With lenders announcing new cash out loans the consumers want to make sure they are getting the best home equity rates available in the marketplace. Yes, mortgage rate shave been rising and that makes home equity rates more attractive.

As you may have heard on the radio recently, the best home equity interest rates remain at some of the lowest levels in decades. One of the best aspects of home ownership is that you grow equity in the property over time.

If you choose, you can pull out some of that cash with a fixed or adjustable rate home equity loan and use it for what you like.

Current Home Equity Loan Rates Are Helping Homeowners Maximize Cash Out Loan Opportunities

People use the equity in their homes to pay off credit card debt, fund a college education, and to renovate their home, among other things. Just like any type of home equity loan or credit line it makes sense financially to shop home equity loan rates online before making a long term commitment.

More an more opportunities are being advertised for homeowners to gain access to money with great home equity rates still available. Find out if you meet the criteria for these low home equity rates you keep hearing about.

What Is a Home Equity Loan and When Should I Get One?

A home equity loan is a lump sum payment to you that is part of your equity in your property. If you have a home that appraises for $300,000 and you owe $200,000 on the property, you may be able to borrow 80-90% of the value of the home, minus what you owe. In this example, you owe $200,000. Eighty percent of the home’s value is $240,000, so you could possibly get a home equity loan of $40,000.

The most popular term on home equity loans is with repayment period of five to 15 years. A major benefit of a home equity loan rates is that your interest payments are usually tax deductible up to the first $100,000 of the loan. Many second-mortgage lenders will offer additional terms, such as, 10 years, 20, years, 25 years and even 30 years in some cases.

A home equity loan is considered a secured installment loan because it has a fixed interest rate with a set number of payments. The advantage is that you know exactly what you will need to pay each month for the term of the loan. On the down side, in many instances your home equity interest rate will be higher than if you were to get a home equity line of credit or HELOC. The HELOC rates carry variable interest that will be lower initially than a home equity loan, but the rate can go up over time.

Shopping for the Lowest Home Equity Loan Rates

If you are interested in getting a home equity loan, you will want to get the lowest possible rate that you can. How low of a rate you can get depends upon your credit, your equity, and what current interest home equity loan rates are like. You also should take a very close look at the mortgage fees that the lender is going to charge you.

This can add up to several thousand dollars. Many lenders will charge you 5-6% of the loan amount in closing costs and fees. If you have little or no equity then you may be required to pay more in fees in addition to higher home equity rates because the risk factor is greater.

If you have had some late payments reported, you may need to shop for a bad credit-home equity loan and the fees could be a bit higher because the risk factor is greater.

Below are some tips that could help to get you the best rate and save you money when you get a home equity loan:

#1 Make Sure You Can Pay the Interest Payment for Years to Come

You may see offers for home equity credit line rates that lure you into the deal with a discounted rate for a few months. But watch out because that special low rate on your home equity loan could rise by .5% or more.

Also, be sure that you will be able to pay the loan for years down the road. A common mistake is for people to assume their income will rise faster than it will. Everyone likes to think that their income will be much higher in 10 years. But it’s better to be honest and realistic than to make pie in the sky assumptions.

#2 Shop Carefully Online and Look at Rates, Terms and Fees

Generally, the lowest rates and fees will go to those who spend the most time looking and comparing home equity loan rates. Some people like to rush through the process and get that loan closed and funded, and get that check in hand. But you will probably end up paying more than you should.

Home equity loan rates and fees can vary substantially depending upon which lender you choose. A simple internet search for a $50,000 2nd mortgage for someone with a 700 credit score can find home equity rates that may vary between 3% to 4%. Some home equity lenders might charge a $50 fee each year, and others may charge nothing. When shopping home equity interest rates, make sure to find out if the lender is charging an annual fees with the loan or line.

It is also important when shopping for fixed home equity interest rates or the best home equity line of credit rates, that you get a “Good Faith Estimate” from the lending company after the underwriter evaluates your credit score and debt to income ratio so that you know that you are getting an accurate quote for the home equity rates you were quoted.

#3 Look for Good Deals

There are a lot of home equity loan lenders out there today. Fixed rate second mortgages and HELOC loan programs are back in a big way. They are competing with each other, and if you look around, you may find a great deal and low home equity loan rates from a credible lending source. Consider refinancing a home equity loan if your adjustable rate has been making your payments rise. Many homeowner are successful increasing their cash flow by consolidating debt with a second mortgage.

Some lenders for example might temporarily waive their annual fees and even closing costs. Keep in mind if you close that credit line within a few years, you could have to pay back the closing costs.

#4 Try a Credit Union

Credit unions frequently offer lower interest rates and fees than banks because they are less oriented towards profits than a traditional lending institution. Many home equity loan shopper find that they can get a substantially lower interest rate with a credit union. However, most credit unions require a very high credit score and sometimes the maximum loan amount is a lot lower than most home equity lenders.

#5 Beware of Minimum Draws

Some borrowers like to get a home equity loan to have it in case of an emergency, such as a major health problem, job loss, etc. But some lenders may have a minimum draw and will require you to borrow a certain amount in a certain time period. You should avoid such lenders if you plan to not touch the credit line except in an emergency.

What You Need to Remember When Searching for the Best Home Equity Loans Online

Home values are rising, and lenders are loosening their lending criteria again. Shopping home equity loan rates is an important step to maximize savings as a homeowner. There is no reason to pay excessive fees or higher home equity interest rates than you have to. Getting a home equity loan or line is getting popular again. But you should do plenty of shopping for your home equity loan to ensure that you get the best possible rate and fees. If you do so and you keep our helpful tips in mind, you will get a better deal and will be able to enjoy a lower payment each month. Shop and compare cash out refinances to a home equity loan.

Check with brokers and lenders now to compare home equity loan rates with your fico score,, DTI and Loan to Value.

How to Find the Best Home Equity Loan Rates with Limited or No Fees

Mortgage interest rates are low. Property values are rising. So, plenty of home owners are considering a home equity loan. By pulling cash out of their home, they can buy things that they want or need: a home remodel, invest in a business, pay for college tuition.

But there are many home equity loan programs on the market. How to know which to choose to get the best rate with the lowest fees? We will get to that, but first understand the difference between a home equity loan and a home equity line of credit (HELOC).

A home equity loan is similar to a car loan. You borrow a portion of your equity all at once, and you pay a fixed interest rate over a set time period. The advantage of home equity loan rates are that typically they are fixed, predictable payment schedule and a fixed rate. You know exactly what you will be paying and for how long.

A home credit line works very much like a credit card but with no grace period. It is a line of credit based upon the equity in your home. You can keep it open for usually five or 10 years. You can borrow on it up to your approved amount, pay it back, and keep borrowing if you like.

A HELOC rates usually are set to a variable interest rate. It is based upon the Prime Rate plus a margin that the mortgage company adds. An equity line of credit has a lower initial rate at first, sometimes interest only payments, but the rate can rise in the future.

To get the best rate on your home equity loan, you need to understand the following:

Differences Between First Mortgages and Home Equity Loans

When you get a first mortgage loan, the lender usually sells the mortgage to Fannie Mae or Freddie Mac. The bank is paid a markup in addition to the wholesale price for working with you and handling the paperwork.

Thus, the home equity loan rates with various lenders, banks and credit unions are similar, normally within .5% of one another. If the best rate for your mortgage that you can find is 4%, you probably won’t see anything higher than 4.5% for the same product if you went to any bank.

But home equity loans are very different. They are usually held by the lender for the long term. This means that the rate that you are charged can vary tremendously. In some instances, the best home equity loan rates are often from credit unions.

However, many Credit Unions will require higher credit scores (ie. Above 740) to qualify for the lowest advertised home equity loan rates. You may discover that banks in your area do not even do home equity loans at all, but a cash out refinance may accomplish the same goal.

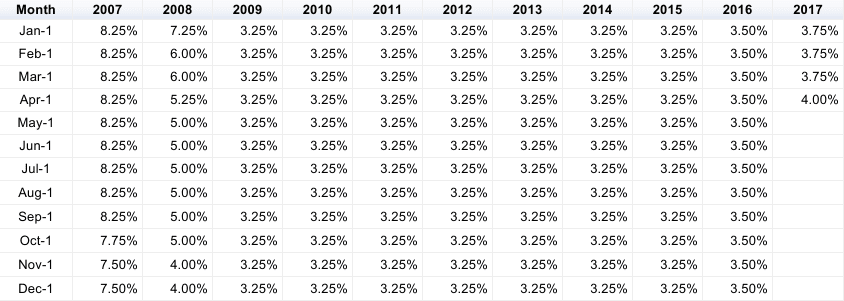

According to a 2016 financial analysis of banks and lenders, there were very different rates available for home equity loans. The below rates were for a $50,000, 5-year, fixed rate home equity loan with good credit:

- Credit union: 3.49%

- Credit union 2: 3.75%

- Credit union 3: 4.25%

- Major bank: 4.25%

- Citibank: 6.24%

That is a substantial spread. Many experts say that credit unions often are your best bet in terms of a low rate, but do not dismiss major banks either. There are also differences on home equity loans and HELOCs.

Pay Closing Costs on Equity Loans

If you want to get the lowest possible rate on your home equity loan, it is wise to cough up the closing costs on the loan up front. You may pay a higher rate on the home equity loan if you want to avoid closing costs, but that higher rate will jack up your payment for the life of the loan. Ask about no cost home equity loans, HELOCs and no closing cost refinance loans.

What About Home Equity Fees?

You will also need to pay for various fees to get the loan to close, including home appraisals, legal fees and credit reports. For many home equity loans, this could add up to $500 to $900. You can pay those fees up front if you like and enjoy a lower rate, but you can avoid all fees if you pay a higher rate in exchange for the company waiving the fees.

Pay Down Debt

Of course, you always will qualify for a lower home equity loan rate if you are making all of your debt payments on time. You also will get the best rates if your credit utilization is as low as possible. So, try to make all of your payments on time as much as possible. Also pay down credit cards before you apply for the best home equity loan. This will ensure you get the best possible rate.

Takeaways on Checking for the Best Home Equity Interest Rates

If you follow the above guidelines, you can get the lowest rate on your home equity loan. But there are important things to remember about a home equity loan.

First and foremost, you are taking out a second mortgage. Your home is collateral for the loan. If you fail to pay, you will lose your home in many cases. It is very important to treat your second mortgage just as seriously as your first mortgage. Make certain that you can afford your payments and that you pay the mortgage on time.

Also remember that in addition to scoring a low home equity rate, you can use the money to raise the value of your home by making wise home improvement choices. Unfortunately, you can no longer deduct the interest on your home equity loan. This will help you to save on your taxes each year, and it can be quite a bit! Read about the new home equity loan tax deductions rules for 2023.

Getting an equity loan can be a great deal if you are able to get a low rate with minimal fees. Shop around and keep your credit score high to find the best home equity loan rate – remember, credit unions often have some of the best rates!