The FHA cash-out refinance plan has helped millions of Americans with affordable refinancing with cash out opportunities., low refi-rates and easy requirements. The Federal Housing Administration (FHA) Cash Out Refinance Plan represents a significant financial opportunity for American homeowners seeking to leverage their home equity while maintaining affordable monthly payments. The RefiGuide published this article to uncover the unique opportunities of FHA cash out refinancing in 2026.

Understanding the FHA Cash Out Refinance Loan Opportunities

For several decades, this program has served as a lifeline for millions of families, offering more flexible credit requirements and accessible lending standards compared to conventional refinancing options.

As housing values have appreciated substantially in recent years, with the median U.S. home price increasing by over 40 percent since 2019 according to recent market data, homeowners now possess unprecedented levels of equity in their properties.

The FHA cash out refinance program allows qualified borrowers to access up to 80 percent of their home’s appraised value, providing liquid capital that can be utilized for a wide range of financial objectives including home improvements, debt consolidation, education expenses, business investments, or emergency funding needs.

For several decades the FHA cash-out refinance plan has helped millions of Americans with affordable refinancing with cash out opportunities that do not require as much equity as most conventional mortgages.

Do you want to refinance your FHA loan into a lower rate and get cash out?

This comprehensive guide examines the FHA Cash Out Refinance Plan in detail, providing homeowners with the knowledge necessary to make informed decisions about accessing their home equity.

We will explore the fundamental mechanics of the program, analyze its advantages and disadvantages through multiple perspectives, outline specific qualification requirements with practical examples, present real-world case studies demonstrating successful applications, and provide authoritative references for further research.

Whether you are considering debt consolidation, planning major home renovations, funding educational pursuits, or exploring investment opportunities, understanding the intricacies of FHA cash out refinancing will empower you to determine if this program aligns with your financial goals and circumstances.

The FHA cash out refinance program enables homeowners to replace their existing mortgage with a new, larger FHA-insured loan and receive the difference in cash. This refinancing option is insured by the Federal Housing Administration, a division of the U.S. Department of Housing and Urban Development (HUD), which provides government backing that reduces lender risk and allows for more accommodating qualification standards. Unlike the FHA Streamline Refinance program, which is limited to rate and term changes with minimal cash back (up to $500), the cash out refinance explicitly permits homeowners to extract substantial equity from their properties while simultaneously refinancing their mortgage terms. The RefiGuide will help you shop lenders that specialize in the FHA cash out plan.

How the FHA Cash Out Refi Program Works

The fundamental mechanism of an FHA cash out refinance is straightforward yet powerful. Homeowners refinance their current mortgage—whether it is an FHA loan, conventional loan, VA loan, USDA loan, or any other mortgage type—into a new FHA-insured loan with a higher principal balance. The new loan pays off the existing mortgage in full, covers all closing costs and fees, and the remaining funds are disbursed to the borrower as cash proceeds. This transaction consolidates all existing liens into a single new mortgage, simplifying the homeowner’s financial obligations while providing access to accumulated equity.

For example, consider a homeowner whose property is appraised at $400,000 with an outstanding mortgage balance of $240,000. Under current FHA guidelines allowing borrowing up to 80 percent of the home’s value, this homeowner could potentially secure a new loan of $320,000. After paying off the $240,000 existing mortgage, and assuming $8,000 in closing costs (which can often be financed into the loan amount), the homeowner would receive approximately $72,000 in cash proceeds. These funds become available typically three business days after closing, deposited directly into the borrower’s bank account, and can be used immediately for any purpose without restriction from the FHA or lender.

Maximum Loan-to-Value Ratios

The loan-to-value (LTV) ratio represents a critical component of FHA cash out refinancing, serving as the primary determinant of how much equity homeowners can access. As of 2025, the Federal Housing Administration permits homeowners to borrow up to 80 percent of their property’s appraised value through a cash out refinance transaction. This means borrowers must maintain at least 20 percent equity in their homes after completing the refinance, a requirement designed to protect both borrowers and lenders from excessive leverage and potential default risk.

It is important to note that these LTV limits have evolved over time in response to changing housing market conditions and economic factors. Prior to 2009, FHA cash out refinances allowed up to 95 percent LTV, providing homeowners with maximum equity access. Following the 2008 financial crisis, the FHA reduced this limit to 85 percent in an effort to promote more conservative lending practices. During the COVID-19 pandemic in 2021, concerns about market volatility prompted a further reduction to 80 percent, where the limit remains as of 2025. Individual states may impose additional restrictions beyond federal guidelines, and lenders typically establish their own more conservative LTV requirements based on their risk assessment, market conditions, and portfolio management strategies.

Historical Context and Program Evolution

The FHA cash out refinance program has a rich history dating back to the organization’s founding in 1934 during the Great Depression. Initially created to stabilize the housing market and expand homeownership opportunities, the FHA introduced cash out refinancing provisions in the 1980s as housing markets recovered and home values began appreciating consistently. Throughout the 1990s and early 2000s, the program gained popularity as homeowners leveraged rising property values to access equity for various purposes.

The 2008 financial crisis prompted significant reforms to FHA lending practices, including stricter underwriting standards, enhanced documentation requirements, and adjusted LTV ratios. These changes aimed to prevent the predatory lending practices and excessive leverage that contributed to the housing market collapse. Post-crisis regulations also introduced more stringent appraisal standards and required lenders to verify borrowers’ ability to repay loans more comprehensively. Despite these restrictions, the FHA cash out refinance program continued to serve an important role in providing credit access to borrowers who might not qualify for conventional financing.

Advantages of the FHA Cash Out Refinances

The FHA cash out refinance program offers numerous benefits that make it an attractive option for many homeowners, particularly those who may not qualify for conventional refinancing due to credit challenges, limited income documentation, or insufficient equity for conventional programs.

The RefiGuide will help learn everything you need t know about FHA cash out plans and refinancing opportunities in 2026.

Competitive FHA Cash-Out Refinance Rates

FHA loans, including cash out refinances, frequently offer competitive interest rates compared to conventional mortgages, particularly for borrowers with lower credit scores.

FHA loans, including cash out refinances, frequently offer competitive interest rates compared to conventional mortgages, particularly for borrowers with lower credit scores.

Because these loans are insured by the federal government, lenders face reduced risk of loss in the event of default, enabling them to offer more favorable terms to borrowers across a wider credit spectrum.

In many cases, FHA cash out refinance rates are 0.25 to 0.50 percentage points lower than comparable conventional products for borrowers with similar credit profiles.

The rate advantage becomes even more pronounced for borrowers with credit scores below 700.

While conventional lenders impose significant rate adjustments ranging from 0.50 to 2.00 percentage points for lower credit scores, FHA rates remain relatively stable across different credit tiers, with minimal pricing adjustments based on credit quality.

For example, a borrower with a 640 credit score might receive an FHA cash out refinance rate of 6.50 percent, while the same borrower would likely face conventional rates exceeding 8.00 percent, if they could qualify at all. This rate differential can translate to savings of hundreds of dollars monthly and tens of thousands of dollars over the loan term.

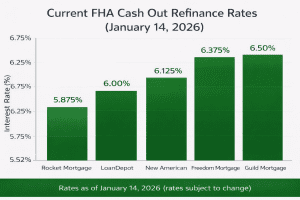

FHA cash-out refinance loans allow homeowners to tap up to 80% of their home’s equity, replacing their mortgage with a larger FHA-backed loan and receiving the difference in cash. As of January 2026, 30-year fixed FHA cash-out refinance rates range from 6.25% to 6.57%, with APRs between 6.52% and 7.07%, per Bankrate. These rates are 0.25–0.5% higher than standard FHA refinances due to riskier loan profiles. Rates vary by credit score (580 minimum, 600+ preferred), debt-to-income ratio (43% or less), and lender. Mortgage insurance premiums (1.75% upfront, 0.15–0.75% annually) apply, increasing costs. The RefiGuide can help you shop multiple lenders for the best FHA cash out refi-rates.

Flexible Credit Requirements for FHA Refinancing

One of the most significant advantages of FHA cash out refinancing is the program’s accommodating credit score requirements. The FHA officially permits borrowers with credit scores as low as 580 to qualify for cash out refinancing with maximum financing. Some specialized FHA lenders may even work with borrowers whose credit scores fall between 500 and 579, though these borrowers typically face stricter requirements including larger down payments, additional documentation, substantial cash reserves, and compensating factors such as long employment history or minimal debt obligations.

Most FHA-approved lenders establish their own credit score minimums, typically ranging from 600 to 620 for cash out refinancing, reflecting their individual risk tolerance and portfolio management strategies. However, these requirements remain substantially more lenient than conventional cash out refinance programs, which often require credit scores of 680 or higher for approval and 740 or above for optimal pricing. This flexibility makes FHA cash out refinancing accessible to borrowers who have experienced past credit challenges, including late payments, collections, charge-offs, medical debt, or even previous foreclosures and bankruptcies, provided sufficient time has elapsed since these events and the borrower has demonstrated credit rehabilitation.

The FHA employs a more holistic underwriting approach compared to conventional automated underwriting systems, allowing loan officers to consider compensating factors such as consistent rental payment history, utility payment records, stable employment, cash reserves, low debt-to-income ratios, and substantial equity beyond the minimum required. This comprehensive evaluation often enables approval for borrowers who would be automatically declined by conventional underwriting algorithms based solely on credit scores.

Higher Loan-to-Value Ratio

The 80 percent LTV ratio available through FHA cash out refinancing exceeds what many conventional lenders offer, particularly for borrowers with lower credit scores or higher debt-to-income ratios. Most conventional cash out refinance programs limit borrowers to 70 to 75 percent LTV, with some lenders restricting cash out refinancing to 65 percent LTV for borrowers with credit scores below 700. This higher LTV ratio means FHA borrowers can access significantly more of their home equity, potentially receiving tens of thousands of dollars more in cash proceeds from the transaction.

Consider a property valued at $500,000 with a $300,000 mortgage balance. Under FHA guidelines, the borrower could refinance up to $400,000 (80 percent LTV), potentially receiving $100,000 in cash after paying closing costs. With conventional 70 percent LTV restrictions, the same borrower would be limited to a $350,000 refinance, netting only $50,000 in cash proceeds—a $50,000 difference that could significantly impact the borrower’s ability to achieve their financial objectives.

Versatile Use of Funds

The FHA imposes no restrictions on how borrowers utilize cash out refinance proceeds, providing maximum flexibility to address diverse financial needs. Common uses include:

- Home improvements and renovations that increase property value, enhance energy efficiency, improve accessibility, or update aging systems and finishes

- Debt consolidation, particularly high-interest credit card balances, personal loans, auto loans, or medical debt, potentially saving thousands in annual interest charges

- Educational expenses for the borrower or family members, including tuition, room and board, books, and related costs

- Investment opportunities, including down payments on rental properties, stock market investments, business acquisitions, or franchise purchases

- Business startup costs or operational capital for existing businesses, including equipment purchases, inventory, marketing, and working capital

- Emergency expenses or medical bills, providing a lower-cost financing alternative to credit cards or personal loans

- Vehicle purchases, avoiding the higher interest rates and shorter terms typical of auto loans

- Building cash reserves for financial security, retirement planning, or future opportunities

Accessible to Non-FHA Loan Holders

Borrowers do not need to currently have an FHA loan to qualify for an FHA cash out refinance. Homeowners with conventional mortgages, VA loans, USDA loans, portfolio loans, or even those who own their properties free and clear can access the FHA cash out program, provided they meet the eligibility requirements. This flexibility expands the program’s reach to a broader population of homeowners, including those who may have initially purchased with conventional financing but have since experienced credit challenges, income changes, or other circumstances that make FHA refinancing more appropriate for their current situation.

Stable Payment Structure

FHA cash out refinances are typically structured as 30-year fixed-rate mortgages, though 15-year and adjustable-rate options are also available. The fixed-rate structure provides payment stability and protection against future interest rate increases, enabling borrowers to budget confidently for their housing costs over the long term. This predictability contrasts with adjustable-rate mortgages that can experience significant payment increases when rates rise, or with home equity lines of credit (HELOCs) that may have variable rates and balloon payments.

Disadvantages of the FHA Cash Out Refinance Plan

While the FHA cash out refinance program offers substantial benefits, prospective borrowers must also carefully consider several significant drawbacks that can impact the overall cost and suitability of this financing option. Understanding these disadvantages enables homeowners to make informed decisions and compare FHA cash out refinancing against alternative equity access methods.

Mandatory Mortgage Insurance Premiums

All FHA loans, including cash out refinances, require borrowers to pay both upfront and annual mortgage insurance premiums (MIP). The upfront premium amounts to 1.75 percent of the loan amount and is typically financed into the mortgage balance rather than paid in cash at closing. For a $300,000 loan, this represents an additional $5,250 added to the principal balance, immediately increasing the amount owed and the lifetime interest paid on the loan.

The annual MIP, paid monthly as part of the total mortgage payment, ranges from 0.15 to 0.75 percent of the loan amount depending on the LTV ratio, loan term, and loan size. For most cash out refinance borrowers with 80 percent LTV, the annual MIP typically equals 0.80 percent. On a $300,000 loan, this translates to $2,400 annually or $200 per month. Importantly, FHA mortgage insurance remains in effect for at least 11 years for loans with LTV ratios above 90 percent at origination, or for the life of the loan for LTV ratios of 90 percent or less. Unlike conventional mortgage insurance (PMI), which can be canceled once the loan balance drops below 80 percent of the original property value, FHA mortgage insurance cannot be removed through principal payments or appreciation—only through refinancing to a non-FHA loan.

Over a 30-year loan term, the cumulative cost of mortgage insurance can exceed $70,000 on a $300,000 loan, representing a substantial expense that must be factored into the total cost analysis. Borrowers should calculate whether the benefits of FHA financing—including lower credit requirements and higher LTV ratios—justify this long-term cost, or whether alternative financing methods might prove more economical.

Closing Costs on FHA Cash Out Refi’s

FHA cash out refinances involve substantial closing costs, typically ranging from 2 to 6 percent of the loan amount depending on the property location, lender fees, and third-party service charges. These costs include appraisal fees (typically $400 to $800), title insurance (varies by state and property value), origination fees (usually 0.5 to 1.0 percent of the loan amount), credit report fees ($25 to $100), flood certification ($15 to $25), tax service fees ($75 to $100), and various other charges. On a $300,000 refinance, borrowers can expect to pay between $6,000 and $18,000 in closing costs, significantly reducing the net cash received from the transaction.

Many borrowers choose to finance closing costs into the loan amount rather than paying them out of pocket, which reduces immediate cash requirements but increases the total amount financed and the lifetime interest paid. For example, a borrower seeking $70,000 in cash proceeds might need to refinance for $383,000 total ($240,000 existing balance plus $70,000 cash plus $8,000 closing costs plus $5,250 upfront mortgage insurance premium plus additional funds to reach 80 percent LTV), demonstrating how various costs compound to require a larger loan than initially anticipated.

Increased Loan Balance and Interest Costs

By definition, a cash out refinance increases the mortgage balance, potentially extending the time required to achieve full homeownership and significantly increasing the total interest paid over the loan term. Borrowers who refinance from a 15-year loan to a 30-year loan will pay substantially more in total interest over the life of the loan, even if they secure a lower interest rate. This trade-off requires careful consideration of long-term financial goals and the opportunity cost of the increased debt.

For example, consider a borrower with 10 years remaining on a 15-year mortgage at 4.5 percent interest with a $150,000 balance. Monthly payments are approximately $1,530, and total interest remaining over the 10 years equals about $33,600. If this borrower refinances to a new 30-year FHA loan at 6.5 percent for $300,000 (to extract $150,000 cash), the new monthly payment will be approximately $1,896—only $366 higher monthly. However, the total interest paid over the new 30-year term will exceed $382,000, compared to the $33,600 remaining on the original loan. This represents an additional $348,000 in interest charges, a cost that must be weighed against the benefit of the $150,000 cash received and how those funds are utilized.

Property Restrictions

FHA cash out refinances are restricted to primary residences only. Borrowers cannot use the program to refinance investment properties, vacation homes, or second homes, limiting the program’s utility for real estate investors or those seeking to leverage vacation property equity. This restriction stems from the FHA’s mission to promote primary homeownership and housing stability rather than investment activity. Real estate investors or second home owners must explore conventional cash out refinancing, portfolio loans, or commercial financing alternatives, which typically have stricter qualification requirements and higher interest rates.

FHA Loan Limits

The FHA establishes maximum loan limits that vary by county based on local median home prices. For 2025, the baseline conforming loan limit stands at $524,225 for single-family homes in most areas, with higher limits up to $1,209,750 in designated high-cost areas such as San Francisco, New York City, Los Angeles, and parts of Hawaii. Homeowners in expensive markets may find these limits insufficient to meet their refinancing needs, particularly if they wish to maximize their cash out proceeds while maintaining 80 percent LTV.

- The home needs to have been bought a year or more ago, and it cannot go over the loan limits established by FHA for your county.

For example, a homeowner in a high-cost area with a property valued at $1,500,000 would be limited to an FHA loan of $1,209,750, restricting cash out proceeds even though they have substantial equity. Such borrowers must explore jumbo cash out refinancing through conventional or portfolio lenders, which typically requires exceptional credit (740 or higher), substantial cash reserves, and lower debt-to-income ratios.

Potentially Better Alternatives for High-Credit Borrowers

Borrowers with excellent credit scores (typically 740 or higher) and substantial equity may find conventional cash out refinancing more cost-effective over the long term. Conventional loans do not require upfront mortgage insurance premiums, and private mortgage insurance (PMI) can be eliminated once the LTV ratio falls below 80 percent through a combination of principal payments and property appreciation. For well-qualified borrowers, the total cost of conventional refinancing may be lower than FHA options, despite potentially higher initial interest rates.

A comprehensive cost comparison should include the present value of all payments over the expected holding period, including principal, interest, mortgage insurance, and opportunity costs. Borrowers should also consider home equity loans or HELOCs as alternatives, particularly if they have strong credit and wish to preserve their existing low-rate first mortgage while accessing equity through a subordinate lien.

Requirements for FHA Cash Out Refinance

The Federal Housing Administration establishes specific eligibility criteria that borrowers must satisfy to qualify for cash out refinancing.

Understanding these requirements helps homeowners determine their likelihood of approval and prepare appropriate documentation.

The FHA cash out refinance qualification process involves evaluation of creditworthiness, income stability, debt obligations, property characteristics, and payment history.

Credit Score Requirements

The FHA technically permits cash out refinancing with credit scores as low as 500, though borrowers in the 500 to 579 range face severely restricted access to financing and must meet additional compensating factors such as substantial cash reserves (typically six to twelve months of housing payments), minimal debt obligations, significant equity beyond the minimum requirements, and extended employment history with the same employer. Most lenders require minimum credit scores between 600 and 620 for cash out refinances, with some institutions extending to 580 for exceptionally strong applications featuring low debt-to-income ratios, substantial equity, or significant cash reserves.

Higher credit scores directly correlate with better interest rates and terms. Borrowers with scores above 680 typically receive the most competitive rates with minimal pricing adjustments, while those between 620 and 679 may face rate adjustments of 0.25 to 0.50 percentage points. Borrowers below 620 may face additional rate adjustments or additional scrutiny during underwriting, including requirements for manual underwriting rather than automated approval.

Debt-to-Income Ratio

The debt-to-income (DTI) ratio measures a borrower’s monthly debt obligations against gross monthly income and serves as a key indicator of repayment capacity. The FHA generally requires DTI ratios not to exceed 43 percent, though some lenders accept higher ratios up to 50 percent for borrowers with compensating factors such as substantial cash reserves (six months or more of housing payments), minimal debt despite high housing costs, significant equity beyond the minimum requirements (30 percent or more), excellent payment history, or strong credit scores above 700.

The DTI calculation includes the new mortgage payment (principal, interest, property taxes, homeowner’s insurance, HOA fees, and mortgage insurance premiums) plus all recurring monthly debts such as car loans, student loans, credit card minimum payments (typically calculated as 1 to 5 percent of the outstanding balance), personal loans, alimony, child support, and other installment obligations. Certain debts may be excluded from DTI calculations if they will be paid off within six to ten months, though policies vary by lender.

Occupancy Requirements

Borrowers must have occupied the property as their primary residence for at least 12 months prior to applying for a cash out refinance. This occupancy requirement ensures the program serves its intended purpose of helping homeowners access equity in their primary residences rather than enabling speculative real estate investments or cash extraction from rental properties. The FHA verifies occupancy through various means including review of tax returns, utility bills, driver’s license addresses, voter registration, and signed occupancy certifications.

Exceptions to the 12-month occupancy requirement exist for inherited properties, properties acquired through divorce settlements, or situations where the borrower relocates due to employment transfers but intends to return to the property as their primary residence. These exceptions require additional documentation and lender approval.

Payment History

Applicants must demonstrate a responsible payment history on their current mortgage, reflecting financial stability and commitment to meeting obligations. The FHA requires no more than one 30-day late payment in the 12 months preceding the application, and no late payments within the most recent three months. Multiple late payments, 60-day or greater delinquencies, or patterns of late payments disqualify borrowers from the program until their payment history improves substantially and sufficient time has elapsed to demonstrate reformed payment behavior.

Lenders typically require 12 months of canceled checks, bank statements showing mortgage payments debited, or servicer payment histories to verify compliance with payment requirements. Borrowers with histories of late payments should consider waiting until their payment record improves before applying for cash out refinancing, as payment history significantly impacts both approval probability and interest rate pricing.

Home Appraisal

All FHA cash out refinances require a complete home appraisal conducted by an FHA-approved appraiser. The appraisal must meet FHA standards, which are typically more stringent than conventional appraisals and focus on property condition, safety, and marketability in addition to value. FHA appraisers evaluate not only the property’s market value through comparison with recent sales of similar properties but also its condition, ensuring it meets minimum property standards for safety, security, and soundness.

FHA appraisals typically cost between $400 and $800 depending on property size, location, and complexity, and include evaluation of structural integrity, mechanical systems (HVAC, plumbing, electrical), roof condition, foundation, exterior surfaces, and potential health and safety hazards. Appraisers may require repairs before the loan can close if they identify issues affecting habitability, safety, or structural integrity. Common repair requirements include roof leaks, broken windows, missing handrails, exposed wiring, malfunctioning HVAC systems, or evidence of pest infestation.

Income Verification

Lenders require comprehensive documentation of income stability and sufficiency to ensure borrowers possess adequate financial capacity to service the new mortgage obligation. Standard documentation requirements include:

- Two most recent pay stubs showing year-to-date earnings and verifying current employment

- W-2 forms from the previous two years demonstrating stable income history

- Federal tax returns for the previous two years (required for self-employed borrowers and recommended for all applicants to verify consistency with W-2 income)

- Bank statements covering the most recent two months to verify assets and regular income deposits

- Documentation of additional income sources such as rental income (requires tax returns and lease agreements), alimony or child support (requires divorce decrees and proof of consistent receipt), retirement distributions (requires award letters and bank statements), or social security income (requires award letters)

- Verification of Employment (VOE) forms completed by employers confirming employment status, position, salary, and likelihood of continued employment

Self-employed borrowers face additional documentation requirements including two years of complete business and personal tax returns with all schedules, profit and loss statements for the current year, balance sheets, business licenses, and evidence of business continuity. Lenders typically average income over the most recent two years, applying adjustments for depreciation, depletion, and business-use vehicle expenses to calculate qualifying income.

Seasoning Requirements

For properties owned less than 12 months, lenders use the lower of the appraised value or original purchase price when calculating the maximum loan amount.

This anti-flipping provision prevents borrowers from quickly refinancing properties that have experienced rapid appreciation due to market conditions or improvements and extracting equity before establishing a proven payment history and property value stability.

This rule protects both borrowers and lenders from potentially inflated values that may not reflect sustainable market conditions.

For properties owned more than 12 months but less than 24 months showing significant appreciation (typically 20 percent or more), lenders may require additional documentation justifying the value increase, such as receipts for substantial improvements, multiple appraisals, or broker price opinions.

Properties showing extreme appreciation may trigger additional scrutiny to ensure the value increase results from legitimate market conditions or improvements rather than appraisal fraud or artificial inflation.

Case Studies: Real-World FHA Cash Out Refinance Scenarios

The following case studies illustrate how different homeowners have utilized the FHA cash out refinance program to achieve various financial objectives. These examples demonstrate the program’s versatility and practical application in diverse circumstances, highlighting both successful outcomes and important considerations that influenced the decision-making process.

Case Study 1: Debt Consolidation and Credit Score Improvement

Background: Sarah, a 42-year-old high school teacher in Phoenix, Arizona, purchased her home in 2018 for $285,000 with a conventional loan requiring 5 percent down payment. By 2025, her home appraised at $425,000, providing substantial equity of $180,000 above her remaining mortgage balance of $245,000. However, Sarah had accumulated $45,000 in high-interest credit card debt over several years, primarily due to medical expenses, home repairs, and gradual lifestyle inflation. The debt carried an average interest rate of 22 percent, resulting in monthly minimum payments of approximately $1,350 that consumed a significant portion of her monthly income. Her credit score had declined from 720 to 635 due to high credit utilization (using over 80 percent of available credit limits), making it impossible to qualify for balance transfer cards or personal loans with favorable terms.

Solution: After consulting with a mortgage advisor, Sarah refinanced her $245,000 remaining mortgage balance into a new FHA loan of $340,000, representing 80 percent of the $425,000 appraised value. The lender quoted an interest rate of 6.75 percent based on her 635 credit score. After paying closing costs of approximately $10,200 (3 percent of the new loan amount) and the upfront FHA mortgage insurance premium of $5,950, she received $78,850 in cash proceeds. Sarah used $45,000 to pay off all credit card balances in full, placed $20,000 in a high-yield savings account as an emergency fund (representing six months of housing expenses), and used the remaining $13,850 to address deferred home maintenance including a new water heater and exterior painting.

Results: Sarah’s new mortgage payment increased from $1,485 (conventional loan at 4.5 percent) to $2,125 monthly, including principal, interest, property taxes ($285 monthly), homeowner’s insurance ($95 monthly), and FHA mortgage insurance ($227 monthly). However, eliminating the $1,350 credit card minimum payments resulted in a net monthly savings of $710, improving her cash flow significantly. Within six months, as credit card companies reported zero balances and her utilization dropped to zero, her credit score improved to 705, qualifying her for better rates on auto insurance and enabling her to refinance to a conventional loan if desired in the future. The effective interest rate on the consolidated debt dropped from 22 percent to 6.75 percent, saving approximately $7,500 annually in interest charges. Over five years, the interest savings totaled $37,500 compared to maintaining the credit card debt, easily justifying the refinancing costs. Sarah’s improved financial position enabled her to begin contributing to retirement accounts and establish a systematic savings plan, transforming her overall financial trajectory.

Case Study 2: Home Renovation and Value Enhancement

Background: Marcus and Jennifer, a married couple in their mid-50s in Charlotte, North Carolina, owned a home valued at $380,000 with an existing FHA loan balance of $195,000. They had lived in the property for 15 years and enjoyed the neighborhood, schools, and proximity to their workplaces. However, the home required significant updates to remain competitive in the market and meet their evolving needs as they approached retirement. Essential improvements included a new roof ($18,000, necessary to prevent water damage), HVAC system replacement ($12,000, as the existing 20-year-old system was inefficient and unreliable), and kitchen remodeling ($35,000 to update outdated 1990s cabinets, countertops, and appliances). Total required investment equaled $65,000. They had credit scores of 680 and 695 respectively, combined annual income of $145,000, and stable employment in healthcare and engineering fields.

Solution: The couple completed an FHA cash out refinance, securing a new loan of $304,000 representing 80 percent LTV. Their lender quoted a 6.50 percent interest rate based on their credit profiles. After paying $9,120 in closing costs (3 percent of the loan amount) and the $5,320 upfront FHA mortgage insurance premium, and paying off their existing mortgage, they received approximately $94,560 in cash proceeds—sufficient for all planned renovations with funds remaining for furniture, appliances, and contingencies.

Results: Marcus and Jennifer completed all planned renovations within four months, hiring licensed contractors and obtaining necessary permits. They spent $68,000 on the core improvements and used the remaining funds for new appliances, window treatments, and landscaping enhancements. A subsequent appraisal for refinancing purposes 18 months later valued the property at $445,000, representing a $65,000 increase in value that substantially exceeded the $68,000 invested in improvements. Their monthly payment increased from $1,285 to $1,965 (an increase of $680), but this compared favorably to the $1,500 monthly they would have paid on a home equity loan with 9 percent interest for the improvement funds. More importantly, the home’s improved condition eliminated deferred maintenance concerns that could have resulted in emergency repairs, significantly enhanced their quality of life through improved comfort and aesthetics, and positioned the property competitively for a future sale when they decide to downsize in retirement.

Case Study 3: Educational Funding

Background: Robert, a 48-year-old single father in Denver, Colorado, owned a home appraised at $550,000 with an outstanding conventional mortgage balance of $310,000. His daughter Emily had been accepted to a prestigious private university with total estimated costs of $160,000 over four years, including tuition, room and board, books, and living expenses. While Robert had diligently saved $80,000 in a 529 education savings plan, he faced an $80,000 funding gap. Federal student loans were available but limited to $5,500 annually for dependent undergraduates, forcing consideration of Parent PLUS loans at 8.05 percent interest or private student loans at 10 to 14 percent for creditworthy borrowers. Robert’s credit score was 625 due to previous late payments on credit cards during a period of unemployment several years earlier, limiting his access to favorable student loan terms and making private loans prohibitively expensive.

Solution: Robert explored several options including home equity loans, HELOCs, and cash out refinancing. He ultimately chose an FHA cash out refinance into a new loan of $440,000, representing 80 percent of appraised value. His lender quoted a 7.00 percent interest rate based on his credit score. After paying $13,200 in closing costs (3 percent of the loan amount) and $7,700 in upfront FHA mortgage insurance premium, and retiring the existing mortgage, he received approximately $109,100 in cash proceeds—sufficient to cover the remaining college expenses with funds remaining for emergencies and providing Emily with a financial cushion for unpaid internships, study abroad opportunities, and post-graduation job search expenses.

Results: The refinance enabled Robert to fund Emily’s education without requiring her to assume substantial student loan debt, providing her with a significant competitive advantage in pursuing career opportunities without the burden of monthly loan payments that could constrain her choices. His mortgage payment increased from $1,850 (conventional loan at 5.5 percent) to $2,835 monthly, an increase of $985. However, this compared extremely favorably to the alternative of paying both his existing mortgage and Parent PLUS loan payments that would have exceeded $3,600 monthly ($1,850 mortgage plus approximately $1,750 for $80,000 in Parent PLUS loans). Additionally, the mortgage interest remained tax-deductible (subject to itemization and income limitations), providing tax savings of approximately $200 monthly assuming a 25 percent marginal tax rate, whereas Parent PLUS loan interest deductibility phases out at higher income levels. Emily graduated debt-free and secured a position at a technology company with a starting salary of $85,000, enabling her to begin saving for retirement and building wealth immediately rather than dedicating years to debt repayment. Robert plans to refinance to a conventional loan once his credit score improves above 680, potentially eliminating mortgage insurance and further reducing his monthly payment.

Case Study 4: Investment Property Down Payment

Background: Lisa and Tom, a married couple in their late 30s in Tampa, Florida, owned a primary residence valued at $365,000 with a remaining mortgage balance of $180,000. Both worked in stable professions—Lisa as a physical therapist earning $85,000 annually and Tom as a software engineer earning $125,000 annually—providing combined annual income of $210,000. They had consistently saved a portion of their income and had become interested in real estate investing as a wealth-building strategy and potential source of retirement income. They identified an attractive investment property—a three-bedroom, two-bathroom single-family home in a desirable rental neighborhood priced at $295,000. Comparable properties in the area rented for $2,400 to $2,600 monthly, suggesting strong rental demand and cash flow potential. However, investment property financing typically requires 25 percent down payment ($73,750) plus closing costs and initial reserves, totaling approximately $85,000—funds they did not have readily available without liquidating retirement accounts or long-term investments.

Solution: After analyzing several financing approaches, Lisa and Tom chose to refinance their primary residence with an FHA cash out loan of $292,000, representing 80 percent LTV. Their lender quoted a 6.25 percent interest rate based on their excellent credit scores of 695 and 710 respectively. After paying $8,760 in closing costs (3 percent of the loan amount) and $5,110 upfront FHA mortgage insurance premium, and retiring their existing mortgage, they received $98,130 in cash proceeds—sufficient for the investment property down payment, closing costs, initial repairs, and six months of cash reserves as required by prudent investment property underwriting.

Results: Lisa and Tom successfully purchased the investment property, financing $221,250 with an investment property loan at 8.5 percent interest. The property generated monthly rental income of $2,450 against total expenses of $2,120 (mortgage payment of $1,700, property taxes of $245, landlord insurance of $95, HOA fees of $45, and estimated maintenance reserves of $35), providing positive cash flow of $330 monthly before accounting for vacancies, capital expenditures, and income taxes. Their primary residence mortgage payment increased from $1,125 (conventional loan at 4.25 percent) to $1,895 monthly, an increase of $770. However, the investment property’s $330 monthly cash flow offset nearly half of this increase. More significantly, the investment property appreciated 12 percent in the first two years to $330,400, adding approximately $35,000 to their net worth. The property’s equity position after two years (approximately $144,150 including principal reduction) represented a substantial return on their initial $98,130 cash investment. They subsequently refinanced their primary residence to a conventional loan, eliminating FHA mortgage insurance once their credit scores exceeded 720, and used cash flow from the rental property to accelerate principal payments on both properties. Five years after the initial investment, Lisa and Tom have acquired two additional rental properties using similar strategies, built a real estate portfolio valued at over $1.2 million, and generate positive monthly cash flow exceeding $2,000 that supplements their employment income and accelerates their path to financial independence.

Case Study 5: Small Business Capital

Background: David, a 51-year-old marketing consultant in Nashville, Tennessee, had worked as an independent contractor for various clients over 12 years, earning between $95,000 and $120,000 annually depending on project availability. While this arrangement provided flexibility and reasonable income, David recognized that establishing a full-service marketing agency with employees, office space, and comprehensive capabilities would enable him to serve larger clients, command premium fees, and build a salable business asset. His detailed business plan projected first-year revenues of $425,000 with eight employees serving the healthcare, technology, and professional services sectors. However, the plan required $85,000 for initial capitalization including security deposits and three months’ rent for office space ($18,000), computers and technology infrastructure ($22,000), furniture and equipment ($12,000), initial staffing costs including salaries and payroll taxes for the first three months ($25,000), and working capital for marketing, insurance, legal, and operating expenses ($8,000). Traditional small business financing proved challenging; SBA 7(a) loans required extensive documentation and 12-month approval processes, equipment financing covered only $22,000, and business credit cards offered inadequate credit limits at prohibitive interest rates exceeding 20 percent.

David owned his home with an appraised value of $410,000 and existing mortgage balance of $215,000. His credit score was 640—adequate for FHA financing but insufficient for optimal conventional loan pricing. After weighing the risks of using home equity to fund a business venture, David concluded that his extensive industry experience, established client relationships, and conservative financial projections justified the approach, particularly given the favorable interest rates available through FHA cash out refinancing compared to business lending alternatives.

Solution: David completed an FHA cash out refinance for $328,000, representing 80 percent LTV. His lender quoted a 6.875 percent interest rate based on his credit score and self-employment documentation showing stable income over two years. After paying $9,840 in closing costs (3 percent of the loan amount) and $5,740 upfront FHA mortgage insurance premium, and paying off the existing mortgage, he received $97,420 in cash proceeds—providing sufficient capital to launch his business with a comfortable financial cushion for unexpected expenses or revenue shortfalls during the critical startup phase.

Results: David launched his marketing agency in January 2024, securing three anchor clients representing $180,000 in annual contracted revenue before opening the office. The agency achieved profitability within nine months—faster than projected—and generated first-year revenues of $445,000 with net income of $105,000 after all expenses including David’s salary. Second-year revenues reached $680,000 with net income of $165,000, validating the business model and providing substantial return on investment. David’s mortgage payment increased from $1,295 (conventional loan at 5.25 percent) to $2,215 monthly, an increase of $920. However, the business income more than compensated for the increased housing cost, and the 6.875 percent mortgage interest rate compared extremely favorably to alternative business financing options such as SBA loans at 9 to 11 percent, business term loans at 12 to 15 percent, or business credit cards at 18 to 24 percent. The mortgage interest deduction provided additional tax benefits averaging $350 monthly. Three years after launching, David’s agency employs 15 people, generates over $1.2 million in annual revenue, and has been valued at $850,000 by business appraisers for potential sale or investment purposes. The $97,420 initial investment has generated cumulative net income exceeding $450,000 and created a business asset that enhances David’s overall net worth significantly beyond the home equity utilized to fund its creation.

Takeaways on FHA Cash Out Refinance Loans

The FHA Cash Out Refinance Plan represents a valuable financial tool for homeowners seeking to leverage accumulated equity while maintaining manageable qualification requirements.

The program’s flexible credit standards, competitive interest rates for lower-credit borrowers, and high loan-to-value ratios make it particularly attractive for borrowers who might not qualify for conventional refinancing options due to credit challenges, income fluctuations, or insufficient equity for conventional program requirements.

However, the mandatory mortgage insurance premiums, substantial closing costs, property restrictions limiting use to primary residences, and increased loan balances require careful consideration and comprehensive financial analysis.

Getting cash out with a FHA refinance loan often makes a great deal of sense. If you have a good reason to get the money, this is one of the best, low interest loans that you will ever be able to get. Check out the most updated cash out refinance rules for tax deductions.

Prospective borrowers should thoroughly evaluate their financial objectives, assess their ability to service increased debt obligations over the long term, compare FHA cash out refinancing against alternative equity access methods such as home equity loans, HELOCs, or conventional cash out refinancing, and calculate the total cost of borrowing over the loan’s anticipated holding period. Important considerations include the present value of all payments including mortgage insurance, opportunity costs of increased leverage, tax implications of mortgage interest deductibility, and the intended use of cash proceeds. Consulting with experienced FHA-approved lenders, financial advisors, and tax professionals can help homeowners make informed decisions aligned with their long-term financial goals and risk tolerance.

The case studies presented demonstrate that when used strategically for purposes such as high-interest debt consolidation, value-enhancing home improvements, education funding that prevents student loan debt, income-producing real estate investments, or business capital that generates returns exceeding borrowing costs, FHA cash out refinancing can serve as a catalyst for achieving significant financial objectives and building long-term wealth. Conversely, using cash out proceeds for depreciating assets, discretionary consumption, or purposes that do not generate measurable financial returns may result in increased debt burdens without corresponding benefits, potentially jeopardizing long-term financial security. As with any major financial decision involving substantial debt, success depends on careful planning, realistic assessment of one’s ability to service increased obligations under various economic scenarios, disciplined use of the funds obtained, and commitment to long-term financial responsibility. Homeowners who approach FHA cash out refinancing with thorough preparation, clear objectives, and professional guidance position themselves to maximize the program’s benefits while minimizing its risks and costs.

Frequently Asked Questions for FHA Cash Out Refinances

Can You Refinance a FHA Loan?

Yes, you can refinance an FHA loan, and we can connect you with Approved FHA lenders that want to earn your business. The two popular FHA refinance programs are the FHA Streamline Refinance and the FHA Cash-Out Refinance. The FHA Streamline Refinance is a straightforward process that doesn’t typically require a credit check or appraisal. It’s designed to lower your interest rate, reduce your monthly payments, and save you money over time. However, the streamline program does not allow you to receive cash back. Borrowers frequently ask if its hard to refinance an FHA loan. The FHA Simple Refinance presents a feasible choice for homeowners who initially bought their homes using an FHA loan.

What Credit Score Do You Need for an FHA Cash-Out Refinance?

Most lenders require a minimum credit score of 580 to qualify for an FHA cash-out refinance with full loan-to-value financing. However, some lenders impose stricter credit criteria, with requirements ranging from 580 to 620, depending on their individual underwriting policies. These higher standards reflect the lender’s risk tolerance and are meant to ensure borrowers can manage the new loan responsibly.

How Long Does It Take to Close an FHA Cash-Out Refinance?

The completion time for an FHA cash-out refinance typically ranges between 30 and 60 days, but the exact timeline can vary based on factors such as the lender’s processing speed, the borrower’s financial profile, and the complexity of the loan application. Delays may also arise from appraisal scheduling, document submission, or the lender’s internal underwriting procedures.

What is the maximum LTV for FHA cash out refinance?

The FHA cash-out refinance max loan-to-value (LTV) ratio is generally 80% of the home’s appraised value. T This means homeowners can refinance their mortgage and borrow up to 80% of the property’s current appraised value. For example, if your home is worth $300,000, you could access up to $240,000 through the refinance, minus any existing mortgage balance. Meeting the FHA cash out refinance max LTV requirement ensures that borrowers maintain some equity in their property, reducing lender risk. The FHA rate and term refinance max LTV is 97.5% for borrowers that mee the DTI and and credit score requirements.

What are the basic FHA cash-out refinance requirements?

To qualify for an cash out refinance with FHA, you generally need to meet several borrower and property standards. Your home must be your primary residence, and you typically must have made on-time mortgage payments for the past 12 months. Lenders often require a minimum credit score (commonly around 620+) and a debt-to-income ratio that makes sense for your finances. An FHA appraisal is ordered to verify your home’s value and equity, and you must show sufficient financial stability to support the new loan.

Have the FHA cash-out refinance rules changed in 2026?

FHA cash-out refinance guidelines have remained consistent into 2026, continuing to require key elements such as owner-occupied primary residence status, on-time mortgage payments, and an appraisal to determine equity. While lenders may adjust their overlays (credit minimums, reserve requirements), the federal baseline — including staying within maximum loan-to-value limits and payment history requirements — has not seen major shifts this year. Always check with your lender for the most current underwriting criteria, as individual lender requirements can evolve.

What are the FHA cash-out refinance seasoning requirements?

Most FHA cash-out refinance borrowers must have owned and lived in their home as their primary residence for at least 12 months before applying. The FHA’s seasoning requirement also typically expects a history of timely mortgage payments (often 12 months), proving financial stability before taking out equity. If you’ve been in your home less than a year, lenders may use the lesser of appraised value or original purchase price for LTV calculations, potentially limiting how much you can borrow.

How to Apply for FHA Refinance No Cash-Out?

To apply for an FHA no cash-out refinance, start by contacting an FHA-approved lender. Provide financial documents such as income verification, credit history, and proof of homeownership. The lender will assess eligibility based on FHA guidelines and your current mortgage terms. This option helps lower your interest rate or change your loan terms without accessing your equity as cash.

What is the FHA Cash Out Plan FACOP?

FACOP is an acronym for the FHA Cash Out Plan. which allows homeowners with FHA-insured loans to refinance their existing mortgage and access the equity in their home as cash. To qualify, borrowers must meet FHA cash out refi requirements, including a minimum credit score, sufficient home equity (typically up to 80% loan-to-value), and verifiable income.

How Much Equity Can You Access with an FHA Cash-Out Refinance?

Borrowers can tap into up to 80% of their home’s current market value through an FHA cash-out refinance. This means at least 20% of the home’s equity must remain untouched after refinancing.

How does the FHA cash out program work?

The FHA cash-out refinance lets homeowners replace their existing mortgage with a larger FHA loan and take the difference in cash. Funds can be used for debt consolidation, home improvements, or other expenses. FHA allows up to 80% loan-to-value, meaning you can borrow against significant equity. The program requires a new appraisal, income verification, and credit review, but it often provides more flexible guidelines than conventional cash-out refinance options.

Does an FHA Cash-Out Refinance Require Mortgage Insurance?

Yes, FHA loans mandate both upfront and annual mortgage insurance premiums (MIP). These premiums add to the overall cost of the loan, with an upfront premium of 1.75% of the loan amount and a smaller annual fee rolled into monthly payments.

Can You Use an FHA Cash-Out Refinance for a Rental or Second Home?

No, FHA cash-out refinancing is only available for primary residences. The property must be owner-occupied for at least 12 months before applying for this type of refinance.

How Long Do You Need to Own Your Home to Qualify?

To be eligible for an FHA cash-out refinance, homeowners must have lived in the home for at least 12 months and made on-time mortgage payments throughout that period.

Is an Appraisal Required for an FHA Cash-Out Refinance?

Yes, an appraisal is required to determine the current market value of the property, which directly impacts how much equity can be accessed.

Can You Do an FHA Cash-Out Loan in Texas?

Yes, FHA cash-out refinance loans are available in Texas, but they must comply with the state’s Texas Equity Laws, which limit cash-out loans to 80% of the home’s appraised value. This program allows homeowners to refinance their mortgage and access their home equity as cash. Ensure you meet FHA requirements, including sufficient credit, income, and property eligibility.

How Many Lates Can I Have for FHA Cash-Out?

To qualify for an FHA cash-out refinance, you must have no more than one late mortgage payment in the past 12 months and none within the last three months. Consistent, on-time payments improve your chances of approval and demonstrate financial reliability to mortgage lenders.

What credit score do you need for FHA cash out refinance plan?

FHA guidelines typically require a minimum credit score of 580 for cash-out refinancing, though many lenders set their own higher standards, often around 600–620. A stronger score improves your chances of approval and may secure better interest rates. Lenders also consider your debt-to-income ratio, payment history, and loan-to-value. While FHA loans are more forgiving than conventional loans, maintaining solid credit habits before applying increases your likelihood of success.

What is a good alternative to FHA refinancing if I want to keep my current mortgage?

If you already have a low interest rate on your current mortgage, consider a home equity loan for cash back. In general, the FHA cash out refinance loan is a good option for people who want access to their cash but have a lower credit score. The cash obtained can be used for various purposes, such as debt consolidation, home improvements, or other financial needs. Cash Out Refinances Versus Home Equity Loans

Can you take cash out on an FHA streamline?

No, the FHA streamline refinance program does not allow cash out. Streamline refinances are designed to lower your interest rate or switch to a fixed-rate loan with minimal documentation. They generally require no appraisal, income verification, or high credit scores. However, you can’t use them to access home equity. For cash-out purposes, you must apply for a standard FHA cash-out refinance, which requires a full underwriting process and appraisal.

References

ALCOVA Mortgage. (2025, September 11). FHA cash-out refinance guidelines: What you need to know. https://alcova.com/fha-cash-out-refinance-guidelines/

Direct Mortgage Loans. (2025, June 10). Guide to FHA cash out refinance: Unlocking your home’s equity for financial flexibility. https://www.directmortgageloans.com/mortgage/guide-to-fha-cash-out-refinance-unlocking-your-homes-equity-for-financial-flexibility/

PNC Insights. (n.d.). FHA cash-out refinance: What homeowners should know. https://www.pnc.com/insights/personal-finance/borrow/what-is-a-fha-cash-out-refinance.htm

U.S. Department of Housing and Urban Development. (n.d.). HOC reference guide—Refinances. https://archives.hud.gov/offices/hsg/sfh/ref/sfhp2-19.cfm

Yahoo Finance. (2025, September 15). FHA cash-out refinance: Requirements and guidelines. https://finance.yahoo.com/personal-finance/mortgages/article/fha-cash-out-refinance-223928777.html