Getting approved for a bad credit home equity loan can be very challenging. In 2026, most smart homeowners consider HELOCs or low credit equity loans if they already have a low interest rate on their first mortgage. We published this article to help homeowners understand the loan to value and credit requirements on HELOCs and equity loan programs in this market. The RefiGuide has a network of home equity lenders that offer bad credit HELOCs and equity loans for people with poor credit scores.

Guide to Bad Credit Home Equity Loans

Qualifying for a poor credit home equity loan requires the applicant to get organized and stick to a solid plan that includes income documentation, letters of explanation for derogatory credit and an alliance with a home equity loan company that is willing to take risks while approving equity loans for people with a bad credit history. Learn how to get approved for a HELOC or home equity loan with bad credit in today’s market.

Qualifying for a poor credit home equity loan requires the applicant to get organized and stick to a solid plan that includes income documentation, letters of explanation for derogatory credit and an alliance with a home equity loan company that is willing to take risks while approving equity loans for people with a bad credit history. Learn how to get approved for a HELOC or home equity loan with bad credit in today’s market.

The landscape of home equity financing in 2026 presents both challenges and opportunities for homeowners with less-than-perfect credit. While traditional lenders have historically maintained stringent credit requirements, the evolving lending environment has created new pathways for borrowers with credit scores below the conventional threshold of 700. This comprehensive guide explores the realistic opportunities available for obtaining a home equity loan with bad credit, detailing the specific requirements, strategies for approval, and alternatives that homeowners can leverage to access their home’s equity.

According to current market data, home equity loan rates average around 8.2% for 10-year terms and 8.15% for 15-year terms as of late 2025, representing a favorable decline from earlier periods due to Federal Reserve rate adjustments. These rates remain substantially more attractive than personal loans, which average approximately 12%, or credit cards, which hover near 21% interest. For homeowners with bad credit who have built equity in their properties, home equity loans represent one of the most cost-effective borrowing options available, despite the additional challenges posed by lower credit scores.

Understanding Bad Credit in the Context of Home Equity Lending

In the context of home equity financing, the definition of ‘bad credit’ differs from other lending scenarios. Most home equity lenders consider credit scores below 680 as subprime, with 620 serving as the absolute minimum threshold for consideration. This elevated standard exists because home equity loans function as second mortgages, creating a subordinate lien position that carries inherently greater risk for lenders. In foreclosure scenarios, first mortgage holders receive priority payment from sale proceeds, leaving home equity lenders with residual claims that may not be fully satisfied.

The FICO credit scoring model categorizes credit scores into distinct ranges: Excellent (800-850), Very Good (740-799), Good (670-739), Fair (580-669), and Poor (300-579). For home equity lending purposes, borrowers with scores in the ‘Fair’ range face significant challenges but remain eligible with certain lenders. Those in the ‘Poor’ category typically cannot qualify for traditional home equity products without substantial compensating factors such as extremely low loan-to-value ratios or exceptional income documentation.

The mathematical reality of lower credit scores manifests in higher interest rates. Research indicates that a borrower with a 760 credit score might secure an 8.0% rate on a 15-year home equity loan, while someone with a 650 score could face rates around 9.5%. On a $50,000 loan, this translates to approximately $55 more per month, accumulating to $660 annually and nearly $10,000 over the loan’s lifetime. This interest rate differential underscores the significant financial benefit of improving credit scores before applying for home equity financing.

Detailed Credit Requirements for Home Equity Loans in 2026

Minimum Credit Score Thresholds

The minimum credit score requirements for home equity loans vary significantly across lender categories. Traditional banks and credit unions typically require credit scores of 680 or higher, with preferential rates reserved for borrowers above 740. However, alternative and subprime lenders have emerged to serve borrowers with scores as low as 620, and in exceptional cases, down to 580 when substantial home equity exists.

The tiered lending structure for bad credit home equity loans operates as follows:

- Premium Tier (740+): Access to the lowest available rates, typically 7.5-8.5% in the current market, with loan-to-value ratios up to 85-90%

- Standard Tier (680-739): Moderate rates ranging from 8.5-9.5%, with maximum LTV ratios of 80-85%

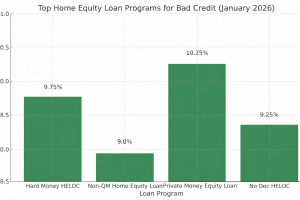

- Noin QM Tier (601-679): Elevated rates between 9.5-11.5%, requiring LTV ratios below 75-80%

- High-Risk Tier (500-600): Specialized hard money and private lenders only, rates exceeding 11.5%, requiring LTV ratios below 70% and significant compensating factors

Loan-to-Value Ratio Requirements

The loan-to-value ratio represents one of the most critical factors in bad credit home equity lending. Lenders calculate the combined loan-to-value (CLTV) ratio by dividing the sum of all mortgage debt by the property’s appraised value. For borrowers with bad credit, maintaining substantial equity becomes essential for approval. Most lenders require that borrowers retain at least 15-20% equity in their homes after the home equity loan closes, meaning maximum CLTV ratios typically range from 80-85% for good credit borrowers but may be restricted to 70-75% for those with credit challenges.

To illustrate this calculation: Consider a homeowner with a property valued at $400,000 and an existing mortgage balance of $250,000. This creates $150,000 in available equity. If the lender maintains an 80% CLTV requirement, the maximum total debt would be $320,000 ($400,000 × 0.80), leaving $70,000 available for a home equity loan ($320,000 – $250,000). However, a borrower with poor credit might face a 75% CLTV restriction, reducing the available loan amount to $50,000 ($300,000 – $250,000).

Debt-to-Income Ratio Standards

The debt-to-income ratio measures monthly debt obligations against gross monthly income, providing lenders with insight into a borrower’s capacity to service additional debt. For home equity loans, most lenders prefer DTI ratios below 43%, though some accommodate ratios up to 50% for borrowers with strong compensating factors. The DTI calculation includes the proposed home equity loan payment, first mortgage payment, minimum credit card payments, car loans, student loans, and other recurring monthly obligations.

For example, a borrower earning $6,500 monthly before taxes with a $1,800 mortgage payment, $450 car payment, $280 in student loans, and $320 in minimum credit card payments carries total monthly obligations of $2,850, resulting in a 43.8% DTI ratio. Adding a $400 home equity loan payment would elevate the DTI to 50%, potentially exceeding many lenders’ thresholds. This mathematical reality necessitates careful consideration of existing debt levels before pursuing home equity financing, particularly for borrowers with credit challenges who already face restricted loan amounts due to LTV limitations.

Deep Dive into Bad Credit Home Equity Loan Opportunities

The bad credit home equity loan market has evolved substantially in recent years, with specialized lenders developing products specifically designed to serve homeowners with impaired credit histories. These products recognize that credit scores represent only one dimension of creditworthiness and that home equity itself provides substantial collateral protection for lenders. The key to accessing these opportunities lies in understanding which compensating factors carry the most weight with subprime lenders and how to strategically present one’s financial profile to maximize approval chances.

Alternative Lender Categories

Several categories of lenders specialize in bad credit home equity financing, each with distinct underwriting approaches and target markets. Non-QM (non-qualified mortgage) lenders focus on alternative documentation and flexible underwriting, often accepting bank statement income verification rather than traditional W-2s and tax returns. Hard money lenders emphasize asset-based lending, placing primary weight on property value and equity position while minimizing credit score considerations. Credit unions frequently demonstrate greater flexibility than commercial banks, particularly for members with established relationships and regular account activity.

Portfolio lenders, who retain loans on their balance sheets rather than selling them to secondary market investors, maintain the greatest flexibility in underwriting standards. These institutions can evaluate applications holistically, considering factors that automated underwriting systems might reject. Online marketplace lenders have also entered the space, leveraging technology to match borrowers with appropriate funding sources while maintaining competitive pricing through reduced overhead costs.

Critical Compensating Factors

When credit scores fall below ideal thresholds, specific compensating factors become instrumental in securing approval. These factors include substantial cash reserves, with many lenders requiring 6-12 months of mortgage payments in liquid savings accounts. Employment stability matters significantly, with two or more years in the same field or with the same employer demonstrating income reliability. Lower housing expense ratios, where the total mortgage payment (including the proposed home equity loan) remains below 28% of gross monthly income, provide additional approval leverage.

Recent positive payment history carries substantial weight, particularly 12-24 months of on-time mortgage payments demonstrating current financial responsibility. Large down payments or, in the context of home equity loans, exceptionally low LTV ratios (below 65-70%) can sometimes overcome credit score deficiencies. Professional income sources or significant verifiable assets outside the primary residence also strengthen applications, as does recent credit score improvement demonstrating upward trajectory.

Strategic Approaches to Securing an Equity Loan Approval

Pre-Application Preparation

Strategic preparation before applying for a bad credit home equity loan significantly enhances approval prospects. Begin by obtaining credit reports from all three major bureaus—Equifax, Experian, and TransUnion—through AnnualCreditReport.com. Review these reports meticulously for errors, inaccuracies, or fraudulent accounts that artificially depress scores. Common errors include incorrectly reported late payments, accounts belonging to other individuals, or negative items that exceed legal reporting periods.

Dispute any inaccuracies through the credit bureaus’ formal dispute processes, providing supporting documentation where available. Focus on reducing credit utilization ratios by paying down revolving debt, ideally below 30% of available credit limits and optimally below 10% for maximum score benefit. Avoid applying for new credit during the 3-6 months preceding the home equity loan application, as hard inquiries temporarily reduce scores and new accounts lower average account age.

Co-Borrower and Co-Signer Strategies

Adding a co-borrower or co-signer with stronger credit can dramatically improve approval chances and interest rates. A co-borrower shares equal responsibility for the loan and typically resides in the property, with their income and credit profile fully considered in the underwriting process. Co-signers assume repayment responsibility without ownership interest in the property, serving as backup guarantors who strengthen applications without requiring property rights.

However, both arrangements carry significant implications. The co-borrower or co-signer’s credit will be impacted by the loan’s performance, with late payments or defaults damaging their credit scores equally. Their debt-to-income ratios will reflect the new obligation, potentially limiting their ability to obtain financing for their own needs. These arrangements work best when established between close family members or spouses who understand the mutual obligations and trust the primary borrower’s commitment to maintaining timely payments.

Letter of Explanation Development

A well-crafted letter of explanation can contextualize credit challenges and demonstrate current financial stability. Effective letters acknowledge specific credit issues directly, explain the circumstances that led to credit problems (job loss, medical emergencies, divorce), and detail the steps taken to resolve these issues and prevent recurrence. Emphasize current financial stability through consistent employment, increased income, or accumulated savings. Document any extenuating circumstances with supporting evidence while maintaining a professional, factual tone that avoids excessive emotional appeals or excuse-making.

Tips to Get a Home Equity Loan with Bad Credit Scores

Get a copy of your current credit report. Examine your credit history. You may find inaccuracies that are hurting your credit report. If there is anything that is wrong that is hurting your score, you can contact each credit bureau and contest each negative, incorrect item. Before applying for a home equity loan or HELOC, make sure that all your loans are being reported with the correct monthly payment.

Collect all of your financial data so you can give your lenders proof of good income and employment. It will help if you have a decent savings account and investments that are producing returns. When discussing a potential home equity loan, it is very important to show with damaged credit that you are financially stable and have been for at least the last 12 months. Unless you are self-employed, the underwriter will be considering your gross monthly income.

Apply for home equity loans with at least three lenders. You will need to give them copies of your credit report, mortgage information and proof of income. You also may need to show bank statements to show that you have cash in the bank. People with poor credit who own a home with equity can get approved, but the more financial documents you have, the better chance you will have to qualify for a low credit home equity loan.

If you have a foreclosure or short sale on your record, you may need to provide letters of explanation to lenders. There are some homeowners who may have been invested in real estate for income purposes during the recession but lost those properties to foreclosure. If you still are current on your home and have equity, you may be able to convince some home equity lenders through manual underwriting to approve you. But you will need to show once again that you have a high level of current financial stability.

Carefully consider the terms and rates you are offered from each lender. If you are getting a HELOC, you should look at whether it is fixed or adjustable and for how long, what the rate is, any fees, payment schedule, and when rate can change. Most equity loans with bad credit have a fixed interest rate with simple interest that guarantees a set monthly payment for the life of the loan, but verify the details with the loan officers you are working with.

Alternative Options When Traditional Approval Proves Elusive

When traditional home equity loans remain inaccessible despite efforts to strengthen applications, several alternative products allow homeowners to access equity. Home Equity Agreements (HEAs) provide upfront cash in exchange for a percentage of future property appreciation, requiring no monthly payments and accepting credit scores as low as 500. These arrangements differ fundamentally from traditional loans, as homeowners receive funding without incurring debt, instead sharing future value increases with the investor.

Cash-out refinancing represents another avenue, though it requires replacing the existing first mortgage. This option works best when current interest rates approximate or fall below existing mortgage rates, allowing borrowers to access equity while potentially maintaining or improving overall interest costs. Reverse mortgages serve homeowners aged 62 and older, converting home equity into tax-free income without requiring monthly payments, though interest accrues and must be repaid upon sale or death.

Personal loans offer unsecured borrowing without home collateral risk, though interest rates typically exceed home equity loan rates substantially. This option provides value when home equity proves inaccessible and borrowing needs remain relatively modest. For specific improvement projects, FHA 203(k) rehabilitation loans combine property purchase or refinancing with renovation funding in single transactions, though these carry their own qualification requirements and complexity.

Long-Term Credit Improvement Strategies

For homeowners whose current credit challenges preclude immediate home equity loan approval, implementing strategic credit improvement measures creates better opportunities within 6-12 months. Credit score improvements of 20-50 points can shift borrowers into more favorable lending tiers with substantially better rates and terms. Focus on consistent, on-time payment of all obligations, as payment history comprises 35% of FICO scores. Setting up automatic payments eliminates the risk of inadvertent late payments.

Credit utilization reduction yields rapid score improvements, particularly when revolving balances fall below 30% of available credit. Strategic debt paydown should prioritize high-utilization cards first, as individual card utilization impacts scores independent of overall utilization. Maintaining older credit accounts preserves average account age, another scoring factor. Avoiding new credit applications prevents hard inquiry accumulation and protects average account age.

Consider secured credit cards or credit-builder loans specifically designed to establish positive payment history. These products report to credit bureaus while minimizing default risk through security deposits or structured designs. Monitor credit reports quarterly through AnnualCreditReport.com, disputing any new inaccuracies promptly. Some credit monitoring services provide monthly score tracking, allowing borrowers to gauge improvement progress and identify factors driving changes.

Takeaways on Qualifying for a Home Equity Loan with Low Credit Scores

The opportunity to obtain a home equity loan with bad credit in 2026 exists within a complex but navigable lending landscape. While credit scores below 680 present genuine challenges and typically result in higher interest rates and more restrictive terms, homeowners with substantial equity positions, stable incomes, and strong compensating factors maintain realistic approval prospects. Success requires strategic preparation, thorough understanding of lender requirements and evaluation criteria, and often persistence in identifying appropriate lending sources.

The case studies presented demonstrate that various credit impairment scenarios—from moderate credit challenges to severe bankruptcy—can be overcome through proper positioning and identification of suitable lenders. The key lies in understanding one’s complete financial profile, identifying and emphasizing compensating factors, and connecting with lenders whose underwriting approaches align with individual circumstances. For homeowners unable to qualify immediately, implementing credit improvement strategies while maintaining current financial stability creates better opportunities within relatively short timeframes.

Ultimately, home equity represents a valuable financial resource that shouldn’t be dismissed as inaccessible due to credit challenges. With proper preparation, strategic approach, and realistic expectations regarding terms and rates, most homeowners with substantial equity can identify viable paths to accessing these funds when legitimate financial needs arise. The evolving lending landscape, featuring increased competition and specialized lenders targeting underserved markets, has created more opportunities than existed in previous years, making 2026 a potentially opportune time for credit-challenged homeowners to explore home equity financing options.

Do Lenders Still Offer Home Equity Loans with Bad Credit?

A home equity loan is similar to a HELOC but you get your home’s equity up to a certain amount in a single lump payment. If you have a single, large expense you need to pay now, you might consider a home equity loan, such as a big medical bill or the down-payment of a home.

A home equity loan has a fixed interest rate and fixed monthly payment. Loans with bad credit may have a higher rate than prime credit equity loans, and even higher still if you have a low credit score, but it still is a good option for people who have bad credit but access to home equity. This is not a guaranteed home equity loan option but worthy of consideration nonetheless.

- Home Equity Loan Credit Score 580 OK

- Fixed Rate Home Equity Loans for Low Credit

- Hard Money, Non-QM and DSCR Equity Loans

The RefiGuide will teach you how to get a home equity loan with bad credit by connecting you with lenders and banks that give a low-credit home equity loans to borrowers that have compensating factors. This is not guaranteed home equity loan with bad credit, but there is an opportunity worth exploring.

Finding Home Equity Lenders Specializing in All Types of Credit

Not all lenders offer home equity loans for people with bad credit. In fact most mortgage lenders do not offer home equity loans and and even the one’s that do, its rare to find a home equity lender offering programs for people with a low credit score. Consumers want to know where they can get a $50,000 equity loan with poor credit? The RefiGuide can help you shop lenders and banks that offer $50,000 loans and HELOCs with low credit scores. Learn more about second mortgages for people with bad credit.

Some brokers specialize in working with individuals with less-than-perfect credit histories. Researching and locating non-prime home equity lenders can be a wise move that increases your chances to get approved.

FAQ for Bad Credit HELOCs and Home Equity Loans

The RefiGuide gets a lot of questions about requirements and home equity loan credit guidelines so we listed a few of the frequently asked questions below:

Can I get a HELOC with low credit scores?

Although lenders usually prefer higher a credit-score when offering a HELOC, a lower score doesn’t necessarily disqualify you. There are home equity lenders that approve a HELOC with bad credit. These lenders consider other factors, such as a low debt-to-income ratio and most important a low loan-to-value ratio. If you are looking for a bad credit HELOC you should have at least 25% equity in your home.(below 75% CLTV) Can I get a HELOC with bad credit? Yes, in many instances when a borrower pulls out funds from their HELOC account and then repays the debt, the borrowers credit will benefit. The more the times you use the credit line and make the payment on time, the better it is for reestablishing your credit profile. The RefiGuide will match you with aggressive home equity lenders if you need a low credit HELOC loan if you have the right credentials.

Can I get an FHA home equity loan with bad credit?

FHA does not insure FHA home equity loans like they do purchase or refinance mortgages. They allow equity home loans or HELOCs behind an FHA insured mortgage, but they do not offer them through the Federal Housing Administration. They do offer the FHA 203K for home renovations, but the rules are stricter than traditional home equity loan products.

What can prevent you from qualifying for a home equity loan?

Besides credit, the combined loan to value is the most important factor to qualify for a home equity loan or HELOC in 2025. Most lenders require that you retain at least 15% to 20% 80 to 85% LTV) equity in your home after accounting for the new home equity loan amount and that is if you have good credit reports. If you have poor credit-scores, then you could need 20 to 35% equity in your home or (65 to 80% LTV) If your home’s value hasn’t increased sufficiently or you haven’t paid down enough of your mortgage, you may be ineligible for a 2nd mortgage or line of credit due to insufficient equity.

Can I use a home equity loan for debt consolidation?

Yes. Many borrowers take out a home equity loan to pay off high interest debt, credit cards, and adjustable rate home equity lines of credit. Consolidating debt with a fixed rate home equity loan can reduce your monthly debt payments and provide increased savings that improve your financial situation.

Do mortgage lenders offer guaranteed home equity loan with bad credit no credit check?

No. Lenders do not guarantee home equity loans without credit check of evaluating a property’s value. Since this is a second lien on the home, the risk factor increases significantly. The home equity loan cannot be guaranteed with no credit check like a small payday loan or personal loan that is unsecured.

Can I Get a Home Equity Loan while in Forbearance?

Generally, no. Most lenders require your mortgage to be current with three to twelve on-time payments after exiting forbearance before approving a home equity loan. Lenders want to see stable repayment history and financial recovery. If you’re still in forbearance, focus on reinstating your loan or completing a modification first, then rebuild payment consistency before applying for new home equity financing.

References

Experian. (2024, August 15). Can you get a home equity loan with bad credit? https://www.experian.com/blogs/ask-experian/what-credit-score-do-i-need-to-get-a-home-equity-loan/

NerdWallet. (2018, May 15). How to get a home equity loan with bad credit. https://www.nerdwallet.com/mortgages/learn/home-equity-loan-bad-credit

Reviewed by: Bryan Dornan, Mortgage Lending Expert (25+ years) | Last Updated: January 2026 | Fact-Checked ✓