Most financial experts advise the average person to spend no more than 30% of their income on housing. The likelihood of making that happen, though, depends largely on where you live. That’s because for people in dozens of American cities, the typical person sees nearly all of their income gobbled up by rent.

According to our analysis of recent Zillow rental value data and wage figures published by the U.S. Bureau of Labor Statistics for nearly 400 U.S. cities, the average resident of these cities has about 60% of their income left after rent.

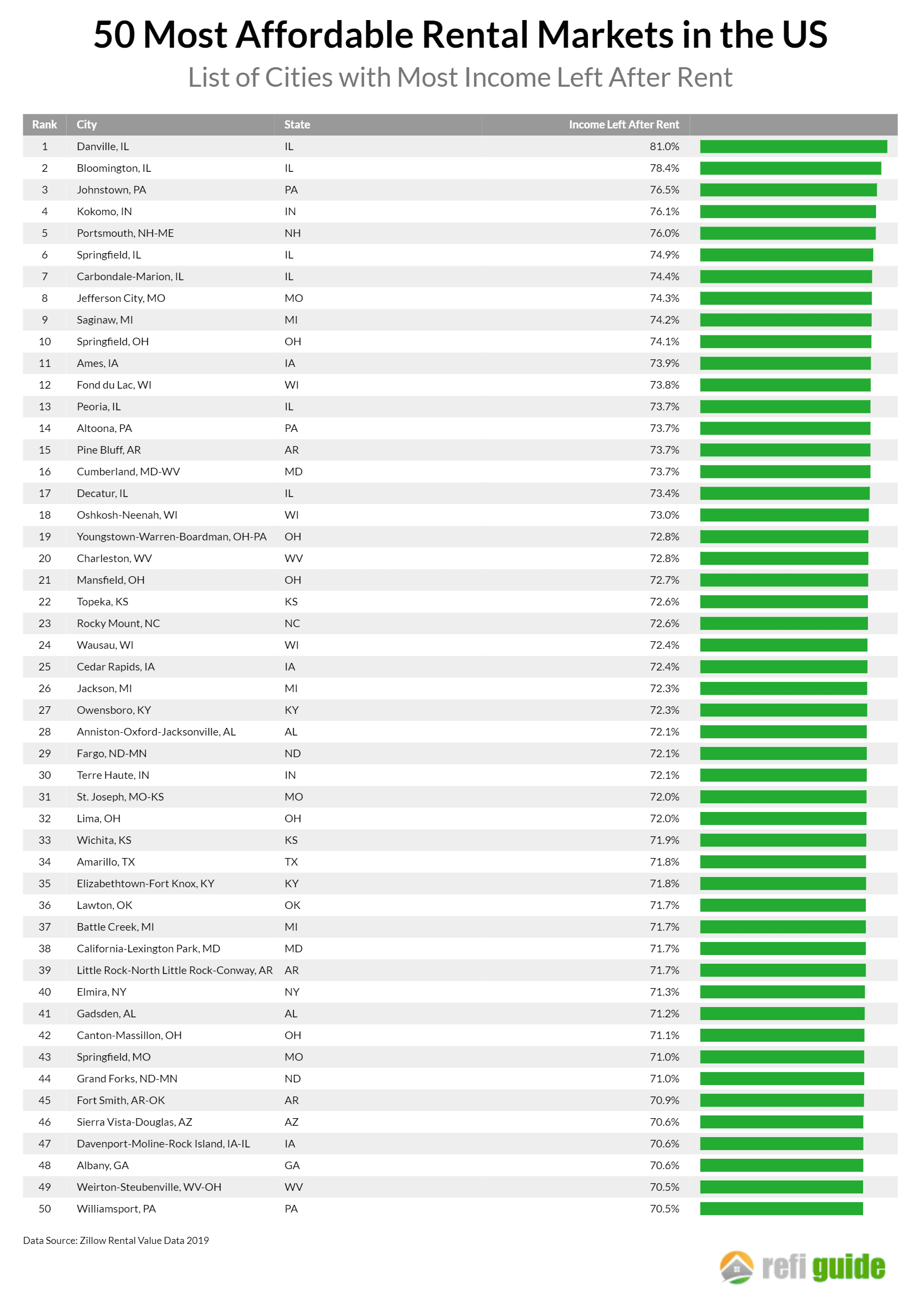

But for people living in dozens of U.S. cities, low rent should help give them some financial flexibility and leave them more money to spend after they’ve covered rental costs, and for people living in the 50 most affordable American rental markets, having 70% or more of their income left after rent is commonplace.

In fact, in each of the 50 markets we’ve identified as the most affordable, the typical person spends about 27% of their income on rent. The most affordable market, according to our analysis, is Danville, Illinois, where the average person can expect to have more than 80% of their paycheck left after paying rent. Granted, these figures reflect the situation for an individual or a single-income family, which may not be the most common situation. Still, our analysis indicates that the 50 markets on our list of most affordable are likely to be realistically within range for most people.

Read on to see our 50 most affordable rental markets, and be sure to check out our full breakdown of the top 15 below that.

Here’s a brief summary of our findings:

- 8 of the 10 most expensive rental markets are in the Midwest, and four of the 10 are in one state — Illinois.

- Only one Western market, Sierra Vista-Douglas, Arizona, appears among the 50 most affordable markets.

- The most affordable Southern rental market is Pine Bluff, Arkansas, where the typical person spends about 74% of their income on rent

A Closer Look: 15 Most Affordable Markets

Here’s a look at all the figures related to the 15 most affordable housing markets, including the median annual wage for full-time workers, the median monthly and annual rent costs and the percentage and amount of income left after rent:

No. 15 Pine Bluff, AR

- Median Annual Wage: $31,830

- Median Monthly Rent: $698

- Median Annual Rent: $8,376

- Percentage of Income Left After Rent: 73.7%

- Amount of Income Left After Rent: $23,454

No. 14 Altoona, PA

- Median Annual Wage: $32,410

- Median Monthly Rent:$710

- Median Annual Rent: $8,520

- Percentage of Income Left After Rent: 73.7%

- Amount of Income Left After Rent: $23,890

No. 13 Peoria, IL

- Median Annual Wage: $38,410

- Median Monthly Rent: $841

- Median Annual Rent: $10,092

- Percentage of Income Left After Rent: 73.7%

- Amount of Income Left After Rent: $28,318

No. 12 Fond du Lac, WI

- Median Annual Wage: $38,520

- Median Monthly Rent: $841

- Median Annual Rent: $10,092

- Percentage of Income Left After Rent: 73.8%

- Amount of Income Left After Rent: $28,428

No. 11 Ames, IA

- Median Annual Wage: $40,530

- Median Monthly Rent: $881

- Median Annual Rent: $10,572

- Percentage of Income Left After Rent: 73.9%

- Amount of Income Left After Rent: $29,958

No. 10 Springfield, OH

- Median Annual Wage: $35,300

- Median Monthly Rent: $761

- Median Annual Rent: $9,132

- Percentage of Income Left After Rent: 74.1%

- Amount of Income Left After Rent: $26,168

No. 9 Saginaw, MI

- Median Annual Wage: $33,860

- Median Monthly Rent: $728

- Median Annual Rent: $8,736

- Percentage of Income Left After Rent: 74.2%

- Amount of Income Left After Rent: $25,124

No. 8 Jefferson City, MO

- Median Annual Wage: $34,630

- Median Monthly Rent: $742

- Median Annual Rent: $8,904

- Percentage of Income Left After Rent: 74.3%

- Amount of Income Left After Rent: $25,726

No. 7 Carbondale-Marion, IL

- Median Annual Wage: $33,220

- Median Monthly Rent: $709

- Median Annual Rent: $8,508

- Percentage of Income Left After Rent: 74.4%

- Amount of Income Left After Rent: $24,712

No. 6 Springfield, IL

- Median Annual Wage: $39,010

- Median Monthly Rent: $815

- Median Annual Rent: $9,780

- Percentage of Income Left After Rent: 74.9%

- Amount of Income Left After Rent: $29,230

No. 5 Portsmouth, NH-ME

- Median Annual Wage: $43,970

- Median Monthly Rent: $878

- Median Annual Rent: $10,536

- Percentage of Income Left After Rent:76.0%

- Amount of Income Left After Rent: $33,434

No. 4 Kokomo, IN

- Median Annual Wage: $37,920

- Median Monthly Rent: $754

- Median Annual Rent: $9,048

- Percentage of Income Left After Rent: 76.1%

- Amount of Income Left After Rent: $28,872

No. 3 Johnstown, PA

- Median Annual Wage: $32,140

- Median Monthly Rent: $630

- Median Annual Rent: $7,560

- Percentage of Income Left After Rent: 76.5%

- Amount of Income Left After Rent: $24,580

No. 2 Bloomington, IL

- Median Annual Wage: $40,620

- Median Monthly Rent: $731

- Median Annual Rent: $8,772

- Percentage of Income Left After Rent: 78.4%

- Amount of Income Left After Rent: $31,848

No. 1 Danville, IL

- Median Annual Wage: $35,590

- Median Monthly Rent: $564

- Median Annual Rent: $6,768

- Percentage of Income Left After Rent: 81.0%

- Amount of Income Left After Rent: $28,822

Conclusion

For many Americans, choosing where to live isn’t as simple as picking the place that seems the most affordable. But for young people just starting out in their lives or those looking for a change, selecting from one of these communities could be a wise decision.

Additional Resources

- Pew Research Center, More U.S. households are renting than at any point in 50 years. (2017.)

- U.S. Bureau of Labor Statistics, Occupational Employment Statistics, OES Data May 2018, metropolitan and nonmetropolitan area. (2019.)