Refinance mortgage rates in February 2026 have dropped to their lowest levels since September 2022, providing significant relief to homeowners following the Federal Reserve’s three consecutive rate cuts in late 2025. Homeowners looking to secure a mortgage refinance can expect average rates around 6.0% for a 30-year fixed and approximately 5.35-5.45% for a 15-year fixed mortgage, according to Freddie Mac’s Primary Mortgage Market Survey as of February 19, 2026 Freddie Mac. Adjustable-rate refinance loans offer competitive initial rates, though specific ARM data varies by lender and individual qualifications.

Shop and Compare the Today’s Best Mortgage Refinance Rates Online

Below we provide a detailed overview of current national averages, a comparison of top lenders with the lowest and best refinance mortgage rates today, and examples of monthly payments at these interest rates.

The RefiGuide also offers expert guidance on how to choose the best refinance option for your financial goals.

Take advantage of our rates guide that provides a side by side analysis for the top banks and lenders competing for the best refinance mortgage rates in 2026.

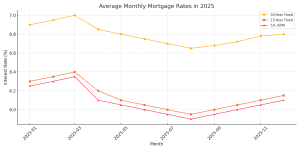

Current National Average Refinance Mortgage Rates (February 2026)

As of late February 2026, refinance mortgage rates have reached their lowest point in over three years following the Federal Reserve’s series of rate cuts in late 2025 (three reductions totaling 75 basis points). Understanding current market rates helps homeowners evaluate whether refinancing aligns with their financial goals and existing loan terms.

Current Refinance Rate Landscape

According to Freddie Mac’s Primary Mortgage Market Survey and data from Bankrate and Mortgage News Daily for February 2026 Mortgage Rates – Freddie Mac +2, average refinance rates demonstrate the following patterns:

30-Year Fixed Refinance: 6.00% to 6.10% APR

The 30-year fixed-rate refinance remains the most popular loan term, offering payment stability and predictability. Freddie Mac reports an average rate of 6.01% as of February 19, 2026, down from 6.09% the previous week Bankrate’s survey of major lenders indicates refinance rates averaging 6.49% to 6.56% Bankrate, while some individual lenders are offering rates in the high 5% range for well-qualified borrowers. The Annual Percentage Rate (APR), which incorporates lender fees and closing costs, typically runs 0.15% to 0.25% higher than the base interest rate.

This rate level represents the lowest point since September 2022 and a significant decrease from early 2025 peaks above 7%. A year ago at this time, the 30-year FRM averaged 6.85% Freddie Mac. Refinance application activity has more than doubled over the past year, enabling many recent buyers to reduce their annual mortgage payments by thousands of dollars.

15-Year Fixed Refinance: 5.35% to 5.50% APR

Shorter-term mortgages carry lower interest rates due to reduced lender risk exposure. Current 15-year fixed refinance rates average 5.35%, according to Freddie Mac data for February 19, 2026, down from 5.44% the previous week Freddie Mac. This shorter amortization period generates substantial lifetime interest savings compared to 30-year terms but requires higher monthly payments.

Freddie Mac’s weekly survey confirms this rate advantage, with 15-year fixed rates consistently running 0.60% to 0.75% below comparable 30-year products. Borrowers with strong credit profiles (740+ FICO) and significant equity positions (80% loan-to-value or better) may qualify for rates in the 5.30% to 5.45% range. A year ago at this time, the 15-year FRM averaged 6.04% Freddie Mac.

5/1 Adjustable-Rate Mortgage (ARM) Refinance

Adjustable-rate mortgages provide initial fixed-rate periods before transitioning to variable rates tied to market indices. The 5/1 ARM—fixed for five years, then adjusting annually—currently offers competitive initial rates that in some cases are similar to or only slightly below fixed-rate products. This hybrid structure may offer modest rate advantages over fixed-term products but introduces future payment uncertainty after the fixed period expires.

Homeowners with shorter term lending plans tend to see ARMs as advantageous. Homeowners considering ARM refinancing should carefully evaluate their financial timeline and risk tolerance, particularly given current economic uncertainty regarding future rate direction and the Federal Reserve’s stance on additional rate adjustments in 2026.

As of February 2026, 5/1 adjustable-rate mortgage refinance rates are competitive with fixed-rate products, averaging approximately 6.0-6.3% APR for the initial five-year fixed period according to current market data. After the initial period, rates adjust annually based on market indices. To qualify for the best 5/1 ARM refinance rates, borrowers typically need a credit score of 740+ and loan-to-value ratio of 80% or better (20%+ equity). Borrowers with 680-720 credit scores can still qualify but may face rates 0.25-0.75% higher. Lower credit scores (620-680) result in significantly higher rates or potential denial. 5/1 ARMs suit homeowners planning to sell or refinance within five years.

7/1 ARM Refinance:

As of February 2026, 7/1 adjustable-rate mortgage refinance rates range from approximately 6.1-6.5% APR for the initial seven-year fixed period, offering slightly longer rate stability than 5/1 ARMs. After seven years, rates adjust annually based on market conditions. Qualification requirements for optimal 7/1 ARM refinance rates include a credit score of 740+ and maximum 80% loan-to-value ratio (20% equity minimum). Borrowers with 680-720 credit scores face rate premiums of 0.25-0.75%, while those below 680 may see rates increase 1.0-2.0% or experience difficulty qualifying. The extended fixed period appeals to homeowners seeking payment predictability longer than five years but maintaining rate advantages over 30-year fixed mortgages.

Market Context and Outlook

According to Sam Khater, Freddie Mac’s Chief Economist: “This lower rate environment is not only improving affordability for prospective homebuyers, it’s also strengthening the financial position of homeowners” Freddie Mac. The Federal Reserve held rates steady at its first meeting of 2026 after three consecutive cuts in late 2025, with no Fed meeting scheduled for February

Rate Variation Factors

Published average rates represent general market conditions, but individual borrower quotes vary significantly based on multiple underwriting factors:

Credit Score Impact: According to Freddie Mac data, borrowers with credit scores above 760 receive rates approximately 0.50% to 1.00% lower than those with scores in the 680-720 range. Scores below 680 face additional premium pricing or may not qualify for conventional refinancing at all.

Loan-to-Value Ratio (LTV): Equity position substantially affects rate offerings. Borrowers with LTV ratios at or below 80% (20%+ equity) qualify for optimal pricing. LTV ratios between 80% and 90% typically incur 0.25% to 0.50% rate premiums, while ratios above 90% face significantly higher costs and may require private mortgage insurance (PMI).

Loan Amount: Conforming loans (within Fannie Mae/Freddie Mac limits of $766,550 for most areas in 2026) receive preferential pricing. Jumbo loans exceeding these limits face rate premiums of 0.25% to 0.75% due to increased lender risk and inability to sell loans to government-sponsored enterprises.

Property Type and Occupancy: Primary residences receive the most favorable rates. Second homes typically carry 0.25% to 0.50% rate premiums, while investment properties face 0.50% to 1.00% additional costs. Single-family detached homes qualify for better rates than condominiums, multi-unit properties, or manufactured homes.

Geographic Location: State-specific lending regulations, local market conditions, and property value trends create regional rate variations. Competitive lending markets in states like California, Texas, and Florida often offer slightly better pricing than less populated regions with fewer lender options.

Debt-to-Income Ratio: Borrowers with DTI ratios below 36% demonstrate strong repayment capacity and qualify for preferential pricing. DTI ratios between 36% and 43% remain acceptable but may incur modest rate adjustments, while ratios approaching 50% face significant underwriting scrutiny and potential rate premiums.

Comparing Purchase to Refinance Rates

Refinance rates consistently run 0.125% to 0.375% higher than equivalent purchase mortgage rates. This pricing differential reflects the statistical reality that refinance loans carry slightly higher default risk than purchase mortgages. Lenders compensate for this increased risk through rate premiums.

For example, while 30-year fixed purchase rates averaged 6.08% in late January 2026 (per Mortgage News Daily), comparable refinance rates averaged 6.21%—a 0.13% premium. This pattern holds across all loan products and terms.

Data Source Methodology: The rates cited represent comprehensive market surveys from authoritative sources.

Freddie Mac Primary Mortgage Market Survey: Weekly survey of conventional conforming mortgages offered by major lenders nationwide, representing approximately 80% of U.S. mortgage originations. Survey methodology involves direct lender reporting of actual loan terms offered to qualified borrowers.

Mortgage News Daily: Real-time aggregation of mortgage rate data from lenders across all 50 states, updated continuously throughout business days. This platform provides the most current market snapshot, reflecting intraday rate movements driven by bond market activity.

Bankrate National Survey: Weekly compilation of rates from the 10 largest banks and mortgage lenders in 10 major U.S. metropolitan markets. Survey assumes standardized borrower profiles (740 FICO, 80% LTV, $300,000 loan amount) to enable direct comparisons.

These complementary data sources provide comprehensive market coverage, balancing real-time precision (Mortgage News Daily) with standardized comparisons (Bankrate) and historical trend analysis (Freddie Mac).

When Will Refinance Rates Go Down in 2026?

Mortgage rate trajectories depend on complex interactions between Federal Reserve monetary policy, inflation trends, Treasury bond yields, and broader economic conditions. Understanding these dynamics helps homeowners make informed timing decisions regarding refinancing opportunities.

Federal Reserve Policy Impact

The Federal Reserve completed three quarter-point rate cuts in late 2025 (September, November, and December), reducing the federal funds rate target range to 4.25%-4.50%. However, contrary to many expectations, mortgage rates did not decline proportionally. In fact, the 30-year fixed mortgage rate increased from approximately 6.08% in September to 6.72% by late December before moderating to current 6.19%-6.23% levels.

This counterintuitive movement reflects the bond market’s forward-looking nature. Mortgage rates track 10-year Treasury yields more closely than the federal funds rate. When the Fed announced its cutting cycle while simultaneously projecting higher-than-expected inflation and stronger economic growth, Treasury yields rose—pulling mortgage rates higher despite Fed rate cuts.

For 2026, the Federal Reserve’s Summary of Economic Projections indicates expectations for just one additional quarter-point rate cut, suggesting a pause in the easing cycle. Fed Chairman Jerome Powell has emphasized a data-dependent approach, noting that inflation remains above the 2% target and the labor market continues demonstrating resilience.

Economic Indicators to Monitor

Several key metrics influence mortgage rate direction:

Inflation Data: The Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) price index provide critical inflation measurements. If inflation continues moderating toward the Fed’s 2% target, this would support rate declines. Conversely, persistent elevated inflation could prompt Fed policy tightening or extended higher rate maintenance.

Employment Reports: Strong job growth and low unemployment signal economic strength but can also indicate inflation pressure, potentially keeping rates elevated. The monthly non-farm payrolls report and unemployment rate provide key labor market insights.

GDP Growth: Robust economic expansion can sustain higher interest rates as borrowing demand remains strong. Slowing growth typically correlates with declining rates as the Fed accommodates economic weakness.

Treasury Yields: The 10-year Treasury note yield serves as the primary benchmark for mortgage rates. Daily monitoring of this indicator provides early signals of mortgage rate direction changes.

Expert Rate Forecasts for 2026

Financial analysts and economists offer varied perspectives on 2026 rate trajectories:

Mortgage Bankers Association (MBA): Projects 30-year fixed mortgage rates averaging 6.3% in Q1 2026, declining to 6.0% by Q4 2026, reflecting gradual economic cooling and continued but measured Fed easing.

Fannie Mae Economic & Strategic Research Group: Forecasts rates averaging 6.4% in early 2026, moderating to 6.1% by year-end, citing sticky inflation and strong economic fundamentals that limit rate decline potential.

Freddie Mac: Anticipates rates remaining in the 6.0% to 6.5% range throughout 2026, with limited dramatic movements absent significant economic shocks or accelerated inflation cooling.

These forecasts suggest modest rate improvements rather than substantial declines. Homeowners expecting a return to sub-4% rates face disappointment, as structural economic factors make such levels unlikely in the near term.

Strategic Timing Considerations

Rather than attempting to perfectly time market bottoms, homeowners should evaluate refinancing based on their specific circumstances:

The “1% Rule”: Traditional guidance suggests refinancing when you can reduce your rate by at least 1 percentage point, ensuring closing costs are recouped through payment savings within a reasonable timeframe (typically 2-3 years).

Break-Even Analysis: Calculate your break-even point by dividing total refinance costs by monthly payment savings. If you plan to remain in the home beyond this timeframe, refinancing likely makes financial sense regardless of future rate movements.

Rate-Lock Strategies: Once you identify favorable rates, consider locking quickly rather than gambling on further declines. Mortgage rates can increase as rapidly as they decrease, and delaying can result in missed opportunities.

Continuous Monitoring: Even if current rates don’t justify refinancing, regularly checking rates (monthly or quarterly) positions you to act quickly when opportunities emerge. Bankrate senior analyst Ted Rossman notes that “if you have good credit and shop around, you can already get rates in the 6’s,” suggesting current conditions may already be opportune for some borrowers.

Market Volatility Reality

Mortgage rates fluctuate daily—sometimes substantially—based on bond market reactions to economic data releases, geopolitical events, and Federal Reserve communications. This volatility means “perfect timing” is impossible to achieve consistently.

Fortune’s mortgage analysis emphasizes that “refinancing involves closing costs, so it’s important to consider when it’s beneficial.” This practical perspective acknowledges that timing considerations must balance potential rate improvements against the certainty of upfront costs.

Top 10 Lenders Offering the Best Refinance Rates Today

Many banks and mortgage companies are advertising competitive refinance rates in 2026. Below is a comparison table of 10 leading lenders known for some of the lowest refinance mortgage rates available today (for top-tier borrowers). These rates are as of December, 2025 and assume a conventional refinance; actual APRs may include points or fees. (Lenders marked N/A for certain ARM products may not widely offer that loan type.) The RefiGuide ranks the top 10 mortgage lenders for today’s refinance rates.

| Lender | 30-Year Fixed Refi | 15-Year Fixed Refi | 5/1 ARM Refi | 3/1 ARM Refi |

|---|---|---|---|---|

| Chase | 6.01% (as low as APR)¹ | 5.35% (as low as APR)¹ | 6.00% (as low as APR)¹ | N/A (not typical) |

| Bank of America | 6.10% (rate)² | 5.40% (rate)² | 6.15% (rate)² | N/A (not offered) |

| LoanDepot | 6.05% (rate)² | 5.38% (rate)² | 6.10% (est.)³ | N/A |

| Guaranteed Rate (Rate.com) | 6.15% (rate)² | 5.45% (rate)² | 6.12% (est.)³ | N/A |

| Rocket Mortgage (Quicken) | 6.20% (avg)² | 5.50% (avg)² | 6.15% (avg)³ | N/A |

| SoFi | 6.08% (est.)² | 5.42% (est.)² | 6.05% (est.)³ | N/A |

| Navy Federal CU | 5.88% (as low as rate)⁴ | 5.25% (as low as rate)⁴ | 5.85% (initial rate)⁴ | 5.75% (initial rate)⁴ |

| PenFed Credit Union | 5.95% (as low as rate)⁴ | 5.30% (est.)⁴ | 5.90% (est.)⁴ | 5.80% (est.)⁴ |

| Citizens Bank | 6.25% (rate)² | 5.55% (rate)² | N/A (not advertised) | N/A |

| U.S. Bank | 6.18% (avg)² | 5.48% (avg)² | 6.10% (est.)³ | N/A |

National Average Benchmarks (February 2026)

| Rate Type | Average Rate | Source |

|---|---|---|

| 30-Year Fixed Refinance | 6.01% | Freddie Mac (Feb 19, 2026)⁵ |

| 15-Year Fixed Refinance | 5.35% | Freddie Mac (Feb 19, 2026)⁵ |

| 30-Year Fixed Refinance | 6.49-6.56% | Bankrate (Feb 25, 2026)⁶ |

| 30-Year Fixed Purchase | 5.76-6.04% | Zillow/Various (Feb 24-25, 2026)⁷ |

Notes: The above “as low as” rates often assume excellent credit (740+) and may require discount points or origination fees. For instance, Navy Federal Credit Union is currently advertising 5.75% for a 3-year ARM with 0.25 points (5.95% APR) and 5.88% for a 30-year fixed with 0.5 points (6.02% APR) – among the lowest rates in the market as of February 2026, reflecting the sharp decline in mortgage rates to their lowest levels since September 2022 (Freddie Mac, 2026). PenFed Credit Union similarly offers competitive rates around 5.80% for 3/1 ARMs and 5.95% for 30-year fixed refinances with member benefits. Many lenders (especially big banks) do not actively offer 3/1 ARMs, focusing instead on 5/6, 7/6, or 10/6 ARMs (fixed 5, 7, or 10 years, then adjusting semi-annually). Always compare APR vs. interest rate when shopping – a lower rate may come with higher fees, so the APR provides a better apples-to-apples comparison of total loan cost. For example, a lender advertising 5.88% with 1.5 points may have a 6.15% APR, while another offering 6.01% with minimal fees shows a 6.08% APR – making the second option less expensive overall despite the higher rate. It’s wise to get quotes from multiple lenders. Our list of best refinance mortgage lenders 2026 is a starting point, but you should request personalized estimates based on your credit score, loan-to-value ratio, and financial situation. Compare the 3/1 and 5/1 ARM rates.

Mortgage Refinance Monthly Payment Examples at Current Rates

Refinancing changes your monthly principal and interest payment. The table below illustrates approximate monthly payments for various loan amounts at the current average rates (from the national averages above). We show payments for a 30-year fixed, 15-year fixed, 5/1 ARM, and 3/1 ARM, assuming the average interest rate for each. (Taxes and insurance are not included, since those vary widely.)

Using these examples as a guide (or a refinance payment calculator), you can see how loan term and rate impact your monthly cost:

| Loan Amount | 30-Year Fixed @ ~6.9% | 15-Year Fixed @ ~6.3% | 5/1 ARM @ ~6.3% | 3/1 ARM @ ~6.0% |

|---|---|---|---|---|

| $200,000 | ~$1,320 /mo | ~$1,718 /mo | ~$1,243 /mo | ~$1,200 /mo |

| $300,000 | ~$1,982 /mo | ~$2,577 /mo | ~$1,865 /mo | ~$1,799 /mo |

| $450,000 | ~$2,973 /mo | ~$3,866 /mo | ~$2,797 /mo | ~$2,698 /mo |

| $650,000 | ~$4,294 /mo | ~$5,584 /mo | ~$4,040 /mo | ~$3,897 /mo |

| $750,000 | ~$4,955 /mo | ~$6,443 /mo | ~$4,662 /mo | ~$4,497 /mo |

In the above table, the 30-year fixed has the lowest monthly payment for a given loan size, while the 15-year fixed has a much higher payment. For example, a $300,000 refinance would be about $1,980 per month on a 30-year term, versus about $2,580 per month on a 15-year term – but the 15-year loan saves tens of thousands in interest and is paid off in half the time. The ARM loans (5/1 and 3/1) show lower initial payments thanks to their teaser rates. A $300,000 loan on a 5/1 ARM at ~6.3% starts around $1,865 per month, even lower than the 30-year fixed payment. However, remember that ARM rates will reset after the fixed period (5 years for a 5/1 ARM, 3 years for a 3/1). Your payment will change once the loan begins adjusting annually, depending on market rates at that time.

These estimates assume a full 30-year amortization for ARMs during the initial fixed-rate period. In reality, if you only keep the ARM for the fixed term, you’d either refinance or pay off/sell before any rate adjustments. The ARM payment advantage is clear in the short run, but you must be prepared for potential rate increases later. Always consider the worst-case adjusted rate to ensure you could afford the refinance payment if you still have the loan after the fixed term.

How to Choose the Best Mortgage Refinance Option

Choosing the right refinance loan type depends on your financial goals and timeframe. Here are some guidelines:

-

Lower Monthly Payment – Go 30-Year Fixed Rate Mortgage Refinance: If your priority is reducing your monthly payment, a 30-year fixed refinance is usually best. Spreading the loan over 30 years yields the smallest payment of the fixed options. For instance, as shown above, the 30-year payment on $450k is about $2,973, versus $3,866 on a 15-year – a huge difference. The trade-off is that the 30-year carries a higher interest rate and you pay interest for a longer period, so you’ll pay more total interest over the life of the loan. This option is good if cash flow relief is key, or if you plan to hold the loan for a long time and want the predictability of a fixed rate.

-

Pay Off Sooner & Save Interest – Consider 15-Year Fixed Rate Refinance: If your goal is to be mortgage-free faster and save on interest, a 15-year fixed refinance is worth considering. The rate on a 15-year loan is typically lower than a 30-year (currently about 0.5–0.7% lower), and you’ll pay it off in half the time. Your monthly payment will be higher (since you’re paying the balance in 180 months instead of 360), but you’ll pay far less interest in total. This option works best if you can comfortably afford the higher payment. Refinancing from a 30-year into a 15-year is a common strategy for homeowners who want to finish paying off their home by retirement, for example. Just ensure that the payment fits your budget without undue strain.

-

Short-Term Ownership or Rate Drops Expected – ARM Refinance: If you don’t plan to keep the loan long – say you might sell the home or refinance again within a few years – an ARM (Adjustable-Rate Mortgage) refinance can make sense. ARMs like the 5/1 or 3/1 offer lower initial rates than 30-year fixed loans. For the first 3 or 5 years, you could save money each month with an ARM. This can be ideal if you know you’ll move before the rate adjusts, or if you strongly expect rates to fall and plan to refinance into a fixed loan before the adjustment. However, ARMs carry risk: if you still have the mortgage when it begins adjusting, the interest rate could rise, increasing your payment. In 2025, the initial rate advantage of ARMs is modest (they’re only about 0.5–0.7% lower than fixed rates on average), so think carefully. ARMs are a good option for borrowers with short horizons – for example, a military family stationed somewhere for 3–5 years might refinance into an ARM to save money, fully expecting to sell the house when they relocate before any rate resets. If you go the ARM route, be sure you understand the adjustment terms, caps, and index. Always budget for the possibility of a higher payment after the fixed period.

-

Compare Costs and Consider Breakeven: No matter which term you choose, pay attention to the closing costs and calculate your “breakeven” – how long it takes the monthly savings to outweigh the costs of refinancing. If you opt for a lower rate with points (prepaid interest), ensure you’ll keep the loan long enough to benefit. The best refinance mortgage option is one that not only gives a good rate but also aligns with your time frame for staying in the home.

In summary, match your refinance to your goals: Choose a 30-year for maximum cash-flow flexibility, a 15-year to build equity faster and pay less interest, or an ARM for short-term savings if you won’t need the loan for long. Always shop around with multiple lenders – rates and fees can vary widely. Our table of the best refinance lenders of 2025 highlights several with excellent rates; use it as a starting point to get quotes. Be sure to compare the APR from each lender (to account for fees) and use a refinance payment calculator or the examples above to gauge your new payment. With the right choice, refinancing can help you achieve a lower rate or better loan term that fits your financial strategy in 2025.

Common Questions for Today’s Mortgage Refinance Rates:

What are today’s FHA rates for mortgage refinancing?

As of February 25, 2026, the national average 30-year FHA refinance interest rate is approximately 6.05-6.25%, with an APR around 6.20-6.40%. These rates represent a significant decrease from late 2025 levels, reflecting the Federal Reserve’s three rate cuts and the overall mortgage market reaching its lowest point since September 2022 (Freddie Mac, 2026). FHA refinance rates can vary based on factors like credit score (minimum 580 for 3.5% down, 500-579 for 10% down), loan amount, upfront mortgage insurance premium (1.75% of loan amount), annual mortgage insurance (0.55-1.05% depending on LTV and loan term), and lender fees. Borrowers with 620-640+ credit scores typically qualify for the most competitive FHA refinance rates. The RefiGuide recommends consulting with multiple FHA refinance lenders to obtain personalized rate quotes, as rates can vary 0.25-0.75% between lenders even for identical qualifications.

What are today’s VA rates for mortgage refinancing?

On February 25, 2026, the average 30-year VA refinance interest rate stands at approximately 5.90-6.15%, with an APR near 6.05-6.30%. VA refinance rates have dropped substantially from December 2025 levels and are currently among the most competitive mortgage products available, often 0.10-0.25% lower than conventional refinances due to the VA guarantee reducing lender risk. VA Interest Rate Reduction Refinance Loans (IRRRLs or “streamline refinances”) may offer even lower rates around 5.85-6.00% with minimal documentation and no appraisal required. VA refinance rates are influenced by credit score (though VA has no minimum, lenders typically require 620+), loan term, VA funding fee (0.5% for IRRRL, 2.3-3.6% for cash-out depending on down payment and first-time use), and lender-specific fees. Veterans with 680+ credit and 20%+ equity access the best rates. The VA funding fee can be financed into the loan but increases the total amount borrowed.

What are today’s second mortgage rates for refinancing?

Second mortgage refinance rates (home equity loans and HELOCs) are typically higher than primary mortgage rates due to junior lien position. As of February 2026, average home equity loan rates range from 7.90-8.15% APR for fixed-rate products, while HELOC rates average 7.25-7.63% APR (variable rates tied to prime). These rates are approximately 1.0-2.0% higher than primary mortgage refinance rates currently around 6.0%. Second mortgage rates for investment properties or vacation homes run even higher at 8.5-9.5% APR due to increased lender risk. Rates vary significantly based on credit score (680-700+ required, 740+ for best rates), combined loan-to-value ratio (80-85% CLTV maximum), debt-to-income ratio (below 43% preferred), and property type. Borrowers with excellent credit (740+) and substantial equity (30%+) may secure rates 0.5-1.0% lower than average. Always compare total costs including origination fees (1-3%) and closing costs.

What are common bond refinance rates?

Bond refinance rates vary significantly based on bond type, issuing agency, and market conditions. As of February 2026, municipal bond refinancing rates range from 3.5-5.5% depending on credit rating and tax-exempt status. USDA Farm Service Agency (FSA) direct farm ownership loans currently offer rates around 5.25-5.50% (down from 5.75% in April 2025), while FSA guaranteed loans through commercial lenders range 6.0-6.5%. Corporate bond refinancing rates vary widely from 4.5-8.0% based on company credit rating and bond maturity. Treasury bond yields (which influence refinancing decisions) show 10-year Treasury notes at approximately 4.15-4.35% as of February 2026. Mortgage revenue bonds for affordable housing programs offer rates around 5.5-6.5%. For current bond refinance rates, consult specific agencies: USDA (farm loans), state housing finance agencies (mortgage revenue bonds), or financial institutions for corporate bond refinancing. Market conditions and Federal Reserve policy significantly impact all bond rates.

What is a rate-and-term refinance?

A rate-and-term refinance replaces your existing mortgage with a new loan to lower the interest rate, change the loan term, or both, without taking cash out. It’s commonly used to reduce monthly payments, shorten the loan term, or switch loan types. Because no equity is withdrawn, rate-and-term refinances typically offer lower rates than cash-out refinances.

Can you refinance into a fixed-rate mortgage?

Yes. Many homeowners refinance into a fixed-rate mortgage to lock in predictable monthly payments and protect against future rate increases. This is especially common for borrowers currently in adjustable-rate mortgages or high-interest loans. Approval depends on credit, income, and equity, but fixed-rate refinancing remains one of the most popular refinance strategies.

Can you refinance an adjustable-rate mortgage?

Yes. You can refinance an adjustable-rate mortgage (ARM) into either another ARM or a fixed-rate loan. Many borrowers refinance before the adjustable period ends to avoid potential payment increases. Timing is important, as refinancing early—before rate adjustments—can help stabilize long-term housing costs and improve financial planning.

Are cash-out refinance rates higher?

Yes. Cash-out refinance rates are usually higher than rate-and-term refinance rates because lenders view them as riskier. You’re increasing the loan balance and tapping home equity, which raises lender exposure. The rate difference can vary based on credit score, loan-to-value ratio, and loan program, but cash-out refis almost always carry a pricing premium. Lenders view cash-out refinances as riskier since they involve borrowing additional funds, leading to slightly elevated interest rates. Also compare the rates for cash out refinance and home equity loans.

Are the rates the same for government and conventional mortgage refinancing?

Not always. Government-backed loans like FHA and VA often offer competitive rates, especially for borrowers with lower credit scores. However, conventional loans may provide better rates for those with strong credit profiles and substantial down payments.

Are land loan refinance rates the same as conventional refinance rates?

No, land loan refinance rates are typically higher than conventional mortgage refinance rates. For instance, as of April 15, 2025, a 3/1 ARM for a building lot may have an interest rate around 7.75%, compared to lower rates for conventional home loans.

Sources and References:

National average rates from Bankrate and Money.com; lender rate data from public postings and surveys Bank Of America, Wells Fargo, Quicken, Chase, LoanDepot, Guaranteed Rate, US Bank, Navy Federal Credit Union rates and mortgage guidance from industry experts. All payments calculated assume principal and interest only. Always consult with lenders for personalized rate quotes.

Holden, A. (2026, February 25). Today’s mortgage and refinance rates, February 25, 2026. Bankrate. https://www.bankrate.com/mortgages/todays-rates/mortgage-rates-for-wednesday-february-25-2026/

Yahoo Finance. (2026b, February 23). Mortgage and refinance interest rates today, February 23, 2026: Looking for a rate below 6%? (How is 5.86%?). https://finance.yahoo.com/personal-finance/mortgages/article/mortgage-refinance-rates-today-monday-february-23-2026-110028639.html

Disclaimer: Mortgage rates and terms are subject to change without notice and may vary based on creditworthiness, loan amount, location, property type, and other factors. The rates displayed on TheRefiGuide.org are for informational purposes only and do not constitute a loan offer or commitment. Final loan terms and approval are provided directly by lenders. Always consult with a licensed mortgage professional or banker to receive personalized rate quotes and verify current rates and eligibility.