FHA loans have been a driving force in the housing industry offering affordable home financing for over five decades. Are you considering an FHA mortgage to buy your next home? If so, you probably have a lot of questions about the FHA loan process and what you need to do to be approved. It is important for perspective house buyers to know what the qualifications are to be approved for an FHA loan.

Find FHA Loans with a Payment You Can Afford from a FHA Mortgage Lender You Trust

This is the ultimate home buyer’s guide below, which explains the process to qualify for an FHA mortgage, so you know what to expect. This free guide will define the updated FHA requirements and rules, so you understand what is needed to qualify for an FHA mortgage loan at a competitive interest rate with the least amount of pain possible. The RefiGuide will help you apply for an FHA loan at a payment you can afford from a lender you trust.

How to Compare FHA Mortgage Rates Today Efficiently

There have been some shifts in FHA mortgage rates. At the start of the current year, rates had held steady at under 4% for nearly half a year.

However, the rates for 30-year mortgages began to climb and have continued their upward trajectory since.

The encouraging news is that potential mortgage rate shoppers seeking FHA loans might still secure fixed rates at affordable levels.

FHA mortgages remain the top choice for individuals whose credit doesn’t meet the requirements for conventional loans.

Even with a credit score in the lower 600s, it’s possible to secure a lower rate compared to conventional loans.

As the current FHA mortgage rates edge higher in response to economic improvement, having an FHA loan can be advantageous for securing a favorable deal.

While mortgage insurance costs are higher with FHA loans, the reduced interest rate often offsets this expense.

Regarding the outlook for FHA rates in the current year, most experts anticipate that they will hover around the mid-4% range by year-end. Historically, both conventional and FHA mortgage rates have remained relatively low, given market conditions.

Therefore, if you are contemplating an FHA loan, the present moment is likely an opportune time to act. It’s anticipated that rates will experience an upturn once the effects of the recent tax cut fully materialize.

Below is more information about how to shop for an FHA loan these days.

Look for FHA Lenders with Experience Approving Lower Credit Scores

Shopping for an FHA loan is easier than a conventional loan. FHA loans are backed by the US government, so lenders can extend credit to you at better terms than you might expect. FHA only has a minimum credit score of 500 to get an FHA loan.

But if you have a credit score under 600, you should start shopping for your FHA mortgage rate by checking with several poor credit score mortgage lenders.

The reason is that FHA approved lenders can have what are called overlays. This simply means lenders have the discretion to require a credit score higher than the 500 minimum set by FHA.

Some FHA approved lenders may have a minimum of 600, 620, or 640. The lower your score, the more lenders you should check. You could find a very similar program with two lenders where one has a rate .5% lower than the other.

Remember to Lock in Your FHA Mortgage Rate Early

As we noted earlier, it appears that rates generally are on the way up this year. Mortgage rates have stayed abnormally low despite the Fed raising the Prime Rate several times in the past 18 months. Rates have edged up in the last few months, but overall FHA mortgage rates remain attractive and competitively priced.

It seems likely this trend will persist. If you plan to close a loan in the next few months, it is smart to lock the rate for as long as you can. Even paying to lock it beyond two months is not out of the question. According to CNBC, interest rates are only going to go up this year as the economy gets even better than it is now.

FHA loans are great products that provide you with a lower than market rate even with average credit. You do have to pay a higher cost for mortgage insurance, but this cost is somewhat offset with the low rate. This means you really should be watching FHA mortgage rates like a hawk if you plan to close soon.

This probably is not a market to let the rate float and hope for lower rates. Time is running out on the artificially low rate environment for all loans – FHA, conventional and others.

FHA Loan Requirements

FHA loans are backed by the Federal Housing Administration. This signifies that every loan endorsed by the FHA enjoys the full backing of the U.S. government’s faith and credit. This assurance implies that in the event of a borrower defaulting on the FHA loan, the Federal Housing Administration assumes responsibility for repaying the lender.

Consequently, numerous FHA-approved lenders can extend favorable credit terms and down payment options to individuals who may not otherwise qualify for a mortgage. FHA loans can secure approval with a 580-credit score and a 3.5% down payment, featuring highly flexible debt-to-income ratios and income requirements. While FHA mortgages are among the easiest to secure approval for in the United States, the duration of the approval and closing process may span several months depending on individual circumstances.

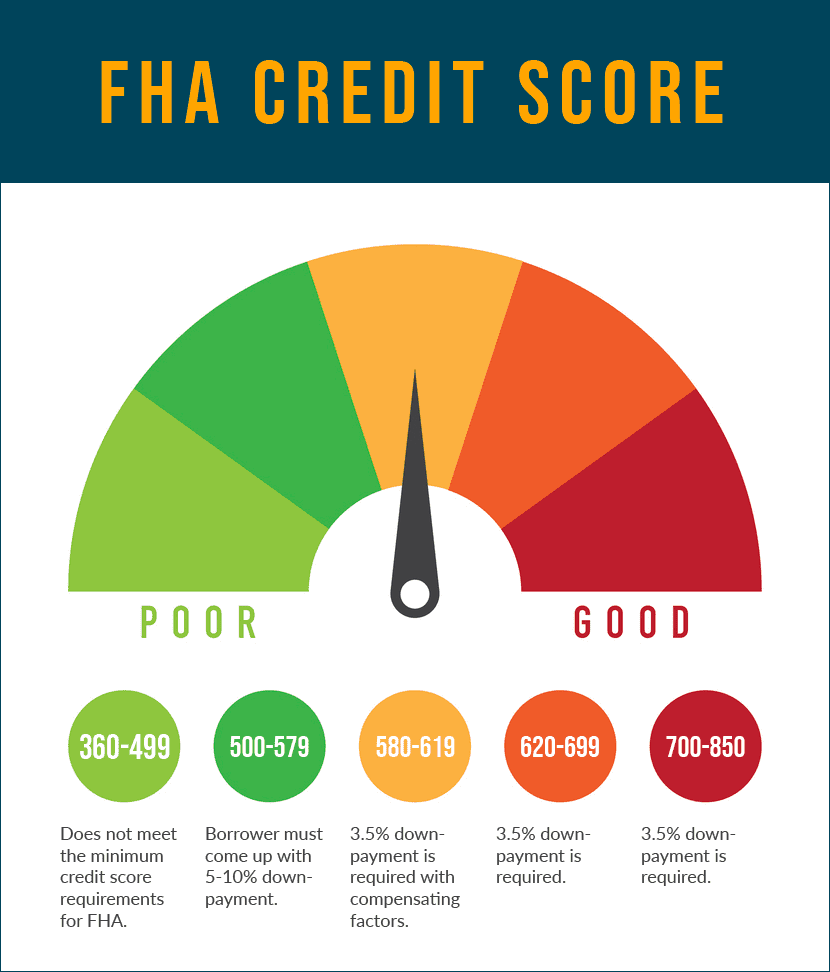

Credit Score Requirements for FHA Loans

FHA loans are a good deal for many of us with lower credit score. As of 2023, the Federal Housing Administration dropped the minimum credit score requirement for FHA loans to 500. In comparison, the minimum credit score for a conventional loan is 620 and 640 for USDA loans. While it is getting easier for people to get FHA loans, having a 500-credit score can make things difficult. Recent statistics show that you are better off with a higher credit score to qualify for an FHA loan. Learn more about the current FHA credit score requirements.

FHA Loan Credit Requirement Overview

What are the FHA loan requirements for a FHA insured mortgage this year? FHA approved lenders now will approve more than 96% of people who have a FICO score of 580.

If your score is at least that high, you may qualify for a 3.5% down payment as well. This is one of the most lenient down payment requirements on the market.

Plus, underwriting standards are very forgiving in terms of credit score and debt to income ratios.

Let’s consider what it takes to qualify for FHA loans today.

If you have a 500-credit score, that is the minimum score that will be considered per FHA requirements. But know that you will have to put down 10% to get a loan at that FICO score.

Only 2% of FHA loans in the past year have gone to people with 500 to 549 credit scores.

Your best chance for a FHA approval with this low of a credit score is to show a clean payment history for the past 180 days and a good sized down payment.

There are many reasons you could have a lower credit score and still qualify for an FHA loan:

- You are using a lot of your available credit. This can lower your score by 50 points in some cases. But as you pay it off, your score will rise.

- You have a lot of credit accounts, or a lot of new credit accounts

- Your credit history is limited

- You had a foreclosure or bankruptcy in the past

FHA guidelines state that if you have made timely payments on your credit obligations in the recent past, you are a reduced risk. So, if you have a bankruptcy on your credit report from two years ago with sub 600 credit, this will not prevent you from getting an FHA loan.

On the other hand, if your credit report shows you have enough income to support your bills but have a lot of late payments, you are less likely to be approved, even if your score is higher. FHA and its approved lenders care the most about a steady payment history on your obligations in the past 12 to 24 months. This indicates a degree of financial stability that reduces lender exposure.

How to Qualify for FHA Loans After a Chapter 7 Bankruptcy

Many individuals hold the mistaken belief that obtaining a mortgage after a bankruptcy is a prolonged process spanning seven to ten years. This misconception is far from the truth. In the aftermath of the mortgage crisis, a substantial number of people found themselves declaring bankruptcy. For the housing market to thrive, it’s crucial that lenders do approve loans for individuals with recent bankruptcies.

The established standard for securing approval for an FHA loan after a Chapter 7 bankruptcy is a two-year waiting period, and it shortens to just 12 months for Chapter 13. The primary focus here is demonstrating to both FHA and its lending institutions that you’ve maintained a solid payment history over the past 12 to 24 months.

In such cases, a prior bankruptcy need not be an impediment. Furthermore, FHA home loans remain a viable option even after a foreclosure. Significantly more individuals faced foreclosures following the mortgage crisis than those who declared bankruptcy. Typically, the waiting period for FHA loans is three years, although some lenders may have more flexible criteria. It’s advisable to inquire within the lending community to explore your options.

What Is Included in FHA Loan Closing Costs?

You can expect to pay for the following closing costs on FHA mortgages. A percentage of these closing costs can be rolled into or financed into the FHA loan:

- Loan origination fee: Percentage of the amount of the loan that the lender charges you

- Discount points to lower rate: 1-point equals 1 percent of the loan amount

- Appraisal fee: What you have to pay to have the home appraised

- Credit report: Charge to pull your credit report

- Tax service: Lender hires a company to ensure there are no liens or taxes owed

- Title insurance: Covers any legal damages if the seller cannot transfer the title legally. This protects the mortgage lender and borrower.

- Attorney fees: What the attorney charges for overseeing the transaction at the title company

- Document fees: FHA lender will charge you to have the many documents ready for closing

- Property taxes: You are charged the remaining yearly property taxes on the home

- Home inspection: Covers cost of having the home inspected

- Survey: The fee to get accurate boundary and property measurements by the surveyor

- FHA Mortgage Insurance Premium: Borrowers that get an FHA loan will be required to pay mortgage insurance every month.

The bottom line is that in some cases, you can reduce your out of pocket expenses when you buy the home by having your closing costs financed or otherwise paid for. Check with your lender to see what options you when considering buying a home with FHA financing.

Remember to Account for Mortgage Insurance

FHA loans are great for many situations, but you have to pay for expensive mortgage insurance to get that low interest rate. There are two types of mortgage insurance on FHA mortgages. The first one is an upfront premium of 1.75% of the loan amount. That is $1,750 for a $100,000 loan. That can be rolled into the mortgage.

The other type of FHA mortgage insurance has the annual premium that is paid each month. The amount varies on the loan length and the loan to value or ‘LTV’. For a 30-year FHA loan with a down payment of less than 5%, your annual insurance premium with be .85% of the loan amount. The reality is that the FHA mortgage insurance premium is the reason people can get an FHA loan with only a 3.5% down-payment in 2023.

The FHA Lender Must Be Approved to Issue FHA Loans

Know that FHA does not lend money; it merely insures the loan issued by a lender. So borrowers need to get an FHA mortgage through a lender approved by the agency. Not all lenders offer the same rates. Some have investors who want more security and charge a higher rate, while others are willing to offer a lower rate.

Are FHA Loans Assumable?

FHA mortgage loans offer the advantage of being assumable, a feature that can prove beneficial for both buyers and sellers. In essence, an assumable mortgage permits a homebuyer to take over the existing FHA loan along with its terms when purchasing a property.

For prospective buyers, assuming an FHA mortgage holds several advantages, particularly if the current FHA mortgage rate is lower than the prevailing market rates. This can result in substantial savings over the duration of the FHA home loan. Furthermore, the process of assuming an FHA loan often involves less rigorous credit requirements compared to securing a new mortgage.

Sellers can also reap the rewards of the assumable feature. It can enhance the marketability of their property, particularly when interest rates are on the rise. The ability to offer a potential buyer an assumable FHA loan can make the property stand out in a competitive real estate market.

However, it’s crucial to note that not all FHA home loans are assumable. For FHA loans initiated after December 1, 1986, the assumption necessitates approval from the lending institution, and specific criteria must be met. The prospective buyer must also qualify for the assumption by demonstrating their creditworthiness and their capacity to meet the obligations of the FHA loan. It’s essential for all parties involved to have a comprehensive understanding of the terms and payment responsibilities associated with assuming an FHA mortgage before committing to this option. It’s important to be aware that if a homebuyer takes over an FHA loan, they will also be obliged to make monthly payments for FHA mortgage insurance premiums.

How to Qualify for a FHA Loan with No Mortgage History

Do you want to buy a home and have limited credit history, no credit history, or no mortgage history? You are not alone. Many first-time home buyers face significant challenges in buying their first house. Specifically, many lack a long credit history. This makes it more difficult for lenders to determine your risk profile and decide to give you a loan.

Most first-time home buyers have never had a mortgage or have not had one in years. They also may own their car in cash and may use their debit card rather than credit cards. These traits make many new house buyers off the grid when it comes to credit and may make getting a mortgage more challenging.

If you think there is no hope, you are wrong: The FHA loan is available to people buying a home for the first time with little credit or no credit. And, FHA backed mortgages can be had from most mortgage lenders in the US.

FHA Loans and Non-Traditional Credit

First-time home buyers typically possess lower credit scores compared to homeowners, primarily because they have had less time to establish a credit history. Payment history plays a pivotal role in determining one’s FICO score.

However, it’s important to note that the solution is not necessarily obtaining a credit card or taking out a car loan, as these actions can temporarily negatively impact your credit score.

Credit score algorithms tend to view acquiring new credit lines as a drawback. Moreover, the impact on your credit score remains limited until the payment history on the account spans at least 12 months.

A more advisable approach, as recommended by many experts, is to explore mortgage loans tailored for individuals with limited credit histories, such as the FHA loan. Sponsored by the Federal Housing Administration, this program explicitly states on its website that a lack of credit history or limited credit usage should not serve as grounds for rejecting a loan application.

Instead of turning away applicants lacking credit history or prior mortgage experience, FHA guidelines necessitate lenders to scrutinize every facet of the loan application.

FHA has the flexibility to consider your rental history as a crucial aspect. If you can demonstrate consistent, on-time rent payments over the last one or two years, provided they are in line with potential mortgage payments, this can serve as a basis for approving a mortgage.

Furthermore, FHA allows lenders to require minimal down payments, with the current minimum being just 3.5%, a highly reasonable option for first-time home buyers. Often, these buyers face challenges in amassing substantial down payments, especially when they lack equity in an existing home.

Additionally, issues related to bad credit loans for first-time home buyers are not insurmountable with FHA, as they permit lenders to accept credit scores as low as 580 with a 3.5% down payment. The program also accommodates higher debt-to-income ratios.

Approval Up to the FHA Mortgage Lender

FHA home loans are underwritten by private lenders that have been approved to do FHA loan programs. All lenders must follow FHA guidelines, but these rules are not absolute when it comes to credit score. Some lenders may work with a borrower with a 580-credit score, while others only work with borrowers with a higher score. If you have a credit score lower on the scale, it is wise to check with several lenders. If you cannot qualify with one lender, you might be able to with another.

Generally, getting an FHA loan approved with a 500 score will be arduous. You will need to have solid income, 10% down payment, and probably some cash reserves. People with a 580 or higher score only need 3.5% down usually, and no cash reserves are needed.

In addition to an acceptable credit score, you must demonstrate enough income to pay the loan and a reasonable amount of debt. Generally, you should have a front-end ratio of 31% and a back-end ratio of 43% to qualify for an FHA loan program. This means your mortgage debt compared to your gross monthly income should not be a ratio of more than 31%, and your total debt compared to your gross monthly income should not be more than 43%. However, some approved FHA lenders might allow those ratios to go higher if you have enough income and reserves. Others with higher credit scores may also be able to be approved with higher debt to income ratios.

According to current FHA statistics, there is a big market in the country for loans for people with a limited credit history – up to five million households across the country. So, it is important to not let your lack of credit history discourage you from applying for a mortgage.

What is the Energy Efficient FHA Mortgage?

The FHA Energy Efficient Mortgage (EEM) is a special FHA financing program designed to empower homeowners to make energy-efficient improvements to their properties. This unique FHA loan program allows borrowers to include the cost of energy-efficient upgrades into their FHA insured mortgage.

By doing so, homeowners can finance projects such as solar panels, insulation, or energy-efficient HVAC systems, facilitating the creation of an environmentally friendly and energy-efficient houses. The primary advantage of the FHA EEM is that it enables borrowers to make these improvements with minimal upfront costs.

The cost of the energy-efficient upgrades is rolled into the mortgage, and the increased monthly payments are offset by the anticipated energy savings, making it a financially sensible choice. This innovative FHA loan program aligns with the growing emphasis on sustainable living and allows homeowners to contribute to both a greener environment and long-term cost savings. FHA EEM serves as a practical and accessible avenue for those seeking to enhance their homes while embracing energy efficiency.

What Are the FHA Property Requirements to Get Approved?

Home buyers who want to buy their home with an FHA mortgage may discover an unpleasant surprise: They are not allowed to buy a certain property because it is not up to FHA standards. To qualify for a FHA loan, the house must meet the property requirements outlined by the Federal Housing Administration. Below are some helpful financial resources that can assist you as you are getting your credit to buy a home:

Minimum Property Standards Set by FHA

The US Department of Housing and Urban Development states that FHA requires properties that it finances with its loans to have these standards at minimum:

- Safety: The home should be of good enough quality to protect the safety and health of all occupants

- Security: The home must protect the overall security of the property

- Soundness: The property should not suffer from major physical deficiencies that affect the overall structure

When you put a contract on a property you want to buy with an FHA loan, the FHA approved appraiser will review the condition of the home and report the results to FHA.

For a single-family home, the appraiser will use the Uniform Residential Appraisal Report. The form requires the appraiser to describe the features of the home, including these items:

- Square footage

- Year it was built

- Number of stories

- Number of rooms and where they are

The appraiser must also describe the overall condition of the home, such as needed repairs, deterioration, remodeling and renovations done. The form also asks if there are any physical deficiencies that will affect the soundness and livability of the property.

FHA does not require minor defects to be fixed, nor does normal wear matter if it does not affect the soundness and security of the home. Some examples of minor issues that do not affect the home sale are:

- Cracked windows

- Missing handrails

- Worn out counters

- Defective paint

- Minor plumbing leaks

- Trip hazards

- Damaged doors that are operable

However, there are many areas of the home that FHA will require to be fixed for the sale to be closed and the FHA loan to be funded . Some of the most common problems that can delay a closing on a home are:

- Electrical and heating issues, such as electrical box problems; lack of heating source for each room

- Roof and attic, such as the roof will not last at least two more years, and general roof problems seen upon attic inspection

- Water heater – must meet local building standards and must be left with the home

- Hazards and nuisances, such as hazardous waste site nearby, contaminated soil, heavy traffic, oil and gas wells, airport noise, near high power lines, near a radio or TV tower

Also, the home must provide ‘safe and adequate accesses for vehicles and pedestrians. The street must have an all-weather surface so emergency vehicle can access the home in any weather condition.

Further, the home must have at least one function toilet, shower and sink; it is not uncommon for people to take these things when the home is foreclosed. The home should also have a functioning stove, but there are not any specific appliance requirements stipulated in the regulations.

What to Expect with FHA Loan Programs in 2024

The FHA loan limits were raised by the US Congress for the coming year and will continue to be a popular choice for first time home buyers and people with average credit scores. All indications point to FHA mortgage rates falling in 2024 and with the elections coming up you can expect the Federal Reserve will play an important role in affordability for new home buyers and homeowners looking to lower their monthly payments with the best FHA mortgage rates we have seen in a few years.