is increasing dramatically. Many industry insiders believe that the minimum credit score requirements on conventional loans will be lowered, so stay tuned.

What is the Lowest Fico Score Home Loans Available?

Most mortgage lenders will tell you that a credit score of at least 620 is required to qualify for a mortgage to buy a house.

This is the minimum threshold set by most traditional lenders offering conventional mortgages.

However, it’s worth noting that some bad credit lenders consider applicants with a lower credit score as low as 500, making it possible to secure a loan with extremely poor credit scores.

This is great news for home buyers with damaged credit getting a new opportunity to qualify for a mortgage with a lower credit score.

If you have derogatory credit, you still will have more challenges to get low credit home loans, but things are easier today than a few years ago. If your profile fits the credit score criteria below, you will likely need to look for bad credit FHA mortgages outside of conventional financing to be approved:

- Minimum credit score range from 500 to 620

- 2 or more late payments of 30 days on a mortgage in the last calendar year

- A delinquency on your mortgage of 60 days in the last calendar year

- A foreclosure in the last 24 months

- Bankruptcy in the last 24 months

- Debt to income ratio over 50%

What credit score do mortgage lenders use for home loans?

CNBC revealed that while the FICO® model is most commonly used for general lending decisions, banks rely on specific FICO scores when you apply for a low credit home loan online:

- FICO® Score 2 (Experian)

- FICO® Score 5 (Equifax)

- FICO® Score 4 (TransUnion)

However, credit reporting agencies use slightly different versions of the FICO score, as this system adjusts its model to better predict creditworthiness for various industries. While you’re credit rating is still assessed based on core factors like payment history, credit usage, credit mix, and the age of your accounts, these elements are weighed differently depending on the context. If mortgage lenders for bad credit determine, based on this data, that you’re likely to make your mortgage payments on time and in full, you could qualify for better loan terms. Typically, the minimum credit score required for most conventional mortgages is around 620, but there are lending sources still approving 500 credit score home loans if you know where to look.

Can I buy a home with 500 credit score?

If you are talking with traditional lenders, the minimum credit score typically need 500 credit score with a home loan from FHA, but they will likely require a 10% down payment with a credit score between 500 and 579. The FHA does not guarantee home loans for bad credit, but they will consider applications from consumers with low credit scores. There are also Non qualified mortgage companies and private money lenders that offer 500 credit score home loans to borrowers that have compensating factors like larger down-payments, good income and steady employment. The RefiGuide will help you locate finance companies that still offer 500 credit score home loans.

Can you get a home loan with 580 credit score?

FHA borrowers may qualify for a credit challenged mortgage with a credit score of 580 or higher and a 3.5% down payment. Conventional loans, on the other hand, usually require a minimum credit score of around 620. (Fannie Mae and Freddie Mac)

Does home loan pre approval affect credit score?

Getting preapproved for a home loan involves a hard credit inquiry, which can slightly lower your credit score. However, the decrease in score is usually minimal and temporary. For most first time home buyers, the advantages of preapproval far outweigh this minor drawback. Our banks and lenders remain committed to offering a pre-approval for a home loan with low credit score.

How can I get a home loan with no credit?

The Federal Housing Administration provides an excellent option for individuals with no credit history. It allows borrowers to qualify for a no-credit home loan while offering benefits that aren’t available through other mortgage options.

Bad Credit Mortgage Lenders Are More Forgiving Today about Home Loans with Low Scores.

Consider These 5 Poor Credit Home Loan Options:

-

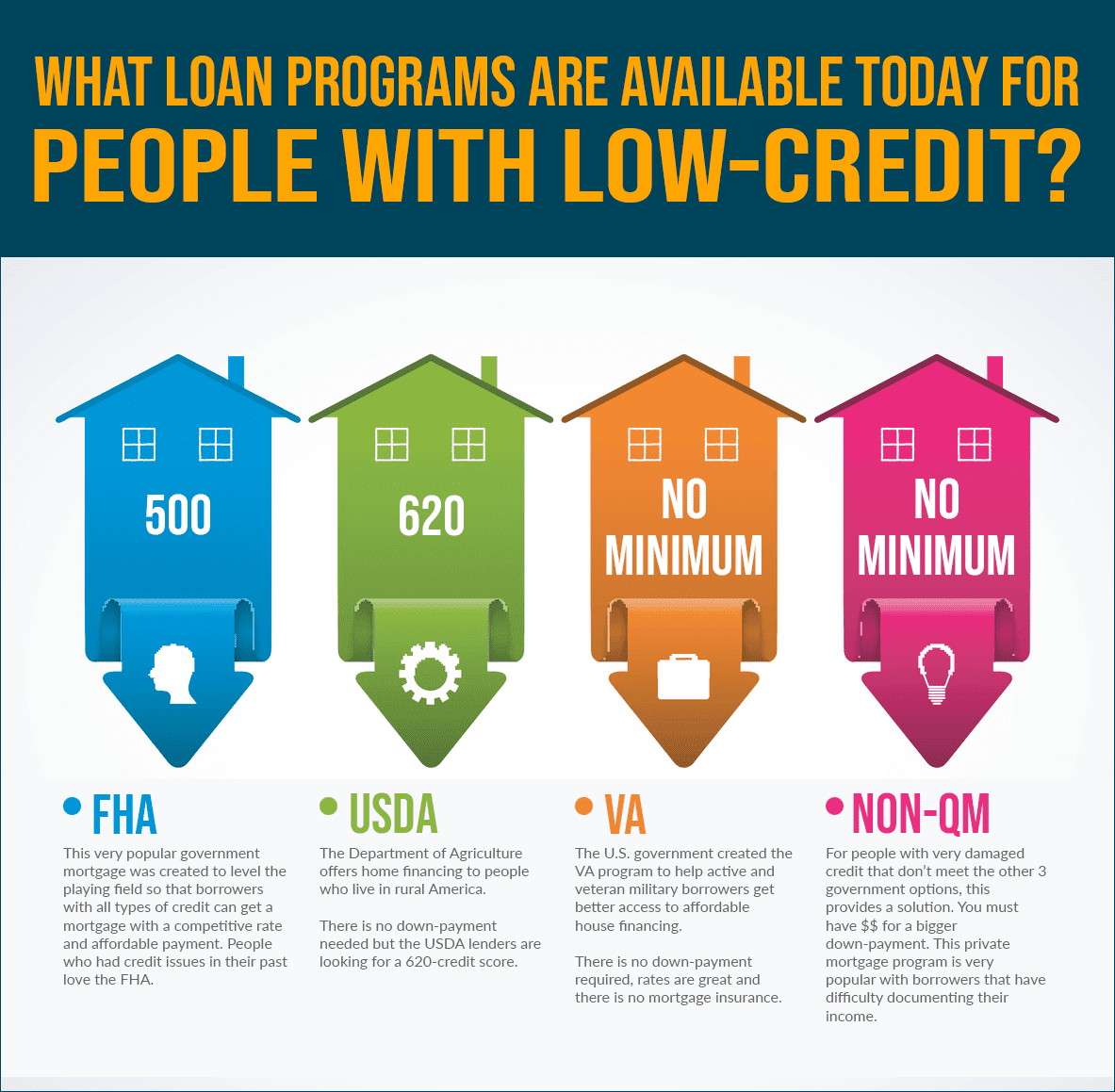

FHA Home Loans for Bad Credit

Your best option for getting a bad credit home loan is the Federal Housing Administration. This is one of the original, government backed mortgages that has been helping home-buyers for more than 70 years. FHA programs are offered by traditional mortgage lenders, but they are secured by FHA, meaning that if you do not pay your mortgage, the FHA will reimburse the lender.

This additional security encourages more lenders to loan to people with average or poor credit. In many cases, to qualify for low credit home loans backed by the FHA, you need to have a 580 or better credit score, but the exact credit requirements will vary by lender. Also, you can get approved for FHA loan financing with a poor credit score in many cases with just a 3.5% down payment. The credit score range and income standards are quite forgiving on these poor credit home loans given that they are backed by the FHA.

Remember you will need to pay both an upfront and annual mortgage insurance premium. While mortgage insurance on bad credit home mortgage loans with FHA has getting more expensive, a poor credit borrower really cannot do much better than an FHA insured home loan for bad credit. One of the easiest ways that people today can buy a house even with bad credit is to get an home loan insured by the FHA.

You would be surprised just how easy it can be to get one of these government-backed loans. The FHA mortgage is guaranteed by Federal Housing Administration so that if you do not pay the loan, the lender is paid back most of what it is owed. It is the guarantee that is what makes it so much easier today for a bad credit borrower to get a home loan. During and directly after the mortgage crash, most lenders including FHA approved ones tightened their lending standards. It was hard to get home loans for poor credit. But now things have evolved and loosened up.

Compare Terms on the FHA Mortgage

Today, one can get an FHA loan with 3.5% down with a FICO score of 580. That is a pretty poor credit score, but with sufficient income, it is indeed possible. It is theoretically possible to get FHA loans with only a 500-credit score. There are people with a recent bankruptcy who do not have a credit score that bad! Of course, it will be easier to get a loan if you have a credit score over 600. Anyone with at least a 620-credit score should have a fairly easy time being approved if they have enough income.

Several years ago, it would have been hard to qualify for a low credit home loan with FHA if you had a recent bankruptcy, but now, it is easier than ever. Because of the lender guarantee, you also will be able to get a very low interest rate, believe it or not, even if you have a lower credit score. With all the expanded programs being announced this year, it makes a lot of sense to research mortgage lenders for bad credit because you may find a good fit. The FHA credit score range varies from 580 to 640 fico scores for most approved lenders in the U.S. today.

-

Fair Credit Home Loan Backed by the USDA

If you have poor credit and are looking to live in a rural area, a USDA loan could be just what you need. The USDA offers zero-down mortgage loans to people with low and moderate incomes in rural areas. The loans can also be for some suburban homes as well, depending upon the location. The loan can include closing costs and the interest rates are very competitive.

As with FHA loans, the credit and income criteria are quite flexible and getting a home loan with fair credit is quite possible. The loan funds also can be used in part to do repairs on the property. Another excellent option for the bad credit borrower today is the USDA loan. This program is designed for people seeking a home loan with fair credit scores and lower income who are buying in a more rural area. USDA loans are not promoted for bad credit borrowers, rather lower income households that have average or good fico scores.

The criteria to be approved are extremely flexible and the program is backed by the USDA. If you do not pay the loan, the lender is reimbursed. So, you can get a loan with a very reasonable interest rate. USDA financing is one of the most popular home loans with fair credit scores.

-

VA Home Loans for Limited or Poor Credit

Can I get a VA home loan with bad credit? For military veterans or active military, you cannot beat the VA loan program. It is similar to the FHA insured financing in that it is secured and backed by the Department of Veterans Affairs. It has been designed to encourage mortgage lenders for bad credit to give loans to members of the military, who often have a low or moderate income.

The military offers some of the best VA loans for bad credit because there is no minimum credit score requirement and these loans are 100% guaranteed by the VA. The loan does not require a down payment, as long as the property appraises for the amount you are borrowing. There is still no down payment required with bad credit VA home loans.

Did you know that VA home loans with bad credit do not have any mortgage insurance? This is a fantastic deal for military vets with poor credit. VA loans are issued to people with who have military experience or are active duty military.

This program is very easy to qualify for, with very flexible credit and debt to income criteria. This is one of the few programs for bad credit borrowers still available where they can get 100% financing as well. If you have military experience, you would be very wise to see if you qualify for a VA loan with a bad credit score. Find out what the 2024 VA requirements are as soon as possible.

-

Non-QM Loan

The Dodd-Frank laws changed many of the rules for banks, credit unions and mortgage lenders. However, many private money and non-prime lenders created new mortgage options for people with poor credit. The non-qualified loan programs opened the door back up for borrowers that had difficulty documenting their income.

The non-QM loans were not the same as the previous versions of stated-income loans, but they helped a lot more self-employed consumers find a solution to buy or refinance a home. The down payment requirement for non QM loans ranges from 10 to 25% depending upon your credit scores.

-

Fannie Mae HomeReady

The Fannie Mae HomeReady program permits non-traditional credit assessment. It accepts credit scores as low as 620, although this threshold is subject to annual adjustments. For home mortgages requiring manual underwriting, a minimum credit score of 660 applies for 1-unit properties, while 2- to 4-unit properties necessitate a minimum credit score of 680. These conventional loans have been popular for decades.

The baseline representative credit score is 620. In cases of manually underwritten loans, the determining factor is the higher of the 620 representative credit score or the average median credit score, as applicable, or the minimum representative credit score dictated by any specific variances. The Fannie HomeReady is considered an attractive home loan for fair credit borrowers. The down payment requirement for this loan ranges from 3 to 10% depending on the scores on your credit report.

What You Need to Know About Mortgage Approvals and Poor Credit

Both Fannie Mae and Freddie Mac have software programs that they use that will automatically approve many loans based upon credit score, total debts, and income. This is referred to as automated underwriting.

If you presently have poor credit scores, you may not be a candidate for automatic underwriting. But the lender still may be able to approve you via manual underwriting. It makes sense to get a pre-approval in writing before making any commitments. Learn how to get a pre-approval for a FHA mortgage today.

Some mortgage companies for bad credit will still allow the loan application to be approved if you have a low credit score. But you may need to have something else to compensate for it. For example, if you have a 590 credit score, you may have trouble being approved for many poor credit home mortgages.

But if you can put more money down or have several months of cash reserves, you may be able to get approved. Or, if you can prove that you paid your rent on time for the last 12 months, you may be able to get the green light. Learn more about the minimum credit scores for a mortgage this year in our recently published guide.

Alternative Fair Credit Home Financing Options Being Rolled Out

Experts in the mortgage industry say you may be able to boost your chances for a loan approval by trying some or all of the following:

- Pay all of your bills and credit card payments on time for at least a year before you apply for a mortgage. Recent payment history is more important for mortgage approval than a spotty payment record three years ago.

- Pay your rent on time for at least a year before you apply for a mortgage. Showing that you are paying your housing payment on time is a major plus.

- Save up to put more money down. If you can put down 20%, you will be able to convince many mortgage companies that you are a good risk.

- If you have to get a higher interest, bad credit home loan, keep your nose clean for two years and pay everything on time. After that, you may be able to refinance into a low interest conventional loan.

- 2nd mortgage programs may be available for people with a checkered past being reported on their credit report, but more equity will likely be required. Ask about home equity loans for bad credit to see if your lender or broker has access to this kind of alternative program.

Today there are more options than ever for people who have poor credit and want a home loan. For the vast majority of borrowers with low fico scores, bad credit home loans insured by the FHA is your best bet, unless you are a military veteran; in that case, go for VA loans.

If you apply at several approved FHA lending sources you may not be approved at every one. Experts advise you to keep shopping until you find a lender who will work with you.

The Evolution of Bad Credit Home Loan Programs

A decade ago, getting approved for a bad credit home loan was pretty simple. Lenders were much laxer in verifying income and checking that debt to income ratios were not too high. These loans were often called subprime loans. Today, brokers and lenders for bad credit will often refer to these as, a non-qualified mortgage, AKA, Non QM loan.

They also did not care as much if you had bad credit. There even were no income verification loans, also referred to as no doc loans. These easy to obtain mortgage loans meant that many people who could not really afford a home bought one. This led in part to the mortgage crash when millions of people could no longer afford their homes.

How Home Loans for Bad Credit Differ from “A” Paper Mortgage Programs

Subprime or low credit loans usually have rates above that of prime loans, although there are exceptions we will discuss below. Home loan companies for bad credit usually have to increase the interest rate on the loan based upon the risk. If you are a first time home buyer with bad credit you need to be prepared and organized so you can fully understand your financing options.

Some bad credit loans may feature a balloon payment, pre-payment penalty or even have penalties for both. The pre-payment penalty is a fee that you pay if you pay off the loan before the end of the loan term. This early payoff off might occur if you sell the property or refinance. A mortgage with a balloon payment means that the borrower must pay off the balance in one large sum after a certain time period passes. That time period normally is five years.

Today, getting loans for bad credit is more difficult, but it is easier than many thinks. The subprime loan programs available have evolved somewhat. Keep reading to discover what you need to do today to get a home loan with bad credit.

Some Bad Credit Home Loans Also Require You to Put More Money Down

In the aftermath of the mortgage crash, many bad credit loans disappeared. But today, more and more lenders offer borrowers second chance opportunities in the form of house loans with bad credit. And many of the above features of bad credit loans are no longer in play, in some cases.

poor-credit house loans have changed a lot over the last 20 years. There was a time when almost anyone could get a home loan without producing proof of income. Those days are over.

However, after the crash, it was very hard for people without good credit to get any type of home loan. Those days also are over. Now, you may get a poor credit home loan with 600 or lower credit. If you can show you are on firm financial ground and have the income to pay the mortgage, having bad credit is no longer an obstacle.

How to Get Bank Approved for a Home Loan with Poor Credit, Late Payments, Etc.

Being afraid of a home loan denial has led to many renters with bad credit to not even bother applying for a mortgage.

Being afraid of a home loan denial has led to many renters with bad credit to not even bother applying for a mortgage.

It is the case that getting a mortgage in 2025 is more difficult than 2005. But it is often a mistake to think that people with poor credit cannot get a home loan.

Today, many bad credit loan companies simply need to verify your income on paper to ensure that you have the financial ability to pay the loan.

What caused the last market crash was less ‘bad credit,’ and more about lenders approving people for loans without verifying carefully their ability to pay. That all has changed in the last 10 years.

Banks today will verify (they have to, it’s the law) that you can pay the loan by verifying your debt, income and your credit score.

You can often get approved for a mortgage at a reasonable interest rate even with a bad credit score, IF you have the income and acceptable debt to income ratio. If you have poor credit and having been wondering if you can get a home of your own, read this article and then talk to your mortgage lender to see what is possible.

Credit Score Isn’t Everything

Your credit score is one part of the mortgage qualification process, but it not everything.

There are many credit scores today where you can get a home loan. Generally speaking, credit scores break down like this:

- 740 and higher = excellent

- 661 to 739 = good

- 601 to 660 = fair

- 501 to 600 = poor

- 500 or lower = bad

After the market crash, it was tough sledding for a while to get a home loan with under a 700 credit score, but things are very different now.

As of 2020, 33% of loans that were closed that year were for borrowers with a sub-700 credit score. We are hearing that the number of approved home loan applications for people with bad credit rose rapidly this year.

More Appealing Options on Home Loans for People with Bad Credit Being Announced

Many potential buyers with bad credit do not realize how easy it is to get approved for some home mortgages, such as those backed by the Federal Housing Administration. FHA-insured mortgages are offered by some HUD-approved lenders who will accept fairly low credit scores. Some approved government lenders will provide you with a home loan even if you have a credit score as low as 500.

More bad credit mortgage lenders will give you a loan if you have a credit score of 580 or higher. Let’s be frank – a 580 credit score is fairly bad. But still, FHA loans for poor credit can be approved at this level if you have an acceptable income and debt to income ratio. FHA home loans for bad credit also are available with only a 3.5% down payment even if you have a score as low as 580. That’s a great deal.

Can I Really Get Approved for a VA Home Loan with Low Credit Scores?

If you have been in the military or are currently serving, one of the best options for getting a home loan is a VA loan.

If you have been in the military or are currently serving, one of the best options for getting a home loan is a VA loan.

These loans feature have no down payments and you do not have to pay mortgage insurance.

But what about credit score? How high does your FICO score need to be to qualify?

Well, the good news is the VA does not feature a minimum credit score requirement.

Each lender that is in the VA approved lender network sets its own guidelines on credit score requirements.

Depending upon the lender you choose, you may need a higher or lower credit score than others.

Credit Score Requirements on VA Home Loans

The VA has no minimum credit score to get a VA loan. But VA lenders are not required to follow VA credit score standards.

Most lenders will set a minimum score of 620 or more. But there are bad credit loan companies who may take loan applications from those with lower scores. On average, the credit score range scales from 580 to 620 depending upon the mortgage company.

The key to buying a home with a lower FICO score is to find the right mortgage lender who will work with you to help you get a home loan approved. For people with a low credit score seeking a home loan, you could get approved if you meet these criteria:

- Have little to no debt in collections

- No judgements are outstanding against you

- You have a steady current income

- You have not had more than one late debt payment in the past year

If your bad credit is due to unusual circumstances, such as a bankruptcy or foreclosure a few years ago, and have since been paying bills on time, you could still be considered for a home loan if you give a reasonable explanation. It is up to the lender’s discretion whether or not you will get the loan. Talk to lenders to see if you qualify for a mortgage after a bankruptcy.

Generally speaking, it is possible to get approved for a VA loan with a very low credit score. There are lenders that will work with a borrower with a credit score in the low 600’s and even high 500s. It is true that you will increase your odds of approval if you have a higher score; more lenders are willing to work with you if you have a score of 620 or higher. But it is possible to become a home owner with a VA home loan with a low credit score.

More FAQs for Bad Credit Home Loans

What is Loan Pre-Approval and How Does It Work?

Pre-approval involves receiving a statement or letter from a bad credit lender outlining the approved amount for purchasing a home and the corresponding potential interest rate. The process typically involves submitting documents such as bank statements, pay stubs, tax forms, and employment verification. Once pre-approved, you’ll obtain a mortgage pre-approval letter. This letter serves as a valuable tool when viewing homes and making offers. Ideally, obtaining pre-approval for a no credit home loan at the beginning of your home-buying journey, before exploring properties, is advisable for a smoother and more informed house-buying process.

How to Improve Your Chances to Be Approved for a Loan that Meets Your Needs

If you have a low credit score, experts recommend that you do the following to get approved on your home loan:

- Show financial stability for the last 12 months. Lenders care less about credit score with FHA and some Fannie and Freddie loans than they do about financial stability. They do not want to see a lot of late payments on your credit report in the last 12-24 months. If you had a job loss three years ago and your credit score tanked, that is not a fatal blow.

- Show a reasonably low debt to income ratio. Lenders want to see that you have a financial cushion. Bad credit lenders know that home ownership comes with additional costs above and beyond the mortgage payment. You should not be throwing your last dime into your monthly mortgage payment as these situations often lead to foreclosure eventually.

- Don’t have any recent loan defaults. Having a car loan that defaulted recently on your credit is bad news. This is much worse than having something like a late school loan payment six months ago.

- Have more down payment. If your score is below 640 or so, it will help if you are able to put more money down.

- Have steady work. The lender will verify that you have been working the same job or at least the same industry for the last two years.

The Bottom Line with Home Loans for Bad Credit Opportunities

Remember that getting a mortgage today is much easier than a few years ago, especially with loans for bad credit. If you can demonstrate a solid income and being reasonably stable financially for the last 12-24 months, a 600-credit score won’t necessarily sink your application.

References: Retrieved from Mortgage Possible with Credit Problems. (n.d.). and CNBC Fico Scoring